Understanding Apple Crop Insurance: New Provisions for Niagara County, NY Farmers

“Niagara County, NY farmers have access to multiple crop insurance plans, including Whole-Farm Revenue Protection and rainfall index insurance.”

As we delve into the intricacies of crop insurance policies and risk management in agriculture, it’s crucial for farmers and insurance providers alike to stay informed about the latest developments. In this comprehensive guide, we’ll explore the new Apple Special Provisions for Niagara County, New York, and provide essential insights into USDA crop insurance details. Our focus will be on empowering farmers with the knowledge they need to make informed decisions about protecting their agricultural investments.

The Importance of Crop Insurance for Apple Farmers

Apple farming is a significant part of Niagara County’s agricultural landscape, and like any farming endeavor, it comes with inherent risks. From unpredictable weather patterns to market fluctuations, apple farmers face numerous challenges that can impact their yield and revenue. This is where crop insurance plays a vital role in agricultural risk mitigation.

Crop insurance policies provide a safety net for farmers, offering financial protection against losses due to various factors such as:

- Adverse weather conditions (e.g., frost, hail, drought)

- Pest infestations and plant diseases

- Market price fluctuations

- Natural disasters

By understanding and utilizing the right crop insurance provisions, Niagara County apple farmers can safeguard their operations and ensure long-term success in the face of agricultural challenges.

New Apple Special Provisions for Niagara County, NY

The United States Department of Agriculture (USDA) and the Risk Management Agency (RMA) regularly update crop insurance provisions to better serve farmers across the country. Recently, new special provisions have been introduced for apple crop insurance in Niagara County, New York. These provisions are designed to address the unique needs and challenges faced by apple farmers in this region.

Key aspects of the new Apple Special Provisions include:

- Enhanced Coverage Options: Expanded protection against specific risks prevalent in Niagara County’s apple orchards.

- Tailored Premium Rates: Adjusted rates that reflect the local risk factors and historical data for apple production in the area.

- Updated Quality Loss Adjustments: Refined methods for assessing and compensating quality-related losses in apple crops.

- Revised Reporting Requirements: Streamlined processes for farmers to report their production and losses accurately.

These provisions aim to provide more comprehensive and relevant coverage for Niagara County apple farmers, ensuring that their crop insurance aligns closely with the realities of local apple production.

Understanding Whole-Farm Revenue Protection

One of the most versatile crop insurance plans available to Niagara County farmers is Whole-Farm Revenue Protection (WFRP). This innovative approach to farm risk management offers coverage for all commodities on a farm under a single policy, making it particularly attractive for diversified operations.

Key features of WFRP include:

- Coverage of up to 85% of the farm’s expected revenue

- Protection against both yield losses and market price declines

- Flexibility to insure a wide range of farm products, including specialty and organic crops

- Incentives for farm diversification through premium rate discounts

For apple farmers in Niagara County who may also grow other crops or engage in value-added activities, WFRP can provide comprehensive protection for their entire operation.

Rainfall Index Insurance: A Weather-Based Approach

Another innovative option in the realm of crop insurance is Rainfall Index Insurance. This type of coverage is particularly relevant for apple farmers, as adequate rainfall is crucial for optimal apple growth and quality.

Rainfall Index Insurance works by:

- Using historical rainfall data to establish expected precipitation levels

- Providing payouts when actual rainfall falls below (or exceeds) predetermined thresholds

- Offering coverage based on geographic grids rather than individual farm yields

- Allowing farmers to customize coverage periods to align with critical growth stages

This type of insurance can be an excellent complement to traditional yield-based policies, offering an additional layer of protection against weather-related risks.

The Role of the Risk Management Agency (RMA)

The USDA’s Risk Management Agency plays a pivotal role in overseeing and administering crop insurance programs across the United States. For Niagara County apple farmers, understanding the RMA’s functions and resources is essential for navigating the complex landscape of agricultural insurance.

Key responsibilities of the RMA include:

- Developing and maintaining crop insurance policies

- Issuing policy bulletins and actuarial releases

- Ensuring compliance with insurance standards and regulations

- Providing education and outreach to farmers and insurance providers

- Conducting research to improve crop insurance products and services

Farmers can access a wealth of information and tools through the RMA’s official website, including policy documents, premium calculators, and educational resources.

Navigating Policy Bulletins and Actuarial Releases

To stay informed about the latest developments in crop insurance, Niagara County apple farmers should regularly review policy bulletins and actuarial releases issued by the RMA. These documents provide crucial updates on:

- Changes to insurance plans and provisions

- Updates to premium rates and coverage levels

- New or modified insurance products

- Compliance requirements and deadlines

By keeping abreast of these updates, farmers can ensure that their insurance coverage remains current and aligned with the latest industry standards and regulations.

Compliance and Reporting Requirements

Adhering to compliance standards and meeting reporting requirements is crucial for maintaining valid crop insurance coverage. For Niagara County apple farmers, this involves:

- Accurate Record-Keeping: Maintaining detailed records of production, sales, and farm operations.

- Timely Reporting: Submitting acreage reports, production history, and loss claims within specified deadlines.

- Following Good Farming Practices: Adhering to recommended agricultural practices to minimize risk and maximize crop potential.

- Cooperating with Inspections: Allowing insurance adjusters to assess crops and verify information as needed.

Failure to comply with these requirements can result in reduced coverage or even policy cancellation, underscoring the importance of understanding and following all compliance guidelines.

Farm Risk Management Tools and Resources

In addition to crop insurance, Niagara County apple farmers have access to a variety of risk management tools and resources. These can complement insurance coverage and help farmers make informed decisions about their operations.

Some valuable resources include:

- Farm Service Agency (FSA) Programs: Offering additional financial support and risk management options.

- Natural Resources Conservation Service (NRCS): Providing technical assistance for sustainable farming practices.

- Cooperative Extension Services: Offering educational programs and expert advice on apple production and farm management.

- Online Decision Support Tools: Such as the RMA’s Cost Estimator and the Ag-Risk Viewer for assessing insurance options.

Farmers should explore these resources to develop a comprehensive risk management strategy that goes beyond crop insurance alone.

“The USDA’s Risk Management Agency oversees a complex policy landscape, managing bulletins, actuarial releases, and compliance requirements for crop insurance.”

Leveraging Technology for Farm Management

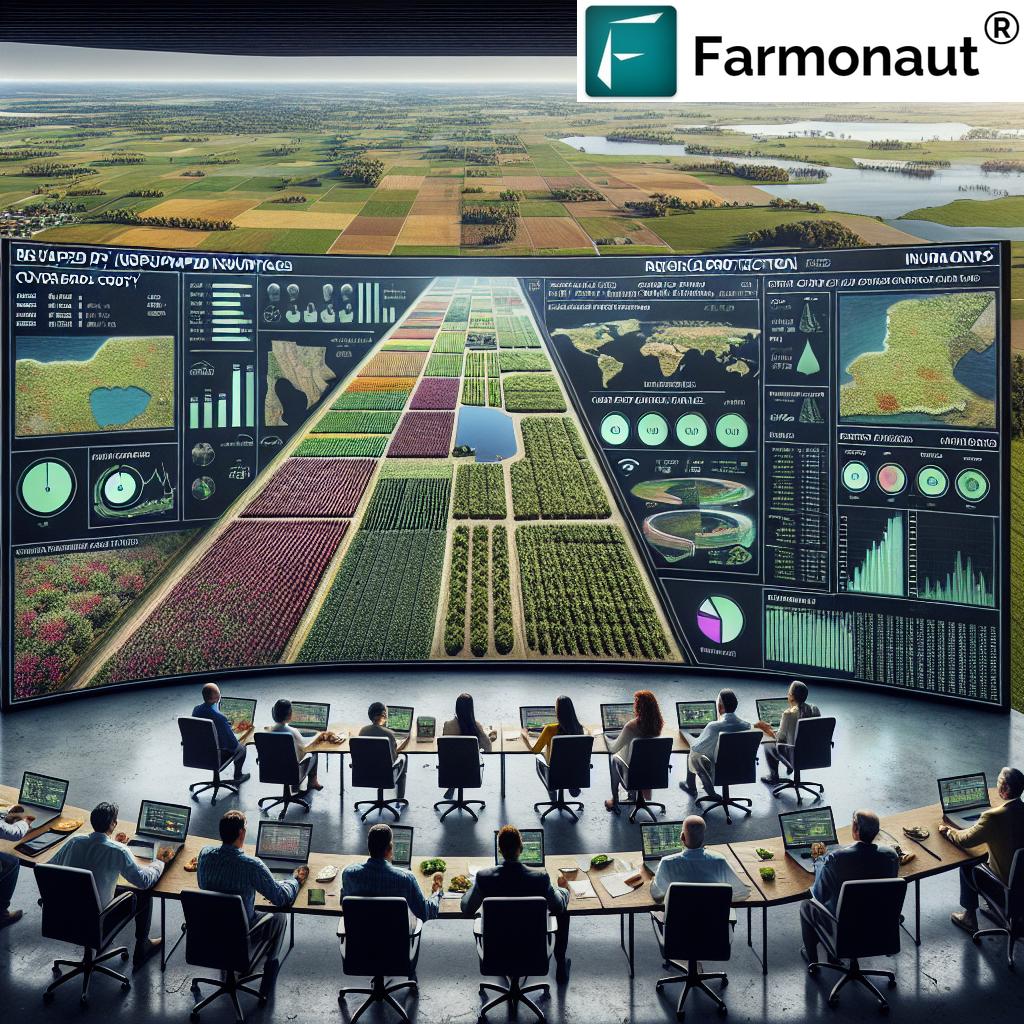

In today’s digital age, technology plays an increasingly important role in farm management and risk mitigation. Innovative solutions like Farmonaut offer valuable tools for apple farmers in Niagara County to enhance their operations and complement their crop insurance strategies.

Farmonaut provides advanced satellite-based farm management solutions that can help farmers:

- Monitor crop health in real-time

- Optimize resource management

- Track weather patterns and predict potential risks

- Improve overall farm productivity and efficiency

By integrating these technological solutions with traditional crop insurance policies, farmers can create a more robust and proactive approach to risk management.

Explore Farmonaut’s solutions:

Comparing Apple Crop Insurance Plans for Niagara County, NY

To help Niagara County apple farmers make informed decisions about their crop insurance options, we’ve compiled a comparison table of available plans:

| Insurance Plan Name | Coverage Type | Risk Factors Covered | Estimated Premium Range | Payout Triggers | Maximum Coverage Limit | Unique Features |

|---|---|---|---|---|---|---|

| Whole-Farm Revenue Protection | Revenue | All crop losses, market price fluctuations | 3% – 7% of insured revenue | Revenue falls below guaranteed level | $8.5 million per policy year | Covers all commodities under one policy |

| Rainfall Index Insurance | Weather-based | Insufficient or excessive rainfall | 2% – 5% of chosen coverage | Rainfall deviates from historical averages | Varies based on grid and coverage level | No loss adjustments required |

| Apple Crop Insurance (Special Provisions) | Yield and Quality | Weather, pests, diseases, market conditions | 4% – 8% of total insured value | Yield or quality falls below guarantee | 75% – 85% of average yield | Tailored to Niagara County apple production |

| Multi-Peril Crop Insurance | Yield | Natural disasters, pests, diseases | 3% – 6% of insured crop value | Yield falls below guaranteed percentage | Up to 85% of average yield | Comprehensive coverage for multiple risks |

This comparison provides a starting point for evaluating different insurance options. Farmers should consult with licensed crop insurance agents to determine the best plan for their specific needs and circumstances.

The Importance of Regular Policy Reviews

Given the dynamic nature of agriculture and the insurance industry, it’s crucial for Niagara County apple farmers to regularly review and update their crop insurance policies. This practice ensures that coverage remains aligned with current farm operations, market conditions, and risk profiles.

Key reasons for regular policy reviews include:

- Changes in farm size or crop mix

- Updates to insurance provisions or new product offerings

- Shifts in market prices or production costs

- Advancements in farming technology or practices

- Evolving climate patterns and associated risks

We recommend that farmers schedule annual reviews with their crop insurance agents to assess their coverage and make any necessary adjustments.

Maximizing the Benefits of Crop Insurance

To get the most out of their crop insurance policies, Niagara County apple farmers should consider the following strategies:

- Accurate Record-Keeping: Maintain detailed and up-to-date records of production history, farm practices, and financial data.

- Timely Reporting: Report acreage, production, and any losses promptly to ensure smooth claims processing.

- Risk Mitigation Practices: Implement best practices in orchard management to reduce the likelihood of losses.

- Stay Informed: Keep abreast of policy changes, market trends, and new risk management tools.

- Explore Complementary Coverage: Consider additional insurance products or risk management strategies to create a comprehensive protection plan.

By following these strategies, farmers can enhance the effectiveness of their crop insurance and better protect their agricultural investments.

The Role of Crop Insurance Agents

Crop insurance agents play a crucial role in helping Niagara County apple farmers navigate the complexities of agricultural risk management. These professionals provide valuable services, including:

- Explaining insurance options and policy details

- Assisting with policy selection and customization

- Guiding farmers through the application and claims processes

- Providing updates on policy changes and new insurance products

- Offering insights on risk management strategies

We encourage farmers to establish a strong working relationship with a reputable crop insurance agent who understands the unique needs of apple production in Niagara County.

Emerging Trends in Agricultural Risk Management

As the agricultural landscape continues to evolve, new trends are emerging in risk management and crop insurance. Niagara County apple farmers should be aware of these developments, which may impact their insurance options and farm management strategies in the future:

- Climate-Smart Agriculture: Insurance products that incentivize sustainable farming practices and climate resilience.

- Precision Agriculture Integration: Utilizing data from precision farming tools to inform insurance policies and risk assessment.

- Blockchain Technology: Enhancing transparency and efficiency in policy administration and claims processing.

- Parametric Insurance: Expanding use of index-based insurance products for faster, more objective payouts.

- Artificial Intelligence: Leveraging AI for more accurate risk modeling and personalized insurance solutions.

Staying informed about these trends can help farmers make forward-thinking decisions about their risk management strategies.

Leveraging Farmonaut’s API for Enhanced Farm Management

For tech-savvy farmers and agribusinesses looking to integrate advanced data analytics into their operations, Farmonaut offers a powerful API solution. This tool can be particularly valuable for Niagara County apple farmers seeking to enhance their risk management strategies alongside their crop insurance policies.

Key benefits of Farmonaut’s API include:

- Access to real-time satellite imagery for crop monitoring

- Integration of weather data for more accurate risk assessment

- Customizable alerts for potential crop health issues

- Historical data analysis for long-term planning

By leveraging these capabilities, farmers can make more informed decisions about their insurance needs and farm management practices.

Explore Farmonaut’s API solutions:

Frequently Asked Questions (FAQ)

To address common queries about apple crop insurance in Niagara County, we’ve compiled a list of frequently asked questions:

- Q: What types of losses are covered under apple crop insurance?

A: Typically, apple crop insurance covers losses due to adverse weather conditions, pests, diseases, and market price fluctuations, depending on the specific policy chosen. - Q: How often should I review my crop insurance policy?

A: We recommend reviewing your policy annually or whenever there are significant changes to your farm operation or market conditions. - Q: Can I insure only a portion of my apple crop?

A: Yes, many policies allow you to insure a percentage of your crop, giving you flexibility in coverage and premium costs. - Q: How are premium rates determined for apple crop insurance?

A: Premium rates are based on factors such as historical yields, coverage level chosen, type of policy, and location-specific risk factors. - Q: What should I do if I suspect a loss to my insured apple crop?

A: Contact your insurance agent immediately to report the potential loss and follow their guidance on next steps and documentation requirements.

Conclusion: Empowering Niagara County Apple Farmers Through Informed Risk Management

As we’ve explored throughout this comprehensive guide, understanding and effectively utilizing crop insurance is crucial for the success and sustainability of apple farming in Niagara County, New York. The new Apple Special Provisions, along with a range of insurance options like Whole-Farm Revenue Protection and Rainfall Index Insurance, offer powerful tools for agricultural risk mitigation.

By staying informed about policy updates, leveraging available resources, and embracing technological solutions like those offered by Farmonaut, farmers can create robust risk management strategies that protect their livelihoods and ensure the long-term viability of their operations.

We encourage all Niagara County apple farmers to take a proactive approach to crop insurance and risk management. Regularly review your policies, consult with knowledgeable agents, and explore complementary tools and technologies to stay ahead in an ever-changing agricultural landscape.

Remember, effective risk management is not just about protecting against losses—it’s about creating a foundation for growth, innovation, and success in apple farming. By making informed decisions and leveraging the full range of available resources, Niagara County apple farmers can cultivate resilience and prosperity for generations to come.

Explore Farmonaut’s Subscription Options

To further enhance your farm management capabilities and complement your crop insurance strategy, consider exploring Farmonaut’s subscription options:

By leveraging Farmonaut’s advanced satellite-based farm management solutions, Niagara County apple farmers can gain valuable insights into their crop health, optimize resource management, and make data-driven decisions that complement their crop insurance strategies.