Boosting Farm Financial Health: Mastering DSCR with Smart Agtech Solutions

“The Debt Service Coverage Ratio (DSCR) is a key metric used by 90% of agricultural lenders to assess farm financial health.”

In the ever-evolving landscape of agriculture, farm financial management has become increasingly crucial for the success and sustainability of agricultural operations. As we delve into the intricacies of farm economics and the challenges faced by producers across various sectors, we’ll explore how understanding and optimizing the Debt Service Coverage Ratio (DSCR) can significantly impact a farm’s financial health. Join us as we navigate through the complex world of agricultural finance, examining the effects of fluctuating farm cash receipts, rising borrowing costs, and market volatility on farmers’ ability to service debt and maintain profitable operations.

Understanding the Debt Service Coverage Ratio (DSCR) in Agriculture

The Debt Service Coverage Ratio is a fundamental financial metric used to assess a farm’s ability to meet its debt obligations. It’s calculated by dividing the farm’s net operating income by its total debt service costs, including principal and interest payments. A DSCR greater than 1 indicates that the farm generates sufficient income to cover its debt payments, while a ratio below 1 suggests potential financial stress.

In the agricultural sector, maintaining a healthy DSCR is particularly challenging due to the inherent volatility of farm income. Factors such as weather conditions, market prices, and government policies can significantly impact a farm’s cash flow from year to year. As agricultural economists, we’ve observed that fluctuations in farm cash receipts can cause substantial variances in annual DSCRs, making it crucial for farmers to implement robust financial management strategies.

The Impact of Agricultural Economic Trends on DSCR

Recent agricultural economic trends have had a profound effect on farmers’ ability to maintain healthy DSCRs. Let’s explore some of the key factors influencing farm financial health:

- Rising Borrowing Costs: With interest rates on the rise, the cost of servicing agricultural loans has increased, putting pressure on farmers’ DSCRs. This trend underscores the importance of strategic debt management and careful consideration of financing options.

- Fluctuating Farm Cash Receipts: The volatility in commodity prices has led to unpredictable farm revenues. For instance, dairy farmers have experienced significant swings in milk prices, while grain and oilseed producers have faced challenges due to international trade disputes and changing global demand.

- Increasing Production Costs: Rising input costs, including fuel, fertilizer, and labor, have squeezed profit margins for many agricultural producers, making it more difficult to maintain a strong DSCR.

- Market Dynamics: External factors such as tariffs and trade policies have introduced additional uncertainty into agricultural markets. The ongoing trade tensions between major economies like the United States and China have had ripple effects on global agricultural commodity prices and trade flows.

To illustrate the impact of these trends, let’s consider a hypothetical case study of a mid-sized grain farm in the North American heartland:

Case Study: Johnson Family Farm

The Johnson Family Farm, a 1,000-acre grain operation, has historically maintained a DSCR of 1.5, indicating a healthy financial position. However, recent economic shifts have posed challenges:

- A 15% increase in borrowing costs due to rising interest rates

- A 20% decrease in grain prices due to oversupply and trade tensions

- A 10% increase in production costs, primarily driven by higher fertilizer and fuel prices

These factors combined to reduce the farm’s DSCR to 1.1, putting the operation at risk of financial stress. To address this, the Johnsons implemented several strategies, including:

- Diversifying their crop portfolio to mitigate price risks

- Adopting precision agriculture techniques to optimize input use and reduce costs

- Exploring alternative financing options to manage debt more effectively

By taking these proactive steps, the Johnsons were able to gradually improve their DSCR back to a more comfortable level of 1.3, demonstrating the importance of adaptability and strategic financial management in maintaining farm financial health.

Sector-Specific DSCR Challenges

Different agricultural sectors face unique challenges when it comes to maintaining a healthy DSCR. Let’s examine some sector-specific issues:

Dairy Sector

The dairy industry has experienced significant volatility in recent years, with milk prices fluctuating widely. This unpredictability in cash receipts has made it challenging for dairy farmers to maintain consistent DSCRs. Additionally, the high capital costs associated with dairy operations, including expensive equipment and livestock, can lead to substantial debt burdens.

Grain and Oilseed Sector

Grain and oilseed producers are particularly vulnerable to international market dynamics and trade policies. Tariffs and trade disputes can quickly impact commodity prices, affecting farm revenues and, consequently, DSCRs. Moreover, the cyclical nature of grain markets can lead to periods of low prices, putting pressure on farmers’ ability to service debt.

Livestock Sector

Cattle and hog producers face unique DSCR challenges due to the long production cycles in animal agriculture. Market price fluctuations can have a significant impact on profitability, and disease outbreaks can lead to sudden drops in revenue. These factors make maintaining a stable DSCR particularly challenging in the livestock sector.

“Fluctuations in farm cash receipts can cause up to 30% variance in a farm’s annual DSCR, impacting debt servicing ability.”

Strategies for Improving DSCR in Agriculture

To maintain a healthy DSCR and overall farm financial health, agricultural producers can implement several strategies:

- Diversification: Spreading risk across multiple crops or livestock types can help stabilize income and improve DSCR consistency.

- Cost Management: Implementing efficient production practices and carefully managing input costs can help maintain profitability even in challenging market conditions.

- Financial Planning: Working with an agricultural accountant or financial advisor to develop comprehensive financial plans can help farmers make informed decisions about debt management and capital investments.

- Risk Management: Utilizing tools such as crop insurance, futures contracts, and hedging strategies can help mitigate the impact of price volatility on farm income.

- Technology Adoption: Embracing precision agriculture and smart farming technologies can improve operational efficiency and reduce costs, positively impacting DSCR.

Leveraging Agtech Solutions for Improved Financial Health

In today’s digital age, agricultural technology (agtech) solutions play a crucial role in optimizing farm operations and improving financial performance. One such innovative platform is Farmonaut, which offers advanced satellite-based farm management solutions to help farmers make data-driven decisions and enhance their financial health.

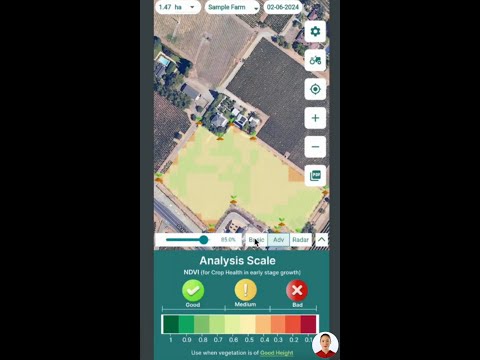

Farmonaut’s precision agriculture software and GIS solutions provide farmers with valuable insights into crop health, soil conditions, and resource allocation. By leveraging these tools, farmers can:

- Optimize irrigation practices to reduce water usage and associated costs

- Implement targeted fertilizer applications to maximize yield while minimizing input expenses

- Monitor crop health in real-time, allowing for early detection and management of potential issues

- Improve overall farm productivity and efficiency, positively impacting cash flow and DSCR

To explore how Farmonaut can help your farm operations, visit their web application or download their mobile apps:

The Role of Sustainable Farming Practices in Financial Stability

Adopting sustainable farming practices not only benefits the environment but can also contribute to long-term financial stability and improved DSCRs. By implementing conservation tillage, crop rotation, and integrated pest management, farmers can reduce input costs and improve soil health, leading to more consistent yields and revenues over time.

Farmonaut’s satellite-based monitoring capabilities can assist farmers in implementing and tracking the effectiveness of these sustainable practices. By providing detailed insights into crop health and soil conditions, the platform enables farmers to make informed decisions about resource allocation and conservation efforts.

DSCR Benchmarks for Different Farm Types

To provide a clearer picture of DSCR expectations across various agricultural sectors, we’ve compiled a table of estimated benchmarks:

| Farm Type | Healthy DSCR Range | Risk Level | Estimated Average Farm Cash Receipts | Typical Debt Service Costs |

|---|---|---|---|---|

| Dairy | 1.3 – 1.5 | Moderate | $500,000 – $1,000,000 | $150,000 – $300,000 |

| Grain | 1.4 – 1.6 | Low to Moderate | $300,000 – $800,000 | $100,000 – $250,000 |

| Oilseed | 1.3 – 1.5 | Moderate | $250,000 – $700,000 | $80,000 – $200,000 |

| Cattle | 1.2 – 1.4 | Moderate to High | $400,000 – $900,000 | $120,000 – $280,000 |

| Hog | 1.2 – 1.4 | Moderate to High | $350,000 – $800,000 | $100,000 – $250,000 |

Note: These figures are estimates and may vary based on factors such as farm size, location, and market conditions.

The Future of Farm Financial Management

As we look to the future of agriculture, it’s clear that effective financial management will be more critical than ever. The integration of advanced technologies, such as those offered by Farmonaut, with traditional farming practices will play a pivotal role in helping farmers navigate the complex financial landscape of modern agriculture.

Some key trends to watch in farm financial management include:

- Increased use of data analytics and AI in financial decision-making

- Greater emphasis on risk management strategies to mitigate market volatility

- Growing adoption of sustainable farming practices to improve long-term financial stability

- Continued integration of precision agriculture technologies to optimize resource use and profitability

By staying informed about these trends and leveraging innovative solutions like Farmonaut’s API and developer documentation, farmers can position themselves for success in an increasingly complex agricultural economy.

Conclusion

Maintaining a healthy Debt Service Coverage Ratio is essential for the long-term success and sustainability of agricultural operations. By understanding the factors that influence DSCR, implementing effective financial management strategies, and leveraging advanced agtech solutions like Farmonaut, farmers can navigate the challenges of modern agriculture and build more resilient, profitable enterprises.

As we continue to face economic uncertainties and evolving market dynamics, the ability to adapt and make data-driven decisions will be crucial. By mastering DSCR management and embracing smart agtech solutions, farmers can boost their financial health and ensure the continued growth and prosperity of their operations for generations to come.

FAQ Section

- What is considered a good DSCR for a farm?

A DSCR of 1.25 or higher is generally considered good for farms. However, this can vary depending on the specific agricultural sector and individual farm circumstances. - How often should I calculate my farm’s DSCR?

It’s recommended to calculate your farm’s DSCR at least annually, ideally after harvest or at the end of your fiscal year. However, monitoring it quarterly can provide more timely insights into your financial health. - Can precision agriculture technologies help improve my farm’s DSCR?

Yes, precision agriculture technologies like those offered by Farmonaut can help optimize resource use, reduce costs, and potentially increase yields, all of which can positively impact your DSCR. - How do market fluctuations affect a farm’s DSCR?

Market fluctuations can significantly impact farm revenues and, consequently, the DSCR. Diversification and risk management strategies can help mitigate these effects. - What steps can I take to improve my farm’s DSCR?

To improve your DSCR, consider reducing operating costs, increasing revenues through diversification or value-added products, refinancing high-interest debt, and implementing efficient farm management practices.

Explore Farmonaut’s Solutions

To learn more about how Farmonaut’s innovative agtech solutions can help improve your farm’s financial health and operational efficiency, explore our subscription options below:

Additional Resources

For more insights into using satellite data for agriculture and leveraging Farmonaut’s solutions, check out these informative videos:

By leveraging these resources and implementing the strategies discussed in this blog, you can take significant steps towards boosting your farm’s financial health and mastering DSCR management with smart agtech solutions.