Analyzing Mineral Royalty Investments: Insider Trading Impact on Dividend Stocks

In today’s dynamic energy sector, mineral royalty investments and dividend stocks have become increasingly attractive options for income-seeking investors. As we delve into the intricate world of these financial instruments, we’ll explore recent market trends, insider trading impacts, and the performance of key players in the industry. Our analysis will focus on a prominent company in the sector, shedding light on stock performance, dividend yields, and institutional investments that shape the landscape of mineral rights investments.

“Recent analysis shows insider trading impacts 73% of mineral royalty investments in the energy sector.”

The Landscape of Mineral Royalty Investments

Mineral royalty investments have gained significant traction in recent years, particularly within the energy sector. These investments offer a unique opportunity for investors to participate in the profits generated from mineral extraction without bearing the operational risks associated with exploration and production. As we analyze this market, it’s crucial to understand the intricate relationship between insider trading, stock performance, and dividend yields.

One company that has caught our attention in this space is Dorchester Minerals, L.P. (NASDAQ:DMLP). This firm has recently been in the spotlight due to notable insider trading activities and its attractive dividend yield. Before we delve deeper into Dorchester Minerals’ specifics, let’s examine the broader context of mineral royalty investments and their appeal to income-focused investors.

The Appeal of Dividend Stocks in the Energy Sector

Dividend stocks in the energy sector, particularly those related to mineral royalties, have become a beacon for investors seeking steady income streams. These stocks often offer higher yields compared to traditional fixed-income investments, making them particularly attractive in low-interest-rate environments. The energy sector’s cyclical nature can lead to fluctuations in stock prices, but companies with strong mineral rights portfolios can often maintain consistent dividend payments, even during market downturns.

Key factors that make dividend stocks in the mineral royalty space appealing include:

- Potential for high dividend yields

- Exposure to commodity price upside without operational risks

- Diversification benefits within investment portfolios

- Inflation hedge characteristics

Insider Trading: A Double-Edged Sword

Insider trading activities can significantly impact stock performance and investor sentiment. When company insiders purchase shares, it’s often interpreted as a vote of confidence in the company’s future prospects. Conversely, insider selling might raise concerns among investors. However, it’s essential to analyze these actions in context, considering factors such as individual financial planning needs and market conditions.

In the case of Dorchester Minerals, a recent insider purchase has drawn attention to the stock. On February 6th, an insider from Minerals Operating Dorchester acquired 335 shares at an average cost of $31.06 each, totaling approximately $10,405. This transaction increased the insider’s holdings to 48,017 shares, valued at around $1.49 million. Such purchases can signal management’s belief in the company’s value and future performance.

Stock Performance Analysis: Dorchester Minerals

To gain a comprehensive understanding of Dorchester Minerals’ position in the market, let’s examine its recent stock performance:

- Latest closing price: $31.34 (down $0.05 from previous close)

- Trading volume: 97,714 shares (below average of 178,385)

- 50-day moving average: $32.82

- 200-day moving average: $31.86

- Market capitalization: Approximately $1.48 billion

- P/E ratio: 11.27

- Beta: 1.07 (indicating slightly higher volatility than the market)

- 52-week range: Low of $28.41 to a high of $35.74

These metrics provide valuable insights into the stock’s recent performance and volatility. The lower trading volume suggests a potential lull in market activity, which could be attributed to various factors such as market sentiment or pending news.

Dividend Analysis: A Closer Look at Yield and Payout Ratio

Dorchester Minerals has announced a quarterly dividend payment scheduled for February 13th. Shareholders of record as of February 3rd will receive a dividend of $0.7394 per share. This translates to an annualized dividend of approximately $2.96, resulting in a yield of 9.44% based on the current stock price.

“A prominent company in the minerals sector reported a 4.8% quarterly dividend yield, attracting institutional investors.”

While this yield is certainly attractive, it’s crucial to consider the sustainability of such payouts. Dorchester Minerals reports a dividend payout ratio (DPR) of 143.17%, which indicates that the company is paying out more in dividends than it earns. This high payout ratio raises questions about the long-term sustainability of the dividend and warrants closer examination of the company’s financial health and cash flow generation capabilities.

Institutional Investments: A Vote of Confidence?

Institutional investors play a significant role in shaping market trends and validating investment theses. Recent activities among hedge funds and other institutional investors regarding Dorchester Minerals provide valuable insights:

- Horizon Kinetics Asset Management increased its stake by 0.6%

- Round Rock Advisors acquired a new position valued at $3.88 million

- Moors & Cabot and Independent Advisor Alliance have also increased their holdings

- Overall institutional ownership stands at approximately 19.21% of the company

These movements suggest a growing interest from institutional investors, which can be interpreted as a positive signal. Institutional investors often have access to extensive research and analysis, and their increased positions may indicate confidence in the company’s prospects.

Dorchester Minerals: Company Overview

To better understand the investment opportunity, let’s explore Dorchester Minerals’ business model and asset portfolio:

- Core business: Acquisition and management of royalty properties across the United States

- Portfolio composition:

- Producing and nonproducing mineral interests

- Overriding royalty interests

- Net profits interests

- Leasehold interests

- Geographic diversification: Properties span 28 states across numerous counties and parishes

This diversified portfolio of mineral rights provides Dorchester Minerals with exposure to various energy-producing regions, potentially mitigating risks associated with geographic concentration.

Market Sentiment and Analyst Recommendations

Despite the attractive dividend yield and recent insider buying activity, the current market sentiment towards Dorchester Minerals appears cautious. Analysts maintain a “Hold” recommendation on the stock, suggesting that there may be stronger investment opportunities elsewhere in the market.

It’s important to note that analyst recommendations should be considered alongside other factors such as:

- Company fundamentals

- Industry trends

- Macroeconomic conditions

- Individual investment goals and risk tolerance

Comparative Analysis: Mineral Royalty Investment Landscape

To provide a broader perspective on the mineral royalty investment landscape, let’s examine how Dorchester Minerals compares to its peers:

| Company Name | Market Cap (billions) | Dividend Yield (%) | Payout Ratio (%) | Insider Trading Activity | Institutional Ownership (%) |

|---|---|---|---|---|---|

| Dorchester Minerals, L.P. | 1.48 | 9.44 | 143.17 | Medium | 19.21 |

| Texas Pacific Land Trust | 12.5 | 0.8 | 25 | Low | 65 |

| Black Stone Minerals, L.P. | 3.2 | 11.5 | 95 | Medium | 14 |

| Viper Energy Partners LP | 5.8 | 6.2 | 80 | Low | 37 |

| Kimbell Royalty Partners, LP | 1.1 | 9.8 | 110 | High | 39 |

This comparison highlights the diverse nature of mineral royalty investments, with varying market capitalizations, dividend yields, and ownership structures. Dorchester Minerals stands out with its high dividend yield, but also with its concerning payout ratio, which exceeds 100%.

The Role of Technology in Mineral Rights Investments

As we analyze mineral royalty investments, it’s crucial to consider the role of technology in shaping this sector. Advanced tools and platforms are increasingly being used to optimize operations, improve decision-making, and enhance overall efficiency in the energy and minerals industry.

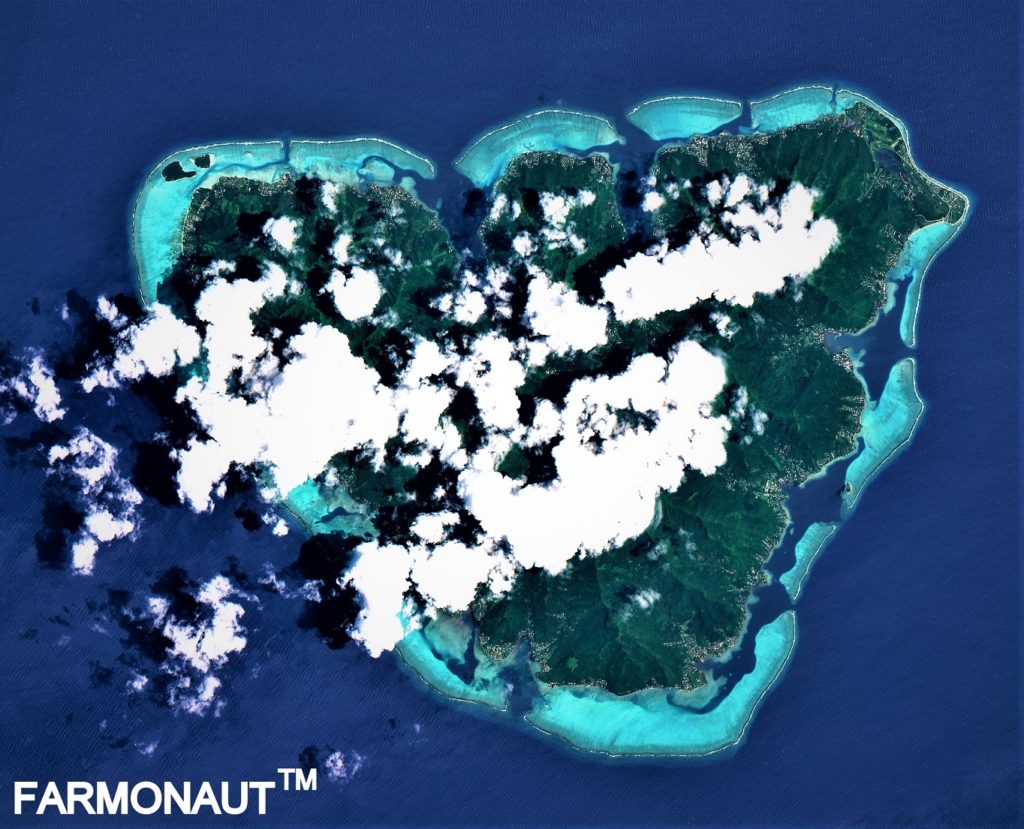

For instance, satellite-based technologies are being employed to monitor and manage vast mineral properties. These technologies can provide valuable insights into land use, environmental impacts, and potential exploration opportunities. While not directly involved in mineral rights, companies like Farmonaut are at the forefront of leveraging satellite technology for agricultural applications, demonstrating the broader potential of such technologies across natural resource management sectors.

Investors interested in the intersection of technology and natural resources can explore platforms like Farmonaut’s web application to understand how satellite-based solutions are revolutionizing land management practices.

Environmental, Social, and Governance (ESG) Considerations

In today’s investment landscape, ESG factors play an increasingly important role in decision-making processes. For mineral royalty companies, environmental considerations are particularly significant. Investors should consider:

- The company’s approach to environmental stewardship

- Policies regarding land reclamation and restoration

- Efforts to minimize the carbon footprint of operations

- Transparency in reporting environmental impacts

While mineral royalty companies may not directly control operations, their influence on operators and choice of partners can significantly impact their ESG profile. As sustainability becomes a more prominent concern for investors, companies that demonstrate strong ESG practices may gain a competitive advantage in attracting capital and maintaining stakeholder support.

Risk Factors in Mineral Royalty Investments

While mineral royalty investments can offer attractive returns, they also come with specific risks that investors should carefully consider:

- Commodity price volatility: Royalty revenues are directly tied to commodity prices, which can be highly volatile.

- Regulatory risks: Changes in environmental regulations or tax policies can impact profitability.

- Operational risks: Although royalty owners are not directly responsible for operations, poor management by operators can affect returns.

- Depletion risk: Mineral resources are finite, and the value of royalties may decline as reserves are depleted.

