Maximizing Farm Efficiency: Smart Financing Options for Agricultural Equipment and Precision Technology

Welcome to our comprehensive guide on farm equipment financing options that can revolutionize your agricultural operations. As experts in the field, we understand the critical role that modern machinery and precision technology play in enhancing farm productivity and sustainability. In this blog post, we’ll explore various financing solutions for tractors, compact machinery, and cutting-edge farming technology, helping you optimize cash flow and boost efficiency.

“Over 60% of farmers use equipment financing to acquire new machinery, improving farm efficiency by up to 25%.”

Understanding Farm Equipment Financing Options

In today’s rapidly evolving agricultural landscape, staying competitive means having access to the latest equipment and technology. However, the significant upfront costs associated with purchasing farm machinery can be prohibitive for many operations. This is where smart financing options come into play, allowing farmers to acquire the tools they need while managing their cash flow effectively.

Types of Farm Equipment Financing

- Traditional Loans: These are often secured by the equipment itself and offer fixed interest rates and terms.

- Equipment Leases: Leasing allows farmers to use equipment for a set period without the burden of ownership.

- Operating Leases: Similar to equipment leases but typically shorter-term and with lower payments.

- Rent-to-Own Programs: These provide the option to purchase the equipment at the end of the rental period.

Each of these options has its own set of advantages and considerations, which we’ll explore in detail throughout this guide.

The Benefits of Agricultural Machinery Loans

Agricultural machinery loans are a popular choice for farmers looking to invest in new equipment. These loans offer several advantages:

- Ownership of the equipment

- Potential tax benefits through depreciation

- Fixed monthly payments for easier budgeting

- Ability to build equity in the equipment

When considering an agricultural machinery loan, it’s essential to shop around for the best rates and terms. Many lenders specialize in farm equipment financing and understand the unique needs of agricultural businesses.

Leasing Farm Tractors: A Flexible Alternative

Leasing farm tractors and other equipment has become an increasingly popular option for many agricultural operations. Here’s why:

- Lower upfront costs compared to purchasing

- Ability to upgrade to newer models more frequently

- Potential tax advantages as lease payments may be deductible as operating expenses

- Reduced maintenance responsibilities, especially with full-service leases

Leasing can be particularly attractive for farmers who want to conserve capital or who operate in industries where having the latest technology is crucial for staying competitive.

Compact Equipment for Agriculture: Financing Solutions

Compact equipment, such as utility vehicles, loaders, and small tractors, plays a vital role in many agricultural operations. Financing options for these versatile machines include:

- Specialized compact equipment loans

- Short-term leases for seasonal use

- Rent-to-own programs for flexibility

When financing compact equipment, consider the frequency of use and the potential for multi-purpose applications to maximize your investment.

Explore our web app for comprehensive farm management solutions.

Managing Farm Cash Flow with Smart Financing

Effective cash flow management is crucial for farm sustainability. Smart financing options can help you balance equipment needs with financial stability:

- Seasonal payment plans that align with harvest cycles

- Balloon payment options to defer larger payments

- Skip payment programs for off-season months

- Lines of credit for flexible equipment purchasing

By strategically using these financing tools, farmers can better manage their cash flow throughout the year, ensuring funds are available when needed most.

Used Farm Equipment Financing: Balancing Cost and Quality

Purchasing used farm equipment can be an excellent way to acquire necessary machinery at a lower cost. However, financing used equipment comes with unique considerations:

- Higher interest rates compared to new equipment loans

- Shorter loan terms due to the age of the equipment

- Importance of thorough equipment inspections before purchase

- Potential for additional maintenance costs

When financing used equipment, work with lenders who specialize in agricultural machinery and can offer competitive rates for pre-owned items.

Agricultural Attachments and Implements: Financing Strategies

Attachments and implements can significantly enhance the versatility of your existing equipment. Consider these financing options:

- Adding attachments to existing equipment loans

- Short-term rental programs for seasonal implements

- Package deals when financing both primary equipment and attachments

By carefully selecting and financing the right attachments, you can expand your farm’s capabilities without overextending your budget.

“Precision farming technology financed through smart loans can reduce input costs by 15% while increasing crop yields by 10%.”

Precision Farming Technology: Investing in Efficiency

Precision farming technology represents a significant investment in your farm’s future. Financing options for these advanced systems include:

- Technology-specific loans with flexible terms

- Leasing programs for rapidly evolving tech

- Bundled financing with equipment purchases

When considering precision farming technology, factor in the potential for increased efficiency and reduced input costs when evaluating financing options.

Enhance your farming operations with our API for satellite and weather data integration.

Sustainable Agriculture Solutions: Financing Green Initiatives

As sustainability becomes increasingly important in agriculture, many lenders offer specialized financing for eco-friendly equipment and practices:

- Green loans with favorable terms for environmentally friendly equipment

- Grants and subsidies for adopting sustainable farming practices

- Energy-efficient equipment financing programs

Investing in sustainable solutions not only benefits the environment but can also lead to long-term cost savings and improved farm efficiency.

