Italian Agricultural Credit Crunch: Challenges and Solutions for Farm Modernization in 2025

“Italian agricultural funding decreased from €43 billion in 2010 to €39.5 billion in 2023, highlighting a significant credit crunch.”

As we delve into the intricate landscape of Italian agriculture in 2025, we find ourselves at a critical juncture. The agricultural sector, a cornerstone of Italy’s economy and cultural heritage, faces unprecedented challenges in accessing credit. This credit shortage threatens to impede farm modernization efforts and jeopardize the future of Italian farming. In this comprehensive analysis, we’ll explore the complexities of the Italian agricultural credit crunch, its far-reaching implications, and potential solutions to overcome these obstacles.

The Current State of Italian Agricultural Credit

The “Credito e Finanza 2025” forum in Rome recently shed light on alarming trends in agricultural lending. Overall funding in the sector has experienced a significant contraction, declining from €43 billion in 2010 to €39.5 billion in 2023. This represents an average annual decline of 2.5% over the past five years, painting a concerning picture for the future of Italian agriculture.

Perhaps even more worrying is the sharp decline in land credit, which has plummeted by 40% between 2009 and 2023. Land credit is crucial for long-term investments such as land acquisition and machinery purchases, making this decline particularly problematic for farm modernization efforts.

Factors Contributing to the Credit Crunch

Several interrelated factors appear to be driving this credit shortage:

- Rising land prices: The increasing cost of agricultural land makes it more difficult for farmers to secure loans for expansion or modernization.

- Decrease in post-crisis lending programs: Following the global financial crisis, many lending initiatives have been scaled back, leaving a gap in agricultural financing.

- Inadequate guarantee systems: The current system disadvantages agricultural businesses, making it harder for them to secure loans compared to other sectors.

- Bureaucratic hurdles: Complex banking procedures and requirements create additional obstacles for farmers seeking credit.

These factors combine to create a challenging environment for Italian farmers and agricultural producers, limiting their ability to invest in modern equipment, adopt new technologies, and expand their operations.

Impact on Farm Modernization and Long-term Growth

“Land credit in Italian agriculture has plummeted by 40%, severely impacting farm modernization and long-term investments.”

The credit crunch has far-reaching consequences for the Italian agricultural sector. Without access to adequate financing, farmers struggle to:

- Invest in modern machinery and equipment

- Adopt precision agriculture techniques

- Implement sustainable farming practices

- Expand operations to achieve economies of scale

- Respond effectively to market pressures and changing consumer demands

This lack of investment in modernization threatens to erode the competitiveness of Italian agriculture on the global stage. As other countries embrace cutting-edge technologies and sustainable practices, Italian farmers risk falling behind without the necessary financial resources to keep pace.

European Counterparts: Innovative Solutions to Agricultural Financing

While Italy grapples with its agricultural credit challenges, other European countries have implemented innovative solutions to support their farming sectors. Let’s examine some of these approaches:

Germany: Public Banks and Zero-Interest Loans

Germany has established a public bank dedicated to agricultural financing. This institution offers zero-interest loans to farmers, providing them with affordable access to capital for modernization and expansion projects. This approach helps to mitigate the impact of rising land prices and ensures that farmers can make long-term investments in their operations.

France: Crop-Based Securities for Short-Term Credit

In France, farmers can obtain short-term credit using securities guarantees based on future crops. This innovative system allows farmers to access financing without requiring real estate mortgages, making it easier to secure operating credit for day-to-day expenses such as purchasing seeds and fertilizers.

These examples demonstrate that alternative approaches to agricultural financing can effectively support farmers and promote sector growth. Italy could potentially adapt and implement similar strategies to address its own credit challenges.

Italian Initiatives to Support the Agricultural Sector

While the credit situation remains challenging, Italy has implemented several initiatives to support its agricultural sector:

- Ismea programs: This public institute periodically launches initiatives to facilitate land purchases by young farmers, helping to address the generational gap in agriculture.

- Agea risk management fund: The agricultural payments agency recently announced a 101 million euro fund for risk management, with nearly 52 million euros earmarked for the wine sector.

- Agricat mutual fund: An additional 10 million euros has been allocated to this fund to provide further support to farmers.

- Law 100/2023: This legislation provides funds for agricultural businesses affected by recent floods and allocates resources to animal husbandry.

While these resources are vital, concerns persist that they may be insufficient to address the long-term challenges facing Italian agriculture. Many of these initiatives focus on providing emergency assistance rather than fostering sustained growth and modernization.

Potential Solutions for the Future of Italian Agricultural Credit

To address the credit crunch and support farm modernization, Italy could consider implementing a range of solutions:

- Establish a dedicated agricultural bank: Following Germany’s example, Italy could create a public bank focused on providing low-interest loans to farmers.

- Develop crop-based securities: Implementing a system similar to France’s could help farmers access short-term credit more easily.

- Streamline bureaucratic processes: Simplifying loan application procedures and requirements could make it easier for farmers to access credit.

- Enhance guarantee systems: Improving the guarantee system for agricultural businesses could help level the playing field with other sectors.

- Promote public-private partnerships: Collaborating with private financial institutions could help increase the availability of credit to farmers.

- Invest in agricultural technology: Supporting the adoption of precision agriculture techniques could improve farm productivity and profitability, making farmers more attractive to lenders.

Implementing these solutions could help revitalize Italian agricultural credit and support the sector’s long-term growth and modernization efforts.

The Role of Technology in Addressing Agricultural Credit Challenges

As we look towards the future of Italian agriculture, technology will play a crucial role in addressing credit challenges and promoting farm modernization. Advanced agricultural technologies can help farmers improve productivity, reduce costs, and demonstrate creditworthiness to lenders.

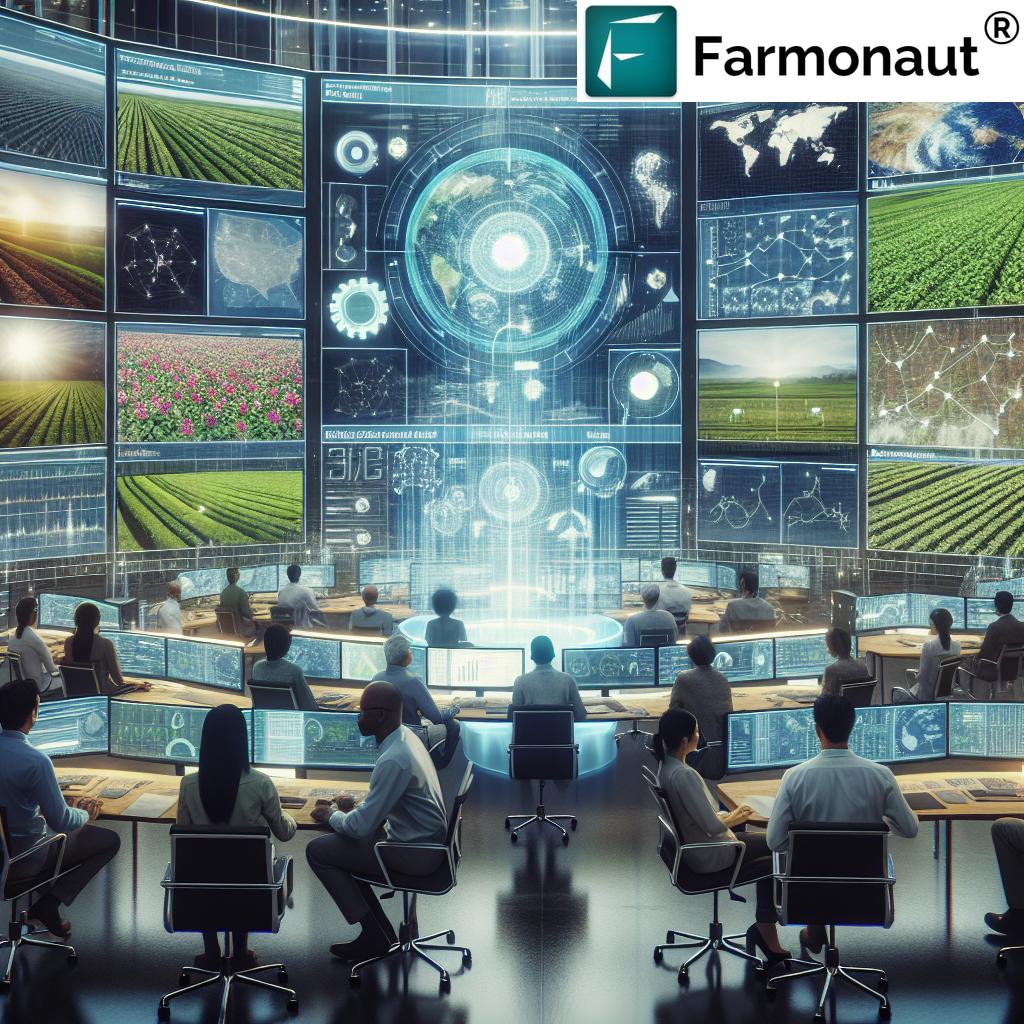

One such technology solution is Farmonaut, a pioneering agricultural technology company that offers advanced, satellite-based farm management solutions. Farmonaut’s platform provides valuable services such as real-time crop health monitoring, AI-based advisory systems, and resource management tools.

By leveraging Farmonaut’s technologies, Italian farmers can:

- Optimize crop yields and reduce resource wastage

- Make data-driven decisions about irrigation, fertilizer usage, and pest management

- Demonstrate improved farm productivity to potential lenders

- Access personalized farm advisory services through the Jeevn AI system

These technological advancements can help Italian farmers become more efficient and profitable, potentially improving their access to credit and supporting long-term modernization efforts.

Comparative Analysis: Italy vs. European Counterparts

| Country | Agricultural Credit Volume (2023 est.) | Land Credit Change (2010-2023 est.) | Key Credit Support Measures |

|---|---|---|---|

| Italy | €39.5 billion | -40% | Ismea and Agea programs |

| Germany | €55 billion | +5% | Public bank offering zero-interest loans |

| France | €52 billion | Stable (0%) | Crop-based securities for short-term credit |

| European Average | €48 billion | -10% | Varied measures across countries |

This comparative analysis highlights the challenges faced by Italian agriculture compared to its European counterparts. While Germany and France have maintained stable or growing agricultural credit volumes, Italy has experienced a significant decline. This underscores the need for innovative solutions to revitalize Italian agricultural financing.

The Importance of Sustainable Farming Practices

As we address the credit crunch and push for farm modernization, it’s crucial to emphasize the importance of sustainable farming practices. Lenders and policymakers are increasingly prioritizing environmentally friendly agricultural methods, making sustainability a key factor in accessing credit.

Farmonaut’s carbon footprinting feature can help Italian farmers track and reduce their environmental impact. By providing real-time data on emissions, this tool allows farmers to take steps towards sustainability and improve their chances of securing loans focused on eco-friendly practices.

Addressing Risk Management in Agriculture

One of the key factors affecting agricultural credit availability is risk management. Lenders are often hesitant to provide loans to farmers due to the inherent risks in agriculture, such as unpredictable weather patterns and market fluctuations.

Farmonaut’s crop loan and insurance solutions can play a crucial role in mitigating these risks. By providing satellite-based verification for crop loans and insurance, Farmonaut helps reduce the likelihood of fraud and improves access to financing for farmers. This technology can be particularly beneficial in the Italian context, where improved risk management could help unlock additional credit for the agricultural sector.

Empowering Young Farmers and Promoting Generational Renewal

Addressing the agricultural credit crunch also involves supporting young farmers and facilitating generational renewal in the sector. Ismea’s programs for young farmers are a step in the right direction, but more comprehensive support may be needed.

Farmonaut’s user-friendly platform and mobile apps make it easier for young farmers to adopt modern agricultural practices. By providing access to advanced technologies through affordable subscriptions, Farmonaut helps lower the barrier to entry for new farmers and supports the long-term sustainability of Italian agriculture.

The Role of Data-Driven Decision Making

In the face of credit challenges, data-driven decision making becomes even more critical for Italian farmers. Accurate, real-time data can help farmers optimize their operations, reduce costs, and demonstrate their creditworthiness to lenders.

Farmonaut’s large-scale farm management solutions provide farmers with comprehensive data on crop health, soil moisture, and weather patterns. This information enables farmers to make informed decisions about resource allocation, potentially improving their profitability and making them more attractive to lenders.

Conclusion: A Path Forward for Italian Agricultural Credit

The Italian agricultural credit crunch presents significant challenges for farm modernization and the future of the sector. However, by learning from European counterparts, leveraging technology solutions like Farmonaut, and implementing innovative financing strategies, Italy can overcome these obstacles and build a more resilient and modern agricultural sector.

Key steps for addressing the credit shortage and supporting Italian agriculture include:

- Establishing dedicated agricultural financing institutions

- Implementing crop-based securities for short-term credit

- Streamlining bureaucratic processes for loan applications

- Investing in agricultural technology and precision farming techniques

- Promoting sustainable farming practices

- Supporting young farmers and facilitating generational renewal

- Emphasizing data-driven decision making in farm management

By taking these steps and embracing innovative solutions, Italy can revitalize its agricultural credit landscape and ensure a bright future for its farming sector. The challenges are significant, but with determination, creativity, and the right technological tools, Italian agriculture can overcome the credit crunch and thrive in the years to come.

FAQ Section

- Q: What is causing the agricultural credit crunch in Italy?

A: The credit crunch is caused by factors such as rising land prices, a decrease in post-crisis lending programs, inadequate guarantee systems, and bureaucratic hurdles in the banking system. - Q: How has agricultural credit in Italy changed since 2010?

A: Overall funding in the Italian agricultural sector has decreased from €43 billion in 2010 to €39.5 billion in 2023, representing an average annual decline of 2.5% over the last five years. - Q: What solutions have other European countries implemented to support agricultural financing?

A: Germany has established a public bank offering zero-interest loans to farmers, while France allows farmers to obtain short-term credit using securities guarantees based on future crops. - Q: How can technology help address the agricultural credit challenges in Italy?

A: Technologies like Farmonaut’s satellite-based farm management solutions can help farmers optimize crop yields, reduce costs, and demonstrate improved productivity to potential lenders. - Q: What initiatives has Italy implemented to support its agricultural sector?

A: Italy has implemented programs through Ismea to facilitate land purchases by young farmers, established risk management funds through Agea, and provided support for flood-affected businesses through Law 100/2023.

Experience the future of agriculture with Farmonaut: