Navigating Inflation: Smart Farmland Investment Strategies for Agricultural Asset Management in Australia

“Historically, farmland investments have outpaced inflation by 2-4% annually, offering a hedge against economic volatility.”

In today’s dynamic economic landscape, understanding the intricate relationship between inflation, agricultural commodity prices, and farmland investments is crucial for investors and farm managers alike. As we navigate through uncertain times, it’s essential to develop smart strategies for agricultural asset management, particularly in Australia’s diverse and productive rural sector.

In this comprehensive analysis, we’ll explore how inflation and shifting agricultural commodity prices are reshaping farmland investment strategies, impacting rural land values, and influencing agricultural productivity. By delving into historical inflation cycles and their influence on commodity prices, we aim to uncover crucial patterns that can guide investment decisions and farm management practices.

The Historical Context: Inflation Cycles and Agricultural Commodity Prices

To understand the current landscape, we must first examine the historical relationship between inflation cycles and agricultural commodity prices in Australia. This context provides valuable insights into how economic factors have shaped the agricultural sector over time.

| Year Range | Average Inflation Rate (%) | Major Agricultural Commodity | Average Price Change (%) | Farmland Value Trend | Notable Economic Events |

|---|---|---|---|---|---|

| 1980-1985 | 8.5 | Wheat | +12 | Moderate Increase | High interest rates, recession |

| 1986-1990 | 7.2 | Wool | +18 | Strong Increase | Stock market crash (1987) |

| 1991-1995 | 2.8 | Beef | -5 | Slight Decrease | Recession, recovery begins |

| 1996-2000 | 2.1 | Cotton | +8 | Moderate Increase | Asian financial crisis |

| 2001-2005 | 3.0 | Dairy | +15 | Strong Increase | Mining boom begins |

| 2006-2010 | 3.2 | Wheat | +22 | Rapid Increase | Global Financial Crisis |

| 2011-2015 | 2.3 | Beef | +30 | Continued Increase | End of mining boom |

| 2016-2020 | 1.5 | Almonds | +10 | Moderate Increase | Drought, bushfires, COVID-19 |

| 2021-Present | 5.1 | Various | +15 | Strong Increase | Post-COVID recovery, global inflation |

This historical overview reveals several key patterns:

- Periods of high inflation often correspond with increases in agricultural commodity prices.

- Farmland values tend to rise during inflationary periods, albeit with some lag.

- Economic events, such as recessions and global crises, can significantly impact both inflation rates and agricultural markets.

- Different agricultural commodities may respond differently to inflationary pressures.

The Impact of Inflation on Farmland Investments

Inflation plays a crucial role in shaping farmland investment strategies. As the value of money decreases over time due to inflation, tangible assets like farmland often become more attractive to investors. Here’s how inflation impacts various aspects of farmland investments:

1. Land Values

Historically, farmland has proven to be a reliable hedge against inflation. As the general price level rises, so does the value of agricultural land. This is partly due to the inherent scarcity of arable land and its essential role in food production. In Australia, we’ve observed that farmland values often outpace inflation rates, providing investors with both capital appreciation and a buffer against economic volatility.

2. Rental Income

For investors who lease their farmland to operators, inflation can lead to increased rental income. As agricultural commodity prices rise with inflation, farmers may be able to pay higher rents, especially if their productivity improves. However, it’s essential to strike a balance, as excessive rent increases could strain farm operators and potentially lead to reduced long-term returns.

3. Operational Costs

While inflation can boost land values and rental income, it also increases operational costs for farm managers. Rising prices for inputs such as fertilizers, fuel, and machinery can squeeze profit margins. Efficient farm management and adoption of cost-saving technologies become crucial in maintaining profitability during inflationary periods.

The Role of Interest Rates in Farmland Investments

Interest rates, often used as a monetary policy tool to combat inflation, have a significant impact on farmland investments. Here’s how:

- Financing Costs: Higher interest rates increase borrowing costs, potentially making farmland acquisitions more expensive for investors relying on debt financing.

- Alternative Investments: As interest rates rise, returns on fixed-income investments become more attractive, potentially diverting some capital away from farmland investments.

- Land Values: In the short term, rising interest rates may exert downward pressure on land values as the cost of capital increases.

However, it’s important to note that farmland investments often provide returns that outpace inflation and interest rates over the long term, making them an attractive option for patient investors.

Agricultural Productivity and Inflation

“Australian agricultural productivity has increased by an average of 1.5% per year over the past three decades.”