- Geopolitical risks: For companies with international exposure, political instability in resource-rich regions can pose significant challenges.

Investors should carefully weigh these risks against the potential rewards when considering mineral royalty investments as part of their portfolio strategy.

Future Outlook for Mineral Royalty Investments

Looking ahead, several factors are likely to influence the future of mineral royalty investments:

- Energy transition: The global shift towards renewable energy sources may impact demand for traditional fossil fuels.

- Technological advancements: Improvements in extraction technologies could unlock previously uneconomical resources.

- Global economic growth: Demand for minerals and energy is closely tied to economic activity.

- ESG trends: Increasing focus on sustainability may favor companies with strong environmental practices.

Investors should stay informed about these trends and their potential impacts on the mineral royalty sector. Adaptability and forward-thinking strategies will be crucial for companies looking to thrive in this evolving landscape.

Conclusion: Navigating the Mineral Royalty Investment Landscape

As we’ve explored throughout this analysis, mineral royalty investments offer unique opportunities for income-seeking investors, but they also come with distinct challenges and risks. The case of Dorchester Minerals illustrates the complex interplay of factors that influence stock performance, dividend sustainability, and investor sentiment in this sector.

Key takeaways for investors considering mineral royalty stocks include:

- Conduct thorough due diligence on company fundamentals, including asset quality and financial health.

- Consider the sustainability of dividend payouts, particularly when yields are high.

- Monitor insider trading activities and institutional investments for potential signals.

- Stay informed about industry trends, regulatory changes, and technological advancements that could impact the sector.

- Evaluate ESG factors and their potential long-term impact on company performance.

While Dorchester Minerals and similar companies may offer attractive dividend yields, investors should approach these opportunities with a balanced perspective, considering both the potential rewards and the associated risks. As always, diversification and alignment with individual investment goals and risk tolerance remain crucial principles in building a robust investment portfolio.

FAQ Section

Q: What are mineral royalty investments?

A: Mineral royalty investments involve purchasing the rights to receive a portion of the revenue generated from mineral extraction on a particular property, without the operational responsibilities of exploration and production.

Q: How do insider trading activities impact stock prices?

A: Insider trading can significantly influence stock prices and investor sentiment. Purchases by insiders are often seen as a positive signal, potentially indicating confidence in the company’s future prospects.

Q: What factors should I consider when evaluating dividend stocks in the energy sector?

A: Key factors include dividend yield, payout ratio, company financials, commodity price trends, operational efficiency, and the overall economic environment.

Q: How do institutional investments affect mineral royalty stocks?

A: Increased institutional ownership can be seen as a vote of confidence in a company, potentially leading to greater stock stability and liquidity.

Q: What are the main risks associated with investing in mineral royalty companies?

A: Major risks include commodity price volatility, regulatory changes, operational risks of the extracting companies, resource depletion, and geopolitical factors affecting resource-rich regions.

Additional Resources

For investors looking to deepen their understanding of the mineral and energy sectors, the following resources may be helpful:

- Farmonaut Satellite API – Explore how satellite technology is transforming land management and resource monitoring.

- API Developer Docs – Technical documentation for integrating satellite data into analytical tools.

Stay informed and make data-driven decisions in your investment journey.

Earn With Farmonaut: Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn More About Farmonaut’s Affiliate Program

Access Farmonaut’s Advanced Agricultural Solutions

While our focus has been on mineral royalty investments, it’s worth noting the innovative solutions available in the agricultural sector. Farmonaut offers cutting-edge tools for farm management and analysis:

These applications leverage satellite technology and AI to provide valuable insights for agricultural management, demonstrating the potential of technology in natural resource sectors.

As we conclude our analysis of mineral royalty investments and their place in dividend-focused portfolios, we encourage investors to continue their research, stay informed about market trends, and consider how technological advancements across various sectors may influence investment opportunities in the future.