Global Grain Market Analysis: Chicago Wheat Futures Decline Amid Winter Crop Resilience and Trade Uncertainties

“Chicago wheat futures declined after reaching a multi-month high, reflecting stabilized winter crop conditions in the Northern Hemisphere.”

In today’s rapidly evolving global agricultural landscape, we find ourselves at a crucial juncture where market dynamics, environmental factors, and geopolitical tensions converge to shape the future of grain markets. As we delve into this comprehensive grain market analysis, we’ll explore the intricate web of factors influencing Chicago wheat futures, corn price forecasts, and soybean export trends. Our focus will be on unraveling the complex interplay between crop acreage projections, Black Sea wheat supply, and the broader commodity trading outlook.

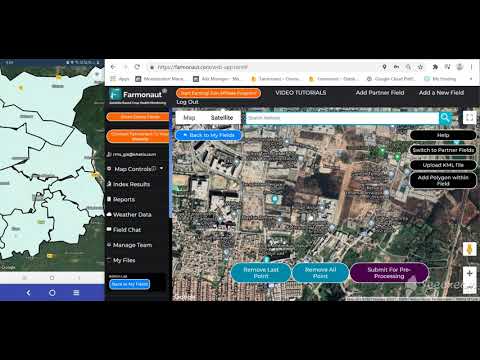

At Farmonaut, we recognize the importance of staying ahead in this ever-changing agricultural environment. Our satellite-based farm management solutions provide farmers and agribusinesses with the tools they need to navigate these market fluctuations effectively. As we examine the current state of global grain markets, we’ll also highlight how precision agriculture technologies can help stakeholders make informed decisions in these uncertain times.

Chicago Wheat Futures: A Rollercoaster Ride

The Chicago Board of Trade (CBOT) wheat futures have recently experienced a significant downturn, extending declines in early trade on Thursday. This comes after a dramatic tumble of more than 6% from a multi-month high reached just last week. The primary catalyst for this shift appears to be the realization that Northern Hemisphere winter crops have successfully weathered a period of cold temperatures without sustaining significant damage.

Let’s break down the key factors influencing this market movement:

- Winter Crop Resilience: Despite initial concerns about potential frost damage, snow cover has effectively protected wheat crops in both the United States and Russia. This natural insulation has mitigated the risk of widespread crop loss, easing supply concerns and putting downward pressure on prices.

- Black Sea Supply Outlook: The potential for improved relations between Russia and Ukraine has added another layer of complexity to the wheat market. Any reduction in tensions could potentially increase the availability of Black Sea wheat exports, further dampening price pressures.

- Commodity Fund Positioning: Traders report that commodity funds, which already held a net short position in CBOT wheat, have been actively selling in recent days. This selling pressure has contributed to the continued decline in futures prices.

As of 0107 GMT, the most-active wheat contract on the CBOT was down 0.2% at $5.78-3/4 a bushel. This represents a significant retreat from the recent peak of $6.21-1/4, which marked the highest level since June 2024.

Corn and Soybean Markets: Navigating Choppy Waters

While wheat has taken center stage in recent market movements, corn and soybean futures are also facing their own set of challenges. Both commodities have seen slight increases but remain below recent highs. The CBOT corn contract was up 0.2% at $4.94-1/4 a bushel, while soybeans edged 0.1% higher to $10.42-1/2 a bushel.

Key factors influencing corn and soybean markets include:

- Tariff Concerns: Renewed fears about potential tariffs have cast a shadow over agricultural trade. Market participants worry that proposed U.S. tariffs could trigger retaliatory measures against U.S. farm exports, potentially stifling global demand for grains and oilseeds.

- Shifting Acreage Projections: As we approach the U.S. Department of Agriculture’s annual Outlook Forum, expectations are building for a potential shift in acreage from soybeans towards corn. This anticipated change is driven by farmers seeking to maximize profits in the current market environment.

- Global Economic Uncertainty: Concerns about protectionist policies and their potential to hinder global economic growth are weighing heavily on the minds of traders and investors in the agricultural commodity space.

The Role of Precision Agriculture in Navigating Market Volatility

In these uncertain times, farmers and agribusinesses need every advantage they can get to make informed decisions. This is where precision agriculture technologies, like those offered by Farmonaut, come into play. Our satellite-based crop health monitoring and AI-driven advisory systems provide real-time insights that can help stakeholders adapt to changing market conditions.

By leveraging advanced technologies, farmers can:

- Optimize resource allocation based on real-time crop health data

- Make informed decisions about crop selection and acreage allocation

- Reduce input costs while maximizing yield potential

- Adapt quickly to changing weather patterns and market conditions

For those interested in harnessing the power of satellite technology for their agricultural operations, Farmonaut offers both mobile and web-based solutions:

Global Agricultural Trade: A Delicate Balance

The current state of global agricultural trade is characterized by a complex interplay of factors, including geopolitical tensions, changing climate patterns, and evolving consumer preferences. Let’s examine some of the key elements shaping the international grain and oilseed markets:

Black Sea Wheat Supply: A Critical Factor

The Black Sea region, particularly Russia and Ukraine, plays a crucial role in global wheat supply. Recent developments in this area have significant implications for the wheat market:

- Export Disruptions: Ongoing tensions between Russia and Ukraine have led to periodic disruptions in wheat exports from the region. Any resolution to this conflict could potentially increase the availability of Black Sea wheat in the global market, putting downward pressure on prices.

- Production Outlook: Despite geopolitical challenges, both Russia and Ukraine have reported favorable winter wheat conditions. This positive outlook contributes to the overall bearish sentiment in the wheat market.

Soybean Export Trends: Shifting Dynamics

The global soybean market is experiencing its own set of challenges and opportunities:

- U.S.-China Trade Relations: The ongoing trade negotiations between the United States and China continue to influence soybean export trends. Any changes in tariff structures or trade agreements could have significant implications for global soybean flows.

- South American Production: Brazil and Argentina, major soybean producers, are facing their own set of challenges. In Argentina, for example, the main oilseed union SOEA is threatening a national strike in soybean processing plants over a salary dispute at exports conglomerate Vicentin. Such labor issues could potentially disrupt soybean supply chains.

“The U.S. Department of Agriculture’s Outlook Forum is anticipated to provide crucial insights on corn price forecasts and planting intentions.”

The USDA Outlook Forum: Shaping Market Expectations

As we approach the U.S. Department of Agriculture’s annual Outlook Forum, market participants are eagerly anticipating key insights that could shape the agricultural commodity landscape in the coming months. Some of the critical areas of focus include:

- Corn Price Forecasts: The USDA’s projections for corn prices will be closely scrutinized, as they can significantly influence planting decisions and market sentiment.

- Shifts in Planting Intentions: Any indications of changes in acreage allocation between corn, soybeans, and other crops could have far-reaching implications for supply and pricing dynamics.

- Global Production Estimates: The USDA’s assessment of global grain and oilseed production will provide valuable context for understanding potential supply-demand imbalances.

For farmers and agribusinesses looking to stay ahead of these market shifts, Farmonaut’s precision agriculture tools can provide valuable insights. Our satellite-based crop monitoring and AI-driven advisory systems help stakeholders make data-driven decisions in response to changing market conditions.

Explore Farmonaut’s API for advanced agricultural insights

The Impact of Tariffs on Agricultural Markets

One of the most significant concerns looming over the agricultural commodity markets is the potential impact of tariffs on global trade. The threat of new tariffs and the possibility of retaliatory measures have introduced an element of uncertainty into the market. Here’s how tariffs could affect different aspects of the grain and oilseed trade:

- Export Competitiveness: Tariffs can significantly alter the competitive landscape for agricultural exports. Countries facing higher tariffs may find it more challenging to maintain their market share in key importing nations.

- Domestic Prices: The imposition of tariffs can lead to changes in domestic price structures as markets adjust to new trade realities. This can have ripple effects throughout the agricultural supply chain.

- Global Demand: There are concerns that an escalation in tariff disputes could dampen overall global economic growth, potentially reducing demand for agricultural commodities.

In this uncertain environment, having access to real-time data and expert analysis is more crucial than ever. Farmonaut’s comprehensive suite of agricultural technology solutions can help farmers and agribusinesses navigate these complex market dynamics.