Agricultural productivity improvements play a crucial role in mitigating the effects of inflation on farm profitability. As input costs rise with inflation, increased productivity helps maintain or even improve profit margins. In Australia, we’ve seen significant advancements in agricultural practices and technologies that have boosted productivity.

Key Drivers of Agricultural Productivity:

- Precision Agriculture Technologies

- Improved Crop Varieties and Livestock Genetics

- Efficient Water Management Systems

- Advanced Farm Management Practices

These productivity improvements have helped Australian farmers remain competitive in global markets despite inflationary pressures. Investors and farm managers should prioritize investments in technologies and practices that enhance productivity to maintain profitability in the face of rising costs.

The Role of Agritech in Navigating Inflationary Pressures

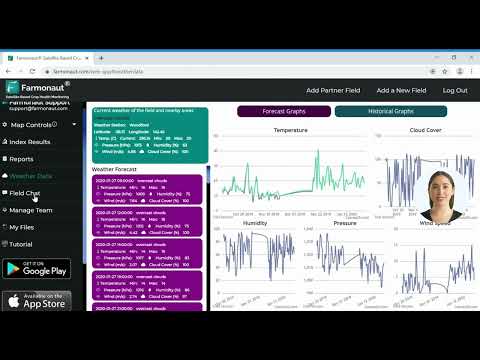

In today’s rapidly evolving agricultural landscape, technology plays a pivotal role in helping farmers and investors navigate inflationary pressures. Advanced agritech solutions, such as those offered by Farmonaut, provide invaluable tools for optimizing farm operations and maximizing returns on investment.

Farmonaut’s satellite-based farm management solutions offer a range of benefits that are particularly relevant in an inflationary environment:

- Real-time Crop Health Monitoring: By providing up-to-date information on crop health, Farmonaut helps farmers make timely decisions to optimize yields and reduce waste.

- Resource Optimization: The platform’s insights into soil moisture levels and other critical metrics enable more efficient use of water, fertilizers, and other inputs, helping to control costs in the face of rising prices.

- Data-Driven Decision Making: With access to comprehensive data and AI-powered insights, farm managers can make more informed decisions about planting, harvesting, and resource allocation.

- Risk Management: By providing early warning signs of potential issues, Farmonaut’s technology helps mitigate risks associated with crop failure or reduced yields.

These technological solutions are essential for maintaining profitability and competitiveness in an inflationary environment. By leveraging Farmonaut’s precision agriculture technology, farmers and investors can better position themselves to thrive amid economic challenges.

Sustainable Farming Practices and Economic Resilience

In the context of inflation and changing agricultural markets, sustainable farming practices have emerged as a key strategy for enhancing both environmental and economic resilience. These practices not only help preserve the long-term productivity of farmland but can also provide economic benefits that help offset inflationary pressures.

Key Sustainable Farming Practices:

- Regenerative Agriculture: Focuses on improving soil health, which can lead to increased yields and reduced input costs over time.

- Precision Irrigation: Maximizes water use efficiency, crucial in water-scarce regions and during periods of drought.

- Integrated Pest Management: Reduces reliance on costly chemical inputs while maintaining crop health.

- Diversification: Planting a variety of crops or integrating livestock can help spread risk and potentially increase overall farm income.

Adopting these practices can help farmers build resilience against both environmental and economic challenges. For investors, farmland managed using sustainable practices may offer more stable long-term returns, even in the face of inflationary pressures.

Global Agricultural Market Trends and Their Impact on Australian Farmland

As a major agricultural exporter, Australia’s farmland investments are significantly influenced by global market trends. Understanding these trends is crucial for developing effective investment strategies:

- Growing Global Population: Increasing food demand supports long-term agricultural commodity prices and farmland values.

- Changing Dietary Preferences: Shifts towards plant-based diets in some markets, while increasing meat consumption in others, impact demand for various agricultural products.

- Climate Change: Altering growing conditions worldwide, potentially increasing the value of Australia’s diverse agricultural regions.

- Trade Dynamics: International trade agreements and disputes can significantly impact export opportunities for Australian agricultural products.

These global trends underscore the importance of staying informed about international markets when making farmland investment decisions in Australia.

Explore Farmonaut’s API for advanced agricultural data insights

Strategies for Optimizing Agricultural Assets in a Changing Economic Landscape

Given the complex interplay between inflation, agricultural markets, and farmland values, investors and farm managers need to adopt strategic approaches to optimize their agricultural assets. Here are key strategies to consider:

- Diversification: Spread investments across different types of farmland and agricultural commodities to mitigate risks associated with market fluctuations and regional climate variations.