Farm Equipment Maintenance Tips to Protect Your Investment

Proper maintenance is crucial for protecting your financed equipment and ensuring its longevity. Consider these tips:

- Develop a regular maintenance schedule based on manufacturer recommendations

- Train staff on proper equipment use and basic maintenance procedures

- Keep detailed maintenance records for warranty purposes and resale value

- Consider maintenance agreements when financing new equipment

By prioritizing equipment maintenance, you can maximize the value of your investment and minimize unexpected repair costs.

Access our comprehensive API Developer Docs for seamless integration of agricultural data into your systems.

Comparing Farm Equipment Financing Options

To help you make an informed decision, we’ve compiled a comparison table of various farm equipment financing options:

| Financing Type | Upfront Costs | Monthly Payments | Ownership | Tax Benefits | Best For |

|---|---|---|---|---|---|

| Traditional Loan | 10-20% | Medium to High | Yes | Depreciation, Interest | Long-term investment, Building equity |

| Equipment Lease | 0-10% | Low to Medium | No | Lease payments may be deductible | Flexibility, Upgrading equipment regularly |

| Operating Lease | 0-5% | Low | No | Lease payments may be deductible | Short-term needs, Seasonal equipment |

| Rent-to-Own | 5-15% | Medium | Optional | Varies based on purchase decision | Testing equipment before committing to purchase |

This table provides a general overview, but it’s important to consult with financial advisors and equipment dealers to determine the best option for your specific situation.

Leveraging Technology for Farm Management

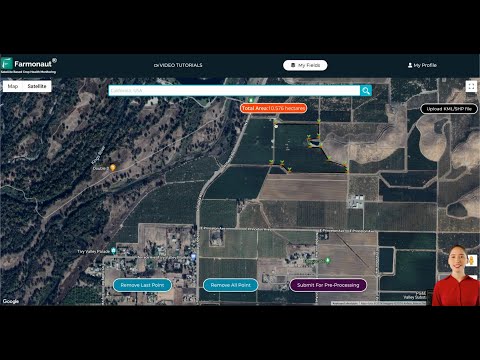

In addition to financing equipment, leveraging technology for overall farm management can significantly enhance efficiency and profitability. Farmonaut offers innovative solutions to support modern agricultural practices:

- Satellite-based crop health monitoring for informed decision-making

- AI-driven advisory systems for personalized farm management strategies

- Blockchain-based traceability for enhanced supply chain transparency

- Resource management tools to optimize operations and reduce waste

By integrating these technologies with your financed equipment, you can create a more efficient and sustainable farming operation.

Download our mobile apps for on-the-go farm management:

Making the Right Financing Decision for Your Farm

Choosing the right financing option for your farm equipment requires careful consideration of several factors:

- Current financial situation and cash flow projections

- Long-term farm goals and expansion plans

- Equipment usage patterns and lifecycle expectations

- Tax implications of various financing options

- Potential for technology integration and future upgrades

By thoroughly evaluating these aspects, you can make an informed decision that aligns with your farm’s needs and financial objectives.

Frequently Asked Questions

Q: What are the main differences between leasing and buying farm equipment?

A: Leasing typically involves lower upfront costs and regular payments for using the equipment, while buying requires a larger initial investment but offers ownership and potential equity building. Leasing provides flexibility to upgrade equipment more frequently, while buying may offer more long-term cost savings.

Q: How can I determine if I qualify for farm equipment financing?

A: Qualification often depends on factors such as credit score, farm income, debt-to-income ratio, and collateral. Many agricultural lenders also consider factors specific to farming, such as crop yields and land value.

Q: Are there special financing options for beginning farmers?

A: Yes, many lenders offer programs specifically for beginning farmers, including lower down payments, reduced interest rates, and more flexible terms. Additionally, government programs through the USDA and Farm Service Agency provide support for new farmers.

Q: How does precision farming technology impact equipment financing?

A: Precision farming technology can often be financed alongside equipment purchases or as a separate technology investment. Some lenders offer specialized loans for precision agriculture systems, recognizing their potential to increase farm efficiency and profitability.

Q: What should I consider when financing used farm equipment?

A: When financing used equipment, consider the equipment’s age, condition, and remaining useful life. Obtain a thorough inspection and maintenance history. Be prepared for potentially higher interest rates and shorter loan terms compared to new equipment financing.

Conclusion: Empowering Your Farm’s Future

Smart financing decisions are crucial for maximizing farm efficiency and ensuring long-term success. By carefully evaluating your options for equipment loans, leases, and technology investments, you can build a strong foundation for your agricultural operation. Remember to consider not only the immediate financial implications but also the potential for increased productivity, sustainability, and future growth.

As you navigate the complex landscape of farm equipment financing, don’t hesitate to seek advice from financial experts and leverage cutting-edge technologies like those offered by Farmonaut. With the right combination of financing strategies and innovative farm management tools, you can position your operation for success in today’s competitive agricultural market.

By making informed decisions about equipment financing and embracing technological advancements, you’re not just investing in machinery – you’re investing in the future of your farm and the broader agricultural community. Let’s work together to build a more efficient, sustainable, and prosperous farming industry for generations to come.