USMCA Compliance: How Canadian Businesses Can Navigate New Trade Regulations and Tariff Exemptions

“USMCA compliance requires Canadian businesses to secure country of origin certification for 100% of their US-bound exports.”

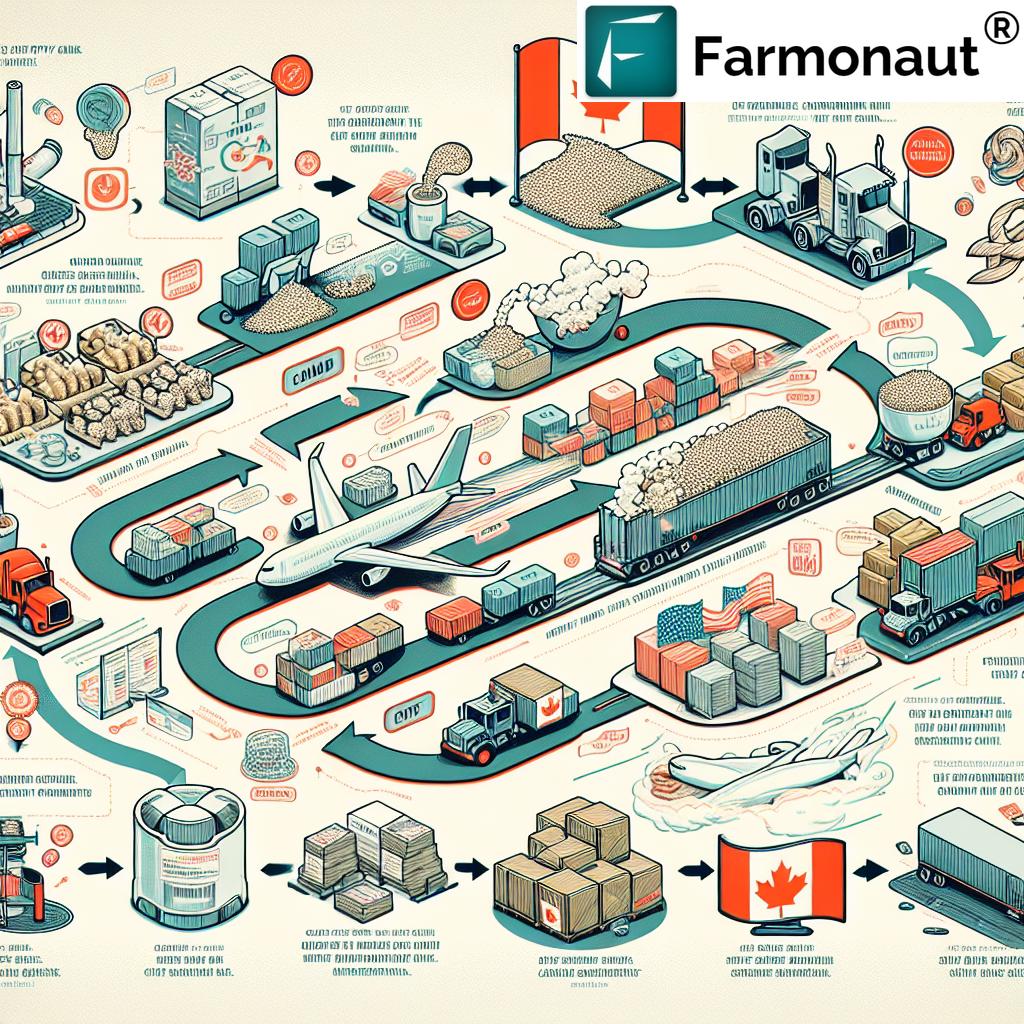

In the ever-evolving landscape of international trade, Canadian businesses are facing a new challenge: navigating the complex waters of USMCA compliance. As we delve into this crucial topic, we’ll explore how recent changes in trade regulations are reshaping the export landscape for Canadian companies and provide actionable insights on how to adapt and thrive in this new era of cross-border commerce.

Understanding USMCA Compliance: A New Era for Canadian Exporters

The United States-Mexico-Canada Agreement (USMCA) has ushered in a new era of trade relations between North American countries. For Canadian businesses, this means adapting to new rules and regulations that govern the flow of goods across borders. At the heart of these changes lies the critical concept of USMCA compliance, which encompasses a range of requirements designed to ensure fair trade practices and promote North American economic integration.

Key aspects of USMCA compliance include:

- Country of origin certification

- Adherence to rules of origin

- Supply chain tracking

- Detailed documentation

- Meeting product-specific thresholds

For many Canadian companies, especially those that have long relied on the simplicity of Most Favored Nation (MFN) tariffs, the shift to USMCA compliance represents a significant change in how they approach international trade. The stakes are high: failing to meet USMCA requirements could result in the loss of tariff exemptions, potentially making Canadian goods less competitive in the U.S. market.

The Importance of Country of Origin Certification

One of the most critical aspects of USMCA compliance is securing country of origin certification. This process involves proving that a product meets the specific rules of origin outlined in the agreement. For Canadian businesses, this means demonstrating that their goods are sufficiently “Canadian” to qualify for USMCA benefits.

The certification process can be complex, involving:

- Detailed analysis of production processes

- Calculation of regional value content

- Tracing the origin of materials and components

- Maintaining comprehensive records

While this process may seem daunting, it’s become increasingly crucial in the current trade environment. As one trade expert noted, “In Donald Trump’s economy, it’s a label that may prove life or death for businesses.”

Navigating the Complexities of USMCA Rules of Origin

The rules of origin under USMCA are product-specific and can be intricate. They determine whether a good qualifies as “originating” within the USMCA region and thus eligible for preferential tariff treatment. These rules consider factors such as:

- The percentage of regional value content

- The extent of production or processing in USMCA countries

- The tariff classification changes of non-originating materials

For some products, meeting these requirements is straightforward. As John Boscariol, head of the International Trade and Investment Law Group at McCarthy Tétrault LLP, points out, “For some, it’s very easy. Agriculture or natural resources. There’s no foreign content. It’s basically pulled out of the ground in Canada.”

However, for manufactured goods with complex supply chains, the process can be much more challenging. Companies may need to trace the origin of numerous components, some of which may come from multiple suppliers across different countries.

The Challenge of Supply Chain Tracking

Effective supply chain tracking is crucial for USMCA compliance. Canadian businesses must now have a clear understanding of where every component of their products originates. This level of detail is necessary not only for certification but also to prepare for potential U.S. customs audits.

Implementing robust supply chain tracking systems may involve:

- Upgrading inventory management software

- Implementing blockchain technology for traceability

- Conducting regular supplier audits

- Training staff on new tracking procedures

While these measures can be costly and time-consuming to implement, they are essential for maintaining compliance and avoiding potential penalties.

The Cost-Benefit Analysis of USMCA Compliance

For many Canadian businesses, the decision to pursue USMCA compliance comes down to a cost-benefit analysis. The process can be expensive and resource-intensive, particularly for companies with complex products or supply chains. However, the potential benefits of tariff exemptions can be substantial, especially in light of recent trade tensions and tariff threats.

Factors to consider in this analysis include:

- The current tariff rate under MFN status

- The volume of exports to the U.S.

- The cost of implementing compliance measures

- The potential impact on competitiveness in the U.S. market

Wendy Wagner, head of Gowling WLG Canada’s International Trade Group, notes that in the past, many companies opted to pay nominal MFN tariffs rather than invest in USMCA compliance. However, with the threat of higher tariffs looming, this calculus is changing for many businesses.

“The USMCA trade agreement, replacing NAFTA, impacts over $1.4 trillion in annual North American trade flows.”

Preparing for U.S. Customs Audits

A critical aspect of USMCA compliance is being prepared for potential U.S. customs audits. These audits can be rigorous, and mistakes can be costly. Canadian exporters must maintain detailed records to substantiate their claims of USMCA compliance.

Key elements of audit preparation include:

- Maintaining comprehensive documentation of origin certification

- Keeping records of all relevant transactions and supply chain details

- Ensuring consistency between certification documents and actual shipments

- Training staff on proper record-keeping procedures

Nithya Nagarajan, a Washington-based trade lawyer, emphasizes that the responsibility extends to U.S. importers as well. They must conduct due diligence on the goods they’re importing, ensuring that all documentation matches the specific products and that invoices align with packing lists.

The Role of Technology in USMCA Compliance

As Canadian businesses grapple with the complexities of USMCA compliance, many are turning to technology solutions to streamline the process. Advanced software systems can help with:

- Automating origin calculations

- Managing supply chain data

- Generating required documentation

- Ensuring real-time compliance monitoring

These technological tools can significantly reduce the administrative burden of compliance and minimize the risk of errors. However, implementing such systems requires investment and may necessitate changes to existing business processes.

For businesses looking to leverage technology in their compliance efforts, platforms like Farmonaut offer innovative solutions. While primarily focused on agricultural technology, Farmonaut’s expertise in satellite-based monitoring and blockchain-enabled traceability could potentially be adapted to support supply chain tracking for USMCA compliance.

The Impact on Canadian Agriculture and Natural Resources

For Canadian agricultural and natural resource sectors, USMCA compliance presents both opportunities and challenges. On one hand, these industries often have a clear advantage when it comes to origin certification, as their products are typically 100% Canadian. This simplifies the compliance process significantly.

However, these sectors must still navigate other aspects of USMCA, including:

- New market access provisions

- Changes to sanitary and phytosanitary measures

- Regulations on biotechnology and gene editing

For agricultural businesses, tools like Farmonaut’s satellite-based crop monitoring could prove valuable in maintaining detailed records of production, which may be useful for origin certification and audit preparation.

USMCA Compliance Checklist for Canadian Exporters

| Compliance Area | USMCA Requirement | Action Items for Businesses | Potential Challenges | Resources/Tools |

|---|---|---|---|---|

| Rules of Origin | Meet product-specific origin criteria |

– Analyze production processes – Calculate regional value content – Trace origin of materials |

Complex supply chains, multiple suppliers | USMCA text, customs brokers, trade lawyers |

| Documentation | Maintain comprehensive records |

– Implement record-keeping system – Train staff on documentation requirements – Regularly audit internal records |

Volume of data, ensuring accuracy | Document management software, compliance training |

| Supply Chain Tracking | Track origin of all inputs |

– Implement traceability system – Conduct supplier audits – Update inventory management |

Multiple tiers of suppliers, data integration | Blockchain solutions, supply chain management software |

| Tariff Classification | Correctly classify goods under HS codes |

– Review product classifications – Stay updated on HS code changes – Consult with customs experts |

Complexity of HS system, frequent updates | Customs rulings, classification databases |

| Customs Audit Preparation | Be ready for potential U.S. customs audits |

– Maintain detailed origin certification records – Ensure consistency in documentation – Conduct internal compliance audits |

Resource intensity, potential for errors | Audit preparation checklists, compliance software |

The Future of Canada-US Trade Under USMCA

As Canadian businesses adapt to the new realities of USMCA compliance, the future of Canada-US trade remains uncertain. The agreement has brought both opportunities and challenges, and its long-term impact is still unfolding.

Key factors to watch include:

- Potential changes in U.S. trade policy

- The evolution of global supply chains

- Technological advancements in trade facilitation

- The impact of environmental and labor provisions in USMCA

Canadian businesses must remain agile and prepared to adapt to further changes in the trade landscape. Staying informed about policy developments, investing in compliance capabilities, and leveraging technology will be crucial for success in this new era of North American trade.

Leveraging Technology for USMCA Compliance

As Canadian businesses navigate the complexities of USMCA compliance, technology is emerging as a crucial tool. Advanced software solutions can streamline the compliance process, reduce errors, and improve efficiency. While not specifically designed for USMCA compliance, platforms like Farmonaut demonstrate the potential of technology in managing complex data and traceability requirements.

Key technological solutions that can aid in USMCA compliance include:

- Blockchain-based traceability systems

- AI-powered document management

- Automated customs classification tools

- Real-time supply chain visibility platforms

For businesses interested in exploring these technological solutions, resources are available:

- Farmonaut API – While focused on agricultural data, this API demonstrates how satellite and weather data can be integrated into business systems.

- API Developer Docs – These documentation guidelines show how businesses can integrate advanced data into their existing systems.

While these tools are primarily designed for the agricultural sector, they illustrate the potential for technology to support complex data management and traceability requirements, which are crucial for USMCA compliance across various industries.

Practical Steps for Canadian Businesses

For Canadian businesses looking to ensure USMCA compliance and maintain their competitive edge in the U.S. market, we recommend the following steps:

- Conduct a comprehensive compliance audit: Review your current processes, documentation, and supply chain to identify gaps in USMCA compliance.

- Invest in staff training: Ensure that your team understands USMCA requirements and can implement necessary procedures.

- Upgrade your technology: Implement software solutions that can automate and streamline compliance processes.

- Engage with experts: Consult with trade lawyers, customs brokers, and other specialists to navigate complex aspects of USMCA.

- Develop a robust record-keeping system: Establish processes to maintain detailed, accurate records that can withstand U.S. customs audits.

- Stay informed: Keep abreast of changes in trade policies and USMCA interpretations that may affect your business.

By taking these steps, Canadian businesses can position themselves to thrive under the new trade regulations, ensuring continued access to the vital U.S. market.

Conclusion: Adapting to the New Trade Landscape

As we’ve explored throughout this article, USMCA compliance represents a significant shift in the landscape of Canada-US trade. While the new regulations present challenges, they also offer opportunities for Canadian businesses to strengthen their position in the North American market.

Key takeaways include:

- The critical importance of securing country of origin certification

- The need for detailed supply chain tracking and documentation

- The potential benefits of leveraging technology for compliance

- The ongoing need to stay informed about trade policy developments

By embracing these changes and investing in compliance capabilities, Canadian businesses can navigate the new trade regulations successfully, ensuring continued access to the U.S. market and maintaining their competitive edge in the global economy.

As we move forward in this new era of North American trade, adaptability, technological innovation, and a thorough understanding of USMCA requirements will be key to success for Canadian exporters.

FAQs

- What is USMCA compliance?

USMCA compliance refers to meeting the requirements set forth in the United States-Mexico-Canada Agreement for goods to qualify for tariff exemptions when traded between these countries. - How does USMCA differ from NAFTA?

USMCA updates and replaces NAFTA with new provisions on digital trade, intellectual property, and labor standards. It also includes stricter rules of origin for certain sectors like automotive. - What are the key requirements for country of origin certification under USMCA?

Key requirements include meeting product-specific rules of origin, maintaining detailed records of production processes and material sourcing, and being prepared for potential customs audits. - How can Canadian businesses prepare for U.S. customs audits?

Businesses should maintain comprehensive documentation, ensure consistency between certification documents and actual shipments, and implement robust record-keeping systems. - What role does technology play in USMCA compliance?

Technology can help automate origin calculations, manage supply chain data, generate required documentation, and ensure real-time compliance monitoring.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions