Farmonaut Insights: Australia’s Household Spending Trends 2024 – Navigating Consumer Behavior in a Changing Economy

“Australia’s consumer confidence index dropped 1.8% in December 2024, following strong November sales.”

As we delve into the intricacies of Australia’s household spending trends in 2024, we at Farmonaut are excited to present a comprehensive analysis of consumer behavior in this evolving economic landscape. Our insights draw from the latest data, revealing fascinating patterns that shed light on the nation’s financial pulse.

The Black Friday Effect: Reshaping Retail Sales

The year 2024 has witnessed a significant shift in consumer spending patterns, largely influenced by the growing prominence of Black Friday sales. This shopping phenomenon has reshaped the traditional retail calendar, causing ripple effects that extend well beyond November.

- Strong November sales driven by Black Friday promotions

- Subsequent decline in December spending

- Changing consumer strategies for holiday shopping

The impact of Black Friday on retail sales has been profound, with many Australians opting to complete their holiday shopping earlier than usual. This strategic shift in consumer behavior has led to a notable decline in December spending, traditionally a peak month for retail activity.

Consumer Confidence: A Delicate Balance

The latest consumer confidence index reveals a complex picture of Australia’s economic sentiment. December 2024 saw a 1.8% decline in consumer confidence, following the strong sales performance in November. This fluctuation underscores the delicate balance between consumer optimism and caution in the face of economic uncertainties.

Discretionary Spending Analysis: A Cautious Approach

Our analysis of discretionary spending reveals a cautious approach among Australian consumers. The CommBank Household Spending Insights (HSI) Index, which tracks macro-level consumption trends, provides valuable insights into this behavior:

- 8.3% drop in household goods spending

- 2.6% decrease in hospitality expenditure

- 2.0% decline in food and beverage purchases

- 2.0% reduction in recreation spending

These figures indicate a significant shift in consumer priorities, with many Australians tightening their belts in traditionally high-spending categories.

