Potash Trade War: How Canadian Exports and US Tariffs Impact American Farmers and Global Agriculture

“Canada exports over 22 million tonnes of potash annually, making it the world’s largest potash exporter.”

In the complex world of international trade, a new battleground has emerged that’s shaking up the agricultural sector on both sides of the Canada-US border. We’re witnessing the unfolding of a potash trade war that has far-reaching implications for American farmers, Canadian exporters, and the global agriculture industry as a whole. This conflict, centered around Canadian potash exports and US tariffs on fertilizer, is a prime example of how trade policies can have profound effects on food production, economic relationships, and even geopolitical dynamics.

As we delve into this intricate issue, we’ll explore the various facets of this trade dispute, including the impact on Saskatchewan’s potash industry, the potential consequences for American farmers, and the broader implications for global agriculture. We’ll also examine the strategies being considered by both Canadian and American stakeholders as they navigate this challenging landscape.

Understanding the Potash Trade War

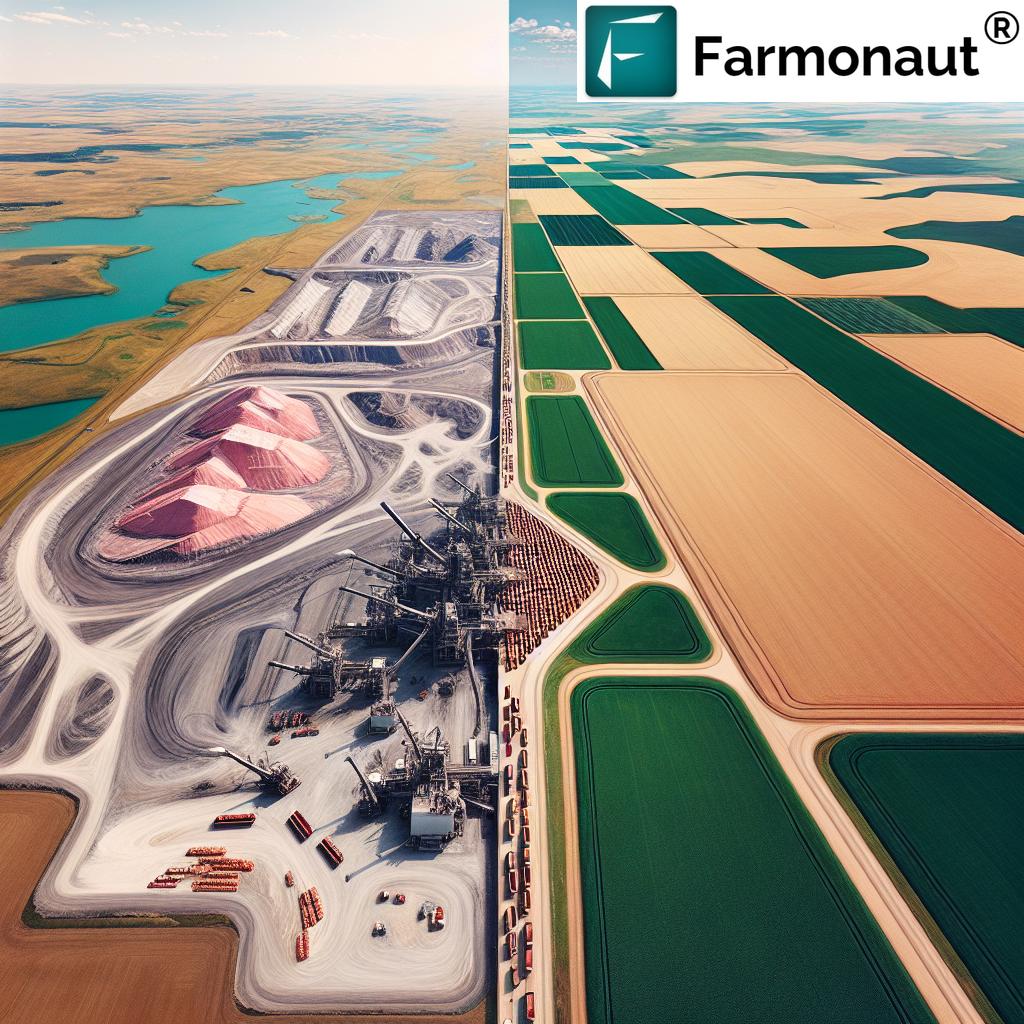

At the heart of this trade conflict lies potash, a vital ingredient in fertilizer production. The importance of potash in agriculture cannot be overstated – it’s essential for crop growth, yield improvement, and overall food security. Canada, particularly the province of Saskatchewan, has long been a dominant player in the global potash market, supplying approximately 85% of the potash used by American farmers.

However, this well-established trade relationship has been thrown into turmoil by the introduction of sweeping tariffs by the US government. These tariffs, part of a broader trade policy shift, have created a complex and potentially volatile situation that threatens to disrupt agricultural production on both sides of the border.

The Impact on Canadian Potash Exports

Saskatchewan, the heartland of Canadian potash production, is bracing for significant impact from this trade dispute. In 2023, despite a decline in potash prices, the province exported over $11.5 billion worth of potash, accounting for a third of global production. This impressive export performance underscores the critical role that Canadian potash plays in the global agricultural supply chain.

The introduction of US tariffs on fertilizer imports poses a direct threat to this thriving industry. Canadian producers are now faced with the challenge of maintaining their market share in the face of artificially inflated prices. The potential loss of their largest market could have severe economic consequences for Saskatchewan and the broader Canadian economy.

American Farmers and the Fertilizer Dilemma

On the other side of the border, American farmers are grappling with the prospect of increased fertilizer costs and potential supply issues. The US agricultural sector, already under pressure from various economic factors, now faces an additional challenge in the form of higher input costs.

“U.S. tariffs on fertilizer imports could increase costs for American farmers by up to 30%, affecting food production nationwide.”

The American Farm Bureau Federation has reported that farmers have suffered losses on most major crops for three consecutive years, due to high global inflation and supply chain constraints. The addition of tariffs on essential fertilizer imports could exacerbate these difficulties, potentially leading to reduced crop yields, increased food prices, and broader economic repercussions.

Global Market Implications

The Canada-US potash trade war has implications that extend far beyond North America. As two of the world’s largest agricultural producers grapple with this dispute, the global potash market is experiencing significant shifts.

Russia and Belarus, which together account for another third of global potash production, stand to potentially benefit from any disruption in Canadian exports to the US. However, concerns have been raised about the environmental and human rights practices of these alternative suppliers.

China, another significant player in the global potash market, is also closely watching these developments. Any major shifts in supply chains could have ripple effects on food production and prices worldwide.

Political Dynamics and Policy Responses

The potash trade war has become a focal point of political debate in both Canada and the United States. In Canada, provincial leaders like Ontario Premier Doug Ford have suggested aggressive countermeasures, including potentially restricting the sale of potash, uranium, and oil to the US. However, Saskatchewan Premier Scott Moe has advocated for a more measured approach, emphasizing the need for reduced interprovincial trade barriers and promotion of infrastructure projects.

Prime Minister Justin Trudeau, while announcing retaliatory tariffs on US products, has indicated that Canada is considering non-tariff measures as well. This measured response reflects the delicate balance Canada must strike between protecting its economic interests and maintaining positive relations with its largest trading partner.

In the US, the tariff policy has faced criticism from some quarters, including farming groups and even some Republican politicians. Senator Chuck Grassley of Iowa, a major agricultural state, has previously pushed for potash to be exempted from the additional levies, highlighting the concerns of the farming community.

Industry Perspectives and Strategies

Key players in the fertilizer industry are actively engaged in addressing the challenges posed by this trade dispute. Nutrien, one of the largest potash producers in Saskatchewan, has warned that the cost of tariffs would ultimately be felt by US farmers. The company has been engaging with policymakers and stakeholders in both countries to make the case against tariffs.

Fertilizer Canada, representing the Canadian fertilizer industry, has expressed concerns that US tariffs not only threaten food production and security on both sides of the border but could also push American farmers towards suppliers from countries with less stringent environmental and human rights standards.

On the US side, organizations like the Fertilizer Institute are closely monitoring the situation. Corey Rosenbusch, the institute’s president and CEO, has noted that while farmers were able to import sufficient fertilizer for the spring planting season, the fall application period could see significant impacts from the tariffs.

Economic Analysis and Expert Opinions

Economists and trade experts have weighed in on the potential consequences of this trade dispute. Many caution against extreme measures, such as completely cutting off potash exports to the US, citing the risk of escalation and negative public perception.

Werner Antweiler, a professor and international trade policy research chair at the University of British Columbia, suggests that such drastic actions could have severe repercussions and potentially turn American public opinion against Canada. He advocates for more nuanced approaches that maintain positive relations while protecting Canadian interests.

Carol McAusland, another professor at the University of British Columbia, proposes alternative strategies such as implementing an export tax on potash sold to the US. This approach could raise prices for American farmers while ensuring that Canada collects some of the additional revenue.

Long-term Effects on Global Agriculture

The potash trade war has the potential to reshape global agricultural practices and supply chains. If sustained, the tariffs could lead to:

- Shifts in crop selection by American farmers to less fertilizer-intensive varieties

- Increased investment in domestic fertilizer production in the US

- Exploration of alternative fertilizer sources and technologies

- Potential changes in global food prices and availability

These changes could have far-reaching consequences for food security, environmental sustainability, and economic relationships between nations.

The Role of Technology in Mitigating Trade Disputes

As the agricultural sector grapples with the challenges posed by trade disputes, technology is emerging as a crucial tool for optimization and resilience. Advanced farm management solutions, such as those offered by Farmonaut, are helping farmers navigate these uncertain times.

Farmonaut’s satellite-based crop health monitoring and AI-driven advisory systems enable farmers to make data-informed decisions about resource allocation, potentially mitigating some of the impacts of increased fertilizer costs. By optimizing the use of inputs like potash, farmers can maintain productivity even in the face of supply challenges.

Furthermore, Farmonaut’s blockchain-based traceability solutions could play a role in verifying the origin and journey of agricultural products, potentially helping to navigate complex trade relationships and regulatory requirements.

Comparative Analysis of Potash Trade Impact

| Stakeholder | Short-term Impact | Long-term Impact | Mitigation Strategies |

|---|---|---|---|

| Canadian Potash Producers | -15% to -25% revenue | Potential loss of US market share | Diversify export markets, lobby for exemptions |

| US Farmers | +20% to +30% fertilizer costs | Reduced crop yields, shifts in crop selection | Optimize fertilizer use, explore alternatives |

| US Government | Increased tariff revenue | Potential agricultural sector instability | Consider targeted exemptions, support domestic production |

| Global Competitors (Russia, China) | +5% to +10% market share gain | Increased influence in global potash market | Expand production capacity, improve trade relations |

| Consumers | Minimal immediate impact | Potential increase in food prices | N/A |

Potential Resolutions and Future Outlook

As the potash trade war continues to unfold, several potential resolutions are being discussed:

- Targeted exemptions for agricultural products from the tariff policy

- Negotiated quotas for Canadian potash exports to the US

- Development of a North American fertilizer strategy to ensure supply security

- Increased investment in domestic US potash production to reduce import dependence

The ultimate resolution will likely depend on a combination of economic pressures, political negotiations, and industry adaptations.

Looking ahead, the global potash market is expected to remain volatile in the short to medium term. However, the long-term outlook for potash demand remains strong, driven by global population growth and the need for increased agricultural productivity.

Conclusion

The potash trade war between Canada and the United States serves as a stark reminder of the interconnectedness of global agriculture and the far-reaching impacts of trade policies. As this situation continues to evolve, it will be crucial for all stakeholders – from farmers and industry leaders to policymakers and consumers – to stay informed and adaptable.

While challenges abound, this period of disruption also presents opportunities for innovation and optimization in the agricultural sector. Technologies like those offered by Farmonaut can play a crucial role in helping farmers navigate these uncertain times, ensuring continued productivity and sustainability in the face of changing market dynamics.

As we move forward, it’s clear that collaborative solutions and data-driven decision-making will be key to resolving this trade dispute and building a more resilient global agricultural system. The outcome of this potash trade war will undoubtedly shape the future of farming practices, international trade relationships, and food security for years to come.

FAQ Section

- What is potash and why is it important for agriculture?

Potash is a potassium-rich salt used primarily in fertilizers. It’s crucial for improving crop yields, enhancing water retention, and strengthening plant roots. - How much of the US potash supply comes from Canada?

Approximately 85% of the potash used by American farmers is sourced from Canada, primarily from Saskatchewan. - What are the potential impacts of US tariffs on Canadian potash?

The tariffs could lead to increased fertilizer costs for US farmers, potential supply issues, and shifts in global potash market dynamics. - How might American farmers be affected by this trade dispute?

American farmers could face higher input costs, potentially leading to reduced crop yields or shifts in crop selection. This could ultimately affect food prices and availability. - What alternative sources of potash are available to US farmers?

While Russia and Belarus are significant global producers, there are concerns about their environmental and trade practices. Domestic US production is limited but could potentially expand.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

Access Farmonaut’s advanced farm management solutions:

For developers interested in integrating Farmonaut’s satellite and weather data into their own systems, check out our API and API Developer Docs.