Mastering Agricultural Futures: Farmonaut’s Expert Guide to Risk Management and Market Analytics

“Agricultural futures trading can reduce price risk by up to 70% for farmers and agribusinesses.”

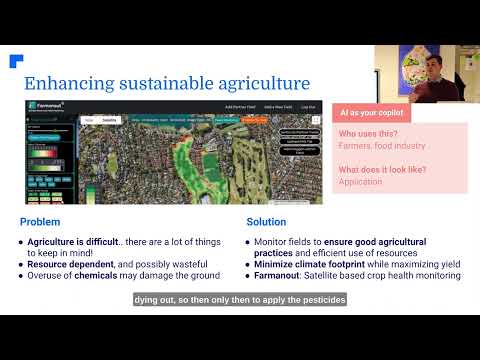

In the dynamic world of agriculture, mastering futures trading and risk management is crucial for success. At Farmonaut, we understand the complexities of agricultural markets and the importance of leveraging advanced analytics to make informed decisions. This comprehensive guide will explore the intricacies of agricultural futures trading, providing valuable insights into risk management strategies and market analytics tools that can help you optimize your agricultural portfolio.

Understanding Agricultural Futures Trading

Agricultural futures trading is a powerful tool for managing risk and capitalizing on market opportunities in the crop markets. As we delve into this topic, it’s essential to understand the fundamental concepts and mechanics of futures trading in agriculture.

- Futures Contracts: These are standardized agreements to buy or sell a specific quantity of an agricultural commodity at a predetermined price on a future date.

- Price Discovery: Futures markets play a crucial role in price discovery, helping farmers, traders, and consumers gauge future price trends.

- Risk Management: Futures contracts allow agricultural producers and consumers to hedge against price fluctuations, providing a level of certainty in an otherwise volatile market.

At Farmonaut, we provide real-time crop health monitoring and AI-based advisory systems that can complement your futures trading strategies. Our satellite-based farm management solutions offer valuable insights into crop conditions, which can inform your trading decisions.

Leveraging Market Analytics for Informed Trading

In today’s data-driven world, access to accurate and timely market analytics is crucial for success in agricultural futures trading. We at Farmonaut emphasize the importance of leveraging advanced analytics to gain a competitive edge in the global agricultural commodities exchange.

- Historical Data Analysis: Studying past market trends and patterns can provide valuable insights into potential future price movements.

- Real-Time Market Data: Access to live market data is essential for making quick, informed decisions in the fast-paced futures market.

- Crop Yield Forecasts: Accurate predictions of crop yields can significantly impact futures prices and trading strategies.

Our Jeevn AI Advisory System at Farmonaut analyzes satellite data and other inputs to generate customized advice, improving farm productivity and efficiency. This data can be invaluable when formulating your futures trading strategies.

Risk Management Strategies in Agricultural Futures

Effective risk management is at the heart of successful futures trading in agriculture. Let’s explore some key strategies that traders and farmers can employ to mitigate risks and optimize their portfolios.

- Hedging: This involves taking an opposite position in the futures market to offset potential losses in the physical market.

- Options Trading: Options provide the right, but not the obligation, to buy or sell a futures contract at a specified price, offering flexibility in risk management.

- Spread Trading: This strategy involves simultaneously buying and selling related futures contracts to capitalize on price differentials.

- Cross-Asset Hedging: Using futures contracts of related commodities to manage risk when a direct hedge is not available.

At Farmonaut, our satellite-based crop health monitoring can provide valuable insights to support these risk management strategies. By offering real-time data on crop conditions, we help traders make more informed decisions about their hedging and trading strategies.

Explore Farmonaut’s API for advanced data integration

The Role of Technology in Agricultural Futures Trading

Technology plays a pivotal role in modern agricultural futures trading. From advanced trading platforms to sophisticated analytics tools, technology is reshaping how we approach the agricultural derivatives marketplace.

- Algorithmic Trading: Automated trading systems can execute trades based on predefined criteria, improving efficiency and reducing emotional decision-making.

- Big Data Analytics: Large-scale data analysis helps in identifying market trends and making more accurate price forecasts.

- Blockchain Technology: Enhances transparency and traceability in agricultural supply chains, which can impact futures trading decisions.

Farmonaut’s blockchain-based product traceability solution aligns perfectly with these technological advancements. By providing transparent and secure tracking of agricultural products from farm to consumer, we contribute to a more informed and efficient futures market.

Optimizing Capital Efficiency in Futures Trading

“Over 4 billion bushels of grain are traded daily on global commodity exchanges, representing $50 billion in value.”

Capital efficiency is crucial in futures trading, especially in the high-volume world of agricultural commodities. Here are some strategies to optimize your capital usage:

- Margin Management: Understand and carefully manage margin requirements to maximize trading capacity.

- Portfolio Diversification: Spread risk across different agricultural commodities and contract months.

- Use of Mini and Micro Contracts: These smaller-sized contracts allow for more precise position sizing and risk management.

- Leverage: While powerful, leverage should be used judiciously to avoid excessive risk.

At Farmonaut, we understand the importance of efficient resource management. Our fleet and resource management tools can help agribusinesses optimize their operations, potentially freeing up capital for trading activities.

Check out our API Developer Docs for seamless integration

Advanced Analytics in Crop Price Forecasting

Accurate crop price forecasting is essential for successful futures trading. Advanced analytics play a crucial role in improving the accuracy and reliability of these forecasts.

- Machine Learning Models: These can analyze vast amounts of data to identify patterns and make predictions about future price movements.

- Sentiment Analysis: Gauging market sentiment through social media and news analysis can provide additional insights into potential price trends.

- Weather Data Integration: Incorporating weather forecasts into pricing models can improve accuracy, especially for weather-sensitive crops.

Farmonaut’s AI-driven personalized farm advisory tool, Jeevn AI, delivers real-time insights and weather forecasts. This data can be invaluable for traders looking to refine their price forecasting models.

Global Agricultural Commodities Exchange: Opportunities and Challenges

The global nature of agricultural commodities trading presents both opportunities and challenges for traders. Understanding these can help in developing more effective trading strategies.

- Market Interconnectedness: Events in one part of the world can significantly impact prices globally.

- Currency Fluctuations: Exchange rate movements can affect the profitability of international trades.

- Regulatory Differences: Varying regulations across countries can impact trading strategies and risk management approaches.

- Geopolitical Factors: Trade policies, sanctions, and international relations can all influence agricultural futures markets.

Farmonaut’s global perspective, powered by satellite imagery and AI analytics, can provide valuable insights into worldwide crop conditions, helping traders navigate the complexities of the global agricultural commodities exchange.

Sustainable Trading Practices in Agricultural Futures

As the world increasingly focuses on sustainability, it’s important to consider how this trend impacts agricultural futures trading.

- ESG Considerations: Environmental, Social, and Governance factors are becoming increasingly important in investment decisions.

- Sustainable Agriculture Futures: Growing interest in sustainably produced crops may lead to new futures contracts and trading opportunities.

- Carbon Markets: The emergence of carbon credit trading could create new opportunities linked to agricultural practices.

At Farmonaut, we’re committed to promoting sustainable farming practices. Our carbon footprint tracking feature helps agribusinesses monitor and reduce their environmental impact, aligning with the growing focus on sustainability in the futures market.

Educating Yourself: Resources for Agricultural Futures Traders

Continuous learning is key to success in the dynamic world of agricultural futures trading. Here are some resources to help you stay informed and improve your trading skills:

- Trading Simulators: Practice your strategies without risking real capital.

- Market Reports: Regular updates on market conditions and trends.

- Educational Webinars: Learn from industry experts about various aspects of futures trading.

- Professional Associations: Join organizations that provide networking and educational opportunities.

While Farmonaut doesn’t directly offer futures trading education, our platform provides valuable data and insights that can complement your learning journey in agricultural futures trading.

Agricultural Futures Risk Management Strategies Comparison

| Strategy Name | Risk Level | Potential Return | Capital Requirement | Complexity | Best Suited For | Key Benefits | Potential Drawbacks |

|---|---|---|---|---|---|---|---|

| Hedging with Futures Contracts | Low | 5-15% | $10,000-$50,000 | Intermediate | Producers, Consumers | Price protection | Limited upside potential |

| Options Trading | Medium | 20-50% | $5,000-$25,000 | Advanced | Speculators, Risk managers | Flexibility, Limited risk | Premium costs |

| Cross-Asset Hedging | Medium | 10-30% | $20,000-$100,000 | Advanced | Diversified portfolios | Broader risk management | Imperfect correlations |

| Micro-Sized Contracts | Low to Medium | 5-25% | $1,000-$10,000 | Beginner | Small-scale traders | Lower capital requirements | Higher relative transaction costs |

| Spread Trading | Medium to High | 15-40% | $15,000-$75,000 | Advanced | Experienced traders | Reduced market exposure | Complex execution |

Conclusion: Embracing the Future of Agricultural Trading

As we’ve explored throughout this guide, mastering agricultural futures trading requires a combination of market knowledge, risk management skills, and leveraging advanced analytics. The agricultural derivatives marketplace offers numerous opportunities for those who are well-informed and strategically positioned.

At Farmonaut, we’re committed to providing cutting-edge tools and insights that can complement your trading strategies. While we don’t directly offer trading services, our satellite-based farm management solutions, AI-driven advisory systems, and blockchain-based traceability solutions can provide valuable data to inform your trading decisions.

Remember, successful trading in agricultural futures requires continuous learning, adaptability, and a keen understanding of both global markets and local agricultural conditions. By combining the power of technology with sound trading principles, you can navigate the complexities of agricultural futures markets and work towards achieving your financial goals.

FAQ Section

- What are agricultural futures?

Agricultural futures are standardized contracts to buy or sell a specific quantity of an agricultural commodity at a predetermined price on a future date. - How can Farmonaut’s services benefit agricultural futures traders?

While Farmonaut doesn’t offer direct trading services, our satellite-based crop monitoring and AI-driven insights can provide valuable data to inform trading decisions. - What is hedging in agricultural futures?

Hedging involves taking an opposite position in the futures market to offset potential losses in the physical market, helping to manage price risk. - How does weather affect agricultural futures trading?

Weather significantly impacts crop yields and quality, which in turn affects supply and prices in the futures market. - What role does technology play in modern agricultural futures trading?

Technology enables more accurate forecasting, faster trade execution, and better risk management through tools like algorithmic trading and big data analytics.