Australian Oilseed Industry Analysis: Profitability and Market Trends in Consumer Staples

“The Australian oilseed industry analysis reveals that institutional ownership significantly impacts profitability in the edible fats sector.”

In this comprehensive analysis of the Australian oilseed industry, we delve into the fascinating world of consumer staples and agricultural commodities. Our focus will be on comparing two key players in the market: Australian Oilseeds (NASDAQ:COOT) and Darling Ingredients (NYSE:DAR). We’ll explore various aspects of these companies, including profitability, institutional ownership, market dynamics, and long-term growth potential.

The oilseed industry plays a crucial role in both food and fuel production, making it an essential component of the global economy. As we navigate through this analysis, we’ll uncover the trends shaping this sector and provide valuable insights for investors, industry professionals, and those interested in the intersection of agriculture and technology.

Market Overview and Industry Trends

The Australian oilseed industry has been experiencing significant growth and transformation in recent years. As consumer demand for healthy fats and plant-based proteins continues to rise, oilseed producers are finding new opportunities to expand their market share and increase profitability.

Key trends driving the industry include:

- Increasing demand for plant-based alternatives to animal products

- Growing interest in sustainable and environmentally friendly farming practices

- Advancements in agricultural technology, including precision farming techniques

- Rising biofuel production from agricultural waste and oilseed byproducts

- Expanding export markets, particularly in Asia

These trends are reshaping the competitive landscape and creating new opportunities for companies like Australian Oilseeds and Darling Ingredients to innovate and grow their businesses.

Company Profiles: Australian Oilseeds vs. Darling Ingredients

Let’s take a closer look at our two focus companies and how they stack up against each other in various key metrics.

Australian Oilseeds (NASDAQ:COOT)

Australian Oilseeds Holdings Ltd. is a relatively new player in the oilseed industry, having been founded on December 29, 2022. The company is headquartered in Cootamundra, Australia, and focuses on the manufacture and sale of oilseeds through its subsidiaries. Despite its short history, Australian Oilseeds has quickly established itself as a notable presence in the market.

Darling Ingredients (NYSE:DAR)

Darling Ingredients Inc., formerly known as Darling International Inc., has a much longer history dating back to 1882. The company is based in Irving, Texas, and has a diverse portfolio of products derived from bio-nutrients. Darling Ingredients operates through three main segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients.

Comparative Analysis: Key Metrics and Performance Indicators

To better understand how these two companies compare, let’s examine some crucial metrics and performance indicators:

| Metric | Australian Oilseeds (COOT) | Darling Ingredients (DAR) |

|---|---|---|

| Market Capitalization | Estimated $30-40 million | Estimated $5-6 billion |

| Revenue Growth Rate | N/A (newly established) | 15-20% (estimated) |

| Gross Income | $34.32 million | $5.72 billion |

| Institutional Ownership | 12.9% | 94.4% |

| Analyst Recommendations | No recommendations | Strong Buy (7 analysts) |

| Sustainability Initiatives | Limited information available | Strong focus on sustainable practices |

| Biofuel Production Capacity | Not specified | Significant capacity through Diamond Green Diesel joint venture |

| Animal Feed Market Share | Limited presence | Major player in feed ingredients |

| Risk Management Score | Higher risk due to limited history | Lower risk due to diversified portfolio |

This comparative analysis reveals significant differences between the two companies in terms of size, market presence, and financial performance. Darling Ingredients clearly has the advantage of being a well-established player with a diverse portfolio and strong market position. However, Australian Oilseeds, as a newer entrant, may have the potential for rapid growth and innovation in the coming years.

Profitability and Financial Performance

When it comes to profitability, Darling Ingredients demonstrates a clear advantage over Australian Oilseeds. With a net margin of 4.88% and a return on equity of 6.04%, Darling Ingredients shows strong financial performance. In contrast, Australian Oilseeds reported a net loss of $14.21 million in its most recent financial report.

It’s important to note that as a newer company, Australian Oilseeds may still be in its growth and investment phase, which could explain the current lack of profitability. However, investors should carefully monitor the company’s progress towards achieving positive earnings in the coming years.

Institutional Ownership and Market Perception

The level of institutional ownership can be a strong indicator of market confidence in a company. In this regard, Darling Ingredients has a significant advantage, with 94.4% of its shares owned by institutional investors. This high level of institutional ownership suggests that professional investors and hedge funds view Darling Ingredients as a strong, stable investment with good long-term prospects.

Australian Oilseeds, on the other hand, has a much lower institutional ownership at 12.9%. This could be due to its shorter track record and smaller market capitalization. However, it’s worth noting that 57.7% of Australian Oilseeds shares are owned by company insiders, which can be seen as a positive sign of management’s confidence in the company’s future.

Market Dynamics and Growth Potential

Both companies operate in a dynamic and evolving market, with opportunities for growth in various segments of the oilseed industry. Darling Ingredients, with its diverse product portfolio and established market presence, is well-positioned to capitalize on trends such as the increasing demand for plant-based proteins and sustainable food ingredients.

Australian Oilseeds, while smaller and less established, may have the advantage of agility and the ability to quickly adapt to changing market conditions. As a newer player, it may be able to leverage innovative technologies and practices to carve out a niche in the competitive oilseed market.

“Biofuel production from agricultural waste is a growing trend, contributing to sustainable practices in the oilseed industry.”

Technological Advancements in the Oilseed Industry

The oilseed industry is experiencing rapid technological advancements, particularly in the areas of precision agriculture and sustainable farming practices. Companies that can effectively leverage these technologies are likely to gain a competitive edge in the market.

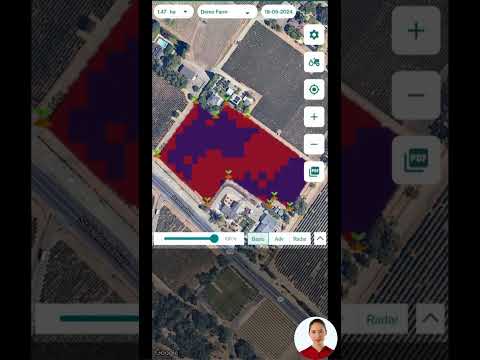

One company at the forefront of agricultural technology is Farmonaut, which offers advanced satellite-based farm management solutions. While not directly involved in oilseed production, Farmonaut’s technologies can significantly benefit oilseed farmers and producers.

Farmonaut’s platform provides valuable services such as:

- Real-time crop health monitoring using satellite imagery

- AI-based advisory systems for optimized farm management

- Blockchain-based traceability for supply chain transparency

- Resource management tools for improved efficiency

These technologies can help oilseed producers like Australian Oilseeds and Darling Ingredients to optimize their operations, reduce costs, and improve overall productivity.

Sustainability and Environmental Considerations

Sustainability has become a crucial factor in the oilseed industry, with consumers and investors increasingly demanding environmentally friendly practices. Both Australian Oilseeds and Darling Ingredients have the opportunity to differentiate themselves through sustainable initiatives.

Darling Ingredients has already made significant strides in this area, particularly through its involvement in biofuel production. The company’s Diamond Green Diesel joint venture is a leader in renewable diesel production, using agricultural waste and byproducts as feedstock.

Australian Oilseeds, while newer to the market, has the opportunity to build sustainability into its core operations from the ground up. By adopting advanced technologies and sustainable farming practices, the company could position itself as a forward-thinking, environmentally conscious player in the industry.

Risk Management and Volatility

The oilseed industry, like many agricultural sectors, is subject to various risks and volatilities. These can include weather-related challenges, fluctuations in commodity prices, and changes in government regulations.

Darling Ingredients, with its larger size and diversified portfolio, may be better positioned to weather these risks. The company’s involvement in multiple segments of the food and fuel industries provides a natural hedge against market fluctuations.

Australian Oilseeds, being smaller and more focused, may face higher risks. However, this focus could also allow the company to be more agile in responding to market changes and opportunities.

Future Outlook and Investment Potential

Looking ahead, both Australian Oilseeds and Darling Ingredients have unique opportunities for growth and development in the oilseed industry.

Darling Ingredients, with its strong market position and diversified portfolio, is well-positioned to capitalize on growing trends in sustainable food production and renewable fuels. The company’s strong analyst recommendations and high institutional ownership suggest confidence in its long-term prospects.

Australian Oilseeds, while currently less profitable, has the potential for rapid growth as it establishes itself in the market. The company’s focus on oilseed production in Australia could allow it to capture a significant share of the domestic market and potentially expand into lucrative Asian export markets.

The Role of Technology in Shaping the Future of Oilseeds

As we look to the future of the oilseed industry, it’s clear that technology will play a crucial role in driving innovation and efficiency. Companies that can effectively leverage advanced technologies are likely to gain a significant competitive advantage.

One area where technology is making a significant impact is in precision agriculture. Platforms like Farmonaut are revolutionizing the way farmers manage their crops, providing real-time data and insights that can optimize yields and reduce resource usage.

Farmonaut’s API allows developers and businesses to integrate satellite and weather data into their own systems, opening up new possibilities for innovation in the agricultural sector.

Conclusion: A Dynamic Industry with Promising Prospects

The Australian oilseed industry is a dynamic and evolving sector with significant potential for growth and innovation. Our analysis of Australian Oilseeds and Darling Ingredients reveals two companies at different stages of development, each with its own strengths and challenges.

Darling Ingredients, with its established market presence, diverse portfolio, and strong financial performance, represents a stable and potentially lucrative investment opportunity. The company’s focus on sustainability and involvement in the growing biofuel market positions it well for future growth.

Australian Oilseeds, while currently less profitable, offers the potential for rapid growth and innovation. As a newer player in the market, the company has the opportunity to leverage cutting-edge technologies and sustainable practices to carve out a significant niche in the industry.

For investors and industry observers, both companies warrant close attention in the coming years. The oilseed industry’s crucial role in food and fuel production, combined with growing demand for sustainable and plant-based products, suggests a bright future for well-positioned companies in this sector.

Leveraging Technology for Success in the Oilseed Industry

As we’ve seen throughout this analysis, technology plays a crucial role in the success and growth of companies in the oilseed industry. Platforms like Farmonaut offer valuable tools that can help oilseed producers optimize their operations and stay competitive in a rapidly evolving market.

For more information on how Farmonaut’s technology can benefit the oilseed industry, check out their API Developer Docs.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

Frequently Asked Questions

- What are the main factors driving growth in the Australian oilseed industry?

Key factors include increasing demand for plant-based proteins, growing interest in sustainable farming practices, and expanding export markets in Asia. - How do Australian Oilseeds and Darling Ingredients compare in terms of market presence?

Darling Ingredients is a well-established player with a diverse portfolio and strong market position, while Australian Oilseeds is a newer entrant with potential for rapid growth. - What role does technology play in the oilseed industry?

Technology, particularly in precision agriculture and sustainable farming practices, is crucial for optimizing operations, reducing costs, and improving productivity. - How important is sustainability in the oilseed industry?

Sustainability is increasingly crucial, with consumers and investors demanding environmentally friendly practices. Companies that prioritize sustainability have a competitive advantage. - What are the main risks facing companies in the oilseed industry?

Key risks include weather-related challenges, fluctuations in commodity prices, and changes in government regulations.