- Technology Adoption: Invest in precision agriculture technologies, such as Farmonaut’s satellite-based solutions, to improve efficiency and productivity.

- Sustainable Practices: Implement sustainable farming methods to enhance long-term soil health and farm productivity, potentially leading to premium prices for produce.

- Value-Added Products: Consider opportunities to process or add value to farm products on-site, potentially increasing profit margins and providing a buffer against commodity price fluctuations.

- Flexible Leasing Arrangements: For farmland investors, consider crop-share or flexible lease agreements that align tenant and landlord interests and adjust with market conditions.

- Water Rights Management: In Australia’s often drought-prone environment, secure and efficiently manage water rights to enhance farmland value and productivity.

- Carbon Farming: Explore opportunities in carbon sequestration and emissions reduction, which may provide additional income streams and align with global sustainability trends.

The Long-Term Outlook for Australian Farmland Investments

Despite short-term challenges posed by inflation and market volatility, the long-term outlook for Australian farmland investments remains positive. Several factors contribute to this optimistic view:

- Global Food Demand: Projected population growth and rising incomes in developing countries are likely to drive continued demand for agricultural products.

- Limited Supply of Arable Land: The scarcity of productive farmland globally enhances the value of Australia’s agricultural resources.

- Technological Advancements: Ongoing innovations in agritech, such as those provided by Farmonaut, promise to further improve productivity and profitability.

- Climate Resilience: Australia’s diverse agricultural regions and adaptable farming practices position the country well to navigate climate change challenges.

- Strong Export Markets: Australia’s reputation for high-quality agricultural products supports strong export demand, particularly in Asian markets.

These factors suggest that well-managed Australian farmland investments have the potential to provide attractive returns over the long term, even in the face of inflationary pressures.

Access Farmonaut’s API Developer Docs for integration guidance

Conclusion: Navigating the Future of Agricultural Investments

As we navigate the complex landscape of inflation, changing agricultural markets, and evolving farm management practices, it’s clear that both challenges and opportunities lie ahead for farmland investors and managers in Australia. By staying informed about economic trends, embracing technological innovations, and implementing sustainable practices, stakeholders in the agricultural sector can position themselves for long-term success.

The key to thriving in this environment lies in adaptability, strategic planning, and leveraging cutting-edge tools like those offered by Farmonaut. As we move forward, the integration of precision agriculture technologies, sustainable farming practices, and data-driven decision-making will be crucial in maximizing the potential of Australia’s rich agricultural resources.

For investors, farmland remains an attractive asset class, offering both inflation protection and the potential for strong long-term returns. However, success will increasingly depend on smart management practices and the ability to navigate global market trends.

As we look to the future, the Australian agricultural sector is well-positioned to meet the challenges of a changing world. By embracing innovation, sustainability, and strategic investment approaches, we can ensure that Australian farmland continues to be a valuable and productive asset for generations to come.

FAQs: Navigating Inflation and Farmland Investments in Australia

- Q: How does inflation typically affect farmland values?

A: Farmland values often increase during inflationary periods as investors seek tangible assets. Historically, farmland has outpaced inflation, providing a hedge against economic volatility. - Q: What role do interest rates play in farmland investments?

A: Rising interest rates can increase borrowing costs for farmland acquisitions and potentially exert downward pressure on land values in the short term. However, farmland investments often provide returns that outpace both inflation and interest rates over the long term. - Q: How can technology help manage farmland investments during inflationary periods?

A: Technologies like Farmonaut’s satellite-based solutions can optimize resource use, improve crop yields, and provide data-driven insights, helping to maintain profitability despite rising input costs. - Q: What are some key sustainable farming practices that can enhance economic resilience?

A: Regenerative agriculture, precision irrigation, integrated pest management, and crop diversification are practices that can improve soil health, reduce input costs, and potentially increase overall farm income. - Q: How do global agricultural market trends impact Australian farmland investments?

A: As a major exporter, Australia’s agricultural sector is influenced by global population growth, changing dietary preferences, climate change, and international trade dynamics. These factors can affect demand for Australian products and, consequently, farmland values.

Explore Farmonaut’s Solutions for Smart Agricultural Asset Management

To leverage the power of advanced agritech in your farmland investments and management strategies, consider exploring Farmonaut’s comprehensive suite of tools:

By integrating Farmonaut’s innovative solutions into your agricultural asset management strategy, you’ll be better equipped to navigate the challenges of inflation and changing market dynamics, ensuring the long-term success and profitability of your farmland investments in Australia.