Comparative Analysis of Global Grain Market Trends

| Commodity | Current Price (USD/bushel) | Price Change (%) | Production Forecast (million metric tons) | Export Forecast (million metric tons) | Key Influencing Factors |

|---|---|---|---|---|---|

| Chicago Wheat | 5.78 | -0.2% | 780 | 205 | Stable winter crop conditions, reduced cold weather damage concerns |

| Black Sea Wheat | 6.10 | -1.5% | 130 | 60 | Geopolitical tensions, potential export disruptions |

| U.S. Corn | 4.94 | +0.2% | 380 | 62 | Shifting acreage projections, tariff concerns |

| U.S. Soybeans | 10.42 | +0.1% | 120 | 55 | Trade uncertainties, South American production outlook |

This table provides a snapshot of the current state of major grain commodities, highlighting the interconnected nature of global agricultural markets. As we can see, each commodity is influenced by a unique set of factors, ranging from weather conditions to geopolitical events.

The Role of Technology in Modern Agriculture

In an era of market volatility and environmental uncertainty, the role of technology in agriculture has never been more critical. Farmonaut is at the forefront of this technological revolution, offering innovative solutions that empower farmers and agribusinesses to make data-driven decisions.

Key features of Farmonaut’s precision agriculture platform include:

- Satellite-based crop health monitoring for real-time insights

- AI-driven advisory systems for personalized farm management strategies

- Blockchain-based traceability solutions for enhanced supply chain transparency

- Carbon footprint tracking to support sustainable farming practices

Explore Farmonaut’s API Developer Docs for integration options

Looking Ahead: Future Trends in Global Grain Markets

As we look to the future of global grain markets, several key trends are likely to shape the landscape:

- Climate Change Adaptation: With increasing weather variability, farmers will need to adapt their practices to ensure resilient crop production. Technologies like Farmonaut’s satellite-based monitoring can play a crucial role in this adaptation process.

- Shifting Trade Patterns: Geopolitical tensions and changing trade agreements may lead to new patterns in global grain flows. Market participants will need to stay informed about these developments to make strategic decisions.

- Sustainable Agriculture: There is growing pressure on the agricultural sector to reduce its environmental footprint. Technologies that support sustainable farming practices, such as Farmonaut’s carbon footprint tracking, will become increasingly important.

- Data-Driven Decision Making: The integration of big data and artificial intelligence in agriculture will continue to grow, enabling more precise and efficient farming practices.

Earn With Farmonaut: Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn more about our affiliate program

Conclusion: Navigating Uncertainty with Technology and Insight

The global grain market is at a critical juncture, with Chicago wheat futures declining amid winter crop resilience and trade uncertainties. As we’ve explored in this comprehensive analysis, a complex interplay of factors—including weather patterns, geopolitical tensions, and shifting trade dynamics—continues to shape the agricultural commodity landscape.

In these challenging times, the importance of precision agriculture and data-driven decision-making cannot be overstated. Farmonaut’s suite of advanced technologies offers farmers and agribusinesses the tools they need to navigate market volatility, optimize resource allocation, and embrace sustainable farming practices.

As we move forward, staying informed about market trends, leveraging cutting-edge technologies, and adapting to changing conditions will be key to success in the global agricultural sector. By embracing innovation and staying attuned to market signals, stakeholders can position themselves to thrive in an ever-evolving landscape.

Farmonaut Subscriptions

Frequently Asked Questions

- What factors are currently influencing Chicago wheat futures?

Chicago wheat futures are being influenced by stabilized winter crop conditions in the Northern Hemisphere, potential changes in Black Sea wheat supply, and broader trade uncertainties. - How are tariff concerns affecting agricultural markets?

Tariff concerns are creating uncertainty in agricultural markets, potentially impacting export competitiveness, domestic prices, and overall global demand for grains and oilseeds. - What role does technology play in modern agriculture?

Technology, such as Farmonaut’s precision agriculture solutions, plays a crucial role in providing real-time crop monitoring, AI-driven advisory services, and data-driven decision-making tools for farmers and agribusinesses. - How can farmers adapt to changing market conditions?

Farmers can adapt by staying informed about market trends, leveraging precision agriculture technologies, and making data-driven decisions about crop selection, resource allocation, and farming practices. - What are the key trends shaping the future of global grain markets?

Key trends include climate change adaptation, shifting trade patterns, a focus on sustainable agriculture, and the increasing importance of data-driven decision-making in farming operations.