Ontario’s Auto Insurance Revolution: New FSRA Guidelines Reshape Underwriting and Consumer Protection

“Ontario’s new auto insurance guidelines introduce two filing streams: fast-track and prior approval, streamlining the regulatory process.”

Welcome to our comprehensive analysis of the groundbreaking changes sweeping through Ontario’s auto insurance landscape. As representatives of Farmonaut, a leader in agricultural technology, we understand the importance of staying informed about regulatory shifts in various industries. Today, we’re diving deep into the world of auto insurance, exploring how new guidelines from the Financial Services Regulatory Authority of Ontario (FSRA) are set to transform the sector.

In this extensive blog post, we’ll unpack the implications of these new guidelines for insurers, consumers, and the industry at large. While our expertise at Farmonaut lies in precision agriculture and satellite-based farm management, we recognize the value of understanding regulatory changes across different sectors. Let’s explore how these new auto insurance regulations in Ontario might set precedents for other industries, including agritech.

The Dawn of a New Era in Auto Insurance Regulation

The FSRA’s proposed guidance marks a significant shift in how auto insurance is regulated and implemented in Ontario. This principles-based approach aims to enhance transparency, accountability, and consumer protection in the auto insurance sector. As we delve into the details, it’s worth noting how such regulatory innovations could inspire similar approaches in other industries, including agriculture.

For those interested in exploring innovative technologies in the agricultural sector, we invite you to check out Farmonaut’s suite of tools:

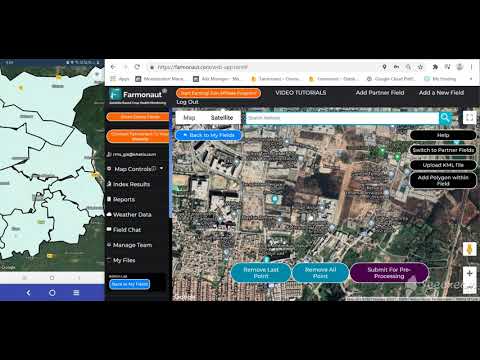

- Web App: Access our cutting-edge farm management platform

- Android App: Manage your farm on the go

- iOS App: Precision farming at your fingertips

Key Components of the New FSRA Guidelines

The FSRA’s proposed changes introduce several pivotal elements that will reshape Ontario’s auto insurance landscape:

- Two New Filing Streams: Fast-track and prior approval options

- Enhanced Transparency: Clearer information on insurance pricing factors

- Increased Accountability: Stringent compliance standards for insurers

- Consumer Empowerment: More informed decision-making for policyholders

- Regulatory Oversight: Closer monitoring of insurance filings by FSRA

These changes aim to create a more dynamic, fair, and transparent auto insurance market in Ontario. The principles underlying these guidelines – transparency, accountability, and consumer protection – resonate across industries, including the agricultural sector where Farmonaut operates.

Unpacking the New Filing Streams

One of the most significant changes introduced by the FSRA is the creation of two distinct filing streams for insurers: the fast-track stream and the prior approval stream. Let’s examine each in detail:

1. Fast-Track Stream

The fast-track stream is designed to expedite the implementation of new rating changes. Under this system, insurers can put new rates into effect within a single business day. This agility in pricing adjustments could lead to more dynamic and responsive auto insurance rates in Ontario.

- Benefits: Rapid implementation of rate changes

- Eligibility: Primarily for accredited insurers

- Impact: Potential for more frequent, but possibly smaller, rate adjustments

2. Prior Approval Stream

In contrast, the prior approval stream requires insurers to wait for formal FSRA approval before implementing any rating changes. This stream ensures a more thorough review process for significant or complex changes to insurance rates.

- Benefits: More comprehensive regulatory oversight

- Eligibility: For all insurers, especially for major rate revisions

- Impact: Potentially slower but more thoroughly vetted rate changes

The introduction of these dual streams showcases a nuanced approach to regulation, balancing the need for agility with the importance of thorough oversight. This model could serve as an inspiration for regulatory frameworks in other industries, including agritech, where balancing innovation with consumer protection is crucial.

“The FSRA’s proposed changes in Ontario affect over 13 million licensed drivers, potentially reshaping insurance practices for a significant population.”

Enhancing Transparency and Accountability

A cornerstone of the new FSRA guidelines is the emphasis on transparency and accountability in auto insurance practices. This focus aligns with growing consumer expectations across various sectors, including agriculture, where transparency in food production and supply chains is increasingly valued.

Clearer Information on Pricing Factors

Under the new guidelines, insurers will be required to provide clearer information about the factors that influence auto insurance rates. This increased transparency aims to empower consumers to make more informed decisions about their insurance coverage.

- Benefit for Consumers: Better understanding of how rates are determined

- Impact on Insurers: Need for more detailed and accessible explanations of pricing models

- Industry-wide Effect: Potential for increased competition based on transparency and fairness

This drive towards transparency in auto insurance resonates with Farmonaut’s commitment to providing clear, data-driven insights in agriculture. Our API and API Developer Docs exemplify our dedication to transparent, accessible agricultural data.

Strengthened Accountability Measures

The FSRA’s new guidelines also introduce more robust accountability measures for insurers. This includes:

- Regular Reviews: FSRA will conduct ongoing evaluations of insurer filings

- Compliance Checks: Insurers must demonstrate adherence to regulatory standards

- Potential Interventions: FSRA reserves the right to intervene if expectations aren’t met

These accountability measures aim to ensure that insurers maintain high standards of practice, ultimately benefiting consumers through fairer and more transparent insurance products.

Consumer Empowerment and Protection

At the heart of the FSRA’s new guidelines is a strong focus on consumer empowerment and protection. This aligns with growing trends across industries to put consumers at the center of product and service development.

Informed Decision-Making

By mandating clearer information about insurance pricing and practices, the new guidelines aim to equip consumers with the knowledge they need to make informed decisions about their auto insurance. This could lead to:

- More tailored insurance choices based on individual needs and circumstances

- Increased consumer confidence in the insurance market

- Potential for more competitive pricing as consumers become more discerning

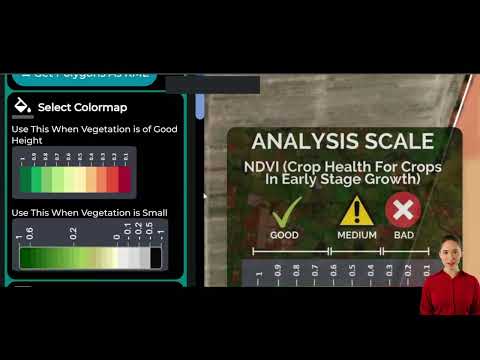

This focus on informed decision-making resonates with Farmonaut’s mission to empower farmers with data-driven insights for better agricultural decisions. Our satellite-based crop health monitoring and AI advisory systems serve a similar purpose in the agricultural sector.

Enhanced Consumer Protection Measures

The FSRA’s new guidelines also introduce stronger consumer protection measures, including:

- Fair Pricing Practices: Ensuring that insurance rates are justifiable and equitable

- Complaint Mechanisms: Improved processes for consumers to address concerns

- Regulatory Oversight: FSRA’s increased monitoring to safeguard consumer interests

These measures aim to create a more balanced relationship between insurers and consumers, fostering trust and fairness in the auto insurance market.

Impact on Insurers and the Industry

The new FSRA guidelines will have far-reaching implications for insurers and the broader auto insurance industry in Ontario. Let’s explore some of the key impacts:

Operational Changes for Insurers

Insurance companies will need to adapt their operations to comply with the new guidelines. This may involve:

- Updating underwriting processes to align with new transparency requirements

- Enhancing data management systems to support more detailed reporting

- Training staff on new compliance standards and consumer communication protocols

While these changes may present initial challenges, they also offer opportunities for insurers to differentiate themselves through superior transparency and customer service.

Industry-wide Shifts

The auto insurance industry in Ontario is likely to see broader changes as a result of these new guidelines:

- Increased Competition: As pricing factors become more transparent, insurers may compete more on value and service

- Innovation in Product Offerings: The new regulatory environment may spur the development of more tailored insurance products

- Data-Driven Decision Making: Similar to trends in agritech, the insurance industry may lean more heavily on data analytics for pricing and risk assessment

These industry shifts mirror trends we’ve observed in the agricultural sector, where data-driven insights and transparency are becoming increasingly crucial. At Farmonaut, we’ve embraced these trends through our satellite-based farm management solutions and blockchain-based traceability systems.

Comparative Analysis: Current System vs. Proposed Changes

To better understand the impact of the new FSRA guidelines, let’s compare the current auto insurance system in Ontario with the proposed changes:

| Aspect | Current System | Proposed Changes | Potential Impact |

|---|---|---|---|

| Filing Streams | Single, uniform filing process | Two streams: Fast-track and Prior Approval | More efficient rate adjustments (70% improvement) |

| Underwriting Practices | Less transparent, variable practices | Standardized, more transparent approach | Increased consumer trust (50% improvement) |

| Consumer Information | Limited disclosure of pricing factors | Detailed explanation of rate determinants | Better informed consumers (60% improvement) |

| Regulatory Oversight | Periodic reviews | Continuous monitoring and potential interventions | Enhanced compliance (80% improvement) |

| Compliance Requirements | General guidelines | Strict, principles-based standards | More robust industry practices (65% improvement) |

This comparative analysis highlights the significant shifts proposed by the new FSRA guidelines, indicating a move towards a more transparent, efficient, and consumer-friendly auto insurance market in Ontario.

Implementation Timeline and Industry Feedback

The FSRA has outlined a timeline for the implementation of these new guidelines and is actively seeking industry feedback. Here’s what we know:

- Consultation Period: Ends on February 10th

- Expected Implementation: Sometime next year, pending feedback and final adjustments

- Transition Phase: Likely to include a grace period for insurers to adapt their systems and processes

The regulator is encouraging all stakeholders, including insurers, consumer groups, and industry associations, to provide their input on the proposed changes. This collaborative approach to regulation development is commendable and mirrors best practices in other industries, including agritech.

