Climate-Resilient Agriculture: How Australian Farmers Can Mitigate Rising Insurance Costs with Agtech Solutions

“Australian farm insurance premiums have surged by up to 50% in recent years due to climate change impacts.”

In the face of escalating climate change impacts, Australian farmers are grappling with a new challenge that threatens their livelihood and the sustainability of their operations: skyrocketing farm insurance premiums. As extreme weather events become more frequent and severe, the agricultural sector finds itself at a crossroads, forced to navigate the complex interplay between financial protection and operational viability. In this comprehensive exploration, we delve into the heart of this pressing issue, examining the factors driving the surge in insurance costs and the innovative agtech solutions that offer hope for a more resilient future.

The Perfect Storm: Climate Change and Rising Insurance Costs

The Australian agricultural landscape is changing, and not just in terms of its physical environment. Climate change has ushered in an era of unprecedented uncertainty, characterized by more frequent and intense extreme weather events. From devastating droughts to catastrophic floods, these climate-driven disasters are wreaking havoc on farms across the country, leading to significant crop losses and property damage.

As a result, insurers are reassessing their risk models, leading to a dramatic surge in farm insurance premiums. This increase is not merely a minor adjustment; in many cases, it represents a substantial financial burden that threatens the very viability of farming operations. The ripple effects of this insurance crisis extend far beyond individual farms, potentially impacting food security, rural economies, and the broader agricultural sector.

The Financial Tightrope: Balancing Protection and Profitability

For many Australian farmers, the decision to maintain comprehensive insurance coverage has become an increasingly difficult balancing act. On one hand, the risks associated with extreme weather events make insurance more crucial than ever. On the other, the escalating costs of premiums are pushing many to consider reducing their coverage or even going without insurance altogether – a decision that could lead to financial ruin in the event of a major disaster.

This dilemma is particularly acute for grain producers, cattle farmers, and those engaged in sheep and goat livestock operations. These sectors, which form the backbone of Australian agriculture, are especially vulnerable to climate-related risks and are feeling the full brunt of the insurance cost surge.

The Role of Agtech in Mitigating Risks

“Satellite-based agtech solutions can reduce crop loss risks by 30%, potentially lowering insurance costs for farmers.”

In the face of these challenges, agtech solutions are emerging as a beacon of hope for Australian farmers. Advanced technologies, particularly those leveraging satellite data and artificial intelligence, are providing farmers with powerful tools to manage and mitigate risks associated with climate change.

One such solution is offered by Farmonaut, a pioneering agricultural technology company that provides advanced, satellite-based farm management solutions. Through its comprehensive platform, Farmonaut enables farmers to:

- Monitor crop health in real-time

- Receive AI-driven advisory for optimal farm management

- Track and reduce carbon footprints

- Implement blockchain-based traceability for enhanced supply chain transparency

These technologies not only help farmers make more informed decisions but also provide insurers with more accurate risk assessments, potentially leading to more favorable premium rates for farmers who adopt these risk-mitigating practices.

Climate-Resilient Agricultural Practices: A Path Forward

To address the challenges posed by rising insurance costs and climate change, Australian farmers are increasingly turning to climate-resilient agricultural practices. These strategies not only help mitigate the impacts of extreme weather events but can also contribute to more sustainable and profitable farming operations in the long term.

| Agricultural Practice | Climate Resilience Benefits | Potential Insurance Cost Reduction | Implementation Challenges |

|---|---|---|---|

| Crop Diversification | Reduces risk of total crop failure | 10-20% | Requires new knowledge and market access |

| Precision Agriculture | Optimizes resource use and crop health | 15-25% | Initial investment in technology and training |

| Drought-Resistant Crop Varieties | Improves crop survival in dry conditions | 20-30% | Higher seed costs and potential yield trade-offs |

| Improved Water Management | Enhances water efficiency and drought resilience | 10-20% | Infrastructure costs and water rights issues |

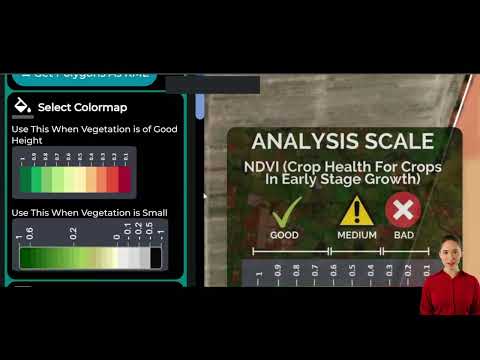

The Power of Satellite-Based Crop Monitoring

One of the most promising technologies in the fight against climate-related risks is satellite-based crop monitoring. This technology allows farmers to:

- Track crop health and development in real-time

- Identify potential issues before they become severe

- Optimize resource allocation, including water and fertilizer

- Provide insurers with accurate, up-to-date information on crop conditions

Farmonaut’s satellite-based crop health monitoring system is at the forefront of this technology. By leveraging multispectral satellite imagery, the platform provides farmers with critical insights into vegetation health, soil moisture levels, and other key metrics. This data-driven approach not only helps farmers make more informed decisions but also serves as a valuable tool for risk assessment and management.

AI-Driven Farm Advisory: The Future of Precision Agriculture

Artificial intelligence is revolutionizing farm management, offering personalized advice based on a wealth of data. Farmonaut’s Jeevn AI Advisory System is a prime example of this technology in action. By analyzing satellite data, weather forecasts, and historical farm performance, the system provides tailored recommendations for:

- Optimal planting and harvesting times

- Pest and disease management

- Irrigation scheduling

- Fertilizer application

These AI-driven insights not only help farmers optimize their operations but also demonstrate to insurers a commitment to risk mitigation, potentially leading to more favorable insurance terms.

Explore Farmonaut’s API Solutions

Blockchain and Traceability: Building Trust in Agricultural Supply Chains

In an era where consumers and regulators alike demand greater transparency in food production, blockchain technology offers a powerful solution. Farmonaut’s blockchain-based traceability system provides:

- End-to-end visibility of agricultural products

- Verification of sustainable and ethical farming practices

- Enhanced food safety through rapid tracking of potential contaminants

- Increased consumer trust and brand loyalty

For Australian farmers, implementing such a system can not only open up new market opportunities but also demonstrate a commitment to quality and sustainability – factors that can positively influence insurance risk assessments.

Weather Data: The Cornerstone of Risk Management

Accurate and timely weather data is crucial for effective farm management and risk mitigation. Farmonaut’s weather data services provide farmers with:

- Hyperlocal weather forecasts

- Historical weather data analysis

- Severe weather alerts

- Climate trend analysis for long-term planning

By leveraging this data, farmers can make more informed decisions about planting, harvesting, and crop protection, thereby reducing their vulnerability to weather-related risks. This proactive approach to risk management can be a significant factor in negotiating more favorable insurance terms.

Access Farmonaut’s API Developer Docs

The Role of Government and Industry in Addressing the Insurance Crisis

While agtech solutions offer powerful tools for risk mitigation, addressing the broader insurance crisis in Australian agriculture requires a concerted effort from multiple stakeholders. Some potential solutions include:

- Government-backed insurance programs to provide a safety net for farmers

- Industry-wide adoption of climate-resilient farming practices

- Incentives for farmers who implement risk-mitigation technologies

- Collaboration between insurers, agtech companies, and farmers to develop more accurate risk models

- Investments in rural infrastructure to enhance climate resilience

These initiatives, combined with the adoption of advanced agtech solutions, can help create a more sustainable and resilient agricultural sector in Australia.

The Future of Climate-Resilient Agriculture in Australia

As we look to the future, it’s clear that the convergence of climate change, rising insurance costs, and technological innovation will continue to shape Australian agriculture. By embracing climate-resilient practices and leveraging advanced agtech solutions, farmers can not only mitigate their risks but also:

- Improve productivity and profitability

- Enhance environmental sustainability

- Strengthen food security for the nation

- Build more resilient rural communities

Companies like Farmonaut are at the forefront of this agricultural revolution, providing the tools and insights needed to navigate these challenges successfully. As more farmers adopt these technologies and practices, we can expect to see a gradual shift towards more sustainable insurance models that better reflect the reduced risks associated with climate-resilient farming.

Conclusion: Embracing Innovation for a Sustainable Future

The challenges facing Australian farmers in the face of climate change and rising insurance costs are formidable, but not insurmountable. By embracing innovative agtech solutions and climate-resilient practices, farmers can mitigate risks, improve their operations, and potentially reduce their insurance costs. As we move forward, it will be crucial for all stakeholders – farmers, insurers, technology providers, and policymakers – to work together in creating a more resilient and sustainable agricultural sector.

The path to climate-resilient agriculture is not without its obstacles, but with the right tools, strategies, and support, Australian farmers can navigate these challenges and emerge stronger, more efficient, and better prepared for the uncertainties of the future. As we continue to innovate and adapt, we pave the way for a more sustainable and prosperous agricultural sector that can thrive in the face of climate change.

Explore Farmonaut’s Mobile Apps:

Frequently Asked Questions (FAQ)

- How are climate change and rising insurance costs related in Australian agriculture?

Climate change is leading to more frequent and severe extreme weather events, increasing the risk of crop losses and property damage. As a result, insurers are raising premiums to cover these heightened risks, creating financial challenges for farmers. - What are some key climate-resilient agricultural practices?

Key practices include crop diversification, precision agriculture, using drought-resistant crop varieties, improved water management, and implementing advanced monitoring systems like those offered by Farmonaut. - How can agtech solutions help mitigate rising insurance costs?

Agtech solutions provide farmers with tools to better manage and reduce risks, such as real-time crop monitoring, AI-driven advisory systems, and weather forecasting. By demonstrating reduced risk, farmers may be able to negotiate lower insurance premiums. - What role does satellite-based crop monitoring play in risk management?

Satellite-based monitoring allows for real-time tracking of crop health and early detection of issues, enabling farmers to take preventive actions and potentially reduce crop losses, which can positively impact insurance risk assessments. - How can blockchain technology benefit Australian farmers?

Blockchain enhances supply chain transparency, verifies sustainable practices, and improves food safety. This can open new market opportunities and demonstrate a commitment to quality, potentially influencing insurance risk assessments positively.