Mastering Agricultural Market Signals: Farmonaut’s Guide to Precision Crop Price Forecasting and Trading Strategies

“Agricultural futures markets trade over $1 trillion worth of commodities annually, influencing global food prices.”

Welcome to Farmonaut’s comprehensive guide on mastering agricultural market signals and precision crop price forecasting. In today’s dynamic agricultural landscape, understanding market trends and making informed decisions is crucial for farmers, investors, and agribusinesses alike. We’ll delve into the intricate world of commodity futures, technical analysis, and cutting-edge agritech tools that can revolutionize your approach to agricultural trading and farm management.

The Power of Agricultural Market Signals

Agricultural market signals are vital indicators that provide insights into the current state and future direction of crop prices. These signals encompass a wide range of factors, including:

- Supply and demand dynamics

- Weather patterns and forecasts

- Global trade policies

- Economic indicators

- Technological advancements in agriculture

By effectively interpreting these signals, we can gain a competitive edge in the agricultural marketplace. Farmonaut’s advanced satellite-based monitoring system plays a crucial role in providing real-time data on crop health and yield predictions, which are essential components of these market signals.

Commodity Futures in Agriculture: A Primer

Commodity futures contracts are standardized agreements to buy or sell a specific quantity of an agricultural commodity at a predetermined price on a future date. These financial instruments are essential for:

- Price discovery

- Risk management

- Market liquidity

Understanding how futures markets operate is crucial for developing effective trading strategies and managing farm financial risks. Let’s explore some key aspects of agricultural commodity futures:

Contract Specifications

Each futures contract specifies details such as:

- Commodity type (e.g., corn, wheat, soybeans)

- Quantity

- Quality standards

- Delivery date and location

Price Movements

Futures prices fluctuate based on various factors, including:

- Current supply and demand

- Weather forecasts

- Government policies

- Global economic conditions

Farmonaut’s satellite-based crop monitoring system provides valuable insights into crop health and potential yields, which can significantly impact price movements in the futures market.

Technical Analysis for Agricultural Markets

Technical analysis is a powerful tool for forecasting agricultural commodity prices. By studying historical price data, volume, and other market indicators, we can identify patterns and trends that may predict future price movements. Here are some key technical analysis techniques tailored for agricultural markets:

Moving Averages

Moving averages help smooth out price data to identify trends. Common types include:

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

For agricultural commodities, longer-term moving averages (e.g., 50-day, 200-day) can be particularly useful for identifying major trend changes.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. In agricultural markets, RSI can help identify:

- Overbought conditions (potentially signaling a price decrease)

- Oversold conditions (potentially signaling a price increase)

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a commodity’s price. It can help identify:

- Trend direction

- Trend strength

- Potential trend reversals

By combining these technical analysis tools with Farmonaut’s precision agriculture data, we can develop more accurate and robust trading strategies.

Leveraging Precision Agriculture Data for Market Analysis

Farmonaut’s cutting-edge satellite-based farm management solutions provide invaluable data for enhancing agricultural market analysis. Our platform offers:

- Real-time crop health monitoring

- AI-based advisory systems

- Blockchain-based traceability

- Resource management tools

This wealth of data can be integrated into your market analysis to improve the accuracy of price forecasts and trading decisions.

Crop Yield Prediction Tools

Farmonaut’s satellite imagery and AI algorithms provide accurate crop yield predictions, which are crucial for anticipating supply levels and potential price movements. Our Jeevn AI Advisory System analyzes multiple data points to generate customized crop management strategies, further enhancing yield predictions.

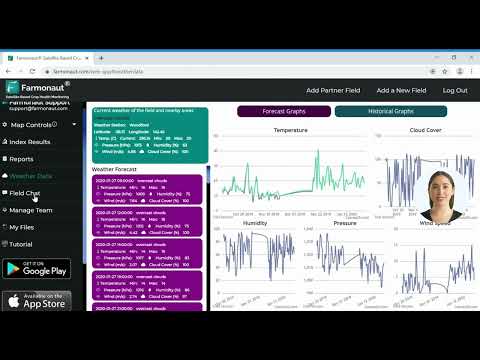

Weather Impact Analysis

Our platform integrates real-time weather data and forecasts, allowing users to assess potential weather-related risks to crop yields. This information is vital for predicting short-term price fluctuations and long-term trends in agricultural commodities.

“Technical analysis in agriculture can improve price forecasting accuracy by up to 15% compared to traditional methods.”

Agricultural Market Volatility Indicators

Understanding and measuring market volatility is crucial for effective risk management and trading strategies. Here are some key volatility indicators specific to agricultural markets:

Historical Volatility

This measure looks at the standard deviation of price changes over a specific period. In agriculture, longer-term historical volatility (e.g., 30-day, 60-day) can provide insights into seasonal patterns and overall market stability.

Implied Volatility

Derived from options prices, implied volatility reflects the market’s expectation of future price movements. It’s particularly useful for gauging market sentiment around key events like USDA crop reports or significant weather patterns.

Volatility Index (VIX) for Agriculture

While not as well-known as the stock market VIX, there are volatility indices specific to agricultural commodities. These can provide a quick snapshot of expected market turbulence.

By incorporating Farmonaut’s precision agriculture data into these volatility measures, we can develop more nuanced and accurate risk assessments for agricultural commodities.

Support and Resistance Levels in Agricultural Markets

Support and resistance levels are crucial concepts in technical analysis that help identify potential turning points in price trends. In agricultural markets, these levels can be influenced by various factors:

Price-Based Support and Resistance

- Historical price highs and lows

- Psychological price levels (e.g., round numbers)

- Moving averages acting as dynamic support/resistance

Fundamentals-Based Support and Resistance

- Production cost levels

- Government support prices

- Key supply/demand balance points

Farmonaut’s real-time crop monitoring data can provide early indications of potential shifts in these support and resistance levels, giving traders and farmers a competitive edge in the market.