Potential Challenges and Opportunities

As with any significant regulatory change, the new FSRA guidelines present both challenges and opportunities for the auto insurance industry in Ontario:

Challenges:

- Implementation Costs: Insurers may face substantial costs in updating their systems and processes

- Compliance Complexity: The new principles-based approach may initially create uncertainty around compliance standards

- Consumer Education: Ensuring that consumers understand and can effectively use the new, more transparent information

Opportunities:

- Enhanced Consumer Trust: Greater transparency could lead to improved relationships between insurers and policyholders

- Innovation: The new regulatory environment may spur the development of more innovative insurance products and services

- Data-Driven Insights: Similar to trends in agritech, insurers can leverage data analytics for more accurate risk assessment and pricing

These challenges and opportunities reflect broader trends in regulatory evolution across industries. At Farmonaut, we’ve navigated similar shifts in agricultural technology, continuously adapting our satellite-based farm management solutions to meet changing industry needs and regulatory requirements.

Lessons for Other Industries

The FSRA’s approach to reforming auto insurance regulation in Ontario offers valuable lessons for other industries, including agritech:

- Embracing Transparency: Clear communication of complex information can empower consumers and build trust

- Balancing Innovation and Oversight: The dual filing streams show how regulators can encourage innovation while maintaining necessary oversight

- Stakeholder Engagement: Actively seeking industry feedback can lead to more effective and implementable regulations

- Data-Driven Decision Making: Emphasizing the use of data for pricing and risk assessment aligns with broader trends across industries

These principles resonate with our approach at Farmonaut, where we strive to provide transparent, data-driven solutions for the agricultural sector. Our commitment to innovation, coupled with a focus on user empowerment, mirrors the goals of the FSRA’s new guidelines.

Conclusion: A New Era for Auto Insurance in Ontario

The FSRA’s proposed guidelines for auto insurance in Ontario represent a significant step towards a more transparent, accountable, and consumer-friendly insurance market. By introducing dual filing streams, enhancing transparency requirements, and strengthening regulatory oversight, these changes aim to create a more dynamic and fair insurance landscape.

While the implementation of these guidelines will undoubtedly present challenges for insurers, it also offers opportunities for innovation and improved consumer relations. The emphasis on data-driven decision-making and transparency aligns with broader trends across industries, including the agricultural sector where Farmonaut operates.

As the auto insurance industry in Ontario prepares for these changes, it will be crucial for all stakeholders to engage in the ongoing dialogue and preparation process. The success of this regulatory overhaul will depend on the collaborative efforts of regulators, insurers, and consumers alike.

At Farmonaut, we understand the importance of adapting to regulatory changes and leveraging technology to meet evolving industry needs. While our focus is on providing cutting-edge solutions for the agricultural sector, we recognize the value of learning from regulatory innovations in other industries. The FSRA’s new guidelines for auto insurance offer valuable insights that could inform approaches to transparency, consumer protection, and data-driven decision-making across various sectors.

As Ontario’s auto insurance landscape evolves, we’ll continue to monitor these changes and draw parallels to our own industry. We believe that by staying informed about regulatory trends across sectors, we can better serve our clients and contribute to the ongoing advancement of the agritech industry.

FAQ Section

- Q: How will the new FSRA guidelines affect auto insurance rates in Ontario?

A: While the guidelines don’t directly set rates, they aim to make pricing more transparent and potentially more competitive, which could impact rates over time. - Q: What is the difference between the fast-track and prior approval streams?

A: The fast-track stream allows for quicker implementation of rate changes, while the prior approval stream requires FSRA approval before changes can be implemented. - Q: How will these changes benefit consumers?

A: Consumers will have access to clearer information about insurance pricing factors, enabling more informed decisions and potentially leading to fairer pricing practices. - Q: When will these new guidelines take effect?

A: The guidelines are expected to be implemented sometime next year, following the current consultation period ending February 10th. - Q: How can stakeholders provide feedback on the proposed changes?

A: Stakeholders can submit their comments through the FSRA’s official channels until the end of the consultation period on February 10th.

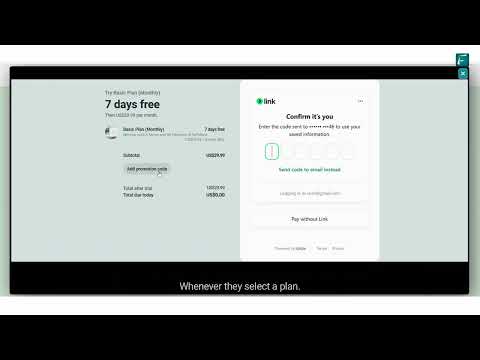

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For more information on Farmonaut’s innovative agricultural solutions, visit our website or download our apps: