Unlocking Agricultural Growth: How Priority Sector Lending and Agri-Tech Solutions Empower Indian Farmers

In the heart of India’s rural landscape, a revolution is underway. The convergence of priority sector lending, agricultural credit, and cutting-edge agri-tech solutions is transforming the face of farming in our nation. As we delve into this exciting realm, we’ll explore how these forces are working together to empower Indian farmers, drive sustainable growth, and reshape the future of agriculture.

“RBI mandates 18% of Adjusted Net Bank Credit for agriculture, promoting rural development and sustainable farming practices.”

The Power of Priority Sector Lending in Agriculture

Priority sector lending has emerged as a cornerstone of India’s strategy to boost agricultural growth and foster rural development. This innovative approach to rural development finance is not just a policy directive; it’s a lifeline for millions of farmers across the country. Let’s unpack the essence of priority sector lending and its profound impact on Indian agriculture.

Understanding Priority Sector Lending

Priority sector lending is a visionary initiative by the Reserve Bank of India (RBI) that mandates banks to allocate a significant portion of their credit to sectors deemed crucial for the nation’s economic development. Agriculture, being the backbone of our economy, stands at the forefront of these priority sectors.

- RBI Targets: The RBI has set specific targets for banks to ensure adequate credit flow to priority sectors. For agriculture, the target is set at 18% of Adjusted Net Bank Credit (ANBC).

- Classification: The priority sector includes agriculture, micro, small and medium enterprises (MSMEs), export credit, education, housing, social infrastructure, and renewable energy.

- Focus on Small and Marginal Farmers: A significant portion of agricultural credit is earmarked for small and marginal farmers, ensuring that the benefits reach those who need it most.

The Impact of Agricultural Credit on Rural Development

Agricultural credit serves as a catalyst for rural development, triggering a chain reaction of positive outcomes:

- Increased Farm Productivity: Access to credit enables farmers to invest in better seeds, fertilizers, and machinery, leading to higher crop yields.

- Modernization of Agriculture: Loans facilitate the adoption of modern farming techniques and technologies, propelling Indian agriculture into the 21st century.

- Risk Mitigation: Credit helps farmers manage risks associated with crop failure, market fluctuations, and natural calamities.

- Rural Employment Generation: As agricultural activities expand, they create more job opportunities in rural areas, stemming migration to urban centers.

As we witness the transformative power of priority sector lending, it’s crucial to recognize the role of technology in amplifying its impact. This is where innovative companies like Farmonaut come into play, bridging the gap between traditional farming practices and modern agri-tech solutions.

Agri-Tech Solutions: The Game Changer in Indian Agriculture

The agricultural landscape in India is undergoing a dramatic transformation, thanks to the infusion of cutting-edge technology. Agri-tech solutions are revolutionizing every aspect of farming, from crop planning to harvest management. Let’s explore how these innovations are reshaping the future of Indian agriculture.

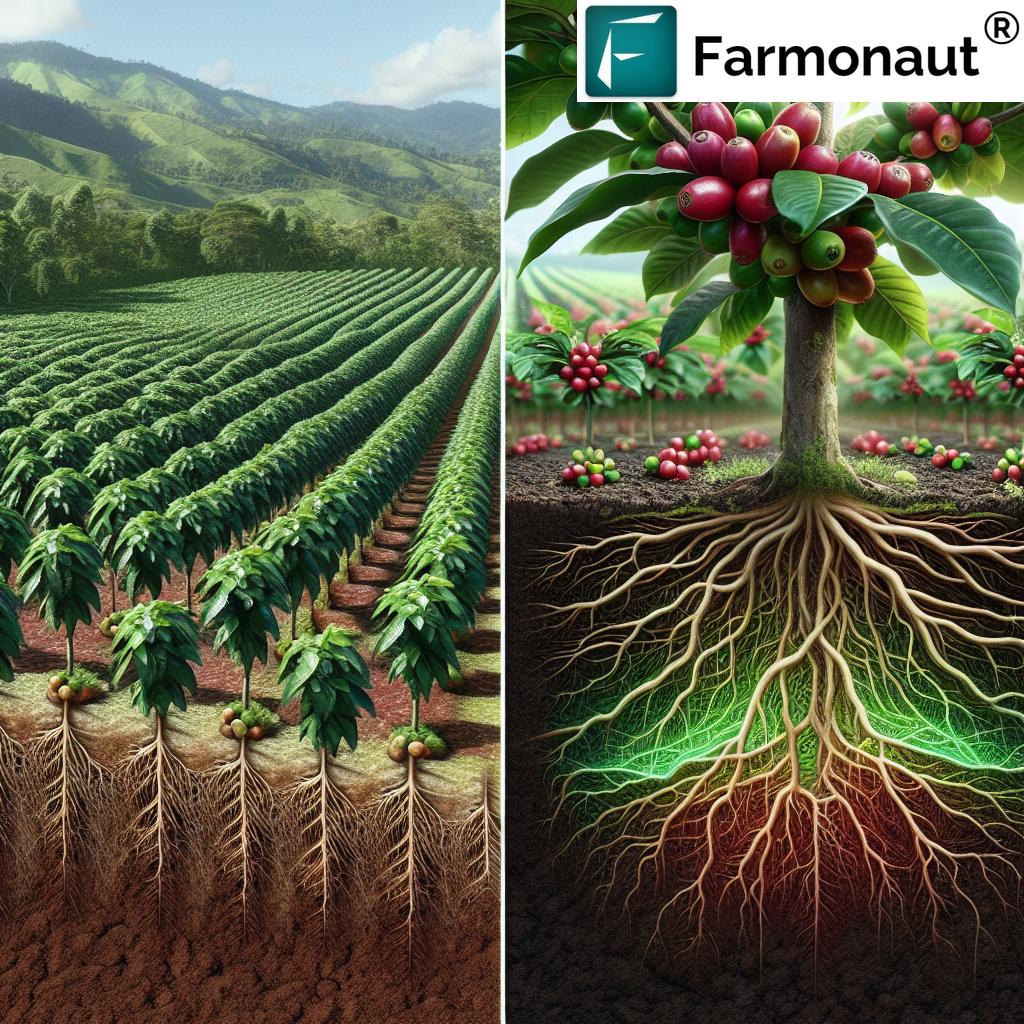

Precision Agriculture: Farming with Pinpoint Accuracy

Precision agriculture technology is at the forefront of this agricultural revolution. By leveraging data-driven insights, farmers can make informed decisions that optimize resource use and maximize yields.

- Satellite-Based Crop Monitoring: Advanced platforms like Farmonaut utilize satellite imagery to provide real-time insights into crop health, enabling farmers to address issues promptly.

- AI-Powered Advisory Systems: Artificial Intelligence analyzes vast amounts of data to provide personalized recommendations for crop management, pest control, and irrigation.

- IoT Sensors: Internet of Things (IoT) devices deployed across fields collect crucial data on soil moisture, temperature, and nutrient levels, facilitating precise resource allocation.

“Precision agriculture technologies have increased crop yields by up to 30% while reducing water usage by 20-50%.”

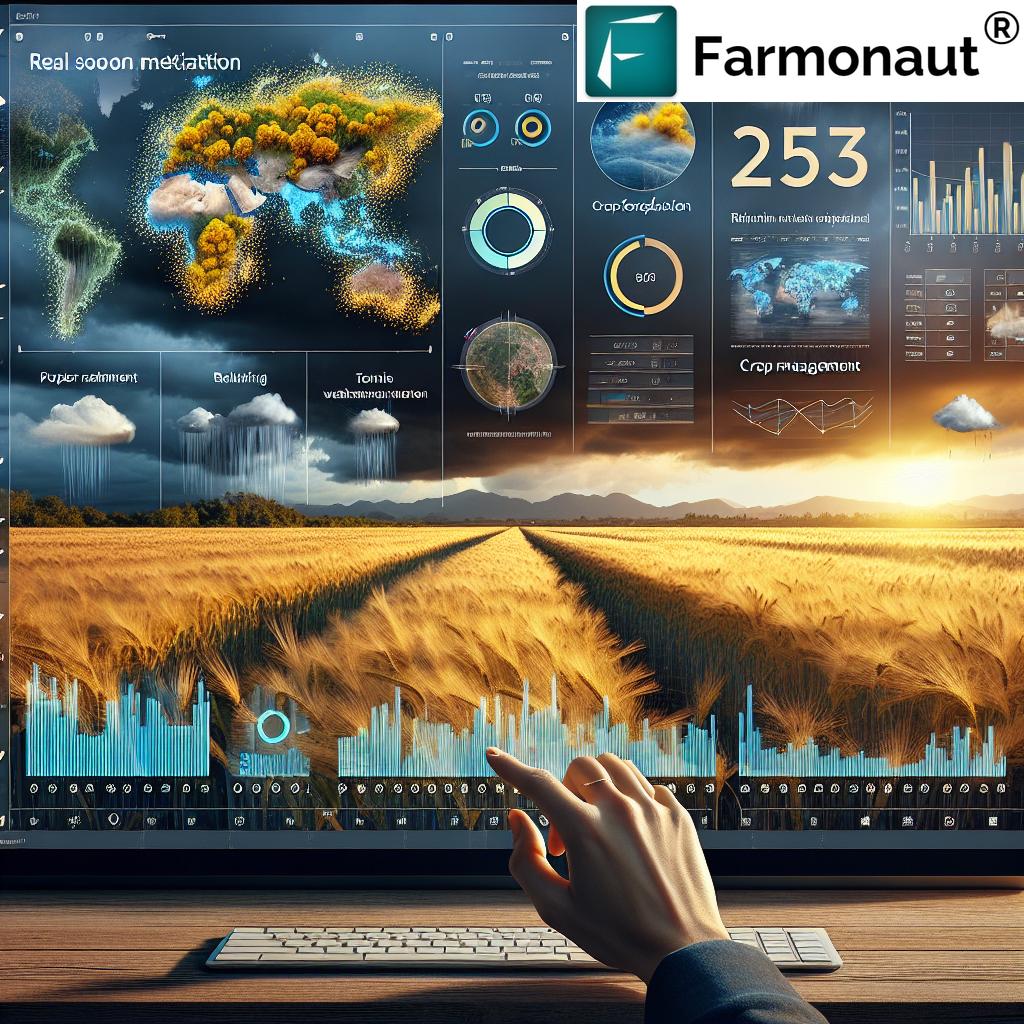

Digital Agriculture: Empowering Farmers with Information

Digital agriculture is democratizing access to critical information and services, empowering farmers to make better decisions and improve their livelihoods.

- Mobile Apps: Smartphone applications provide farmers with instant access to market prices, weather forecasts, and expert advice.

- E-Commerce Platforms: Digital marketplaces connect farmers directly with buyers, eliminating intermediaries and ensuring better prices for produce.

- Blockchain for Traceability: Blockchain technology ensures transparency in the supply chain, building trust between producers and consumers.

Sustainable Farming Practices: Technology for a Greener Future

Agri-tech solutions are not just about increasing productivity; they’re also paving the way for more sustainable and environmentally friendly farming practices.

- Precision Irrigation: Smart irrigation systems optimize water usage, reducing waste and conserving this precious resource.

- Integrated Pest Management: AI-driven systems help farmers implement targeted pest control measures, minimizing the use of harmful chemicals.

- Carbon Footprint Tracking: Advanced tools allow farmers to monitor and reduce their carbon emissions, contributing to global climate goals.

As we embrace these technological advancements, it’s important to remember that their true potential can only be realized when coupled with supportive financial mechanisms. This is where the synergy between priority sector lending and agri-tech solutions becomes evident.

The Synergy of Finance and Technology in Agriculture

The convergence of priority sector lending and agri-tech solutions is creating a powerful ecosystem that’s propelling Indian agriculture towards a brighter future. Let’s explore how this synergy is manifesting and its implications for farmers across the country.

Financing Technological Adoption

Priority sector lending is playing a crucial role in accelerating the adoption of agri-tech solutions among Indian farmers:

- Tech-Specific Loans: Banks are offering specialized loans for the purchase of precision farming equipment, IoT devices, and other agri-tech tools.

- Subsidized Interest Rates: Many financial institutions provide loans at reduced interest rates for farmers investing in sustainable and tech-driven farming practices.

- Capacity Building Programs: Credit institutions are partnering with agri-tech companies to offer training programs, ensuring farmers can effectively utilize the technologies they invest in.

Risk Mitigation through Technology

The integration of technology is helping financial institutions better assess and mitigate risks associated with agricultural lending:

- Satellite-Based Crop Monitoring: Banks can use platforms like Farmonaut to verify crop conditions, reducing the risk of fraudulent loan applications.

- Weather-Based Insurance: Advanced weather forecasting technologies are enabling the development of more accurate and fair crop insurance products.

- Digital Credit Scoring: AI algorithms analyze various data points to create more comprehensive credit profiles for farmers, facilitating faster loan approvals.

Promoting Financial Inclusion in Farming

The combination of priority sector lending and agri-tech is breaking down barriers to financial inclusion in rural India:

- Mobile Banking Solutions: Digital platforms are making banking services accessible to farmers in remote areas.

- Blockchain-Based Microfinance: Innovative blockchain solutions are enabling peer-to-peer lending and crowdfunding for small-scale farmers.

- Data-Driven Financial Products: Fintech companies are leveraging agricultural data to create tailored financial products for different farmer segments.

As we delve deeper into this synergy, it’s clear that the impact extends far beyond individual farms. It’s reshaping entire rural communities and driving socio-economic development across India.

Empowering Rural Communities through Agricultural Finance and Technology

The ripple effects of the agricultural finance and technology revolution are being felt across rural India, catalyzing positive change in various spheres of rural life.

Boosting Rural Employment and Entrepreneurship

The influx of credit and technology into agriculture is creating diverse employment opportunities in rural areas:

- Agri-Tech Startups: Rural youth are launching innovative startups that cater to local agricultural needs.

- Skill Development: The demand for tech-savvy agricultural professionals is driving new training and education initiatives.

- Support Services: A whole ecosystem of support services is emerging, from equipment maintenance to data analysis.

Enhancing Social Infrastructure

Priority sector lending isn’t just about agriculture; it’s also driving improvements in rural social infrastructure:

- Education: Improved agricultural incomes are enabling families to invest more in their children’s education.

- Healthcare: Banks are extending credit for rural healthcare initiatives, improving access to medical services.

- Sanitation: Loans for sanitation projects are helping to improve public health in rural areas.

Promoting Women’s Empowerment and Child Welfare

The agricultural finance and technology revolution is playing a crucial role in advancing women’s rights and child welfare in rural India:

- Women-Focused Credit Programs: Many banks offer specialized loans and financial products designed for women farmers and entrepreneurs.

- Technology Training for Women: Initiatives are underway to train rural women in using agri-tech solutions, empowering them to take on leadership roles in farming.

- Child-Centric Rural Development: Improved agricultural incomes are enabling families to invest more in child nutrition, education, and healthcare.

The Role of Collaborative Efforts in Agricultural Growth

The transformation of Indian agriculture is not the work of any single entity. It’s the result of collaborative efforts between various stakeholders, each playing a crucial role in this ongoing revolution.

Partnerships between Banks and Rural Communities

Financial institutions are moving beyond traditional banking roles to become active partners in rural development:

- Agricultural Training Programs: Many banks are organizing training sessions to educate farmers about modern farming techniques and financial management.

- Rural Outreach Initiatives: Banks are setting up mobile banking units and organizing financial literacy camps in remote villages.

- Customized Financial Products: Through continuous engagement with rural communities, banks are developing financial products that cater to the unique needs of different agricultural segments.

Government Initiatives and Policy Support

The government plays a pivotal role in creating an enabling environment for agricultural growth:

- E-NAM (Electronic National Agriculture Market): This digital platform is integrating agricultural markets across the country, ensuring better prices for farmers.

- PM-KISAN Scheme: Direct income support to farmers is helping them invest in better farming practices and technologies.

- Digital India Land Records Modernization Programme: Digitization of land records is facilitating easier access to credit for farmers.

The Role of Agri-Tech Companies

Innovative companies like Farmonaut are at the forefront of the agri-tech revolution, bridging the gap between technology and agriculture:

- Satellite-Based Farm Management: Farmonaut’s advanced satellite imagery solutions provide farmers with real-time insights into crop health and soil conditions.

- AI-Driven Advisory Systems: Cutting-edge AI algorithms analyze various data points to provide personalized recommendations to farmers.

- Blockchain for Traceability: Farmonaut’s blockchain solutions ensure transparency and trust in agricultural supply chains.

As we continue to witness the transformative power of these collaborative efforts, it’s clear that the future of Indian agriculture is bright. However, challenges remain, and addressing them will be crucial for sustaining this growth trajectory.

Explore Farmonaut’s API Solutions

Challenges and Future Outlook

While the convergence of priority sector lending and agri-tech solutions has brought about significant positive changes, several challenges need to be addressed to ensure sustainable growth in Indian agriculture.

Bridging the Digital Divide

One of the primary challenges is ensuring that the benefits of agri-tech reach all farmers, including those in remote areas:

- Digital Literacy: There’s a need for more comprehensive digital literacy programs tailored for rural populations.

- Infrastructure Development: Improving internet connectivity and electricity supply in rural areas is crucial for the widespread adoption of digital agriculture solutions.

- Affordable Technologies: Developing cost-effective agri-tech solutions that are accessible to small and marginal farmers remains a priority.

Enhancing Credit Accessibility

While priority sector lending has improved credit flow to agriculture, some challenges persist:

- Reaching the Unbanked: There’s a need to extend banking services to the still unbanked rural population.

- Simplifying Loan Procedures: Streamlining the loan application and approval process can encourage more farmers to seek formal credit.

- Addressing Regional Disparities: Ensuring equitable distribution of agricultural credit across different regions of India remains a challenge.

Promoting Sustainable Practices

As we embrace technological advancements, ensuring environmental sustainability becomes increasingly important:

- Water Conservation: Developing and promoting water-efficient farming techniques is crucial, especially in water-stressed regions.

- Soil Health Management: Encouraging practices that maintain and improve soil health is essential for long-term agricultural productivity.

- Climate-Resilient Agriculture: Developing crop varieties and farming practices that can withstand changing climate patterns is a priority.

Future Outlook: A Tech-Driven, Sustainable Agricultural Ecosystem

Despite these challenges, the future of Indian agriculture looks promising. We envision a future where:

- Data-Driven Decision Making: Farmers leverage real-time data and AI-powered insights to make informed decisions about every aspect of farming.

- Seamless Integration of Finance and Technology: Financial products are deeply integrated with agri-tech solutions, providing holistic support to farmers.

- Sustainable and Resilient Farming: Advanced technologies enable farmers to adopt practices that are not only productive but also environmentally sustainable and resilient to climate change.

- Empowered Rural Communities: The agricultural revolution leads to overall rural development, creating prosperous and self-reliant rural economies.

As we look ahead, it’s clear that the synergy between priority sector lending and agri-tech solutions will continue to play a pivotal role in shaping the future of Indian agriculture. By addressing the challenges and building on the successes, we can create a robust, sustainable, and inclusive agricultural ecosystem that empowers farmers and drives national growth.

Access Farmonaut’s API Developer Docs

Conclusion: A New Era of Agricultural Prosperity

As we conclude our exploration of how priority sector lending and agri-tech solutions are empowering Indian farmers, it’s clear that we stand at the threshold of a new era in agriculture. The convergence of financial inclusion and technological innovation is not just transforming farming practices; it’s reshaping the entire rural landscape of India.

From the fields of Punjab to the plantations of Kerala, farmers across the nation are embracing a future where data-driven insights, precision technologies, and tailored financial products work in harmony to boost productivity, sustainability, and profitability. The ripple effects of this agricultural revolution are far-reaching, touching every aspect of rural life – from education and healthcare to women’s empowerment and child welfare.

As we move forward, the challenges are significant, but so are the opportunities. By continuing to foster collaboration between financial institutions, technology providers, government agencies, and most importantly, the farmers themselves, we can overcome these hurdles and realize the full potential of Indian agriculture.

The journey ahead is exciting, filled with the promise of innovation, sustainability, and prosperity. As we embrace this tech-driven, financially inclusive future of farming, we’re not just cultivating crops; we’re nurturing hope, empowering communities, and sowing the seeds of a stronger, more resilient India.

The future of Indian agriculture is bright, and it’s a future we’re building together, one farm, one innovation, and one empowered farmer at a time.

Frequently Asked Questions (FAQ)

- What is priority sector lending in agriculture?

Priority sector lending in agriculture refers to the RBI mandate that requires banks to allocate a certain percentage of their credit to the agricultural sector. This ensures a steady flow of credit to farmers and agricultural activities. - How are agri-tech solutions benefiting Indian farmers?

Agri-tech solutions are helping farmers by providing real-time crop monitoring, personalized advisory services, precision farming techniques, and better market linkages, leading to increased productivity and profitability. - What role does Farmonaut play in the agricultural ecosystem?

Farmonaut offers advanced satellite-based farm management solutions, providing farmers with real-time insights into crop health, soil conditions, and weather patterns. Their AI-driven advisory system helps farmers make informed decisions about crop management. - How is financial inclusion being promoted in rural areas?

Financial inclusion is being promoted through mobile banking solutions, specialized loan products for farmers, financial literacy programs, and the integration of technology in rural banking services. - What are the main challenges in implementing agri-tech solutions in India?

The main challenges include bridging the digital divide, improving digital literacy among farmers, developing affordable technologies, and ensuring reliable internet connectivity in rural areas.