Chicago Soybean Futures Surge: 5 Key Trade Dynamics in 2024

“Chicago soybean futures climbed over 8% in early 2024, driven by renewed U.S.-China trade optimism.”

Overview: Chicago Soybean Futures Surge in 2024

In 2024, the Chicago soybean futures market has staged an impressive rally, capturing the attention of global agricultural stakeholders and investors alike. For the fourth consecutive session, Chicago Board of Trade (CBOT) soybeans continued upward, buoyed by renewed optimism over U.S.-China trade relations and anticipation of easing tariffs. Notably, as of April, the most-active soybean contract climbed to $10.52 per bushel at 0157 GMT—edging close to the prior day’s intraday peak of $10.57-1/2, the highest since late February.

We observed this surge amid increased buying activity in the wake of de-escalating trade rhetoric between Washington and Beijing. This positive shift quickly reverberated across the commodity space, affecting not just soybeans but also wheat and corn futures. The CBOT wheat contract has dipped on improved weather for the U.S. winter wheat crop, while corn showed relative stability after a dollar-driven dip. These movements highlight complex, global supply and demand dynamics, further shaped by regional weather in the Black Sea cropping regions and a weather-improved, yet delayed, Argentina soybean harvest.

In this blog, we present a comprehensive overview of the 5 key trade dynamics fueling the Chicago soybean futures surge, analyze interlinked markets, and explore how platforms like Farmonaut empower stakeholders to make data-driven decisions in a volatile marketplace.

5 Key Trade Dynamics Driving Chicago Soybean Futures

- U.S.-China Trade Prospects: Fluctuating tariffs and trade war rhetoric between Washington and Beijing persist as critical drivers for CBOT soybean prices. Improvements in diplomatic relations have sparked hope for a revival in US soy exports to China, directly impacting futures prices. When trade optimism surges, so do contracts and prices.

- Impact of Tariffs on Soybeans: The imposition and potential repeal of tariffs play a substantial role. China, the world’s largest soybean importer, had implemented counter-tariffs in retaliation to U.S. actions, making American soy costly and less competitive. Policy shifts, such as Treasury Secretary Bessent stating the unsustainability of high tariffs, can instantly influence the futures market.

- Global Supply and Weather in Cropping Regions: Weather disruptions—from droughts in Argentina (delaying the harvest) to rains boosting Black Sea cropping regions and U.S. winter wheat—impact yields and productivity, influencing grain and oilseed prices worldwide.

- Currency Fluctuations and Macroeconomic Conditions: Shifts in the U.S. dollar index affect global commodity competitiveness. A stronger dollar places downward pressure on U.S. exports; a decline improves prospects for soybeans, wheat, and corn.

- Speculator and Market Sentiment: Investor reactions to headlines, fundamentals reports, and crop progress estimates can drive high volatility in short-term futures prices, as seen in the quick response to trade de-escalation narratives in April.

We have also seen technology-driven insights from agritech leaders like Farmonaut revolutionizing how we analyze these factors. Their carbon footprinting tool, for example, provides near real-time data on emissions—a key concern for global supply chains striving for sustainability.

CBOT Soybean Prices and Comparative Futures Market Table

To contextualize the current surge in CBOT soybean prices and the interrelated movement of wheat and corn, we constructed the following comparative table. This resource enables readers to instantly visualize estimated 2024 futures prices, quarterly changes, major trade partner impact, and market drivers:

| Commodity | Estimated Avg Futures Price (2024, $/bushel) | Quarterly Price Change (%) | Major Trade Partner Impact | Key Market Driver |

|---|---|---|---|---|

| Soybeans | $10.52 | +8% | U.S.-China | Trade Policy / Tariffs |

| Wheat | $5.41 | +4% | Black Sea, U.S. | Weather / Supply |

| Corn | $4.80 | +4% | U.S., Argentina, China | Currency / Demand |

U.S.-China Trade Prospects and Impact on Global Soybean Markets

The drama between Washington and Beijing remains the single most potent factor in shaping soybean futures. The imposition of tariffs and their subsequent adjustment—or even the expectation of adjustment—can cause pricing whiplash across markets. Most recently, statements by U.S. President Trump and Treasury Secretary Scott Bessent, suggesting openness to de-escalation, sent a wave of optimism through financial and agricultural markets.

China is the world’s largest soybean importer, responsible for two-thirds of global imports. When China placed counter tariffs on U.S. soy in retaliation for American duties on steel and other products, US soy exports to China dried up practically overnight, decimating demand for U.S. grain. This created surpluses, drove price declines, and forced farmers to seek markets elsewhere.

Now, as trade negotiations show signs of thawing and tariff volatility cools, we expect to see a rebound in US soy exports to China. The swift response of speculators and commercial buyers was evident in increased open interest and rising futures prices through each positive government announcement.

- Immediate Impact: Announcements from key policymakers can move the needle on prices within a single session, as market participants react instantly to shifting expectations.

- Lasting Influence: Sustainable trade reopening could reset the mid-term outlook for the entire U.S. grain belt, including soybeans, corn, and wheat.

The world’s agricultural supply chains are highly sensitive to such diplomatic maneuvers. Real-time market analytics—supported by platforms like Farmonaut—are now essential in providing stakeholders with early warning signals and data to support hedging, logistics, and resource allocation.

For those managing large operations, Farmonaut’s fleet management tools help agribusinesses track agricultural machinery and optimize vehicle usage—cutting operational costs amidst volatile trade environments.

“Wheat and corn futures on CBOT saw a 4% average increase alongside soybeans amid shifting global commodity market trends.”

Macroeconomic Movers: Dollar, Policy, and Global Commodity Markets

As we evaluate the broader commodity market outlook, it’s imperative to consider macroeconomic drivers such as currency strength, policy shifts, and speculative flows.

- U.S. Dollar Index: When the U.S. dollar strengthens, it generally exerts downward pressure on CBOT prices by making American commodities pricier for international buyers. During April, the dollar dipped after a streak of gains, making U.S. exports like soybeans and corn more attractive and supporting positive price action.

- Federal Reserve Policy: The Federal Reserve’s rate decisions and leadership changes can spark rapid capital shifts in both directions. Traders track these moves closely, as policy signals influence everything from export competitiveness to the willingness of investors to hold agricultural contracts.

- Stock Market Fluctuations: Global stocks often move in tandem with risk sentiment. When stocks drift or turn volatile—as seen in late April—capital can rotate into “real assets” like commodities, offering hedges against inflation or macroeconomic uncertainty.

CBOT soybean futures benefit from this interconnectivity. Market participants now rely on digital tools and advanced analytics more than ever, leveraging data from platforms like Farmonaut, which integrates real-time weather and crop health insights.

Argentina Soybean Harvest, Black Sea Cropping Regions, and Weather Outlook

Beyond trade and policy, crop yields are critically affected by regional weather in the world’s most important agricultural zones—namely, the American Midwest, Argentina, and the Black Sea cropping regions.

Argentina Soybean Harvest in 2024

According to the Buenos Aires grains exchange, drier conditions in Argentina’s biggest farm regions have accelerated the previously delayed 2024/25 soybean harvest. Timely harvest progression is critical since Argentina is among the world’s top soybean exporters. A positive harvest outcome in Argentina often leads to competitive pricing pressure on the CBOT.

Black Sea Cropping Regions and Wheat Supply

Commodity Weather Group updates show showers benefiting winter wheat in U.S. Plains as well as promising moisture in the Black Sea area. A favorable weather report can boost the global supply outlook for wheat, explaining April’s slip in wheat futures prices even as beans surged.

- Interconnection: Good rainfall in both the U.S. and Black Sea regions expands available wheat supply, moderating prices and improving grain inventories—affecting the broader matrix of trade.

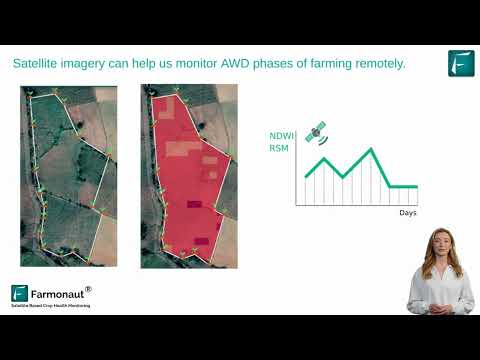

Farmonaut: The Power of Satellite-Driven Crop Monitoring & Weather Advisory

With weather volatility at an all-time high, actionable insights are crucial. Farmonaut’s solutions—like satellite-based crop health monitoring—help farmers and agribusinesses tap into real-time NDVI, soil moisture, and AI-powered advisory for informed decision making, reduced input costs, and yield maximization.

Additionally, Farmonaut’s blockchain-based traceability ensures transparent, secure tracking of the agricultural products from field to market, building trust within global supply chains and helping mitigate risks during unpredictable weather cycles.

Wheat and Corn Futures: Interconnected Commodities on CBOT

Soybean, wheat, and corn futures tend to move in step, reflecting their role as core staples in global food production and livestock feed. While the main spotlight is often on the soybean contracts, wheat and corn futures have experienced similar, if not slightly more restrained, upward momentum.

- Wheat: The CBOT wheat contract fell 0.3% to $5.41-3/4 a bushel in late April, owing to improved supply outlook in the U.S. Plains and Black Sea. Improved rainfall and positive crop conditions help cap price spikes.

- Corn: The corn contract has risen 0.2% to $4.80 per bushel after previously weakening as a stronger U.S. dollar trimmed demand. However, the rebound in US soy exports to China and weather improvements in the Americas now support corn alongside beans and wheat.

The move of these commodities is monitored closely using advanced analytics. Modern platforms—like Farmonaut, with subscription-based access for both mobile and web apps—provide operators across the value chain with a competitive edge as prices fluctuate and global competition intensifies.

Grain Supply Fundamentals and 2024 Commodity Market Outlook

The grain supply fundamentals shaping 2024 commodity markets reflect a delicate balance among weather, policy, and shifting global trade patterns. Let’s break down the forces at play:

- Weather and Yield: Improvements in the U.S. winter wheat forecast due to rainfall, coupled with drier weather aiding the Argentina soybean harvest, improve the projected global supply and moderate volatility.

- Regional Competition: As Black Sea cropping regions and South American producers improve their output, the competitive landscape for CBOT grains intensifies.

- Speculation and Stock Watch: Funds and commodity traders respond swiftly to report releases and crop progress—resulting in rapid swings, especially during volatile trade rhetoric in April.

Data-centric agriculture has become a necessity rather than a luxury in this climate. Farmonaut’s advanced large-scale farm management solutions provide flexible, satellite-powered insights for both individual and corporate farms, ensuring rapid response to supply chain disruptions or price shifts.

Farmonaut’s Role in the Future of Precision Agriculture

Farmonaut stands at the intersection of traditional agriculture and next-generation technology, empowering users with actionable data that influences farm-level decisions and macroeconomic strategies alike. Let’s clarify how Farmonaut addresses agricultural and market challenges:

Key Technologies Empowering Stakeholders

- Satellite-Based Crop Health Monitoring: Multispectral imagery provides real-time views (NDVI, soil moisture, etc.), supporting irrigation, fertilization, and pest management for optimal yields.

- Jeevn AI Advisory System: Automated crop management advice, weather forecasts, and strategic recommendations at field level, powered by AI.

- Blockchain for Traceability: Ensures every stage of the supply chain is transparent and verifiable—crucial in export markets and for compliance.

- Fleet and Resource Management: Tracks and predicts logistics for large-scale farms and agribusinesses, reducing costs and inefficiency.

- Carbon Footprint Analysis: Delivers real-time emission data, supporting sustainability efforts and helping brands meet regulatory demands.

Serving Diverse Stakeholders in the Agricultural Value Chain

- Individual Farmers: Access precise, real-time data via user-friendly mobile and web apps, enabling cost-effective crop monitoring and improved yields.

- Agribusinesses: Streamline plantation management, optimize fleets, and monitor vast areas with ease.

- Government Agencies & NGOs: Support large-scale monitoring, yield estimation, and program implementation for sustainable agriculture.

- Financial Institutions: Offer crop loan and insurance verification with satellite-based evidence, minimizing fraud and improving loan access. Learn more about Farmonaut’s crop loan & insurance solutions.

- Corporate Supply Chains: Enhance authenticity and consumer trust with blockchain-led product traceability.

Farmonaut’s Value Proposition

- Cost-Effectiveness: Subscription models start low and flex as operations scale, democratizing digital agriculture.

- Increased Productivity: Enables tailored management for every hectare, boosting yields and reducing resource waste.

- Sustainability: Reduces environmental impact with carbon footprint analytics and efficient input usage.

- Transparency & Trust: Verifiable, tamper-resistant data for every stage of agriculture and food processing.

- Access & Scalability: From field-level monitoring for smallholders to integrated management for vast agro-enterprises.

Farmonaut Subscription Plans

Want to empower your farm or agribusiness with the latest satellite, AI, and blockchain-powered insights? Discover flexible, affordable Farmonaut subscription tiers below. (For detailed developer API access, also see Farmonaut API and Developer Documentation.)

Frequently Asked Questions

The main reason for the surge is renewed optimism over U.S.-China trade relations and potential tariff reductions, which have reignited demand for U.S. soybeans. Additional support comes from improved crop prospects in South America and fluctuating currency and macroeconomic conditions.

Q2: What are the estimated average CBOT futures prices for soybeans, wheat, and corn in 2024?

Based on current market activity, the estimated 2024 average CBOT futures prices are $10.52 for soybeans, $5.41 for wheat, and $4.80 for corn per bushel.

Q3: How do macro factors like the U.S. dollar and Federal Reserve policies affect agri commodity prices?

A stronger U.S. dollar makes U.S. exports less competitive, typically pressuring futures prices. Federal Reserve interest rate moves can influence market liquidity and investment flows, impacting prices of grains and oilseeds.

Q4: What benefits does Farmonaut bring to modern agriculture?

Farmonaut offers real-time satellite monitoring, AI-driven management, blockchain-based traceability, and resource optimization—driving higher productivity, cost savings, and sustainability in agriculture.

Q5: How can farmers and agribusinesses get started with Farmonaut?

Users can join via web or mobile app or contact the team for enterprise and API integration. Flexible subscription models cater to all farm sizes.

Q6: Where can I find detailed Farmonaut product offerings?

See Carbon Footprinting, Traceability, Fleet Management, Crop Loan and Insurance, and Large Scale Farm Management.

Conclusion: Navigating 2024’s Grain and Oilseed Markets

The surge in chicago soybean futures in 2024 underscores the critical, intertwined roles of trade policy, weather, and technology in shaping the global grain supply fundamentals. As macroeconomic signals shift—driven by U.S.-China negotiations, policy rhetoric, and ongoing weather variability in the Americas and Black Sea—stakeholders face both fresh opportunities and hidden risks.

We believe that success in this rapidly changing environment depends on early access to reliable data and actionable analytics. Farmonaut’s suite of tailored, satellite- and AI-powered solutions empowers everyone in the agri value chain—from small farms to large agribusinesses—to plan, adapt, and thrive.

Navigate the future of precision agriculture by leveraging advanced, technology-driven insights. To experience the benefits of transformative agri-tech and position your operation ahead of the curve, get started with Farmonaut’s app today.

Disclaimer: This article provides factual market analysis based on available, referenced data and current events. Please consult your financial advisor before making investment or trade decisions. Farmonaut is an agricultural technology company providing digital solutions, not a marketplace, manufacturer, seller, or regulatory authority.