Global Grain Market Shifts: USDA Forecasts Impact Corn, Soybean, and Wheat Futures Amid Weather Concerns

“USDA forecasts predict record Brazilian soybean harvests, causing futures to decline by up to 5% in recent trading.”

In the ever-evolving landscape of global agriculture, we find ourselves amidst significant shifts in the grain market. As agricultural commodity experts, we at Farmonaut are closely monitoring these changes and their potential impacts on farmers, traders, and consumers worldwide. Today, we’ll delve into the recent developments in corn futures market trends, soybean production forecasts, and wheat demand analysis, all while considering the crucial role of weather impacts on crop yields.

Understanding the Current Market Dynamics

The agricultural commodity markets are experiencing a period of volatility, with corn futures and soybean production forecasts taking center stage. Recent USDA crop estimates have sparked considerable movement in grain prices, while weather conditions continue to play a pivotal role in shaping market trends. Let’s break down the current situation for each major grain:

Corn: Resilience Amid Challenges

Corn futures have shown remarkable resilience in recent trading sessions. Despite a slight retreat, prices remain near their highest levels since December 2023. The most active corn contract on the Chicago Board of Trade (CBOT) settled at $4.75-1/2 a bushel, representing a minor decrease of 0.7%. However, it’s worth noting that corn had recently surged to $4.80 per bushel, marking a significant milestone in the market.

The strength in corn prices can be attributed to growing concerns about dry weather conditions in Argentina, the world’s third-largest corn exporter. The Rosario grains exchange has revised its 2024-25 harvest estimation downward from 50-51 million metric tons to 48 million metric tons, reflecting the adverse impact of weather on crop yields.

While heavy rain is expected over the weekend, potentially providing a temporary respite from the dry conditions, there’s apprehension about the possibility of dry weather returning later in the month. This uncertainty continues to support bullish sentiments in the corn market.

Soybeans: Record Brazilian Production Weighs on Prices

In contrast to corn, soybean futures have experienced a significant decline. The most active soybean contract dropped by 1.3%, reaching $10.29-1/4 a bushel. This downturn is largely attributed to market anticipations of record soybean production from Brazil, the world’s leading producer of soybeans.

It’s important to note that soybean prices had recently spiked to $10.64, marking the highest level since October 2022. This surge was influenced by USDA downgrades and a rally in soyoil prices linked to potential modifications in U.S. biofuel policies. However, the bullish trend in soyoil halted on Thursday with a 0.7% drop.

Wheat: Struggling with Subdued Demand

Wheat futures have also seen a decline, with prices falling by 0.6% to $5.43-3/4 a bushel. The wheat market is currently grappling with lackluster demand, which is putting downward pressure on prices. This situation highlights the complex interplay between supply, demand, and global economic factors in the agricultural commodity markets.

USDA Forecasts and Their Market Impact

The United States Department of Agriculture (USDA) plays a crucial role in shaping market expectations and trends through its regular crop estimates and forecasts. The recent adjustments made by the USDA have had a significant impact on the grain markets:

- Corn Production: The USDA has lowered its estimates for U.S. corn production in 2024, contributing to the bullish sentiment in the corn futures market.

- Soybean Production: Similarly, soybean production forecasts for the U.S. have been revised downward, initially supporting higher prices before being offset by expectations of record Brazilian output.

- Ending Stocks: The USDA’s projections for ending stocks, which represent the amount of grain left over at the end of the marketing year, have also influenced market dynamics. Tighter ending stocks typically lead to higher prices due to supply concerns.

These USDA crop estimates serve as a key reference point for traders, farmers, and policymakers alike. They provide valuable insights into the supply and demand balance of major grains, helping stakeholders make informed decisions about planting, trading, and policy formulation.

Weather Impacts on Crop Yields

“Corn prices remain elevated, with futures up 3% due to dry conditions affecting 40% of Argentina’s crop-growing regions.”

Weather conditions play a critical role in determining crop yields and, consequently, grain prices. The current market situation provides a clear example of how weather can impact different regions and crops:

Argentina’s Dry Spell

Argentina, a major corn exporter, is experiencing dry conditions that are causing significant concern in the global corn market. The lack of rainfall has led to reduced yield expectations, as evidenced by the Rosario grains exchange’s downward revision of its harvest forecast. This situation underscores the vulnerability of crop production to weather extremes and the ripple effects on global supply chains.

