Spring Weather’s Impact on Prairie Feed Grain Markets: 2024 Outlook and Price Trends

“Canadian feed wheat prices remain steady despite tight supplies, influenced by U.S. corn imports moderating the market.”

As we delve into the intricate world of Prairie feed grain markets, the impact of spring weather takes center stage in our 2024 outlook. The agricultural landscape is poised for potential shifts, with Canadian grain supply and feed market dynamics at the forefront of industry discussions. In this comprehensive analysis, we’ll explore how melting snow and road bans could influence grain transport and pricing strategies, examine current feed wheat prices and barley acreage forecasts, and investigate the role of U.S. corn imports in moderating Canadian prices.

The Pulse of Prairie Feed Grain Markets

The Prairie regions of Canada, encompassing vast swathes of Alberta, Saskatchewan, and Manitoba, are the heartbeat of the nation’s grain production. As we look ahead to the 2024 crop year, several factors are converging to shape the feed grain markets:

- Spring weather patterns

- Grain transport challenges

- Fluctuating supply and demand dynamics

- Global market influences

These elements collectively paint a complex picture for farmers, feedlot operators, and commodity traders alike. Let’s break down each component to better understand the potential impacts on feed grain markets.

Spring Weather: The Game-Changer

“Spring weather conditions, including melting snow and road bans, can significantly impact grain transport and pricing for Prairie feed markets.”

The arrival of spring in the Prairie provinces brings a mix of anticipation and challenges for the agricultural sector. As temperatures rise and snow begins to melt, the landscape transforms, setting the stage for the upcoming planting season. However, this transition period also introduces unique obstacles that can ripple through the feed grain markets:

- Road Bans: Melting snow and thawing ground lead to seasonal road restrictions, limiting the weight of vehicles that can travel on certain routes. This directly affects grain transport, potentially creating bottlenecks in the supply chain.

- Field Access: Wet conditions can delay field work, impacting planting schedules and potentially shifting crop choices based on optimal seeding windows.

- Price Volatility: Weather-induced transportation challenges can lead to localized supply shortages, influencing short-term price fluctuations in feed grain markets.

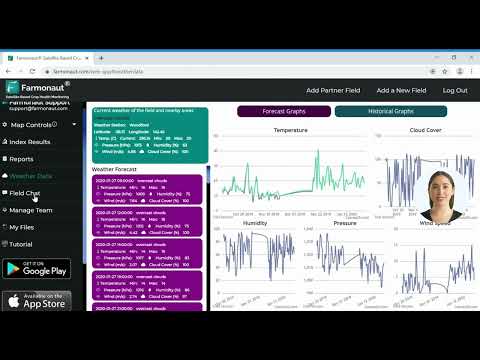

For farmers and agribusinesses looking to navigate these spring weather impacts, tools like Farmonaut’s satellite-based crop monitoring and AI-driven advisory systems can provide valuable insights. By leveraging real-time data on field conditions and weather patterns, stakeholders can make more informed decisions about planting, transportation, and market timing.

Current Market Dynamics: Feed Wheat and Barley

As we analyze the current state of Prairie feed grain markets, two key players emerge at the forefront: feed wheat and barley. Let’s examine the latest trends and forecasts for these crucial commodities:

Feed Wheat: Steady Amidst Tight Supplies

Despite the challenges of tight supplies, feed wheat prices have maintained a relatively stable position in recent months. This resilience can be attributed to several factors:

- Global Demand: Consistent international demand for Canadian wheat has helped support prices.

- Alternative Feed Sources: The availability of other feed grains, particularly imported U.S. corn, has prevented dramatic price spikes.

- Strategic Reserves: Careful management of existing wheat stocks by grain handlers and end-users has helped balance supply and demand.

Looking ahead to the 2024 crop year, industry experts anticipate a potential increase in feed wheat acreage as farmers respond to favorable price signals and crop rotation needs.

Barley: Acreage Forecasts and Market Outlook

Barley, a staple in livestock feed rations across the Prairies, is poised for an interesting year in 2024. Current forecasts suggest:

- Acreage Expansion: Early projections indicate a possible increase in barley plantings, driven by strong feed market demand and competitive pricing relative to other crops.

- Export Potential: Growing interest from international markets, particularly China, could influence domestic barley prices and availability for feed use.

- Weather Dependency: The success of the barley crop and its impact on feed markets will heavily depend on spring planting conditions and subsequent growing season weather.

For those involved in barley production or procurement, staying informed about market trends and weather patterns is crucial. Farmonaut’s comprehensive agricultural monitoring solutions can provide valuable insights to support decision-making throughout the growing season.

Access Farmonaut’s Web App for real-time crop monitoring and market insights

The U.S. Corn Factor: Impact on Canadian Feed Markets

One of the most significant influences on Prairie feed grain markets in recent years has been the influx of U.S. corn imports. This trend has played a crucial role in moderating Canadian feed prices and reshaping market dynamics:

- Price Moderation: Imported corn has provided a cost-effective alternative to domestic feed grains, helping to keep overall feed prices in check.

- Supply Buffer: In years of tight domestic grain supplies, U.S. corn has served as a vital buffer, ensuring consistent feed availability for livestock operations.

- Market Competition: The presence of imported corn has increased competition in the feed market, prompting Canadian producers to remain price-competitive.

As we look ahead to the 2024 crop year, the role of U.S. corn in Canadian feed markets is expected to remain significant. Factors that will influence its impact include:

- Exchange rates between the Canadian and U.S. dollars

- Comparative production costs and yields in both countries

- Transportation costs and logistical considerations

- Any potential trade policy changes affecting grain imports

For feedlot operators and grain buyers, staying attuned to these cross-border dynamics will be crucial for optimizing feed costs and managing supply risks.

Prairie Crop Outlook: Beyond Feed Grains

While feed wheat and barley are central to our discussion, it’s important to consider the broader Prairie crop outlook for 2024. Other key crops that could influence feed grain markets include:

- Canola: As a major oilseed crop, canola acreage decisions can impact the availability of land for feed grain production.

- Soybeans: Increasing soybean production in certain Prairie regions could affect crop rotations and feed protein sources.

- Pulses: Crops like peas and lentils offer alternative protein sources for livestock feed, potentially influencing demand for traditional feed grains.

The interplay between these various crops creates a complex agricultural landscape, where changes in one sector can have ripple effects across the entire industry. Farmers and agribusinesses must navigate these interconnected markets with care and foresight.

Commodity Trading Landscape: Navigating Uncertainty

The Prairie feed grain markets operate within a broader commodity trading landscape that is constantly evolving. Key factors shaping this environment in 2024 include:

- Global Supply and Demand: International crop production levels and consumption patterns can significantly impact Canadian grain prices.

- Geopolitical Events: Trade tensions, policy changes, or conflicts in major agricultural regions can create market volatility.

- Climate Change: Increasing frequency of extreme weather events poses risks to crop production and market stability.

- Technological Advancements: Innovations in farming practices and crop varieties can influence production levels and grain quality.

For those engaged in commodity trading or risk management in the agricultural sector, access to timely and accurate information is paramount. Farmonaut’s satellite-based monitoring and AI-driven analytics can provide valuable insights to support trading decisions and risk assessment.

Explore Farmonaut’s API for integrating agricultural data into your trading systems

Feedlot Preparedness: Strategies for 2024

As we consider the various factors influencing Prairie feed grain markets, it’s crucial to examine how feedlot operators can prepare for the challenges and opportunities that lie ahead in 2024:

- Diversified Sourcing: Maintaining relationships with multiple grain suppliers can help mitigate risks associated with localized shortages or price spikes.

- Forward Contracting: Locking in prices for a portion of feed requirements can provide budget certainty and protection against market volatility.

- Storage Capacity: Investing in on-site storage facilities allows feedlots to take advantage of favorable market conditions and ensure consistent supply.

- Ration Flexibility: Developing the ability to adjust feed rations based on grain availability and pricing can optimize costs and maintain animal performance.

- Market Monitoring: Utilizing advanced tools and data analytics to stay informed about market trends and weather impacts on crop production.

By implementing these strategies, feedlot operators can enhance their resilience to market fluctuations and position themselves for success in the coming year.

Technology’s Role in Feed Market Management

As the agricultural industry continues to evolve, technology plays an increasingly crucial role in managing feed grain markets and optimizing farm operations. Innovative solutions like those offered by Farmonaut are transforming how stakeholders approach decision-making:

- Satellite-Based Crop Monitoring: Real-time insights into crop health and development across vast areas.

- AI-Driven Weather Forecasting: Advanced predictions to support planting, harvesting, and grain transport decisions.

- Blockchain Traceability: Enhanced supply chain transparency for feed grain sourcing and quality assurance.

- Data-Driven Advisory Services: Personalized recommendations for crop management and market timing.

By leveraging these technological advancements, farmers, traders, and feedlot operators can gain a competitive edge in navigating the complex feed grain markets of the Prairie regions.

