Essential Guide: Navigating Livestock Insurance and Disaster Recovery After Hurricane Helene

In the wake of Hurricane Helene’s devastating impact on agriculture, we at Farmonaut understand the critical importance of livestock insurance programs and disaster recovery strategies for farmers. This comprehensive guide delves into the intricacies of agricultural risk management, with a focus on livestock gross margin insurance and dairy revenue protection. We’ll explore how cutting-edge technology aids in assessing crop and livestock losses due to natural disasters, and provide vital information on farm service agency programs, reporting requirements, and the interplay between various insurance policies.

“Livestock Gross Margin Insurance and Dairy Revenue Protection are two key programs covering 90% of livestock insurance options.”

Understanding Livestock Insurance Programs

Livestock insurance programs are essential tools for farmers to protect their investments and livelihoods against unforeseen events, including natural disasters like Hurricane Helene. Let’s break down the two primary types of livestock insurance:

1. Livestock Gross Margin Insurance

- Protects against loss of gross margin (market value of livestock minus feed costs)

- Available for cattle, dairy, and swine producers

- Offers customizable coverage options based on expected prices and production levels

- Helps manage price risk for both livestock and feed

2. Dairy Revenue Protection

- Designed specifically for dairy producers

- Insures against unexpected declines in milk prices or milk production

- Offers quarterly coverage options

- Allows producers to choose between class pricing and component pricing options

Both of these insurance programs play a crucial role in agricultural risk management, providing a safety net for farmers against market volatility and natural disasters like Hurricane Helene.

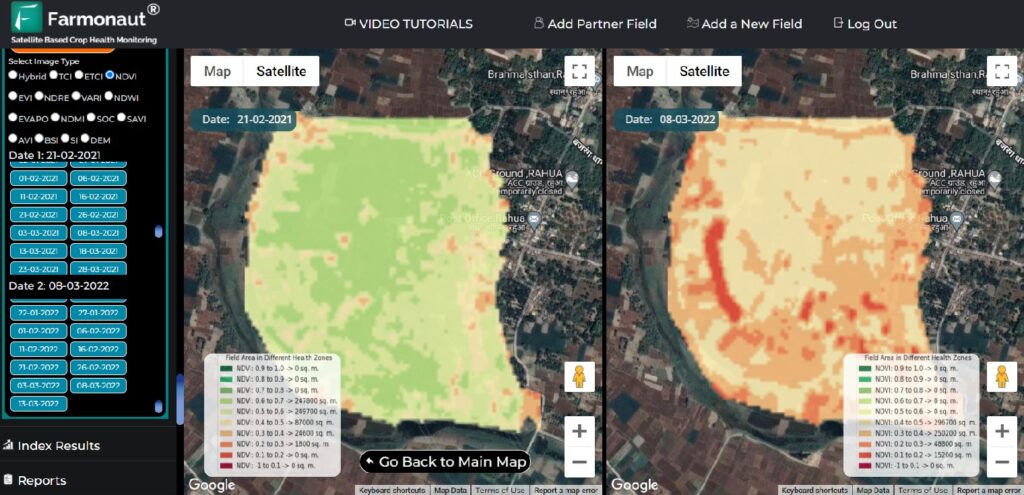

The Role of Technology in Disaster Assessment

In the aftermath of natural disasters like Hurricane Helene, accurate assessment of crop and livestock losses is crucial for insurance claims and disaster recovery efforts. This is where Farmonaut’s advanced technology comes into play.

Our satellite-based farm management solutions provide real-time data on crop health, soil moisture levels, and other critical metrics. This information is invaluable for:

- Assessing the extent of damage caused by hurricanes and other natural disasters

- Providing evidence for insurance claims

- Helping farmers make informed decisions about recovery and replanting

- Supporting government agencies in allocating disaster relief resources

To access our advanced agricultural solutions, visit our web app or download our mobile apps:

Farm Service Agency Programs and Disaster Recovery

The Farm Service Agency (FSA) offers several programs to assist farmers in disaster recovery:

- Emergency Conservation Program (ECP): Provides funding for farmers to rehabilitate farmland damaged by natural disasters

- Livestock Indemnity Program (LIP): Offers compensation for livestock deaths in excess of normal mortality caused by adverse weather

- Emergency Assistance for Livestock, Honeybees, and Farm-Raised Fish Program (ELAP): Provides emergency assistance to eligible producers of livestock, honeybees, and farm-raised fish

- Noninsured Crop Disaster Assistance Program (NAP): Offers financial assistance to producers of non-insurable crops when low yields, loss of inventory, or prevented planting occur due to natural disasters

Reporting Requirements for Livestock Indemnity

Timely and accurate reporting is crucial for successful livestock indemnity claims. Here are the key requirements:

- Report livestock losses within 30 days of the loss becoming apparent

- Provide evidence of loss, such as photographs or video documentation

- Submit a notice of loss to the local FSA office

- Complete an application for payment within 60 calendar days following the end of the calendar year in which the loss occurred

“Farmers must report livestock losses within 30 days and submit marketing reports within 15 days for timely insurance claims.”

Interplay Between Insurance Policies

Understanding how different insurance policies interact is crucial for maximizing coverage and avoiding gaps in protection. Here’s what farmers need to know:

- Crop insurance and livestock insurance can be complementary, covering different aspects of farm operations

- Some policies may have overlapping coverage; it’s important to review and adjust as needed

- FSA programs can provide additional support beyond private insurance policies

- Consider a combination of policies to create a comprehensive risk management strategy

Key Steps for Disaster Recovery

In the aftermath of Hurricane Helene, farmers should take the following steps to ensure a smooth recovery process:

- Document the damage: Take photos and videos of all affected areas, livestock, and crops

- Contact your insurance agent: Notify them of the loss and begin the claims process

- Report to FSA: File a Notice of Loss with your local FSA office

- Assess and mitigate: Take immediate action to prevent further damage where possible

- Keep records: Maintain detailed records of all disaster-related expenses and losses

- Explore assistance programs: Research and apply for relevant disaster assistance programs

- Plan for recovery: Develop a strategy for rebuilding and replanting

Flexibility in Coverage and Marketing Requirements

During challenging times like the aftermath of Hurricane Helene, insurance providers and government agencies often offer flexibility in coverage and marketing requirements. This may include:

- Extended deadlines for submitting claims or reports

- Relaxed documentation requirements in cases of extreme hardship

- Adjustments to marketing requirements for price protection policies

- Options to defer premium payments

It’s crucial to stay in close communication with your insurance provider and local FSA office to understand and take advantage of any available flexibilities.

Prevented Planting and Specialty Crops

Hurricane Helene may have left some farmers unable to plant their crops as planned. Here’s what you need to know about prevented planting coverage:

- Prevented planting coverage is available for most crops under a multi-peril crop insurance policy

- It provides payments to farmers who are unable to plant due to an insured cause of loss

- Farmers must report prevented planting acres within 15 days of the final planting date

- Coverage levels vary depending on the crop and the insurance plan

For specialty crop producers, additional considerations include:

- Specialized insurance options may be available for certain specialty crops

- The Noninsured Crop Disaster Assistance Program (NAP) can provide coverage for crops not eligible for traditional crop insurance

- Accurate record-keeping is especially crucial for specialty crop losses

Conservation Practices and Disaster Resilience

Implementing conservation practices can help improve farm resilience against future disasters. Some key practices include:

- Cover cropping to improve soil health and reduce erosion

- Contour farming to minimize water runoff

- Windbreaks to protect against high winds

- Improved drainage systems to manage excess water

Many of these practices are supported by USDA conservation programs, which can provide financial and technical assistance to farmers implementing them.

For real-time monitoring of your farm’s resilience, consider using Farmonaut’s satellite-based solutions. Learn more about our API and developer documentation.

Comparison of Livestock Insurance and Disaster Recovery Options

| Insurance Type/Program | Coverage Details | Eligibility Criteria | Claim Process | Disaster Recovery Support |

|---|---|---|---|---|

| Livestock Gross Margin Insurance | Protects against loss of gross margin | Available for cattle, dairy, and swine producers | Submit claims within 30 days of loss | Provides financial protection against market fluctuations |

| Dairy Revenue Protection | Insures against declines in milk prices or production | Dairy producers | Quarterly claim submissions | Stabilizes income during market volatility |

| Farm Service Agency Programs | Various programs for different types of losses | Varies by program | Apply through local FSA office | Offers emergency loans and direct assistance |

| Farmonaut Technology Solution | Satellite-based crop monitoring | All farmers | N/A (provides data for claims) | Assists in accurate loss assessment and recovery planning |

FAQs

Q: How soon after Hurricane Helene should I file an insurance claim?

A: You should file a claim as soon as possible, ideally within 72 hours of noticing the damage. Most policies require notification within 30 days of the loss becoming apparent.

Q: Can I receive both crop insurance and disaster assistance payments?

A: Yes, in many cases you can receive both. However, there may be limitations to prevent overpayment. It’s best to consult with your insurance agent and local FSA office for specific details.

Q: How can Farmonaut’s technology help in disaster recovery?

A: Our satellite-based monitoring provides accurate, real-time data on crop health and field conditions. This information can be crucial for assessing damage, supporting insurance claims, and planning recovery efforts.

Q: What if I can’t meet reporting deadlines due to the impact of Hurricane Helene?

A: In cases of severe disasters, deadlines are often extended. Contact your insurance provider and local FSA office immediately to explain your situation and request accommodations.

Q: Are there any special considerations for organic farmers in disaster recovery?

A: Yes, organic farmers should maintain thorough documentation of their organic practices and certification. Some disaster assistance programs have specific provisions for organic operations.

Conclusion

Navigating the complex world of livestock insurance and disaster recovery after an event like Hurricane Helene can be challenging. However, with a clear understanding of available programs, timely reporting, and the use of advanced technologies like those offered by Farmonaut, farmers can effectively manage risks and recover from disasters.

Remember, the key to successful recovery lies in prompt action, thorough documentation, and leveraging all available resources. By combining traditional insurance programs with cutting-edge agricultural technology, farmers can build more resilient operations capable of weathering future storms.

For more information on how Farmonaut’s satellite-based solutions can support your farm’s risk management and recovery efforts, visit our website or contact our team of experts.

Ready to enhance your farm’s resilience? Explore Farmonaut’s subscription options:

By staying informed, prepared, and leveraging the right tools and resources, farmers can navigate the challenges posed by natural disasters like Hurricane Helene and emerge stronger and more resilient.