Unlocking Profitability: Oilseed Industry Outlook and Agricultural Stock Analysis

“Oilseed commodities account for over 20% of global agricultural trade, with soybean being the most traded oilseed crop.”

In the ever-evolving landscape of consumer staples investing, oilseed commodities and agricultural commodity stocks have taken center stage. Today, we’ll embark on a comprehensive journey through the oilseed industry outlook and conduct an in-depth agricultural stock analysis. Our focus will be on two major players in the agricultural market: Australian Oilseeds (NASDAQ:COOT) and Archer-Daniels-Midland (NYSE:ADM).

The Oilseed Industry: A Global Perspective

Before we dive into our stock analysis, let’s set the stage with an overview of the oilseed industry. Oilseeds are a crucial component of global agriculture, serving as a primary source of vegetable oils and protein meals. The industry encompasses a variety of crops, including soybeans, rapeseed, sunflower seeds, and palm kernels.

The oilseed market has been experiencing steady growth, driven by increasing global population, rising demand for biofuels, and changing dietary preferences. As we analyze the profitability and potential of companies in this sector, it’s essential to consider these macro trends and their impact on agricultural commodity stocks.

Company Profiles: Australian Oilseeds and Archer-Daniels-Midland

Australian Oilseeds (NASDAQ:COOT)

Australian Oilseeds Holdings Ltd. is a relatively new player in the oilseed industry, having been founded in December 2022. The company focuses on the manufacture and sale of oil seeds through its subsidiaries. Despite its short history, Australian Oilseeds has quickly established itself as a noteworthy contender in the agricultural market.

Archer-Daniels-Midland (NYSE:ADM)

In contrast, Archer-Daniels-Midland Company boasts a rich history dating back to 1902. ADM has grown into a global powerhouse in the agricultural processing industry, with operations spanning procurement, transportation, storage, processing, and merchandising of agricultural commodities and products.

Financial Metrics and Stock Performance

To gain a deeper understanding of these companies’ positions in the agricultural market, let’s examine their key financial metrics and stock performance indicators:

| Metric | Australian Oilseeds (COOT) | Archer-Daniels-Midland (ADM) |

|---|---|---|

| Market Capitalization | $28.98 million | $24.76 billion |

| Revenue (Last Fiscal Year) | $22.12 million | $85.53 billion |

| Earnings Per Share (EPS) | N/A | $3.61 |

| Price-to-Earnings (P/E) Ratio | N/A | 13.38 |

| Dividend Yield | N/A | 3.62% |

| 52-Week Stock Price Range | $0.85 – $4.00 | $48.28 – $87.99 |

| Analyst Recommendations | N/A | 2 Sell, 7 Hold, 0 Buy |

| Primary Oilseed Commodities | Various oilseeds | Soybeans, corn, wheat |

| Year-over-Year Growth Rate | N/A | 5.7% |

| Debt-to-Equity Ratio | N/A | 0.41 |

This comparative analysis reveals stark differences between the two companies. Archer-Daniels-Midland, with its long-standing presence in the market, demonstrates robust financial performance and a significant market presence. Australian Oilseeds, while showing potential, is still in its nascent stages and has yet to establish a comparable financial track record.

Profitability and Market Position

When examining profitability in the oilseed industry, several factors come into play. These include operational efficiency, market share, and the ability to navigate commodity price fluctuations. Let’s delve deeper into how our two companies fare in these areas.

Archer-Daniels-Midland: A Profitability Powerhouse

ADM’s profitability metrics paint a picture of a well-established and efficiently run operation:

- Net Margin: 2.10%

- Return on Equity: 10.44%

- Return on Assets: 4.78%

These figures indicate that ADM is adept at converting revenue into profit, effectively utilizing its assets, and generating returns for shareholders. The company’s diversified portfolio, which includes various oilseed commodities such as soybeans, corn, and wheat, contributes to its resilience in the face of market fluctuations.

Australian Oilseeds: A Newcomer with Potential

As a relatively new entrant, Australian Oilseeds’ profitability metrics are not yet fully established. However, the company’s focus on manufacturing and selling oil seeds positions it well to capitalize on the growing demand for oilseed commodities. Its gross revenue of $22.12 million in the last fiscal year suggests a promising start, though the reported net loss of $14.21 million indicates that the company is still in its investment and growth phase.

“The global oilseed market is projected to reach $320 billion by 2025, growing at a CAGR of 4.5% from 2020.”

Industry Outlook and Growth Opportunities

The oilseed industry outlook remains positive, driven by several key factors:

- Rising Global Population: Increasing food demand, particularly in developing countries, is boosting the need for oilseed products.

- Biofuel Demand: The push for renewable energy sources is creating new markets for oilseed-derived biofuels.

- Health-Conscious Consumers: Growing awareness of the health benefits of certain vegetable oils is driving demand in the food industry.

- Industrial Applications: Oilseeds are finding increased use in various industrial products, from lubricants to cosmetics.

Both ADM and Australian Oilseeds are well-positioned to capitalize on these trends, albeit in different ways.

Agricultural Commodity Stock Analysis

When evaluating agricultural commodity stocks, investors must consider various factors, including market trends, commodity price analysis, and company-specific strengths. Let’s examine how ADM and Australian Oilseeds stack up in these areas.

Archer-Daniels-Midland (ADM)

ADM’s stock has shown resilience in the face of market volatility. The company’s diversified portfolio, which extends beyond oilseeds to include corn processing, agricultural services, and nutrition products, provides a buffer against fluctuations in any single commodity market.

Key strengths include:

- Global Presence: ADM’s extensive network allows it to capitalize on international market opportunities.

- Vertical Integration: Control over various stages of the supply chain enhances operational efficiency.

- Innovation: Continuous investment in R&D keeps ADM at the forefront of industry trends.

However, ADM faces challenges such as trade tensions and climate-related risks that could impact agricultural production.

Australian Oilseeds (COOT)

As a newer entrant, Australian Oilseeds presents a different investment profile. The company’s focus on the oilseed niche could be advantageous in a growing market. Potential strengths include:

- Specialization: Concentrated focus on oilseeds could lead to efficiency and expertise in this specific sector.

- Growth Potential: As a smaller company, COOT has significant room for expansion.

- Regional Advantage: Strong positioning in the Australian market could provide a solid foundation for growth.

However, investors should be aware of the risks associated with the company’s limited operational history and current unprofitability.

Commodity Trading Strategies

For investors looking to capitalize on the oilseed industry, several commodity trading strategies could be considered:

- Diversification: Spreading investments across multiple agricultural commodities can help mitigate risk.

- Futures Contracts: Trading oilseed futures allows investors to speculate on price movements or hedge existing positions.

- ETFs: Agricultural commodity ETFs provide exposure to the sector without direct commodity ownership.

- Stock Selection: Investing in companies like ADM or Australian Oilseeds offers indirect exposure to oilseed commodities.

It’s crucial to note that commodity markets can be volatile, and thorough research and risk management are essential.

Analyst Recommendations and Market Sentiment

Understanding analyst recommendations and overall market sentiment is crucial when evaluating agricultural commodity stocks. Let’s examine the current views on ADM and Australian Oilseeds:

Archer-Daniels-Midland (ADM)

Analyst sentiment towards ADM is mixed, with the consensus leaning towards a cautious outlook:

- 2 Sell ratings

- 7 Hold ratings

- 0 Buy ratings

The average price target for ADM stands at $55.11, suggesting a potential upside of 14.11% from current levels. This indicates that while analysts see some growth potential, they also have reservations about the company’s near-term prospects.

Australian Oilseeds (COOT)

As a newer and smaller company, Australian Oilseeds has limited analyst coverage. The lack of established financial metrics and historical performance makes it challenging for analysts to provide concrete recommendations. Investors considering COOT should be aware that they may need to rely more heavily on their own research and risk assessment.

Crop Profitability Comparison

When analyzing agricultural commodity stocks, it’s essential to consider the profitability of different crops within the oilseed industry. This comparison can provide insights into which companies might be better positioned based on their crop focus.

Soybeans

Soybeans remain one of the most profitable oilseed crops globally. ADM, with its significant presence in soybean processing, stands to benefit from the continued strong demand for soy products in both food and industrial applications.

Rapeseed/Canola

Rapeseed, particularly canola, has seen increasing profitability due to its health benefits and use in biofuel production. Australian Oilseeds, operating in a region where canola is a major crop, could potentially capitalize on this trend.

Sunflower Seeds

While less prominent than soybeans, sunflower seeds have shown steady profitability, particularly in certain regional markets. Both ADM and Australian Oilseeds have opportunities in this space, though it may represent a smaller portion of their overall operations.

Agricultural Futures Market Insights

The agricultural futures market plays a crucial role in price discovery and risk management for oilseed commodities. Understanding these markets can provide valuable insights for investors in agricultural commodity stocks.

Key trends in the oilseed futures market include:

- Increased Volatility: Global events, such as trade disputes and climate-related supply disruptions, have led to more frequent price swings.

- Growing Liquidity: Oilseed futures markets have seen increased participation from both hedgers and speculators, improving overall market liquidity.

- Correlation with Energy Markets: The link between oilseeds and biofuels has strengthened the correlation between agricultural and energy futures.

These trends can significantly impact the profitability and stock performance of companies like ADM and Australian Oilseeds, making it essential for investors to monitor futures market developments closely.

Technological Advancements in Agriculture

The integration of technology in agriculture is reshaping the oilseed industry and impacting the performance of agricultural commodity stocks. Companies that effectively leverage these technologies can gain a significant competitive advantage.

Key technological trends include:

- Precision Agriculture: Use of GPS, sensors, and data analytics to optimize crop yields and resource usage.

- Genetic Modification: Development of oilseed varieties with improved traits such as pest resistance or higher oil content.

- Blockchain for Traceability: Implementation of blockchain technology to enhance supply chain transparency and food safety.

- AI and Machine Learning: Application of artificial intelligence in crop management, weather prediction, and market analysis.

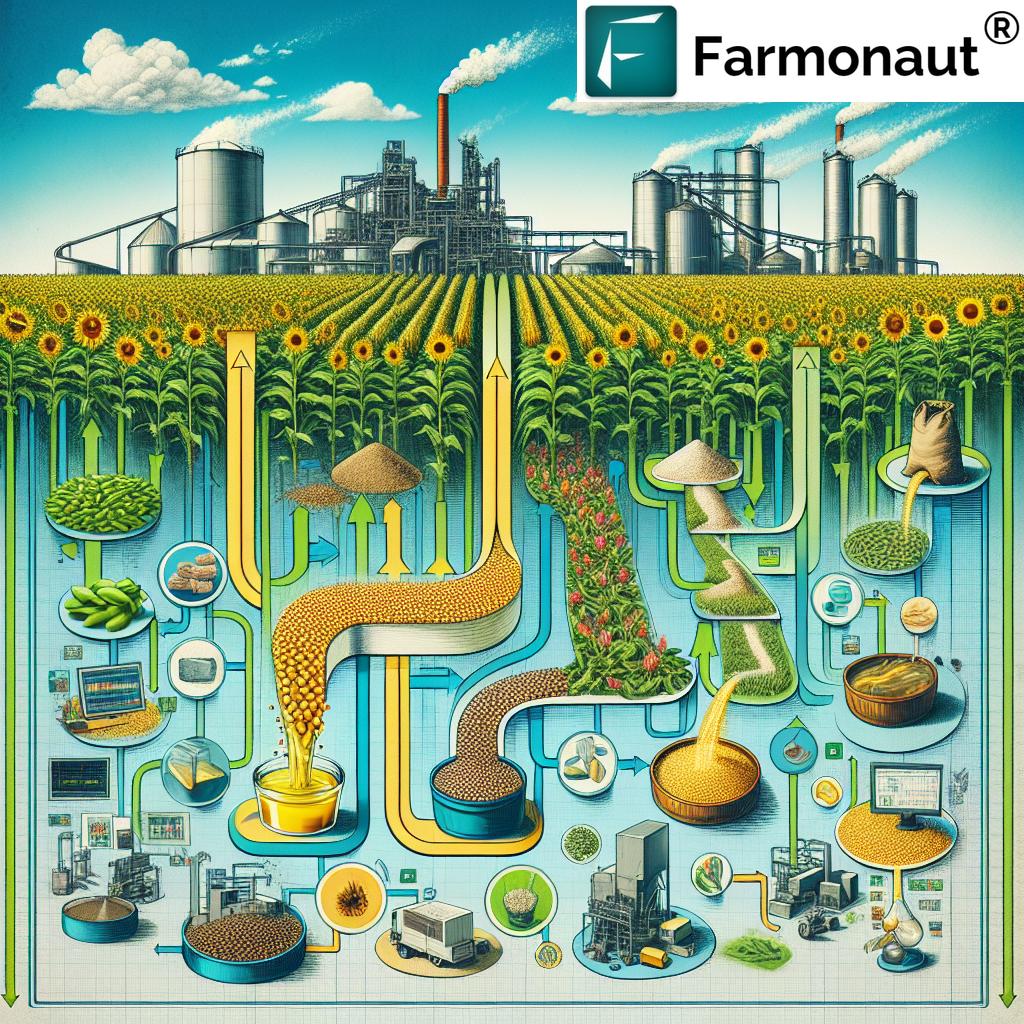

In this context, it’s worth noting the role of companies like Farmonaut, which provide advanced satellite-based farm management solutions. While not directly competing with ADM or Australian Oilseeds, such technology providers are transforming the broader agricultural landscape.

Farmonaut’s platform offers valuable services such as real-time crop health monitoring and AI-based advisory systems, which can significantly enhance farm productivity and efficiency. For investors in agricultural commodity stocks, understanding the impact of these technological advancements is crucial in assessing long-term industry trends and company competitiveness.

Environmental, Social, and Governance (ESG) Considerations

In today’s investment landscape, ESG factors play an increasingly important role in evaluating agricultural commodity stocks. Companies that demonstrate strong ESG practices often enjoy better long-term sustainability and investor confidence.

Archer-Daniels-Midland (ADM)

ADM has made significant strides in its ESG initiatives:

- Environmental: Commitment to reducing greenhouse gas emissions and improving water efficiency in operations.

- Social: Focus on sustainable supply chains and improving farmer livelihoods in sourcing regions.

- Governance: Strong corporate governance practices and transparent reporting on sustainability metrics.

Australian Oilseeds (COOT)

As a newer company, Australian Oilseeds’ ESG profile is still developing. However, operating in Australia, a country with stringent environmental regulations, the company is likely to adhere to high environmental standards in its operations.

Investors should monitor how both companies continue to address ESG concerns, as this will likely impact their long-term profitability and stock performance.

Global Trade Dynamics and Their Impact

The oilseed industry is heavily influenced by global trade dynamics, which can significantly affect the performance of agricultural commodity stocks. Key factors to consider include:

- Trade Agreements: Changes in international trade policies can open new markets or create barriers for oilseed exports.

- Currency Fluctuations: Exchange rate movements can impact the competitiveness of exports and the profitability of international operations.

- Geopolitical Tensions: Political disputes between major producing and consuming countries can disrupt trade flows and price stability.

ADM, with its global presence, is particularly susceptible to these factors. Australian Oilseeds, while more focused on the Australian market, is not immune to global trade dynamics, especially given Australia’s role as a major agricultural exporter.

Investment Strategies for Oilseed Industry Stocks

Based on our analysis, here are some potential investment strategies for the oilseed industry:

- Long-term Value Investing: For investors with a longer time horizon, ADM’s established market position and dividend yield make it an attractive option.

- Growth Potential Play: Australian Oilseeds, while riskier, offers potential for significant growth as it establishes itself in the market.

- Balanced Approach: A combination of established players like ADM and emerging companies like Australian Oilseeds can provide a balance of stability and growth potential.

- ETF Investment: For broader exposure to the agricultural sector, consider ETFs that include a mix of established and emerging agricultural companies.

Remember, all investments carry risk, and thorough due diligence is essential before making any investment decisions.

Conclusion: Navigating the Oilseed Industry Landscape

As we’ve seen, the oilseed industry presents a complex but potentially rewarding landscape for investors. Archer-Daniels-Midland, with its established presence and diverse operations, offers stability and consistent returns. Australian Oilseeds, while less proven, represents the potential for growth in a rapidly evolving market.

Investors should carefully consider their risk tolerance, investment goals, and the broader agricultural market trends when making decisions about these agricultural commodity stocks. The oilseed industry’s close ties to global food security, renewable energy, and emerging technologies make it a sector ripe with opportunities, but also fraught with challenges.

As the industry continues to evolve, staying informed about technological advancements, regulatory changes, and global trade dynamics will be crucial for making informed investment decisions. Whether you’re considering a stake in a global giant like ADM or an emerging player like Australian Oilseeds, a thorough understanding of the oilseed industry outlook and ongoing market analysis will be your best tools for unlocking profitability in this dynamic sector.

FAQ Section

- What are the main factors driving growth in the oilseed industry?

The primary drivers include increasing global population, rising demand for biofuels, changing dietary preferences, and expanding industrial applications of oilseed products. - How do trade policies affect oilseed commodity stocks?

Trade policies can significantly impact stock performance by influencing export opportunities, market access, and overall demand for oilseed products. - What role does technology play in the oilseed industry?

Technology, including precision agriculture, genetic modification, and data analytics, is crucial for improving crop yields, reducing costs, and enhancing overall efficiency in the oilseed industry. - How do ESG factors influence investment decisions in agricultural stocks?

ESG considerations are increasingly important, with investors favoring companies that demonstrate sustainable practices, responsible sourcing, and strong corporate governance. - What are the key differences between investing in established companies like ADM and newer entrants like Australian Oilseeds?

Established companies often offer stability and consistent returns, while newer entrants may present higher growth potential but also carry more risk due to their limited operational history.

Farmonaut: Empowering Agricultural Innovation

While our focus has been on oilseed industry stocks, it’s worth noting the role of agricultural technology companies in shaping the future of farming. Farmonaut, a leading provider of satellite-based farm management solutions, is at the forefront of this technological revolution.

Farmonaut’s platform offers a range of services that can significantly benefit farmers and agribusinesses in the oilseed industry:

- Real-time Crop Health Monitoring: Using satellite imagery to provide insights into vegetation health and soil moisture levels.

- AI-based Advisory Systems: Offering personalized recommendations for crop management and resource optimization.

- Blockchain-based Traceability: Enhancing supply chain transparency and product authenticity.

- Resource Management Tools: Helping farmers and agribusinesses optimize their operations and reduce waste.

While Farmonaut is not directly involved in oilseed production or processing, its technologies can play a crucial role in improving crop yields, reducing costs, and enhancing overall efficiency in the agricultural sector. For investors in agricultural commodity stocks, understanding the impact of such technological advancements is essential in assessing the long-term potential of companies in the industry.

Earn With Farmonaut: Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn More About Farmonaut’s Affiliate Program

Farmonaut Subscriptions

As we conclude our analysis of the oilseed industry and agricultural commodity stocks, it’s clear that the sector is ripe with opportunities for growth and innovation. Whether you’re considering investing in established giants like Archer-Daniels-Midland, exploring the potential of emerging players like Australian Oilseeds, or leveraging cutting-edge technologies offered by companies like Farmonaut, the agricultural sector offers diverse avenues for participation in this essential global industry.

Remember, successful investing in this sector requires ongoing research, a keen understanding of global trends, and a willingness to adapt to the ever-changing agricultural landscape. By staying informed and leveraging the best available tools and technologies, investors can position themselves to capitalize on the growth and innovation driving the future of agriculture.