Unlocking Investor Insights: Q4 Stock Performance and Portfolio Management Strategies

In the ever-evolving landscape of stock market analysis and investment portfolio management, understanding the intricate dynamics of major players like Alphabet Inc. (NASDAQ:GOOG) is crucial. As we delve into the latest quarterly earnings reports and institutional investor strategies, we’ll uncover valuable insights that shape the company’s performance and market capitalization trends.

“A key investor increased their stake by 0.9%, reflecting growing confidence in the company’s performance.”

Our comprehensive analysis will explore significant stake changes, including a notable 0.9% increase by a key investor and substantial holdings by major asset management firms. We’ll examine crucial financial metrics such as price-to-earnings ratio, dividend yield calculations, and hedge fund holdings to provide a holistic view of Alphabet’s market position.

Q4 Stock Performance Overview

Alphabet Inc., the information services provider behind Google, has demonstrated impressive market capitalization and financial performance in the fourth quarter. Let’s break down the key elements that have contributed to its robust standing:

- Market Capitalization: $2.14 trillion

- Price-to-Earnings (P/E) Ratio: 21.83

- Beta Value: 1.03

- 52-Week Low: $134.80

- 52-Week High: $208.70

These figures paint a picture of a company with substantial market presence and relatively stable stock performance. The P/E ratio of 21.83 suggests that investors are willing to pay a premium for Alphabet’s earnings, indicating confidence in the company’s future growth prospects.

Institutional Investor Movements

The fourth quarter saw significant activity among institutional investors, with several key players adjusting their stakes in Alphabet. Here’s a closer look at some notable changes:

| Investor Name | Percentage Stake | Stake Change (Q4) | Total Holdings Value | P/E Ratio | Dividend Yield | Market Cap | Beta Value |

|---|---|---|---|---|---|---|---|

| NS Partners Ltd | 5.5% | +0.9% | $134,176,000 | 21.83 | 0.46% | $2.14T | 1.03 |

| FMR LLC | N/A | +5.2% | $19,193,768,000 | 21.83 | 0.46% | $2.14T | 1.03 |

| Geode Capital Management LLC | N/A | +0.3% | $17,247,208,000 | 21.83 | 0.46% | $2.14T | 1.03 |

| UBS Asset Management Americas LLC | N/A | +10.3% | $5,573,125,000 | 21.83 | 0.46% | $2.14T | 1.03 |

| Charles Schwab Investment Management Inc. | N/A | +2.9% | $5,870,181,000 | 21.83 | 0.46% | $2.14T | 1.03 |

NS Partners Ltd’s decision to increase its stake by 0.9% is particularly noteworthy, as it signals growing confidence in Alphabet’s performance. With Alphabet now comprising 5.5% of NS Partners Ltd’s investment portfolio, it has become their largest position.

Earnings Report Highlights

Alphabet’s recent earnings results have surpassed analysts’ estimates, further solidifying its strong financial position. Key takeaways from the quarterly report include:

- Earnings Per Share (EPS): $2.15, beating consensus estimates of $2.12

- Return on Equity: 32.49%

- Net Margin: 28.60%

These results demonstrate Alphabet’s ability to maintain profitability and exceed market expectations, which is crucial for sustaining investor confidence and driving stock performance.

Portfolio Management Strategies

In light of Alphabet’s strong performance, investors are adapting their portfolio management strategies. Here are some key approaches being employed:

- Increased Allocation: Many institutional investors are increasing their allocation to Alphabet, as evidenced by the stake increases we’ve observed.

- Diversification: While increasing exposure to Alphabet, savvy investors are also maintaining a diversified portfolio to mitigate risk.

- Long-term Holding: Given Alphabet’s consistent performance and strong market position, many investors are adopting a long-term holding strategy.

- Regular Rebalancing: To maintain desired portfolio allocations, investors are regularly rebalancing their holdings, especially after significant price movements.

These strategies reflect a balanced approach to capitalizing on Alphabet’s growth while managing overall portfolio risk.

“The company’s recent earnings results surpassed analysts’ estimates, demonstrating strong financial health.”

Market Capitalization and Growth Prospects

With a market capitalization of $2.14 trillion, Alphabet stands as one of the most valuable companies globally. This massive valuation is a testament to the company’s dominant market position and investor confidence in its future growth prospects.

Several factors contribute to Alphabet’s impressive market cap:

- Diverse Revenue Streams: Beyond its core search business, Alphabet has successfully diversified into areas like cloud computing, AI, and hardware.

- Innovation Leadership: Continuous investment in research and development keeps Alphabet at the forefront of technological advancements.

- Global Reach: Alphabet’s products and services have a vast international user base, providing stability and growth opportunities.

- Strong Financial Performance: Consistent revenue growth and high profit margins support the company’s valuation.

As we analyze these factors, it’s clear that Alphabet’s market capitalization is not just a reflection of its current success but also an indicator of anticipated future performance.

Dividend Yield and Shareholder Returns

While Alphabet is primarily known as a growth stock, it has recently introduced a dividend program, reflecting a maturing business model and commitment to shareholder returns. The current dividend yield stands at 0.46%, which, while modest, represents a new avenue for investor value.

Key points regarding Alphabet’s dividend strategy:

- Quarterly Dividend: $0.20 per share

- Annualized Dividend: $0.80 per share

- Ex-Dividend Date: March 10th

- Payment Date: March 17th

While the dividend yield is currently low compared to some traditional dividend stocks, it’s important to consider this in the context of Alphabet’s overall return potential, which includes significant capital appreciation.

Insider Trading and Corporate Governance

Insider trading activities can provide valuable insights into a company’s internal perspective. Recent notable transactions include:

- Director John L. Hennessy sold 1,500 shares at $194.22 per share, totaling $291,330.

- CAO Amie Thuener O’toole sold 1,374 shares at $173.47 per share, amounting to $238,347.78.

These insider sales, while significant, should be interpreted cautiously. They may be part of pre-planned trading programs or personal financial planning rather than a reflection on the company’s prospects.

It’s worth noting that insiders still own 12.99% of the company’s stock, indicating substantial alignment between management and shareholder interests.

Analyst Ratings and Price Targets

Wall Street analysts play a crucial role in shaping investor perceptions and expectations. Current analyst ratings for Alphabet reflect a generally positive outlook:

- 1 Sell rating

- 6 Hold ratings

- 14 Buy ratings

- 3 Strong Buy ratings

The average analyst rating is “Moderate Buy,” with a consensus price target of $209.13. This target represents potential upside from the current trading price, reflecting analysts’ confidence in Alphabet’s future performance.

Notable analyst comments include:

- Needham & Company LLC reaffirmed a “buy” rating.

- Wedbush reiterated an “outperform” rating with a price target of $220.00.

- Scotiabank raised their price target from $212.00 to $240.00, maintaining a “sector outperform” rating.

These ratings and price targets provide valuable context for investors considering their position in Alphabet stock.

Beta Value and Volatility

Alphabet’s beta value of 1.03 indicates that its stock price movements are closely aligned with the overall market. A beta of 1 suggests that a stock moves in line with the market, while values above 1 indicate higher volatility, and below 1 suggest lower volatility.

Implications of Alphabet’s beta value:

- Moderate Volatility: The stock is likely to experience price movements similar to the broader market.

- Balanced Risk Profile: Alphabet offers a mix of growth potential and relative stability.

- Portfolio Fit: The stock can serve as a core holding in diversified portfolios, offering exposure to tech sector growth with manageable volatility.

Understanding beta helps investors gauge the potential risk and return characteristics of Alphabet stock within their overall investment strategy.

Financial Regulatory Filings and Transparency

Alphabet’s commitment to transparency is evident in its timely and comprehensive financial regulatory filings. These documents provide crucial information for investors and analysts to assess the company’s financial health and compliance with securities regulations.

Key filings and their significance:

- 10-K Annual Report: Offers a detailed overview of the company’s business, risks, and audited financial statements.

- 10-Q Quarterly Reports: Provide interim financial statements and management discussion on a quarterly basis.

- 8-K Current Reports: Disclose significant events or corporate changes as they occur.

- Proxy Statements: Inform shareholders about corporate governance matters and items requiring a vote.

Regular analysis of these filings is essential for maintaining an up-to-date understanding of Alphabet’s financial position and corporate strategy.

Stock Trading Strategies for Alphabet

Given Alphabet’s market position and financial performance, investors employ various strategies when trading its stock. Here are some popular approaches:

- Long-Term Buy and Hold: Many investors view Alphabet as a core holding for long-term growth, given its strong market position and consistent performance.

- Dollar-Cost Averaging: Regularly investing fixed amounts can help mitigate the impact of short-term price fluctuations.

- Options Strategies: More advanced investors may use options to generate income or hedge their positions in Alphabet stock.

- Momentum Trading: Some traders focus on Alphabet’s price trends and trading volume to make short-term trading decisions.

- Event-Driven Trading: Trading around earnings releases or other significant company events can be a strategy for short-term gains.

It’s important to note that each strategy carries its own risk profile, and investors should choose an approach that aligns with their financial goals and risk tolerance.

Impact of Market Trends on Alphabet’s Performance

Alphabet’s stock performance is influenced by broader market trends and sector-specific factors. Understanding these dynamics is crucial for investors:

- Tech Sector Momentum: As a leading tech company, Alphabet often moves in tandem with the overall tech sector trends.

- Digital Advertising Market: Changes in digital ad spending directly impact Alphabet’s core business revenue.

- Regulatory Environment: Evolving tech regulations and antitrust concerns can affect investor sentiment towards Alphabet.

- Innovation in AI and Cloud Computing: Alphabet’s investments in these areas are closely watched as indicators of future growth potential.

- Global Economic Factors: As a multinational corporation, Alphabet is sensitive to global economic conditions and currency fluctuations.

Monitoring these trends helps investors contextualize Alphabet’s performance within the broader market landscape.

Conclusion: Navigating Alphabet’s Investment Landscape

As we’ve explored in this comprehensive analysis, Alphabet Inc. (NASDAQ:GOOG) continues to be a dominant force in the tech sector, attracting significant attention from institutional investors and analysts alike. The company’s robust financial performance, impressive market capitalization, and strategic positioning in high-growth areas underscore its appeal as an investment opportunity.

Key takeaways for investors:

- Strong Financial Metrics: With a P/E ratio of 21.83 and a beta of 1.03, Alphabet offers a balance of growth potential and relative stability.

- Institutional Confidence: Increased stakes by major investors like NS Partners Ltd signal ongoing faith in the company’s prospects.

- Analyst Optimism: The consensus “Moderate Buy” rating and upside price targets reflect positive sentiment among market experts.

- Dividend Introduction: While modest, the new dividend program adds an income component to Alphabet’s investment profile.

- Market Leadership: Alphabet’s $2.14 trillion market cap and strong position in digital advertising, cloud computing, and AI reinforce its market leadership.

As with any investment, it’s crucial to conduct thorough due diligence and consider how Alphabet fits within your overall portfolio strategy. The stock’s performance, while impressive, should be evaluated in the context of your personal financial goals, risk tolerance, and investment horizon.

By staying informed about Alphabet’s financial reports, analyst insights, and broader market trends, investors can make more educated decisions about their engagement with this tech giant’s stock. Whether you’re considering a long-term hold, active trading strategies, or portfolio rebalancing, Alphabet’s market presence and financial strength make it a compelling subject for ongoing investor attention and analysis.

FAQs

- What is Alphabet’s current dividend yield?

Alphabet’s current dividend yield is 0.46%, based on an annual dividend of $0.80 per share. - How does Alphabet’s P/E ratio compare to the industry average?

Alphabet’s P/E ratio of 21.83 is competitive within the tech sector, reflecting investor confidence in its earnings potential. - What percentage of Alphabet stock is owned by institutional investors?

According to recent filings, approximately 27.26% of Alphabet’s stock is owned by institutional investors. - How has Alphabet’s stock performed over the past year?

Alphabet’s stock has shown strong performance, with a 52-week range of $134.80 to $208.70, demonstrating significant growth potential. - What is the consensus analyst rating for Alphabet stock?

The consensus analyst rating for Alphabet is “Moderate Buy,” with an average price target of $209.13.

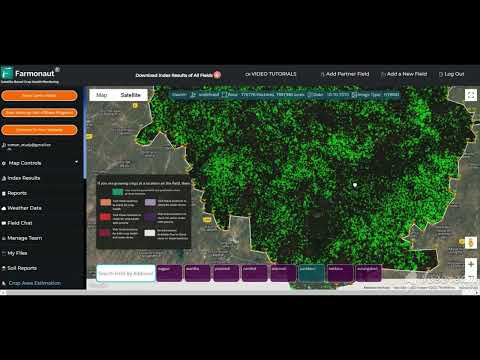

Earn With Farmonaut: Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For more information on Farmonaut’s API services, visit our API page or check out our API Developer Docs.