Revolutionizing Environmental Remediation: How Green Bonds Drive Sustainable Projects in Scottsdale and Beyond

“A groundbreaking GBP 50 million Green Bond investment is driving global environmental remediation projects.”

In an era where environmental sustainability has become paramount, we are witnessing a revolutionary approach to funding eco-friendly initiatives. The recent announcement of a GBP 50 million Green Bond investment by Cyber Enviro-Tech, Inc. (CETI) marks a significant milestone in the realm of sustainable finance and environmental remediation. This groundbreaking development not only showcases the power of green investments but also highlights the growing trend of using financial instruments to drive positive environmental change.

Understanding Green Bonds: A Sustainable Investment Opportunity

Green Bonds have emerged as a powerful tool in the world of sustainable finance. These specialized financial instruments are designed to fund projects that have a positive environmental impact. The concept of Green Bonds has gained significant traction since the European Investment Bank (EIB) issued the first one in 2007. Since then, the market has expanded exponentially, with the total value of Green Bonds now exceeding USD 2 trillion.

What sets Green Bonds apart is their strict adherence to the four core principles of the Green Bond Principles:

- Transparency in the use of proceeds

- Project evaluation and selection

- Management of funds

- Annual reporting

These principles ensure that the funds raised through Green Bonds are exclusively allocated to financing or refinancing eligible green initiatives. This level of transparency and accountability makes Green Bonds an attractive option for investors who wish to align their financial goals with sustainable objectives.

The Global Impact of CETI’s Green Bond Initiative

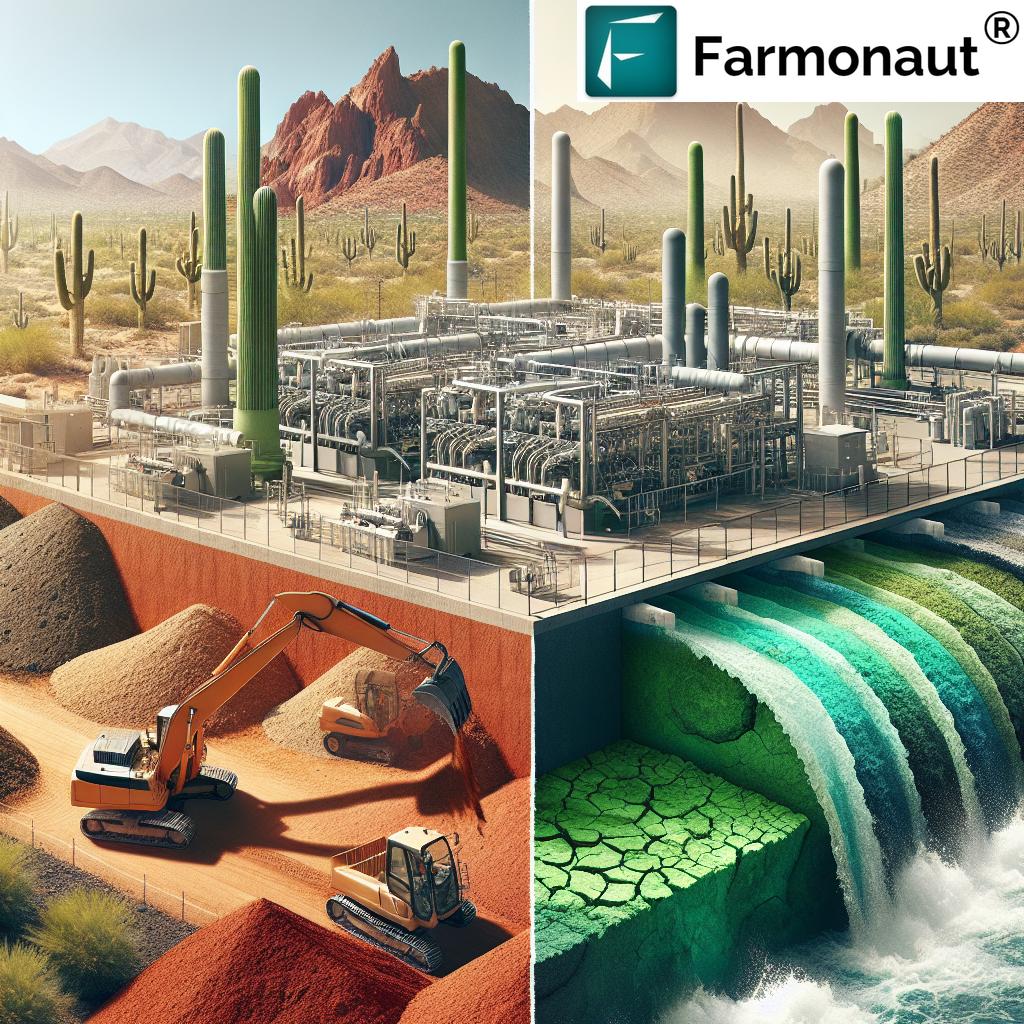

Cyber International, a wholly-owned subsidiary of CETI, plans to utilize the funds from the Green Bond to support large-scale environmental remediation projects across Turkey, the Middle East, and Africa. These initiatives will focus on critical areas of environmental concern, including:

- Sludge pond remediation

- Oil refinery slope management

- Contaminated soil reclamation

- Industrial wastewater treatment

By addressing decades of environmental damage caused by oil production, Cyber International is not only mitigating ecological risks but also generating revenue through the recovery and sale of valuable byproducts. This innovative approach underscores CETI’s commitment to environmental restoration and resource efficiency.

The Green Bond Market: A Rapidly Expanding Frontier

“The green bond market is projected to exceed USD 600 billion by 2025, showcasing rapid growth in sustainable finance.”

The issuance of Green Bonds has been on an upward trajectory, with analysts predicting that the market could surpass USD 600 billion by 2025. This rapid growth reflects the increasing recognition of the importance of sustainable finance in addressing global environmental challenges.

Investors are increasingly drawn to Green Bonds for several reasons:

- Potential for attractive financial returns

- Opportunity to participate in high-impact environmental initiatives

- Possible tax-exempt benefits, depending on the jurisdiction

- Alignment with sustainable investment goals

The growing demand for Green Bonds is driving innovation in the financial sector, with new products and platforms emerging to facilitate sustainable investments. This trend is not only reshaping the investment landscape but also accelerating the transition towards a more sustainable global economy.

Cutting-Edge Technologies Driving Environmental Remediation

At the heart of CETI’s environmental remediation projects are cutting-edge technologies that are revolutionizing the field. These innovative solutions are enabling more efficient and effective cleanup of contaminated sites, particularly in areas affected by decades of oil production.

Some of the key technologies being employed include:

- Advanced bioremediation techniques

- Nano-scale remediation materials

- Electrokinetic separation

- Phytoremediation

- In-situ chemical oxidation

These technologies not only accelerate the cleanup process but also minimize the environmental impact of the remediation efforts themselves. By leveraging these innovative approaches, CETI is setting new standards for environmental restoration projects worldwide.

The Role of Sustainable Finance in Environmental Impact Investing

Sustainable finance solutions, such as Green Bonds, are playing an increasingly crucial role in environmental impact investing. These financial instruments provide a bridge between investors seeking sustainable options and projects that require funding to drive positive environmental change.

The benefits of sustainable finance in environmental remediation include:

- Mobilizing capital for large-scale environmental projects

- Encouraging transparency and accountability in project implementation

- Fostering innovation in environmental technologies

- Aligning financial incentives with environmental goals

As the demand for sustainable investment options continues to grow, we can expect to see further innovations in this space, potentially leading to even more effective ways of funding critical environmental initiatives.

Green Bond Impact Comparison

| Project Type | Estimated Environmental Impact | Projected Financial Returns (%) | Technology Used | Location |

|---|---|---|---|---|

| Industrial Wastewater Treatment | 500 million gallons treated annually | 7.5% | Advanced membrane filtration | Scottsdale, Arizona |

| Soil Contamination Removal | 1,000 acres restored | 6.8% | Bioremediation and phytoremediation | Turkey |

| Oil Sludge Cleanup | 100,000 tons processed | 8.2% | Thermal desorption | Middle East |

| Groundwater Purification | 200 million liters purified | 7.0% | Nano-filtration and UV disinfection | Africa |

The Scottsdale Connection: A Hub for Sustainable Innovation

While CETI’s Green Bond-funded projects span multiple international locations, the company’s headquarters in Scottsdale, Arizona, plays a crucial role in driving these sustainable initiatives. Scottsdale has emerged as a hub for environmental innovation, attracting companies and talent dedicated to developing cutting-edge solutions for global environmental challenges.

The city’s commitment to sustainability aligns perfectly with CETI’s mission, creating a synergistic relationship that fosters innovation and drives progress in environmental remediation technologies. This partnership between local expertise and global impact exemplifies the power of sustainable finance in creating positive change on a worldwide scale.

The Future of Green Bonds and Environmental Remediation

As we look to the future, the role of Green Bonds in funding environmental remediation projects is expected to grow significantly. This trend is driven by several factors:

- Increasing awareness of environmental issues

- Stricter regulations on industrial pollution

- Growing investor demand for sustainable investment options

- Advancements in remediation technologies

The success of initiatives like CETI’s Green Bond is likely to inspire similar projects worldwide, potentially leading to a new era of environmental restoration and sustainable development.

The Role of Technology in Environmental Remediation

In the context of environmental remediation, technology plays a crucial role in enhancing the efficiency and effectiveness of cleanup efforts. Advanced technologies are not only improving the speed and thoroughness of remediation processes but also reducing the overall environmental impact of these activities.

Some key technological advancements in this field include:

- AI-powered site assessment and monitoring

- Robotic systems for hazardous waste handling

- 3D modeling for contamination mapping

- IoT sensors for real-time data collection

These technologies are revolutionizing the way we approach environmental cleanup, making it possible to tackle even the most challenging contamination scenarios with greater precision and efficiency.

The Global Impact of Environmental Remediation

The environmental remediation projects funded by Green Bonds have far-reaching implications that extend beyond the immediate cleanup of contaminated sites. These initiatives contribute to:

- Improved public health in affected communities

- Restoration of ecosystems and biodiversity

- Economic revitalization of previously polluted areas

- Advancement of sustainable industrial practices

By addressing the legacy of industrial pollution, these projects are paving the way for a more sustainable and environmentally responsible future.

The Intersection of Environmental Remediation and Agriculture

While CETI’s focus is on industrial and oil-related environmental remediation, it’s worth noting the broader context of environmental sustainability, which often intersects with agriculture. In this regard, companies like Farmonaut are making significant contributions to sustainable agriculture through advanced technologies.

Farmonaut’s satellite-based farm management solutions offer valuable tools for:

- Crop health monitoring

- Resource optimization

- Sustainable farming practices

These technologies complement environmental remediation efforts by promoting sustainable land use and reducing the environmental impact of agricultural activities.

Explore Farmonaut’s innovative solutions:

The Role of Data in Environmental Remediation

Data plays a crucial role in modern environmental remediation efforts. Advanced data collection and analysis techniques enable more accurate assessment of contamination levels, more efficient cleanup strategies, and better monitoring of remediation progress.

Key aspects of data utilization in environmental remediation include:

- Satellite imagery for large-scale site assessment

- Machine learning algorithms for predictive modeling

- Big data analytics for trend identification

- Blockchain technology for transparent project tracking

For those interested in leveraging data for environmental applications, Farmonaut’s API offers access to valuable satellite and weather data. Developers can explore the API Developer Docs for more information on integrating this data into environmental monitoring and management systems.

Sustainable Finance: A Catalyst for Global Change

The success of Green Bonds in funding environmental remediation projects demonstrates the power of sustainable finance as a catalyst for global change. By aligning financial incentives with environmental goals, these instruments are mobilizing capital at an unprecedented scale to address some of the world’s most pressing ecological challenges.

Key benefits of sustainable finance include:

- Accelerating the transition to a low-carbon economy

- Promoting corporate accountability for environmental impact

- Fostering innovation in green technologies

- Creating new opportunities for sustainable economic growth

As the sustainable finance market continues to evolve, we can expect to see even more innovative financial products designed to drive positive environmental outcomes.

FAQs

- What are Green Bonds?

Green Bonds are specialized financial instruments designed to fund projects with positive environmental impacts. They adhere to strict principles ensuring transparency and accountability in the use of funds. - How do Green Bonds contribute to environmental remediation?

Green Bonds provide funding for large-scale environmental cleanup projects, enabling the implementation of advanced technologies and comprehensive remediation strategies. - What types of projects does CETI’s Green Bond fund?

CETI’s Green Bond funds projects including industrial wastewater treatment, soil contamination removal, oil sludge cleanup, and other environmental remediation initiatives across multiple countries. - How large is the Green Bond market?

The Green Bond market currently exceeds USD 2 trillion and is projected to surpass USD 600 billion in annual issuance by 2025. - What technologies are used in environmental remediation?

Environmental remediation utilizes various technologies including bioremediation, nano-scale materials, electrokinetic separation, phytoremediation, and in-situ chemical oxidation.

Conclusion: A Greener Future Through Sustainable Finance

The GBP 50 million Green Bond secured by Cyber Enviro-Tech, Inc. represents a significant milestone in the journey towards a more sustainable future. By leveraging the power of sustainable finance, companies like CETI are able to drive large-scale environmental remediation projects that have the potential to reverse decades of ecological damage.

As we look to the future, the continued growth of the Green Bond market and the development of innovative environmental technologies offer hope for addressing some of the world’s most pressing ecological challenges. Through the combined efforts of investors, technology innovators, and environmental stewards, we are paving the way for a cleaner, greener, and more sustainable world.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!