Streamlining Australian Farm Finances: How Direct Debit Agreements Revolutionize Agricultural Payment Solutions

“Direct debit agreements can reduce payment processing time by up to 70% for Australian farms, streamlining financial operations.”

In the ever-evolving landscape of Australian agriculture, financial management plays a crucial role in the success and sustainability of farms. At Farmonaut, we understand the unique challenges faced by farmers when it comes to managing their finances efficiently. That’s why we’re excited to explore how direct debit agreements are revolutionizing agricultural payment solutions, offering a streamlined approach to farm finances that can significantly impact the bottom line of Australian farmers.

The Australian Agricultural Landscape: A Financial Perspective

Australia’s agricultural sector is diverse and dynamic, encompassing everything from vast sheep stations to intricate crop farms. The financial challenges faced by farmers are equally varied, ranging from seasonal cash flow fluctuations to the need for substantial capital investments in equipment and technology. In this context, efficient financial management is not just beneficial – it’s essential for survival and growth.

Traditional payment methods have long been a staple in the agricultural sector, but they often come with limitations that can hinder farm operations:

- Delayed payments affecting cash flow

- High transaction fees eating into profits

- Time-consuming manual processing of invoices and checks

- Inconsistent payment schedules making financial planning difficult

These challenges underscore the need for more efficient, reliable, and cost-effective payment solutions tailored to the unique needs of Australian farms.

Enter Direct Debit Agreements: A Game-Changer for Farm Finances

Direct debit agreements are emerging as a powerful tool in the arsenal of agricultural financial services. But what exactly are they, and how do they benefit Australian farmers?

A direct debit agreement is a financial arrangement that allows a business (in this case, a farm) to collect payments directly from a customer’s bank account at agreed-upon intervals. This system offers several key advantages that are particularly relevant to the agricultural sector:

- Improved Cash Flow: Regular, predictable payments help stabilize farm income.

- Reduced Administrative Burden: Automated payments mean less time spent on paperwork.

- Lower Transaction Costs: Direct debits often incur lower fees compared to credit card transactions or manual processing.

- Enhanced Customer Relationships: Simplified payment processes can lead to improved relationships with buyers and suppliers.

For Australian farmers, these benefits translate into tangible improvements in financial management and overall farm operations.

Implementing Direct Debit Solutions in Australian Farms

Adopting direct debit agreements as part of your farm payment solutions strategy requires careful planning and execution. Here’s a step-by-step guide to help Australian farmers get started:

- Assess Your Financial Needs: Evaluate your farm’s cash flow patterns and payment requirements.

- Choose a Reliable Provider: Select a financial institution or payment service provider with experience in agricultural financial services.

- Set Up the Agreement: Work with your chosen provider to establish the direct debit agreement, including payment frequencies and amounts.

- Communicate with Stakeholders: Inform your customers, suppliers, and other relevant parties about the new payment system.

- Integrate with Existing Systems: Ensure that the direct debit system integrates smoothly with your farm’s existing financial management tools.

- Monitor and Adjust: Regularly review the performance of your direct debit system and make adjustments as needed to optimize its benefits.

By following these steps, Australian farmers can effectively implement direct debit agreements and start reaping the benefits of streamlined financial operations.

The Role of Technology in Agricultural Financial Services

As we discuss modernizing farm payment solutions, it’s crucial to acknowledge the role of technology in driving these advancements. Digital agriculture platforms like Farmonaut are at the forefront of this revolution, offering tools that complement and enhance financial management strategies.

Our platform provides a range of solutions that can work hand-in-hand with direct debit agreements to further optimize farm finances:

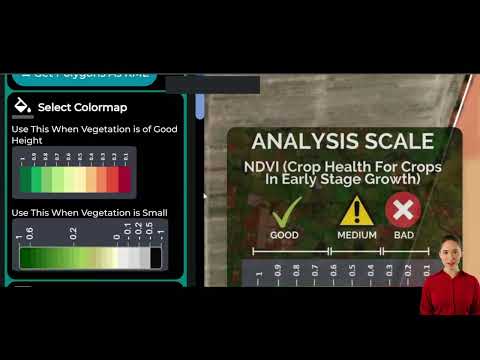

- Real-time Crop Monitoring: By providing accurate, up-to-date information on crop health and yield potential, our satellite-based monitoring system helps farmers make informed financial decisions.

- AI-Driven Advisory: Our Jeevn AI system offers personalized recommendations that can help farmers optimize resource allocation and improve profitability.

- Blockchain-Based Traceability: This feature enhances transparency in the supply chain, potentially opening up new markets and premium pricing opportunities for Australian farmers.

By leveraging these digital tools alongside direct debit agreements, farmers can create a comprehensive financial management strategy that addresses both income and expenditure aspects of their operations.

Sustainable Farming Practices and Financial Stability

“Implementing precision agriculture tools through Farmonaut’s platform can increase crop yields by 15-20% while reducing water usage by 30%.”

The adoption of sustainable farming practices is not just an environmental imperative – it’s also a key factor in long-term financial stability for Australian farms. Direct debit agreements and digital agriculture platforms play a crucial role in enabling and supporting these practices:

- Resource Optimization: By providing regular, predictable income through direct debits, farmers can better plan and invest in sustainable technologies and practices.

- Data-Driven Decision Making: Farmonaut’s precision agriculture tools provide insights that help farmers optimize resource use, reducing waste and improving profitability.

- Access to Green Finance: Demonstrable sustainable practices, supported by data from digital platforms, can open up new financing opportunities, including green loans and sustainability-linked credit lines.

This synergy between financial tools and sustainable practices creates a virtuous cycle, where improved financial stability enables greater investment in sustainability, which in turn enhances long-term profitability.

Comparing Payment Solutions for Australian Farms

To better understand the advantages of direct debit agreements in the context of Australian agriculture, let’s compare various payment solutions:

| Payment Method | Processing Time | Transaction Fees (Estimated) | Ease of Setup (1-5) | Cash Flow Management (1-5) | Automation Potential (1-5) | Suitability for Different Farm Types |

|---|---|---|---|---|---|---|

| Traditional Invoicing | 7-30 days | Low to None | 3 | 2 | 1 | All types, but less efficient for high-volume transactions |

| Bank Transfers | 1-3 days | Low | 4 | 3 | 3 | Suitable for all farm types |

| Credit Card Payments | Instant to 2 days | High (1.5-3.5%) | 4 | 4 | 4 | Better for smaller farms or retail sales |

| Direct Debit Agreements | 1-3 days | Low to Medium | 5 | 5 | 5 | Ideal for all farm types, especially those with recurring payments |

As the table illustrates, direct debit agreements offer a compelling combination of efficiency, cost-effectiveness, and automation potential, making them an excellent choice for many Australian farms.

Overcoming Challenges in Implementing Direct Debit Agreements

While the benefits of direct debit agreements are clear, implementing them can come with challenges. Here are some common hurdles Australian farmers might face and strategies to overcome them:

- Customer Resistance: Some customers may be hesitant to set up direct debits. Educate them on the benefits, including potential discounts for using this payment method.

- Technical Setup: The initial setup can be complex. Consider partnering with a financial institution or service provider that offers support and guidance throughout the process.

- Cash Flow Adjustments: Transitioning to a new payment system may require adjustments to your cash flow management. Use Farmonaut’s financial planning tools to help forecast and manage these changes.

- Regulatory Compliance: Ensure that your direct debit system complies with all relevant Australian financial regulations. Stay informed about any changes in legislation that might affect your operations.

By anticipating and addressing these challenges proactively, Australian farmers can smooth the transition to direct debit agreements and maximize their benefits.

Integrating Direct Debits with Farmonaut’s Digital Agriculture Platform

At Farmonaut, we believe in the power of integrated solutions. Our digital agriculture platform can work seamlessly with your direct debit system to create a comprehensive farm management solution. Here’s how:

- Financial Forecasting: Use our AI-driven advisory system to predict crop yields and potential income, helping you set appropriate direct debit amounts.

- Resource Management: Our satellite-based monitoring can help you optimize resource use, potentially reducing costs and improving the accuracy of your direct debit calculations.

- Supply Chain Integration: Our blockchain-based traceability system can help you manage and track payments throughout your supply chain, enhancing the efficiency of your direct debit agreements.

By leveraging these tools alongside your direct debit system, you can create a robust, data-driven approach to farm financial management.

Explore our range of digital agriculture solutions:

For developers interested in integrating our solutions into their own systems, check out our API and API Developer Docs.

The Future of Farm Payment Solutions in Australia

As we look to the future, it’s clear that the integration of direct debit agreements with advanced digital agriculture platforms will play a crucial role in shaping the financial landscape of Australian farms. Here are some trends we anticipate:

- Increased Adoption of AI in Financial Planning: AI-driven tools will become more sophisticated, offering even more accurate financial forecasts and recommendations.

- Greater Integration of Blockchain Technology: Blockchain will likely play a larger role in securing and streamlining financial transactions in agriculture.

- Evolution of Sustainable Finance: We expect to see more financial products and services tailored to support sustainable farming practices.

- Enhanced Data Analytics: As more data becomes available, farmers will have access to increasingly detailed insights to inform their financial decisions.

At Farmonaut, we’re committed to staying at the forefront of these developments, continually evolving our platform to meet the changing needs of Australian farmers.

Conclusion: Embracing Financial Innovation in Australian Agriculture

The adoption of direct debit agreements, coupled with the use of advanced digital agriculture platforms like Farmonaut, represents a significant step forward in streamlining Australian farm finances. By embracing these innovations, farmers can improve their cash flow, reduce administrative burdens, and make more informed financial decisions.

As we’ve explored throughout this article, the benefits of this approach extend beyond mere financial efficiency. They enable farmers to invest in sustainable practices, optimize resource use, and build more resilient agricultural businesses. In an era of climate uncertainty and market volatility, these tools provide a solid foundation for the future of Australian farming.

We encourage all Australian farmers to consider how direct debit agreements and digital agriculture solutions can benefit their operations. By leveraging these powerful tools, you can position your farm for success in an increasingly complex and competitive agricultural landscape.

Farmonaut Subscriptions

Frequently Asked Questions

- What is a direct debit agreement in agriculture?

A direct debit agreement in agriculture is a financial arrangement that allows farmers to automatically collect payments from their customers’ bank accounts at agreed-upon intervals. This system streamlines payment processes and improves cash flow management for farms. - How can direct debit agreements benefit Australian farmers?

Direct debit agreements can benefit Australian farmers by providing more predictable cash flow, reducing administrative work, lowering transaction costs, and improving relationships with customers and suppliers. - Is it difficult to set up a direct debit system for my farm?

While the initial setup may require some effort, many financial institutions and service providers offer support to make the process smoother. The long-term benefits often outweigh the initial setup challenges. - How does Farmonaut’s platform complement direct debit agreements?

Farmonaut’s digital agriculture platform provides valuable data and insights that can help farmers make informed financial decisions, optimize resource use, and improve overall farm management. This complements direct debit agreements by enhancing financial planning and forecasting capabilities. - Are direct debit agreements suitable for all types of farms in Australia?

Direct debit agreements can be beneficial for various types of farms, including sheep, dairy, and crop farms. However, the specific advantages may vary depending on the farm’s size, type of products, and customer base. - How can I ensure compliance with Australian regulations when using direct debit agreements?

To ensure compliance, work with reputable financial institutions familiar with Australian regulations. Stay informed about any changes in legislation and consider consulting with a financial advisor experienced in agricultural finance. - Can direct debit agreements help with sustainable farming practices?

Yes, by providing more stable and predictable cash flow, direct debit agreements can enable farmers to invest in sustainable farming practices and technologies. This financial stability supports long-term planning for sustainability initiatives. - How secure are direct debit transactions?

Direct debit transactions are generally very secure, as they are processed through established banking systems. However, it’s important to work with trusted financial institutions and implement proper security measures to protect sensitive financial information.