Global Wheat Futures Surge: Black Sea Frost Fears and USDA Report Impact on Agricultural Markets

“Chicago wheat futures hit a multi-year high, with corn and soy futures reaching multi-month peaks in volatile agricultural markets.”

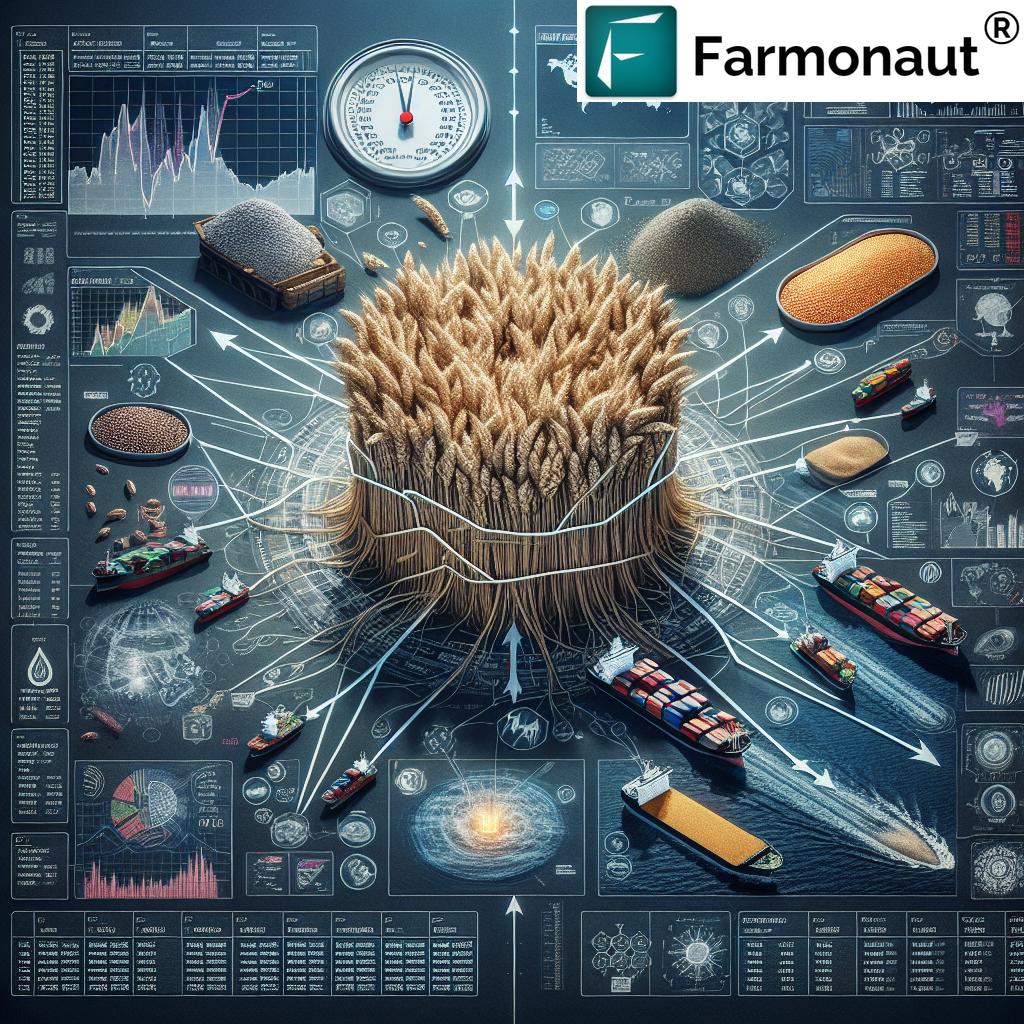

In the ever-evolving landscape of agricultural commodities, we find ourselves amidst a period of significant market volatility. The recent surge in global wheat futures has sent ripples through the industry, with implications that extend far beyond the wheat fields. As we delve into this complex situation, we’ll explore the factors driving these changes and their potential impacts on farmers, traders, and consumers worldwide.

The Perfect Storm: Black Sea Frost Fears and Market Dynamics

On February 7, 2024, the agricultural world witnessed a remarkable event as Chicago wheat futures skyrocketed to levels not seen since October 2021. This dramatic increase was primarily fueled by growing concerns over potential crop damage in the Black Sea region due to unexpected cold weather. The sudden shift caught many speculators off guard, triggering a wave of short-covering among those who had been betting on declining prices.

As of the latest data, wheat is now priced at $5.90-1/2 a bushel, representing a substantial 5% increase over the week. This significant jump has caught the attention of investors and market analysts alike, who are closely monitoring the situation for further developments.

Corn and Soy: Following Wheat’s Upward Trajectory

The ripple effects of the wheat market’s volatility have extended to other key agricultural commodities. Both corn and soy futures are holding steady near multi-month highs, reflecting broader trends in the agricultural sector:

- Corn: Experienced a slight increase of 0.1% to $4.95-3/4 a bushel, marking a weekly gain of 1.8%.

- Soybeans: Mirrored corn’s trend, also rising by 0.1% to $10.61-3/4 a bushel, representing an impressive 2.8% advancement since the previous Friday.

Earlier in the week, corn prices reached a peak of $4.98-1/2, the highest since October 2023, while soybeans touched $10.79-3/4, marking their most elevated point since July 2023.

The Black Sea Conundrum: Weather Woes and Export Quotas

At the heart of the current market turmoil lies the Black Sea region, a crucial area for global wheat production. The forecast of colder temperatures for Russia and Ukraine has raised alarms about potential frost damage to wheat crops, which have been vulnerable due to an unusually mild winter. This weather-related uncertainty is adding significant volatility to wheat pricing.

Compounding these concerns is Russia’s impending implementation of a restrictive export quota. This move is expected to slow shipments from the Black Sea in the coming months, further exacerbating global supply worries. The combination of potential crop damage and reduced exports from this key region is creating a perfect storm of market uncertainty.

The USDA Report: A Pivotal Moment for Market Direction

As market participants grapple with these developments, all eyes are turning to the upcoming monthly supply-demand report from the U.S. Department of Agriculture (USDA). Set to be released on Tuesday, this report is expected to significantly influence market movements and shape trading strategies in the grain futures market.

The USDA report’s importance cannot be overstated, as it provides crucial insights into global agricultural production, consumption, and trade. Traders and analysts will be scrutinizing the data for any indications of how the recent weather events and export policies might impact the global wheat supply chain.

Market Pressures and Shifting Sentiments

Despite the overall upward momentum in wheat prices, it’s important to note that the market is still facing pressure from weak demand and an abundance of inexpensive shipments from the Black Sea. However, expectations of dwindling supply are beginning to shift market sentiments, creating a complex and dynamic trading environment.

This interplay between bearish and bullish factors highlights the need for sophisticated market analysis and risk management strategies. For farmers and traders navigating these turbulent waters, access to real-time data and expert insights has never been more crucial.

The Broader Economic Context

While agricultural commodities are experiencing significant volatility, it’s essential to consider the broader economic landscape. U.S. equities have shown mixed performance in recent trading sessions, with fluctuating earnings reports contributing to market uncertainty. However, there has been some stabilization in commodity markets, particularly in gold, as apprehensions related to escalating trade conflicts around tariffs have eased somewhat.

This interconnectedness of global markets underscores the importance of a holistic approach to agricultural trading and risk management. Factors such as currency fluctuations, trade policies, and global economic indicators all play a role in shaping the agricultural commodity landscape.

Navigating Market Volatility with Technology

In these uncertain times, farmers and traders are increasingly turning to technological solutions to gain a competitive edge. Platforms like Farmonaut offer valuable tools for crop monitoring and market analysis, helping agricultural professionals make informed decisions in a rapidly changing environment.

Farmonaut’s satellite-based crop monitoring technology provides real-time insights into crop health and development, allowing farmers to optimize their production strategies. This data-driven approach can be particularly valuable when dealing with weather-related uncertainties, such as the frost concerns currently affecting the Black Sea region.

For traders and analysts, Farmonaut’s API offers access to comprehensive agricultural data, enabling more accurate forecasting and risk assessment. By leveraging these technological tools, market participants can better navigate the complexities of the current agricultural commodity landscape.

Looking Ahead: Key Factors to Watch

As we move forward, several key factors will continue to shape the agricultural commodity markets:

- Weather Patterns: Ongoing monitoring of weather conditions in key growing regions, particularly the Black Sea area, will be crucial for predicting potential impacts on crop yields.

- Export Policies: The implementation and effects of Russia’s export quota will be closely watched for its impact on global wheat supply.

- USDA Reports: Future USDA supply-demand reports will continue to provide important benchmarks for market analysis.

- Global Demand: Changes in global wheat consumption patterns and import demands from major buyers will influence price trends.

- Trade Dynamics: Any shifts in international trade policies or relationships could have significant implications for agricultural commodity flows.

The Role of Technology in Modern Agriculture

As the agricultural sector faces these complex challenges, the role of technology in farming and trading becomes increasingly important. Farmonaut’s suite of tools exemplifies how modern technology can provide crucial support to the agricultural industry:

- Satellite-Based Crop Monitoring: By utilizing multispectral satellite imagery, farmers can gain real-time insights into crop health, soil moisture levels, and other critical metrics. This data-driven approach allows for more precise decision-making in irrigation, fertilizer usage, and pest management.

- AI-Powered Advisory Systems: Advanced AI tools like Farmonaut’s Jeevn AI provide personalized farm advisory services, delivering real-time insights and expert crop management strategies tailored to specific farm conditions.

- Blockchain-Based Traceability: For industries concerned with supply chain transparency, blockchain technology offers a secure and verifiable way to track agricultural products from farm to consumer.

- Resource Management Tools: Efficient management of agricultural resources, including fleet and machinery, is crucial for optimizing operations and reducing costs.

By leveraging these technological advancements, farmers and agribusinesses can better navigate market volatility and improve their overall resilience to external shocks.

Global Implications of Wheat Market Volatility

The current surge in wheat futures prices has far-reaching implications that extend beyond the immediate agricultural sector:

- Food Security: As a staple food for billions of people worldwide, fluctuations in wheat prices can have significant impacts on global food security, particularly in import-dependent countries.

- Economic Ripple Effects: Changes in agricultural commodity prices can affect inflation rates, trade balances, and economic growth in both exporting and importing nations.

- Policy Responses: Governments and international organizations may need to consider policy interventions to address food price volatility and ensure stable supply chains.

- Investment Strategies: The agricultural commodity market’s volatility presents both risks and opportunities for investors, potentially leading to shifts in global investment patterns.

“Russia’s impending export quota and potential frost damage in the Black Sea region could significantly reduce global wheat supply.”

Comparative Analysis: Wheat Futures Across Regions

To provide a clearer picture of the global wheat market situation, let’s examine a comparative analysis of wheat futures prices across different regions:

| Region | Current Price (est.) | Previous Month’s Price (est.) | Year-to-Date Change (%) | Factors Influencing Price |

|---|---|---|---|---|

| Chicago (CBOT) | $5.90-1/2 per bushel | $5.62 per bushel | +5.0% | Black Sea frost fears, USDA report anticipation |

| Black Sea Region | $5.85 per bushel | $5.70 per bushel | +2.6% | Cold weather concerns, Russian export quota |

| European Union | €220 per tonne | €215 per tonne | +2.3% | Global supply concerns, domestic demand |

| Australia | AUD 380 per tonne | AUD 370 per tonne | +2.7% | Export opportunities, currency fluctuations |

This table illustrates the interconnected nature of global wheat markets and how regional factors can influence prices across different exchanges. The Chicago Board of Trade (CBOT) prices serve as a global benchmark, but each region has its unique dynamics that contribute to price variations.

The Impact on Farmers and Agricultural Practices

For farmers, the current market volatility presents both challenges and opportunities. Higher wheat prices can potentially lead to increased revenues, but they also come with greater risks and uncertainties. In this environment, adopting precision agriculture techniques and leveraging data-driven insights becomes crucial for maximizing yields and managing risks effectively.

Farmonaut’s satellite-based crop monitoring technology can play a vital role in helping farmers navigate these challenges. By providing real-time data on crop health, soil conditions, and weather patterns, Farmonaut enables farmers to make informed decisions about planting, irrigation, and harvesting strategies. This level of precision can be particularly valuable when dealing with the unpredictable weather conditions that are currently affecting major wheat-producing regions.

Trading Strategies in a Volatile Market

For traders and investors in the agricultural commodities market, the current situation calls for careful strategy and risk management. Some key considerations include:

- Diversification: Spreading investments across different agricultural commodities can help mitigate risks associated with volatility in any single market.

- Hedging: Utilizing futures contracts and options can provide protection against adverse price movements.

- Stay Informed: Keeping abreast of global weather patterns, trade policies, and market reports is crucial for making informed trading decisions.

- Technical Analysis: Employing chart analysis and technical indicators can help identify potential entry and exit points in the market.

- Fundamental Analysis: Understanding the underlying supply and demand dynamics remains essential for long-term investment strategies.

Farmonaut’s API and data services can provide traders with valuable insights into crop conditions and potential yield forecasts, enhancing their ability to make informed trading decisions. Access to such real-time, data-driven information can be a significant advantage in today’s fast-moving markets.

The Future of Wheat Production and Global Food Security

Looking beyond the current market volatility, it’s important to consider the long-term implications for global wheat production and food security. Climate change and geopolitical factors continue to pose challenges to stable wheat supplies, underscoring the need for resilient and adaptive agricultural practices.

Innovations in crop genetics, precision agriculture, and sustainable farming methods will play crucial roles in ensuring future food security. Technologies like those offered by Farmonaut, which enable more efficient and data-driven farming practices, will be instrumental in helping the agricultural sector adapt to these challenges.

Conclusion: Navigating Uncertainty with Technology and Insight

The current surge in wheat futures prices, driven by Black Sea frost fears and anticipation of the USDA report, highlights the complex and interconnected nature of global agricultural markets. As we’ve explored, factors ranging from weather patterns to trade policies can have significant impacts on commodity prices, with ripple effects felt throughout the global economy.

In this environment of uncertainty and volatility, the role of technology and data-driven insights becomes increasingly crucial. Platforms like Farmonaut offer valuable tools for farmers, traders, and policymakers to navigate these challenges more effectively. By leveraging satellite-based crop monitoring, AI-powered advisory systems, and comprehensive market data, stakeholders in the agricultural sector can make more informed decisions and better manage risks.

As we look to the future, the ability to adapt to changing conditions and leverage technological innovations will be key to ensuring stable food supplies and sustainable agricultural practices. Whether you’re a farmer looking to optimize your crop yields, a trader seeking to navigate market volatility, or a policymaker concerned with food security, staying informed and embracing technological solutions will be essential for success in the ever-evolving landscape of global agriculture.

FAQ Section

- Q: What is causing the current surge in wheat futures prices?

A: The surge is primarily driven by fears of potential crop damage due to cold weather in the Black Sea region and anticipation of the upcoming USDA supply-demand report. - Q: How are corn and soybean markets affected by the wheat price surge?

A: Corn and soybean futures have also reached multi-month highs, reflecting broader trends in agricultural commodities and interconnected market dynamics. - Q: What impact could Russia’s export quota have on global wheat supply?

A: Russia’s impending export quota is expected to slow shipments from the Black Sea region, potentially reducing global wheat supply and contributing to price volatility. - Q: How can farmers use technology like Farmonaut to navigate market uncertainties?

A: Farmonaut’s satellite-based crop monitoring and AI-powered advisory systems provide real-time data and insights, helping farmers make informed decisions about crop management and resource allocation. - Q: What are the long-term implications of current market volatility for global food security?

A: The current situation highlights the need for resilient and adaptive agricultural practices, emphasizing the importance of technological innovations and sustainable farming methods to ensure future food security.

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

As we conclude this comprehensive analysis of the global wheat futures surge and its implications, we encourage readers to stay informed and consider how technological solutions like Farmonaut can provide valuable support in navigating these complex market dynamics. Whether you’re a farmer, trader, or simply interested in agricultural trends, the tools and insights available today can help you make more informed decisions in an increasingly interconnected world.

You’re a star!