Climate-Proofing UK Properties: Essential Guide to Flood Risk and Insurance in a Changing Environment

“UK winters are becoming 30% wetter due to climate change, increasing flood risks for properties.”

As we navigate the complexities of climate change, UK property owners and investors face unprecedented challenges. In this comprehensive guide, we’ll explore how extreme weather events are reshaping the landscape for homeowners and landlords across the country. From the risks of flooding to the financial implications for insurance policies, we’ll dive deep into the essential information you need to protect your UK flood risk property investments.

Understanding the Changing Climate Landscape in the UK

The United Kingdom has long been known for its wet weather, but recent years have brought a stark reminder that our climate is changing rapidly. Homeowners have traditionally dealt with issues like damp and leaky roofs, but now face new challenges as summers become hotter and winters wetter.

According to the Met Office, since 2010, UK summers have become 13% wetter and winters 12% wetter compared to previous decades. Even more alarming is the fact that seven of the eleven wettest winters in 160 years of records have occurred within the past 25 years. This trend paints a clear picture of the changing weather patterns affecting our properties.

The Impact of Extreme Weather on UK Properties

The effects of climate change on UK properties are multifaceted:

- Increased Flood Risk: With wetter winters, the risk of flooding has significantly increased across many parts of the UK.

- Heat-Related Damage: Record-breaking summers, with temperatures reaching 40 degrees Celsius, can lead to structural issues and increased cooling costs.

- Coastal Erosion: Rising sea levels threaten properties in coastal areas, with some cities at risk of partial submersion by 2100.

- Subsidence: Prolonged dry spells followed by heavy rain can cause soil to shrink and swell, leading to foundation problems.

These climate risks are not just theoretical; they have real, long-term implications for property values, insurance premiums, and the overall viability of certain areas for residential and commercial use.

Flood Risk Assessment for Property Buyers

For those looking to invest in UK property, understanding flood risk is now a crucial part of the due diligence process. The UK government provides online tools for prospective buyers to assess flood risks in their areas, including maps and information about local flood management authorities.

When assessing flood risk, consider the following factors:

- Proximity to bodies of water (rivers, seas, lakes)

- Elevation of the property

- Local flood defense infrastructure

- Historical flood data for the area

- Property-specific features (e.g., raised foundations, flood barriers)

It’s important to note that mortgage lenders are increasingly taking flood risk into account when evaluating loan applications. Properties in high-risk areas may require larger deposits or face reduced loan-to-value ratios.

Insurance Implications in a Changing Climate

“The Met Office reports a 1°C increase in UK average temperatures since 1980, affecting property insurance premiums.”

As climate risks increase, so do the challenges for property insurance. Currently, there appears to be no immediate change in insurance policies to address these emerging risks. However, this situation is likely to evolve as insurers grapple with the increasing frequency and severity of weather-related claims.

Property owners should be aware of the following insurance considerations:

- Rising Premiums: Properties in high-risk areas may face higher insurance costs.

- Coverage Limitations: Some insurers may introduce exclusions or caps on flood-related damage.

- Flood Re Scheme: This government-backed program helps provide affordable flood insurance for at-risk properties, but it’s set to end in 2039.

- Policy Accuracy: Ensure all details about your property are accurately reported to avoid policy invalidation.

It’s crucial for property owners to review their insurance policies regularly and consider consulting with insurance brokers who can offer tailored advice and potentially better deals than online searches.

Climate Change Impact on UK Real Estate: A Regional Perspective

The effects of climate change on UK properties vary significantly by region. Coastal cities like Brighton, Cardiff, and Belfast face particularly high risks due to their proximity to rising seas. Inland areas near rivers, such as parts of London and York, also face increased flood risks.

Here’s a breakdown of how different regions are affected:

| Region | Flood Risk Level | Insurance Premium Trends | Property Value Impact | Adaptation Measures |

|---|---|---|---|---|

| Coastal Areas | High | Rapidly Increasing | Significant Decrease | Sea Walls, Raised Foundations |

| River Valleys | High | Increasing | Moderate Decrease | Flood Barriers, Improved Drainage |

| Urban Centers | Medium | Stable to Increasing | Slight Decrease | Green Infrastructure, Sustainable Drainage |

| Rural Landscapes | Low to Medium | Stable | Minimal Impact | Natural Flood Management, Land Use Planning |

This matrix provides a clear overview of how climate change is affecting different property types across the UK. It’s essential for investors and homeowners to consider these regional variations when making property decisions.

Landlord Responsibilities for Flood Damage

For landlords, the increasing risk of flooding brings additional responsibilities and potential financial burdens. Understanding these obligations is crucial for protecting both your investment and your tenants.

Key responsibilities include:

- Ensuring the property is adequately insured against flood damage

- Implementing flood prevention measures where possible

- Providing alternative accommodation for tenants if the property becomes uninhabitable due to flooding

- Repairing flood damage promptly to maintain the property’s habitability

Landlords should also consider including specific clauses in tenancy agreements regarding flood risk and responsibilities. This can help clarify expectations and reduce potential disputes in the event of flooding.