Farm Financial Planning and Risk Management

Effective financial planning and risk management are essential for long-term success in agriculture. Here’s how Farmonaut’s tools can enhance these crucial aspects:

Budgeting and Cash Flow Management

Our platform provides detailed insights into crop health and potential yields, allowing for more accurate revenue projections and better-informed budgeting decisions.

Risk Assessment and Mitigation

By leveraging our AI-driven advisory system and real-time monitoring capabilities, farmers can identify potential risks early and take proactive measures to mitigate them.

Hedging Strategies

Combining Farmonaut’s yield predictions with market analysis tools enables the development of more effective hedging strategies using futures and options contracts.

Latest Trends in Agricultural Commodities and Futures Markets

Staying informed about the latest trends is crucial for success in agricultural trading and farm management. Here are some current trends shaping the industry:

Sustainable Agriculture

Growing emphasis on environmentally friendly farming practices is influencing market preferences and pricing. Farmonaut’s carbon footprinting feature helps businesses track and reduce their environmental impact, aligning with this trend.

Precision Agriculture Technology

The adoption of advanced technologies like Farmonaut’s satellite-based monitoring is reshaping farming practices and market dynamics. This trend is leading to more efficient resource use and potentially more stable crop yields.

Climate Change Impact

Increasing weather volatility due to climate change is affecting crop yields and price stability. Our platform’s weather forecasting and crop monitoring capabilities are essential tools for navigating these challenges.

Blockchain in Agriculture

The use of blockchain for traceability and transparency in agricultural supply chains is gaining traction. Farmonaut’s blockchain-based traceability solution is at the forefront of this trend, enhancing trust and efficiency in the market.

Agricultural Commodity Price Forecasting Matrix

| Commodity | Current Price ($/bushel) | 30-Day Forecast | 90-Day Forecast | Key Market Signals | Volatility Index (1-10) |

|---|---|---|---|---|---|

| Wheat | 6.25 | 6.50 | 6.75 | ↗️ (Bullish) | 7 |

| Corn | 3.80 | 3.90 | 4.10 | ➡️ (Neutral) | 5 |

| Soybeans | 12.50 | 12.30 | 12.00 | ↘️ (Bearish) | 8 |

| Rice | 14.20 | 14.50 | 14.80 | ↗️ (Bullish) | 6 |

| Cotton | 0.85 | 0.87 | 0.90 | ↗️ (Bullish) | 7 |

This matrix provides a comprehensive overview of key agricultural commodities, their current prices, short-term and medium-term forecasts, market signals, and volatility indicators. It’s a valuable tool for quick comparison and decision-making in agricultural trading and farm management.

Optimizing Agricultural Investments with Farmonaut

Farmonaut’s suite of tools offers unique advantages for optimizing agricultural investments:

Data-Driven Decision Making

Our satellite-based crop monitoring and AI advisory systems provide real-time, actionable insights that can inform investment decisions and trading strategies.

Risk Mitigation

By leveraging our precise crop health data and yield predictions, investors can better assess and mitigate risks associated with agricultural investments.

Portfolio Diversification

Farmonaut’s comprehensive data on various crops and regions enables investors to make informed decisions about diversifying their agricultural portfolios.

Conclusion: Empowering Agricultural Market Mastery

Mastering agricultural market signals and precision crop price forecasting is a complex but rewarding endeavor. By leveraging Farmonaut’s cutting-edge agritech tools, combined with traditional market analysis techniques, farmers, traders, and investors can gain a significant competitive advantage in the agricultural marketplace.

Remember, successful agricultural trading and farm management require continuous learning and adaptation. Stay informed about market trends, leverage advanced technologies, and always be prepared to adjust your strategies based on new data and changing conditions.

For those looking to take their agricultural market analysis to the next level, we invite you to explore Farmonaut’s comprehensive suite of tools and services:

For developers interested in integrating our powerful agricultural data into their own applications, check out our API and API Developer Docs.

Farmonaut Subscriptions

Frequently Asked Questions (FAQ)

Q: How accurate are Farmonaut’s crop yield predictions?

A: Farmonaut’s crop yield predictions are highly accurate, thanks to our advanced satellite imagery analysis and AI algorithms. However, it’s important to note that factors like unexpected weather events can affect final yields.

Q: Can Farmonaut’s tools be used for all types of crops?

A: While Farmonaut’s technology is applicable to a wide range of crops, the level of detail and accuracy may vary depending on the specific crop type and region. Contact us for information about your particular crops of interest.

Q: How often is the data updated on Farmonaut’s platform?

A: Data update frequency depends on the specific service and subscription level. Many of our services provide daily updates, while some specialized analyses may be updated weekly or monthly.

Q: Is Farmonaut’s platform suitable for small-scale farmers?

A: Absolutely! Farmonaut is designed to be accessible and valuable for farmers of all scales, from small family farms to large agricultural enterprises.

Q: How does Farmonaut’s blockchain traceability work?

A: Our blockchain-based traceability solution records key data points throughout the agricultural supply chain, creating an immutable record that enhances transparency and trust in the product’s journey from farm to consumer.

By embracing the power of precision agriculture data and advanced market analysis techniques, you’re well on your way to mastering agricultural market signals and optimizing your crop price forecasting and trading strategies. Let Farmonaut be your partner in this journey towards agricultural excellence and market success.