Brazil’s Favorable Conditions

In contrast to Argentina’s challenges, Brazil is experiencing favorable weather conditions that are contributing to expectations of record soybean production. This positive outlook for Brazilian soybeans is a key factor in the recent decline of soybean futures prices. It also highlights the importance of considering global weather patterns when analyzing agricultural commodity markets.

United States Crop Outlook

Weather conditions in the United States, a major producer of corn, soybeans, and wheat, also play a crucial role in shaping global grain markets. The USDA’s recent downward revisions of U.S. corn and soybean production estimates reflect the impact of weather patterns on crop yields in key growing regions.

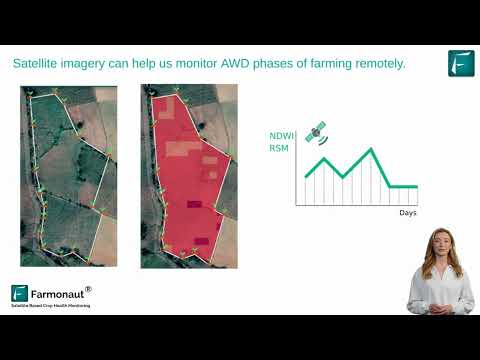

At Farmonaut, we understand the critical importance of accurate weather data and its impact on crop yields. Our satellite-based crop monitoring technology provides farmers and agribusinesses with real-time insights into weather patterns and their potential effects on crop health. By leveraging this technology, stakeholders can make more informed decisions about planting, irrigation, and harvest timing.

Global Grain Trade Outlook

The current market dynamics are shaping a complex outlook for global grain trade. Here are some key factors to consider:

Corn Export Concerns

With Argentina facing production challenges due to dry weather, there are growing concerns about global corn supplies. This situation could potentially lead to increased demand for corn exports from other major producers, such as the United States and Brazil. Farmers and traders should closely monitor these developments, as they may present both challenges and opportunities in the coming months.

Soybean Market Dynamics

The anticipated record soybean production in Brazil is likely to have significant implications for global soybean trade. As the world’s largest soybean exporter, Brazil’s bumper crop could lead to increased competition in international markets. This may put pressure on soybean prices and affect export opportunities for other producing countries.

Wheat Demand Analysis

The current subdued demand for wheat is a key factor in the recent price declines. Understanding the drivers behind this lackluster demand is crucial for predicting future market trends. Factors such as changing dietary preferences, economic conditions in key importing countries, and competition from other grains all play a role in shaping wheat demand.

Biofuel Policy Effects on Agriculture

The recent rally in soyoil prices, linked to potential modifications in U.S. biofuel policies, highlights the interconnectedness of energy and agricultural markets. Biofuel policies can have significant impacts on agricultural commodity prices and production decisions:

- Demand Shifts: Changes in biofuel mandates or incentives can lead to shifts in demand for crops used in biofuel production, such as corn and soybeans.

- Price Volatility: The biofuel market can introduce additional price volatility to agricultural commodities, as it creates a link between food, feed, and fuel markets.

- Land Use Decisions: Biofuel policies can influence farmers’ decisions about which crops to plant, potentially affecting the supply balance of various grains.

As we navigate these complex market dynamics, it’s crucial for stakeholders in the agricultural sector to stay informed about policy developments and their potential impacts on commodity prices and production patterns.

Commodity Price Comparison

| Commodity | Corn | Soybeans | Wheat |

|---|---|---|---|

| Current Price (estimated) | $4.75-1/2 per bushel | $10.29-1/4 per bushel | $5.43-3/4 per bushel |

| Price Change (%) (estimated) | -0.7% | -1.3% | -0.6% |

| USDA Production Forecast (estimated) | Lowered | Lowered for U.S., Record for Brazil | Not specified |

| Key Weather Impact | Dry conditions in Argentina | Favorable conditions in Brazil | Not specified |

| Major Producing Country Affected | Argentina | Brazil (positively) | Not specified |

This table provides a quick overview of the current state of major grain commodities, highlighting the differences in price movements, production forecasts, and key factors affecting each crop. It’s clear that while corn and wheat are facing some challenges, soybeans are in a unique position due to the expected record production in Brazil.

The Role of Technology in Agricultural Decision-Making

In today’s rapidly changing agricultural landscape, access to accurate and timely information is crucial for making informed decisions. This is where advanced agricultural technology solutions, such as those offered by Farmonaut, come into play.

Farmonaut’s satellite-based crop monitoring technology provides farmers, traders, and policymakers with valuable insights into crop health, weather patterns, and potential yield estimates. By leveraging this technology, stakeholders can:

- Monitor crop development in real-time

- Identify potential issues early, such as pest infestations or nutrient deficiencies

- Make data-driven decisions about irrigation, fertilization, and harvest timing

- Assess the impact of weather events on crop yields

- Gain a competitive edge in the market through more accurate yield predictions

To learn more about how Farmonaut’s technology can benefit your agricultural operations, visit our web application or download our mobile apps:

Looking Ahead: Market Trends and Predictions

As we look to the future of global grain markets, several key trends and factors are likely to shape the landscape:

1. Climate Change and Weather Variability

The increasing frequency and severity of extreme weather events due to climate change will continue to impact crop yields and market volatility. Farmers and traders will need to adapt their strategies to account for this heightened uncertainty.

2. Technological Advancements

The adoption of precision agriculture technologies, such as those offered by Farmonaut, is likely to accelerate. These tools will enable more efficient resource use and better risk management in farming operations.

3. Shifting Global Demand Patterns

Changes in dietary preferences, population growth, and economic development in emerging markets will influence demand for various grains and oilseeds. Understanding these shifts will be crucial for long-term planning in the agricultural sector.

4. Policy Developments

Agricultural and trade policies, including biofuel mandates and international trade agreements, will continue to play a significant role in shaping global grain markets. Stakeholders should stay informed about policy changes and their potential impacts.

5. Supply Chain Innovations

Advancements in logistics, storage, and transportation technologies may lead to more efficient global grain trade. This could potentially reduce price disparities between regions and improve overall market stability.

By staying informed about these trends and leveraging advanced technologies like Farmonaut’s satellite-based crop monitoring, farmers, traders, and policymakers can better navigate the complexities of the global grain market.

Conclusion: Navigating Uncertainty in the Global Grain Market

The current shifts in the global grain market underscore the complex interplay of factors that influence agricultural commodity prices. From weather impacts on crop yields to USDA forecasts and changing biofuel policies, stakeholders in the agricultural sector must remain vigilant and adaptable.

As we’ve seen, corn futures remain resilient despite recent challenges, while soybean markets are adjusting to expectations of record Brazilian production. Wheat prices continue to struggle with subdued demand, highlighting the need for comprehensive market analysis.

In this dynamic environment, access to accurate, real-time data is more crucial than ever. Farmonaut’s advanced satellite-based crop monitoring technology offers valuable insights that can help farmers, traders, and policymakers make informed decisions in the face of uncertainty.

By leveraging these technological solutions and staying informed about market trends, we can work towards a more resilient and sustainable global agricultural system. As we move forward, it’s clear that the ability to adapt to changing conditions and make data-driven decisions will be key to success in the ever-evolving world of global grain markets.

FAQ Section

- Q: How do USDA forecasts impact grain prices?

A: USDA forecasts provide crucial information about expected crop production, supply, and demand. These estimates can significantly influence market sentiment and prices. For example, lowered production forecasts often lead to higher prices due to anticipated supply constraints. - Q: What role does weather play in grain market fluctuations?

A: Weather is a critical factor in crop yields and, consequently, grain prices. Adverse weather conditions in major producing regions can lead to supply concerns and price increases, while favorable conditions can result in abundant harvests and price declines. - Q: How do biofuel policies affect agricultural commodity prices?

A: Biofuel policies can significantly impact demand for crops like corn and soybeans, which are used in biofuel production. Changes in these policies can lead to shifts in demand and price fluctuations in both the energy and agricultural markets. - Q: What are the benefits of using satellite-based crop monitoring technology?

A: Satellite-based crop monitoring, like that offered by Farmonaut, provides real-time insights into crop health, weather patterns, and potential yields. This technology enables more informed decision-making in areas such as irrigation, fertilization, and harvest timing. - Q: How can farmers and traders stay informed about global grain market trends?

A: Staying informed requires a combination of following official reports (like USDA forecasts), monitoring weather patterns, understanding policy developments, and leveraging advanced technologies. Platforms like Farmonaut offer valuable tools for real-time crop monitoring and market analysis.

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For more information about our affiliate program, visit Farmonaut Affiliate Program.

Farmonaut Subscriptions

Stay ahead of the curve in the global grain market with Farmonaut’s cutting-edge satellite-based crop monitoring technology. Visit our web application or explore our API capabilities at Farmonaut API. For detailed information on integrating our services into your systems, check out our API Developer Docs.

Together, we can navigate the complexities of the global grain market and work towards a more sustainable and productive agricultural future.