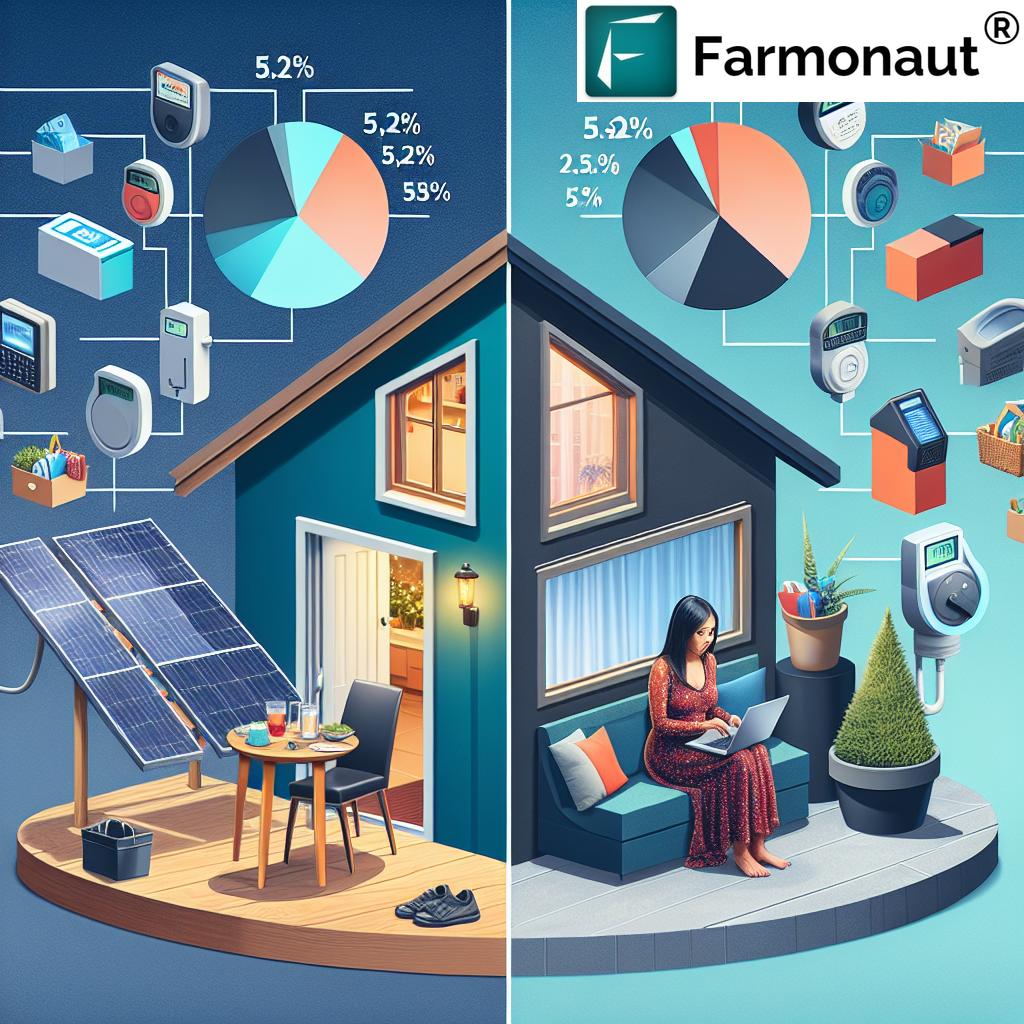

Homeowner vs. Renter Spending Habits: A Tale of Two Consumers

One of the most intriguing aspects of our analysis is the divergence in spending habits between homeowners and renters. This disparity offers valuable insights into the economic pressures and opportunities facing different segments of the Australian population.

- Homeowners with mortgages: 3.8% increase in spending

- Outright homeowners: 2.8% increase in spending

- Renters: 2.4% increase in spending

These figures highlight the impact of property ownership on consumer confidence and spending power. Homeowners, particularly those with mortgages, appear more willing to increase their expenditure, possibly buoyed by the sense of financial security that property ownership provides.

Sector-Specific Trends: Winners and Losers

While some sectors experienced declines, others saw growth, painting a nuanced picture of Australia’s economic landscape:

- Growth Sectors:

- Utilities: 4.9% increase (driven by strata management fees)

- Communication and digital services: 1.2% rise

- Transportation: 0.7% growth

- Declining Sectors:

- Household goods: 8.3% decrease

- Hospitality: 2.6% fall

- Food and beverage: 2.0% reduction

These trends reflect a shift towards essential services and digital consumption, while discretionary spending in traditional retail and hospitality sectors faced challenges.

“Annual household spending growth in Australia reached 5.2% in 2024, with homeowners outspending renters.”

Annual Spending Growth Rate: A Closer Look

Despite monthly fluctuations, the annual HSI growth rate rose to 5.2% by December 2024. This overall increase masks significant variations across different categories:

- Insurance: 11.5% growth

- Communications and digital: 10% increase

- Health: 9.4% rise

- Recreation: 7.3% growth

- Transport: 0.7% decline (the only category to decrease annually)

These figures highlight the evolving priorities of Australian consumers, with a clear emphasis on health, digital services, and financial security.

Explore Farmonaut’s API for detailed economic insights

Inflation and Consumer Behavior: A Complex Relationship

The interplay between inflation and consumer behavior continues to shape Australia’s economic landscape. Our analysis reveals:

- Cautious spending in inflationary environment

- Shift towards essential goods and services

- Increased focus on value for money

As inflation concerns persist, consumers are becoming more discerning in their purchasing decisions, prioritizing necessities and seeking out deals and promotions.

Interest Rate Forecasts for 2025: Potential Easing on the Horizon

Looking ahead to 2025, economic forecasts suggest a potential easing of interest rates. This outlook is based on several factors:

- Improving inflation environment

- Subdued consumer spending in late 2024

- Potential for 100 basis points of monetary policy easing throughout 2025

These projections indicate that the Reserve Bank of Australia (RBA) may consider interest rate cuts as early as February 2025, potentially providing relief to borrowers and stimulating economic activity.

