Navigating Farm Inheritance: Estate Planning Strategies for Modern Rural Families in the Midwest

“Over 98% of farms in the U.S. Midwest are family-owned, making estate planning crucial for rural legacy preservation.”

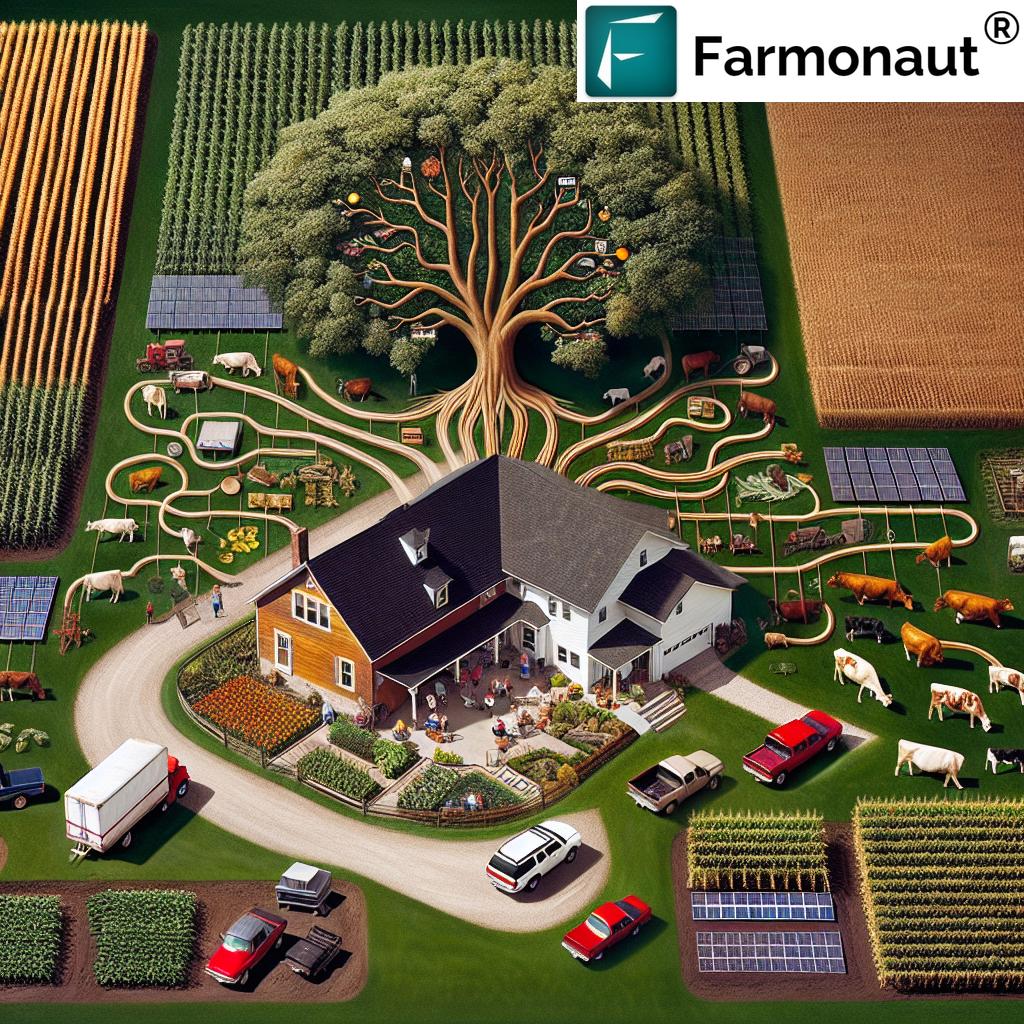

In the heart of America’s breadbasket, where vast fields of corn and soybeans stretch to the horizon, a quiet revolution is taking place. The Midwest, long known for its agricultural prowess and family-owned farms, is facing a critical juncture in its history. As the stewards of these lands age, the question of farm inheritance and estate planning for family farms has become more pressing than ever before.

We at Farmonaut understand the unique challenges facing rural families in states like Iowa, Illinois, Kansas, and Missouri. The traditional model of passing down the family farm to the next generation is no longer as straightforward as it once was. With changing demographics, economic pressures, and the lure of urban opportunities, many designated heirs have left farming behind, creating complex scenarios for agricultural land succession planning.

In this comprehensive guide, we’ll explore the intricacies of modern agricultural inheritance issues and provide strategies for navigating these choppy waters. Whether you’re a farmer looking to secure your legacy or an heir grappling with the responsibilities of inherited land, this blog post will offer valuable insights into maintaining family harmony while preserving the rich agricultural heritage of the Midwest.

The Changing Landscape of Midwestern Farming

Before we delve into the specifics of estate planning for family farms, it’s crucial to understand the context in which these decisions are being made. The Midwest, often referred to as America’s heartland, has long been the agricultural powerhouse of the United States. However, the region is experiencing significant shifts that are reshaping the future of farming:

- Aging farmer population

- Increasing farm sizes and consolidation

- Technological advancements in agriculture

- Environmental challenges and climate change

- Economic pressures and market volatility

These factors contribute to the complexity of farm inheritance strategies and underscore the importance of thoughtful, forward-looking estate planning. As we navigate these changes, it’s essential to consider how technology can aid in the transition process. Farmonaut’s satellite-based farm management solutions, accessible via our  , can provide valuable insights for both current farm operators and potential heirs, helping to bridge the gap between generations and ensure informed decision-making.

, can provide valuable insights for both current farm operators and potential heirs, helping to bridge the gap between generations and ensure informed decision-making.

The Core Challenges of Farm Succession

When it comes to generational farming transitions, several key challenges often arise:

- Equitable distribution among heirs: How do you fairly divide a farm when only one child wants to continue farming?

- Preserving the farm’s viability: Ensuring the farm remains operationally sound after division or transfer.

- Tax implications: Navigating the complex tax landscape of farm inheritance and transfer.

- Emotional attachments: Balancing sentimental value with practical considerations.

- Lack of interest from heirs: Addressing scenarios where no family member wishes to continue farming.

These challenges are at the heart of many family farm succession disputes and require careful consideration and planning to overcome.

Strategies for Equitable Farm Asset Distribution

One of the most contentious aspects of farm inheritance is the fair division of farmland assets. When the designated farming heir has moved on, it can create tension among siblings and potentially lead to the fragmentation of the farm. Here are some strategies to consider:

1. Buy-Sell Agreements

These agreements allow interested heirs to buy out others, ensuring the farm stays intact while providing fair compensation.

2. Life Insurance Equalization

Using life insurance policies to provide non-farming heirs with equivalent value, allowing the farm to pass intact to the farming heir.

3. Phased Inheritance

Gradually transferring ownership over time, allowing for a smoother transition and potential for changing circumstances.

4. Trust Formation

Creating a trust to manage the farm assets, potentially providing income to all heirs while maintaining the farm’s integrity.

Implementing these strategies often requires sophisticated planning and management tools. Farmonaut’s API and API Developer Docs can be integrated into estate management systems, providing real-time data on farm productivity and value, which can be crucial for making informed decisions about asset distribution.

Reassessing Wills and Trusts for Modern Family Dynamics

As rural families become more geographically dispersed and family structures evolve, it’s crucial to regularly reassess and update wills and trusts. This process should take into account:

- Changed circumstances of potential heirs

- New additions to the family

- Updated valuation of farm assets

- Changes in tax laws and regulations

Regular reviews ensure that your estate plan remains aligned with your current wishes and family situation. It’s also an opportunity to leverage modern tools for farm management and valuation. Farmonaut’s mobile apps, available for both  and

and  , can provide up-to-date information on crop health and yield predictions, which can be invaluable when assessing the current and future value of agricultural assets.

, can provide up-to-date information on crop health and yield predictions, which can be invaluable when assessing the current and future value of agricultural assets.

“Approximately 70% of family farms fail to survive the transition from the 2nd to 3rd generation due to inadequate succession planning.”

Navigating Rural Estate Planning Challenges

The unique nature of farming assets presents specific challenges in estate planning. Unlike urban or suburban estates, farms often include:

- Large tracts of land

- Specialized equipment

- Livestock

- Complex business structures

These factors can complicate valuation and distribution. Moreover, rural estate planning challenges often include considerations such as:

Conservation Easements

Protecting farmland from development while potentially reducing estate taxes.

Family Limited Partnerships

Structuring ownership to facilitate gradual transfer and potential tax benefits.

Special Use Valuation

Utilizing IRS provisions to value farmland based on its agricultural use rather than market value.

Addressing these challenges requires a multifaceted approach. Farmonaut’s technology can assist in providing accurate, up-to-date information on land use and crop performance, which can be crucial for valuation and decision-making in the estate planning process.

Preserving Family Harmony Through Effective Legacy Planning

One of the most critical aspects of farm legacy planning is maintaining family relationships throughout the process. Here are some strategies to help preserve harmony:

Open Communication

Encourage frank discussions about expectations and intentions early and often.

Professional Mediation

Consider bringing in a neutral third party to facilitate difficult conversations.

Clear Documentation

Ensure all agreements and decisions are clearly documented to prevent future misunderstandings.

Flexibility in Planning

Build in mechanisms for adjusting the plan as family circumstances change.

By addressing potential conflicts proactively and transparently, families can navigate the complexities of farm inheritance while maintaining strong bonds.

Comparison of Farm Inheritance Strategies

| Strategy Name | Pros | Cons | Best Suited For | Estimated Implementation Time | Potential Tax Implications |

|---|---|---|---|---|---|

| Traditional Single-Heir Succession |

|

|

Families with one clear successor who wants to continue farming | 1-3 months | Potential for high estate taxes without proper planning |

| Equal Asset Division |

|

|

Families with multiple heirs who value equality over farm continuity | 3-6 months | May trigger capital gains taxes if assets are sold for division |

| Farmland Trust Formation |

|

|

Large farms with multiple heirs interested in long-term preservation | 6-12 months | Can provide estate tax benefits if structured correctly |

| Buy-Sell Agreements |

|

|

Families where some heirs want to farm and others prefer cash | 3-6 months | Careful structuring needed to avoid unintended tax consequences |

| Limited Liability Company (LLC) Structure |

|

|

Farms looking for flexible ownership and management structures | 2-4 months | Can facilitate gradual ownership transfer with potential tax benefits |

Leveraging Technology in Farm Succession Planning

In today’s digital age, technology plays a crucial role in agricultural land succession planning. Advanced tools can provide valuable insights and facilitate smoother transitions. Here’s how Farmonaut’s solutions can contribute to effective estate planning:

Accurate Land Valuation

Our satellite-based crop health monitoring can provide precise data on land productivity, helping to determine fair market value for inheritance purposes.

Historical Performance Tracking

Access to historical crop yield data can inform decisions about the farm’s long-term viability and potential for future generations.

Resource Management Tools

Our platform’s resource management features can help heirs understand the operational aspects of the farm, even if they’re not directly involved in day-to-day farming.

Transparent Communication

Farmonaut’s collaborative features allow family members to share and discuss farm-related data, fostering open communication during the succession planning process.

By integrating these technological solutions, families can make more informed decisions and potentially reduce conflicts arising from lack of information or misunderstandings about the farm’s operations and value.

Legal and Financial Considerations in Farm Inheritance

Navigating the legal and financial aspects of farm inheritance requires careful consideration and often professional guidance. Key areas to focus on include:

Estate Tax Planning

Understanding and mitigating potential estate tax liabilities through strategies such as gifting, trusts, and special valuation methods for agricultural properties.

Business Structure Evaluation

Assessing whether the current farm business structure (sole proprietorship, partnership, corporation, etc.) is optimal for succession purposes.

Retirement Planning for Current Operators

Ensuring that the older generation has sufficient resources for retirement without compromising the farm’s viability for the next generation.

Insurance and Risk Management

Reviewing and updating insurance policies to protect assets and provide liquidity for estate taxes or buyouts if necessary.

It’s crucial to work with legal and financial professionals who specialize in agricultural estate planning to navigate these complex issues effectively.

Preparing the Next Generation for Farm Management

Successful farm succession isn’t just about transferring assets; it’s also about preparing the next generation to manage those assets effectively. This preparation can include:

Education and Training

Encouraging formal agricultural education or providing on-the-job training in various aspects of farm management.

Gradual Responsibility Transfer

Incrementally involving the younger generation in decision-making processes and operational management.

Exposure to Financial Management

Teaching budgeting, cash flow management, and other financial skills crucial for running a successful farm business.

Embracing Innovation

Introducing new technologies and sustainable farming practices to ensure the farm remains competitive in the future.

Farmonaut’s platform can play a significant role in this preparation process. Our user-friendly interface and comprehensive data analytics can help the next generation understand modern farm management techniques and make data-driven decisions.

Alternative Succession Strategies for Non-Farming Heirs

In cases where no family members wish to continue farming, alternative strategies may need to be considered:

Leasing Arrangements

Leasing the farmland to other farmers while retaining ownership within the family.

Conservation Programs

Enrolling land in conservation programs that provide income while preserving the land’s agricultural or natural state.

Partial Sale and Leaseback

Selling a portion of the land and leasing it back to maintain some connection to the family farm.

Charitable Donations

Donating the farm or a portion of it to agricultural education programs or land trusts.

These alternatives can provide solutions that honor the family’s agricultural legacy while accommodating the realities of changing family interests and circumstances.

The Role of Professional Advisors in Farm Succession Planning

Given the complexities of farm inheritance and estate planning, it’s often beneficial to work with a team of professional advisors. This team might include:

- Estate Planning Attorney

- Accountant with agricultural expertise

- Financial Planner

- Agricultural Consultant

- Family Business Mediator

These professionals can provide invaluable guidance in navigating the legal, financial, and interpersonal aspects of farm succession planning. They can help ensure that your plan is comprehensive, legally sound, and tailored to your family’s unique circumstances.

Conclusion: Securing the Future of Midwestern Farms

Navigating farm inheritance and estate planning in the modern Midwest is a complex but crucial process. By embracing comprehensive planning strategies, leveraging technology, and maintaining open communication, rural families can preserve their agricultural heritage while adapting to changing times.

Remember, there’s no one-size-fits-all solution to farm succession planning. Each family’s situation is unique and requires a tailored approach. However, by starting early, staying informed, and remaining flexible, you can create a plan that honors your family’s legacy, preserves family harmony, and ensures the continued vitality of your farm for generations to come.

At Farmonaut, we’re committed to supporting the agricultural community through innovative technologies and data-driven insights. While we don’t directly provide estate planning services, our platform can offer valuable tools and information to aid in the decision-making process. We encourage you to explore how our solutions can complement your succession planning efforts and contribute to the long-term success of your family farm.

FAQs

Q: When should I start thinking about farm succession planning?

A: It’s never too early to start planning. Ideally, you should begin the process at least 5-10 years before you plan to retire or transfer ownership. This gives ample time for discussion, planning, and gradual implementation.

Q: How can I ensure fair treatment of all my children in my farm inheritance plan?

A: Fair doesn’t always mean equal. Consider each child’s contributions to the farm, their interest in continuing the operation, and their other assets or opportunities. Open communication and possibly professional mediation can help achieve a plan that feels fair to all parties.

Q: What are the tax implications of transferring farm ownership to the next generation?

A: Tax implications can be complex and depend on various factors, including the farm’s value, how it’s transferred, and current tax laws. Strategies like gifting, using special valuation methods, or creating trusts can help minimize tax burdens. It’s crucial to work with a tax professional experienced in agricultural estates.

Q: How can technology assist in farm succession planning?

A: Technology like Farmonaut’s platform can provide accurate data on farm productivity, asset values, and operational efficiency. This information is crucial for making informed decisions about farm division, valuation, and future viability.

Q: What if none of my children want to continue farming?

A: If no heirs wish to farm, you have several options. You could consider selling the farm, leasing it to other farmers, placing it in a trust, or exploring conservation easements. The choice depends on your family’s goals and the desire to preserve the land’s agricultural use.