Adapting Investment Strategies for Climate Change

As the climate continues to change, property investors need to adapt their strategies to account for these new risks. Here are some key considerations:

- Long-term View: Consider how climate change might impact property values over decades, not just years.

- Diversification: Spread investments across different regions and property types to mitigate climate-related risks.

- Resilience Measures: Invest in properties with built-in climate resilience features or budget for upgrades.

- Insurance Coverage: Ensure comprehensive insurance coverage and regularly review policies.

- Local Knowledge: Understand local flood management plans and infrastructure improvements.

By incorporating these factors into your investment strategy, you can better protect your portfolio against the impacts of climate change.

Technological Solutions for Climate-Proofing Properties

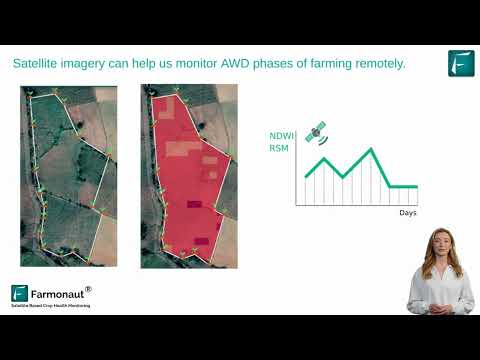

As we face these climate challenges, technology is playing an increasingly important role in helping property owners and investors make informed decisions. One such technological solution is provided by Farmonaut, a company that leverages satellite imagery and AI to offer valuable insights for land management.

While Farmonaut’s primary focus is on agricultural applications, their technology has potential implications for property management in a changing climate. For instance:

- Satellite-based monitoring could help identify areas at risk of flooding or erosion.

- AI-driven analysis could provide early warnings for extreme weather events.

- Data on soil moisture and vegetation health could inform decisions about landscaping and drainage for properties.

For those interested in exploring how satellite technology can aid in property management, you can check out Farmonaut’s services:

For developers looking to integrate satellite data into their own systems, Farmonaut offers an API:

And for those who prefer mobile access:

Financial Considerations in Climate-Proofing Properties

Adapting properties to withstand the impacts of climate change can require significant investment. However, these costs should be weighed against the potential long-term savings and protection of property value.

Key financial considerations include:

- Cost of implementing flood prevention measures

- Potential increases in insurance premiums

- Impact on property value and rental income

- Availability of government grants or incentives for climate-proofing measures

It’s important to approach these investments with a long-term perspective, considering both the immediate costs and the potential future benefits.

The Role of Government and Local Authorities

The UK government and local authorities play a crucial role in managing flood risk and supporting property owners. Key initiatives include:

- National flood defense infrastructure projects

- Planning regulations to limit development in high-risk areas

- The Flood Re scheme to support affordable flood insurance

- Grants for property-level flood resilience measures

Property owners and investors should stay informed about local and national policies that may affect their properties. This information can be valuable for making decisions about property purchases, improvements, and long-term investment strategies.

Future Outlook: Preparing for Continued Climate Change

As we look to the future, it’s clear that the impacts of climate change on UK properties will continue to evolve. Preparing for these changes requires a proactive approach from property owners, investors, and policymakers alike.

Key areas to watch include:

- Advancements in climate modeling and risk assessment

- Development of new building materials and techniques for climate resilience

- Changes in insurance products and pricing models

- Shifts in property market dynamics based on climate risk

By staying informed and adaptable, property owners and investors can better position themselves to navigate the challenges and opportunities presented by a changing climate.

Conclusion: Embracing Resilience in a Changing World

Climate-proofing UK properties is no longer an option but a necessity in our changing environment. From understanding flood risks to adapting investment strategies, property owners and investors must take a proactive approach to protect their assets and ensure long-term viability.

By leveraging available resources, staying informed about climate trends, and embracing technological solutions, we can build a more resilient property landscape in the UK. Remember, the key to success in this new era is adaptability, informed decision-making, and a commitment to long-term sustainability.

FAQ Section

Q: How can I assess the flood risk for a property I’m interested in buying?

A: You can use the UK government’s online flood risk assessment tools, which provide detailed maps and information about local flood risks. Additionally, hiring a surveyor with expertise in flood risk assessment can provide more detailed insights.

Q: Will climate change affect my property insurance premiums?

A: It’s likely that insurance premiums will be affected, especially for properties in high-risk areas. Regular reviews of your policy and shopping around for the best deals can help manage costs.

Q: What are some practical steps I can take to climate-proof my property?

A: Practical steps include installing flood barriers, improving drainage systems, using water-resistant materials for ground floor walls and floors, and raising electrical sockets and appliances above potential flood levels.

Q: How might climate change impact property values in the UK?

A: Climate change could lead to decreased property values in high-risk areas, particularly those prone to flooding or coastal erosion. However, properties with robust climate resilience features may see their values maintained or even increased.

Q: Are there any government grants available for climate-proofing properties?

A: Yes, the UK government occasionally offers grants for flood resilience measures. Check with your local authority or the Environment Agency for current available schemes.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!