Access Farmonaut’s API Developer Docs for in-depth economic data

Comparative Spending Trends: 2023 vs 2024

To provide a clearer picture of how consumer behavior has evolved, we’ve compiled a comparative table of spending trends across various categories:

| Spending Category | 2023 Spending (% of total household budget) | 2024 Spending (% of total household budget) | Percentage Change |

|---|---|---|---|

| Household Goods | 15.5% | 14.2% | -8.3% |

| Hospitality | 8.2% | 8.0% | -2.6% |

| Utilities | 6.5% | 6.8% | +4.9% |

| Digital Services | 4.8% | 5.3% | +10.0% |

| Food and Beverage | 20.5% | 20.1% | -2.0% |

| Recreation | 7.8% | 8.4% | +7.3% |

| Transport | 12.5% | 12.4% | -0.7% |

| Insurance | 4.2% | 4.7% | +11.5% |

| Health | 6.8% | 7.4% | +9.4% |

This table clearly illustrates the shift in consumer priorities, with significant growth in areas like digital services, insurance, and health, while traditional retail categories like household goods experienced declines.

The Role of Technology in Shaping Consumer Behavior

In 2024, technology continued to play a pivotal role in shaping consumer behavior. The growth in digital services spending reflects this trend, with Australians increasingly turning to online platforms for shopping, entertainment, and financial management.

- Rise of e-commerce and digital marketplaces

- Increased adoption of digital payment solutions

- Growing popularity of subscription-based services

These technological shifts have not only changed how consumers spend but also how businesses operate and interact with their customers.

The Impact of Economic Uncertainty on Consumer Confidence

Economic uncertainty continued to influence consumer confidence throughout 2024. Factors contributing to this uncertainty included:

- Global economic fluctuations

- Ongoing concerns about inflation

- Labor market changes

These factors led many Australians to adopt a more cautious approach to spending, particularly in discretionary categories.

The Emergence of Sustainable Consumption

Another notable trend in 2024 was the growing emphasis on sustainable consumption. This shift was reflected in various spending patterns:

- Increased demand for eco-friendly products

- Rise in second-hand and vintage goods purchases

- Greater interest in locally-produced items

This trend towards sustainability is likely to continue shaping consumer behavior in the coming years, influencing both product choices and overall spending patterns.

The Future of Australian Consumer Spending

As we look towards the future, several factors are likely to influence Australian consumer spending:

- Potential interest rate cuts in 2025

- Ongoing technological advancements

- Evolving work patterns and their impact on household budgets

- Continued focus on sustainability and ethical consumption

These factors will shape not only how much Australians spend but also what they choose to spend their money on.

Conclusion: Navigating the Changing Landscape

Australia’s household spending trends in 2024 paint a picture of a nation adapting to economic challenges while embracing new opportunities. The shift towards digital services, the growing divide between homeowner and renter spending, and the increasing focus on sustainability all point to a consumer landscape in flux.

As we move into 2025, businesses and policymakers will need to remain agile, responding to these evolving trends and the potential for economic policy changes. For consumers, the key will be balancing cautious spending with strategic investments in areas that offer long-term value and align with changing priorities.

At Farmonaut, we remain committed to providing cutting-edge insights and technologies to help navigate this changing economic landscape. By leveraging data-driven approaches and innovative solutions, we aim to support informed decision-making in an increasingly complex world.

Frequently Asked Questions

- What caused the decline in consumer confidence in December 2024?

The 1.8% decline in consumer confidence was largely attributed to a shift in shopping patterns, with many consumers completing their holiday shopping earlier during Black Friday sales in November. - How did Black Friday sales impact overall retail trends in 2024?

Black Friday sales led to strong November retail performance but resulted in a subsequent decline in December spending, reshaping traditional holiday shopping patterns. - What were the key differences in spending habits between homeowners and renters?

Homeowners, especially those with mortgages, showed higher spending increases (3.8%) compared to renters (2.4%), indicating greater financial confidence among property owners. - Which sectors saw the most growth in consumer spending in 2024?

Insurance (11.5% growth), communications and digital services (10% increase), and health (9.4% rise) were among the top-performing sectors in terms of consumer spending growth. - What is the outlook for interest rates in 2025?

Economic forecasts suggest potential interest rate cuts in 2025, with expectations of up to 100 basis points in monetary policy easing throughout the year.

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions