EU Rapeseed Supply Crunch: Global Canola Market Trends and Trade Flow Dynamics for 2024-25

“EU rapeseed production is forecasted to fall below the four-year average in 2024, impacting global oilseed markets.”

As we approach 2024, the global rapeseed and canola markets are poised for significant shifts, with the European Union (EU) at the epicenter of a looming supply crunch. At Farmonaut, we’re closely monitoring these developments to provide you with the most up-to-date insights and analysis. Our advanced satellite-based crop monitoring technology allows us to track global agricultural trends with unprecedented accuracy, giving you a competitive edge in navigating the complex landscape of oilseed trade.

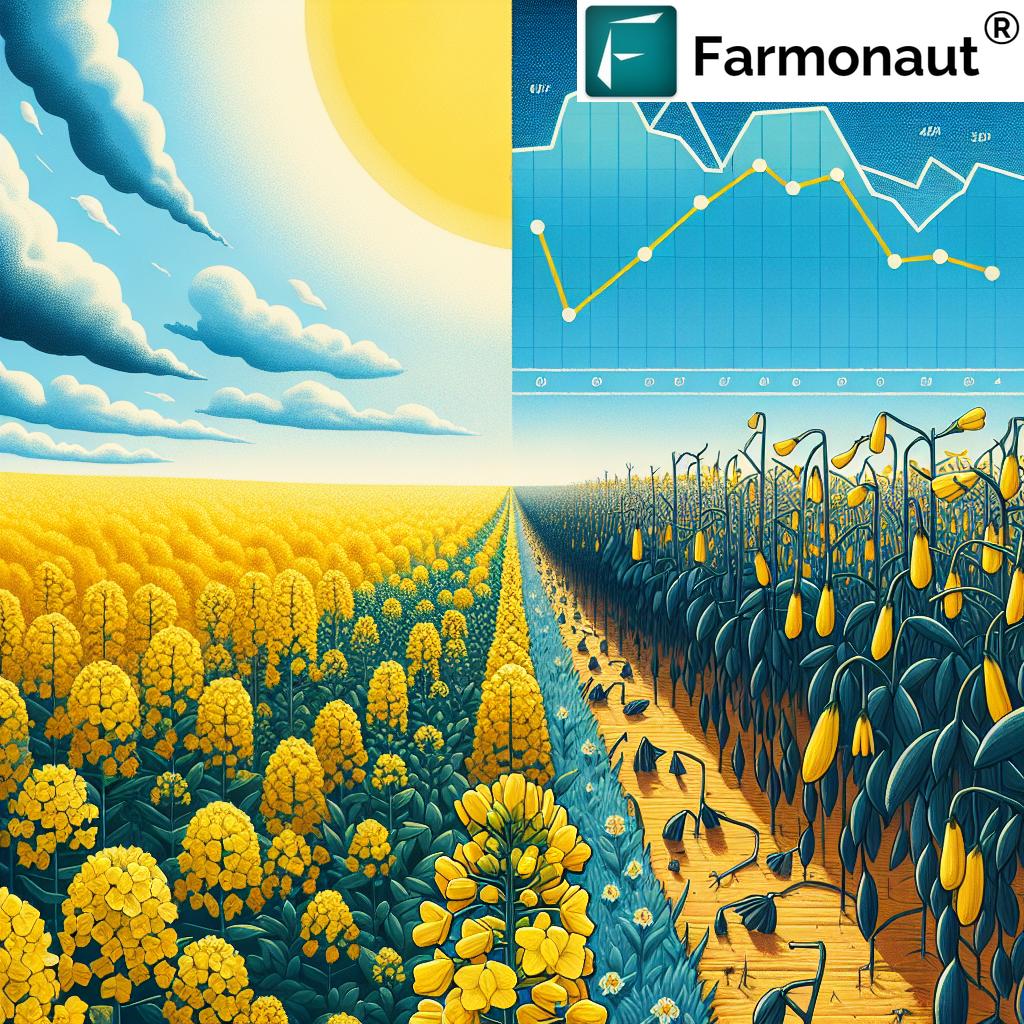

EU Rapeseed Production Forecast: A Challenging Outlook

The European Commission’s latest projections paint a concerning picture for EU rapeseed production in the 2024-25 crop year. With an estimated output of approximately 17 million tonnes, we’re looking at a significant decline from the four-year average of 18.2 million tonnes. This shortfall is expected to have far-reaching implications for the global oilseed market, particularly given the EU’s position as a major player in rapeseed production and consumption.

- Projected EU rapeseed production: 17 million tonnes

- Four-year average production: 18.2 million tonnes

- Expected shortfall: 1.2 million tonnes

The reasons behind this decline are multifaceted, ranging from adverse weather conditions to shifting agricultural policies within the EU. Our satellite imagery and AI-driven analytics at Farmonaut have been instrumental in identifying these trends early, allowing farmers and agribusinesses to prepare for the challenges ahead.

To explore how Farmonaut’s technology can help you monitor crop health and predict yields, check out our web application or download our mobile apps:

Global Canola Market Trends: Shifting Supply Dynamics

As the EU grapples with reduced rapeseed production, the global canola market is experiencing significant shifts in supply dynamics. Australia and Ukraine are emerging as key players in meeting the EU’s import requirements, while Canada faces its own production challenges.

Australia’s Canola Exports: A Beacon of Hope

Australia is poised to play a crucial role in alleviating the EU’s rapeseed shortage. Forecasts suggest that Australian canola exports could reach 4.1 million tonnes in the upcoming crop year. This figure underscores Australia’s growing importance in the global oilseed trade, with 50-70% of its canola exports typically destined for the EU market.

- Projected Australian canola exports: 4.1 million tonnes

- Percentage of exports to EU: 50-70%

Our satellite-based crop monitoring at Farmonaut has been tracking Australian canola fields, providing real-time insights into crop health and potential yields. This data is crucial for both exporters and importers in planning their trade strategies.

Ukraine’s Resilience: Rapeseed Export Projections

Despite ongoing geopolitical challenges, Ukraine is showing remarkable resilience in its agricultural sector. Projections indicate a 22% increase in rapeseed exports to the EU for the 2024-25 crop year, with estimates ranging from 3.4 to 3.6 million tonnes.

- Projected increase in Ukrainian rapeseed exports: 22%

- Estimated export volume: 3.4 – 3.6 million tonnes

This increase is a testament to the adaptability of Ukrainian farmers and the global agricultural supply chain. At Farmonaut, we’ve been using our advanced satellite technology to monitor crop progress in Ukraine, providing valuable data on potential yields and harvest timings.

Canada’s Canola Conundrum

While Australia and Ukraine are stepping up to meet EU demand, Canada is facing its own set of challenges. The forecast for Canadian canola production stands at 17.8 million tonnes, marking the lowest output since 2021-22. This decline, coupled with increased domestic crushing levels, is expected to limit Canada’s export capabilities.

- Projected Canadian canola production: 17.8 million tonnes

- Lowest production since: 2021-22

The situation in Canada highlights the intricate balance of global oilseed trade. As one major exporter faces constraints, others must fill the gap to meet global demand. This dynamic underscores the importance of accurate, real-time crop monitoring, which is where Farmonaut’s satellite-based solutions excel.

“Canada’s declining canola production and increased domestic crush may tighten global supplies, affecting trade dynamics.”

Biodiesel Demand Impact on Oilseeds: A Double-Edged Sword

The growing demand for biodiesel continues to be a significant driver in the oilseed market. The EU’s ambitious targets for renewable energy in transportation have created a robust market for rapeseed oil, the preferred feedstock for European biodiesel production.

- EU’s average rapeseed crush requirements: 25 million tonnes

- Estimated import needs: 7 million tonnes

This sustained demand for biodiesel is a double-edged sword for the oilseed industry. While it provides a steady market for rapeseed and canola, it also puts pressure on supplies, potentially driving up prices and creating competition between food and fuel uses.

Vegetable Oil Price Analysis: A Complex Picture

The interplay between biodiesel demand and oilseed supply constraints is reflected in the complex dynamics of vegetable oil prices. Our analysis at Farmonaut indicates a steep backwardation in rapeseed oil futures contracts, particularly for the August-September-October period.

- Current crop contracts trading at a premium

- Future contracts (ASO) showing significant discounts

- Potential squeeze on biodiesel producer margins

This price structure reflects market concerns about rapeseed availability leading into the 2025-26 crop year. It also presents challenges for biodiesel producers, who may face tighter margins as they navigate these price differentials.

Oilseed Supply Challenges: A Global Perspective

The challenges facing the EU rapeseed market are part of a broader global context of oilseed supply constraints. Factors such as climate change, shifting agricultural practices, and geopolitical tensions are all contributing to a complex and sometimes unpredictable supply situation.

At Farmonaut, our satellite-based crop monitoring and AI-driven analytics are helping farmers and agribusinesses navigate these challenges. By providing real-time data on crop health, soil moisture, and potential yields, we’re enabling more informed decision-making across the oilseed supply chain.

For those interested in leveraging our technology for their own operations, we offer flexible API access to our satellite and weather data. Learn more about our API capabilities and check out our developer documentation.

Rapeseed Oil Futures Market: Indicators of Future Trends

The rapeseed oil futures market provides valuable insights into industry expectations and potential future trends. Current market structures suggest:

- Short-term supply tightness reflected in higher nearby contract prices

- Expectations of improved supply in the medium term, as seen in lower-priced forward contracts

- Potential volatility as the market adjusts to changing supply-demand dynamics

These market indicators are crucial for stakeholders across the oilseed industry, from farmers planning their crop rotations to processors managing their procurement strategies. At Farmonaut, we combine these market insights with our satellite-based crop monitoring to provide a comprehensive view of the oilseed landscape.

Canola Trade Flow Dynamics: A Shifting Landscape

The global canola trade is experiencing significant shifts in response to the supply challenges and changing demand patterns. Key trends include:

- Increased reliance on Australian and Ukrainian exports to meet EU demand

- Potential redirection of Canadian exports to markets offering premium prices for non-GMO canola

- Growing importance of emerging markets like China and Mexico in shaping global trade flows

These changing trade dynamics underscore the need for accurate, real-time data on crop production and market trends. Farmonaut’s satellite-based monitoring and AI-driven analytics are at the forefront of providing this crucial information to industry stakeholders.

EU Oilseed Import Requirements: Bridging the Gap

With domestic production falling short of demand, the EU’s oilseed import requirements are set to play a crucial role in shaping global trade flows. Our analysis suggests:

- EU may need to import around 7 million tonnes of rapeseed and canola

- Diversification of import sources to mitigate supply risks

- Potential for increased imports of alternative oilseeds to supplement rapeseed shortfall

Meeting these import requirements will require careful coordination across the global oilseed supply chain. Farmonaut’s technology is helping to facilitate this coordination by providing real-time insights into crop progress and potential yields across major producing regions.

Comparative Analysis of Global Rapeseed/Canola Market Dynamics 2024-25

| Country/Region | Estimated Production (million tonnes) | Export Forecast (million tonnes) | Domestic Crush Capacity (million tonnes) | Biodiesel Demand Impact | Trade Policy Influence |

|---|---|---|---|---|---|

| EU | 17.0 | 0.3 | 25.0 | High | Strong |

| Australia | 5.5 | 4.1 | 1.3 | Low | Moderate |

| Ukraine | 4.0 | 3.5 | 0.5 | Medium | Strong |

| Canada | 17.8 | 8.5 | 9.0 | Medium | Strong |

This comparative analysis highlights the complex interplay of production, export, and domestic consumption factors shaping the global rapeseed and canola markets. It underscores the importance of a holistic approach to market analysis, combining production data with trade policy considerations and demand drivers like biodiesel production.

The Role of Technology in Navigating Market Challenges

As the oilseed industry grapples with these complex market dynamics, technology is playing an increasingly crucial role in decision-making processes. Farmonaut’s satellite-based crop monitoring and AI-driven analytics are at the forefront of this technological revolution in agriculture.

- Real-time crop health monitoring allows for early identification of potential yield issues

- AI-based yield prediction models help in forecasting production levels more accurately

- Blockchain-based traceability solutions enhance supply chain transparency and efficiency

By leveraging these technologies, stakeholders across the oilseed industry can make more informed decisions, from planting and harvesting to trading and processing.

Looking Ahead: Future Trends and Considerations

As we look towards the future of the global rapeseed and canola markets, several key trends and considerations emerge:

- Continued growth in biodiesel demand, driven by renewable energy policies

- Increasing importance of sustainability and traceability in oilseed supply chains

- Potential for new production regions to emerge as traditional areas face challenges

- Growing role of technology in optimizing production and streamlining trade flows

At Farmonaut, we’re committed to staying at the forefront of these trends, continually refining our technology to provide the most accurate and actionable insights to our users.

Conclusion: Navigating the Complexities of the Global Oilseed Market

The EU rapeseed supply crunch and its ripple effects across the global canola market underscore the interconnected nature of today’s agricultural markets. As supply challenges in one region create opportunities in others, stakeholders across the industry must remain agile and informed to navigate these complex dynamics successfully.

Farmonaut’s advanced satellite-based monitoring and AI-driven analytics are powerful tools in this landscape, providing real-time insights that can inform decision-making at every level of the oilseed supply chain. Whether you’re a farmer looking to optimize your crop management, a trader seeking to anticipate market trends, or a policymaker working to ensure food security, our technology can provide the data and insights you need.

To learn more about how Farmonaut can support your operations in the oilseed industry, explore our web application or get in touch with our team today.

FAQ Section

Q: How will the EU rapeseed production shortfall impact global oilseed markets?

A: The EU’s reduced rapeseed production is expected to increase import demand, potentially driving up global prices and reshaping trade flows, with countries like Australia and Ukraine likely to play larger roles in supplying the EU market.

Q: What factors are contributing to Canada’s declining canola production?

A: Canada’s canola production is being affected by a combination of factors, including weather conditions, crop rotation practices, and increased domestic crushing capacity, which is reducing the volume available for export.

Q: How is the growing demand for biodiesel affecting the oilseed market?

A: The increasing demand for biodiesel, particularly in the EU, is creating sustained demand for rapeseed oil, which can put pressure on supplies and potentially drive up prices, affecting both food and fuel markets.

Q: What role does satellite technology play in monitoring global oilseed production?

A: Satellite technology, like that used by Farmonaut, allows for real-time monitoring of crop health, soil moisture levels, and potential yields across vast areas, providing valuable insights for farmers, traders, and policymakers in the oilseed industry.

Q: How might changing trade policies affect global canola market trends?

A: Trade policies, such as tariffs or blending mandates, can significantly impact market dynamics by altering the competitiveness of different suppliers or changing demand patterns in key importing countries.

Farmonaut Subscriptions

By leveraging Farmonaut’s advanced satellite-based monitoring and AI-driven analytics, stakeholders in the oilseed industry can gain valuable insights to navigate the complex landscape of global rapeseed and canola markets. Our technology provides real-time data on crop health, yield predictions, and market trends, empowering users to make informed decisions in an ever-changing agricultural environment.

To explore how Farmonaut can support your operations in the oilseed industry, visit our web application or download our mobile apps today:

Stay ahead of the curve in the rapidly evolving world of global oilseed trade with Farmonaut’s cutting-edge technology and insights.