Access Farmonaut’s API Developer Docs for custom integration options

Market Analysis: Feed Grain Price Trends

To provide a clear overview of the current feed grain market situation and future outlook, we’ve compiled a comparative analysis of key crops in the Prairie region:

| Crop Type | Current Price ($/tonne) | Year-over-Year Price Change (%) | Projected Acreage (hectares) | Acreage Change from Previous Year (%) |

|---|---|---|---|---|

| Feed Wheat | 285 | +2.5% | 3,200,000 | +3.8% |

| Barley | 270 | +1.8% | 2,900,000 | +5.2% |

| Corn (Domestic) | 240 | -1.2% | 1,450,000 | +2.1% |

| U.S. Corn Import Price | 230 | -2.5% | N/A | N/A |

This table highlights several key trends in the Prairie feed grain markets:

- Feed wheat and barley prices show modest year-over-year increases, reflecting tight supplies and steady demand.

- Projected acreage for both feed wheat and barley is set to expand, potentially easing supply concerns in the coming crop year.

- Domestic corn prices have slightly decreased, influenced by competitive U.S. import prices.

- The lower U.S. corn import price continues to play a role in moderating overall feed grain costs in the Canadian market.

These trends underscore the complex interplay between domestic production, international trade, and market demand in shaping the Prairie feed grain landscape.

Looking Ahead: Key Factors to Watch

As we progress through 2024, several key factors will continue to shape the Prairie feed grain markets:

- Weather Patterns: Ongoing monitoring of spring conditions and their impact on planting progress and crop development.

- Global Grain Trade: Changes in international demand or supply disruptions that could affect Canadian export opportunities and domestic availability.

- Livestock Industry Dynamics: Shifts in cattle, hog, or poultry production levels that could influence feed demand.

- Policy Changes: Any new agricultural or trade policies that might affect grain production, transportation, or pricing.

- Technological Adoption: The rate at which farmers and industry stakeholders embrace new technologies to enhance productivity and market responsiveness.

Staying informed about these factors will be crucial for anyone involved in the Prairie feed grain markets, from producers to end-users and commodity traders.

Conclusion: Navigating the 2024 Prairie Feed Grain Landscape

As we’ve explored throughout this analysis, the Prairie feed grain markets in 2024 present a complex and dynamic landscape influenced by a myriad of factors. From the immediate impacts of spring weather on planting and transportation to the broader influences of global trade and technological innovation, stakeholders across the agricultural value chain must remain vigilant and adaptable.

Key takeaways for navigating the 2024 feed grain markets include:

- Closely monitoring weather patterns and their effects on crop development and grain transport.

- Staying informed about acreage projections and potential shifts in crop mix across the Prairies.

- Understanding the ongoing influence of U.S. corn imports on domestic feed grain pricing.

- Leveraging technology and data analytics to make informed decisions about production, procurement, and risk management.

- Maintaining flexibility in feed sourcing and ration formulation to adapt to market fluctuations.

By embracing these strategies and staying attuned to market developments, industry participants can position themselves for success in the evolving Prairie feed grain landscape. As we move forward, the integration of advanced technologies like those offered by Farmonaut will play an increasingly important role in helping stakeholders navigate market complexities and optimize their operations.

In this era of rapid change and information abundance, the ability to access accurate, timely data and translate it into actionable insights will be a key differentiator. Whether you’re a grain producer, livestock operator, or commodity trader, embracing the tools and knowledge available can help you thrive in the dynamic world of Prairie feed grain markets.

FAQ Section

Q: How does spring weather typically affect Prairie feed grain markets?

A: Spring weather can significantly impact planting schedules, crop development, and grain transport. Wet conditions may delay seeding and affect crop choices, while road bans due to melting snow can create transportation challenges, potentially leading to localized supply issues and price fluctuations.

Q: What role do U.S. corn imports play in Canadian feed markets?

A: U.S. corn imports serve as a price moderator in Canadian feed markets. They provide a cost-effective alternative to domestic grains, help buffer tight local supplies, and increase market competition, encouraging Canadian producers to remain price-competitive.

Q: How can feedlot operators prepare for potential market volatility in 2024?

A: Feedlot operators can prepare by diversifying grain sourcing, engaging in forward contracting, investing in storage capacity, maintaining flexible feed rations, and utilizing market monitoring tools to stay informed about trends and potential disruptions.

Q: What technologies are available to help manage feed grain market risks?

A: Advanced technologies like satellite-based crop monitoring, AI-driven weather forecasting, blockchain traceability systems, and data-driven advisory services are becoming increasingly important for managing market risks and optimizing decisions in the feed grain industry.

Q: How might climate change impact Prairie feed grain markets in the coming years?

A: Climate change could lead to more frequent extreme weather events, potentially affecting crop yields, quality, and market stability. It may also shift suitable growing regions for certain crops, influencing long-term production patterns and market dynamics in the Prairies.