California Wildfire Crisis: Navigating the Homeowners Insurance Exodus in San Diego and Beyond

“California’s wildfire insurance crisis has led to a moratorium on policy cancellations, affecting thousands of homeowners.”

As we delve into the complex landscape of California’s wildfire insurance crisis, it’s crucial to understand the far-reaching implications for homeowners, particularly in San Diego and other vulnerable areas across the state. The ongoing challenges in securing insurance coverage have created a precarious situation for residents, with ripple effects extending throughout the housing market and beyond.

The Evolving Insurance Landscape in California

California’s insurance market has been under immense strain for several years, with the situation reaching a critical point in recent times. The combination of increasing natural disasters, particularly wildfires, and a vulnerable insurance system has led to a mass exodus of major insurance providers from the state. This departure has left many homeowners, condo owners, and renters struggling to find affordable coverage options.

The situation has become so dire that California Insurance Commissioner Ricardo Lara has been forced to take unprecedented action. A moratorium on insurance cancellations has been implemented for existing homeowners in specific areas affected by recent fires, such as the Palisades and Eaton fires. However, industry experts warn that this measure may only be a temporary bandage on a much larger wound.

The San Diego Perspective

In San Diego, the impact of the wildfire insurance crisis is particularly acute. As a region prone to wildfires, San Diego residents face mounting challenges in securing and maintaining insurance coverage for their homes, condos, and rental properties. The exodus of insurance providers has left a significant gap in the market, with remaining insurers often charging exorbitant premiums or refusing coverage altogether.

Chris Kleitsch, a seasoned insurance agent, paints a grim picture of the situation: “The insurance landscape in California has been deteriorating for the past three years, with many major providers pulling out of the market. The current wildfires represent a new level of risk that is likely to scare off any remaining insurers, threatening the availability of coverage across the state.”

The Domino Effect of Wildfire Destruction

One of the most devastating aspects of the current crisis is the potential long-term impact on homeowners who experience total property loss due to wildfires. These individuals may return to find that securing new insurance coverage is virtually impossible. This creates a tragic situation where rebuilding becomes an insurmountable challenge, potentially leading to the displacement of entire communities.

Kleitsch advises: “Residents should actively seek new insurance options before the situation worsens. It’s crucial to search for agencies that offer homeowners, renters, and condo insurance now, as coverage for rental units may soon become prohibitively difficult to obtain.”

The Broader Implications for California’s Insurance Market

The wildfire insurance crisis extends far beyond individual homeowners. It poses a systemic challenge for the entire California insurance market. As more providers exit the state, the remaining insurers face increased pressure, leading to higher premiums and stricter underwriting guidelines. This creates a vicious cycle that further exacerbates the problem.

Key factors contributing to the market strain include:

- Increased frequency and severity of wildfires

- Rising costs of property repairs and rebuilding

- Regulatory challenges in adjusting rates to reflect actual risk

- The impact of climate change on long-term risk assessments

“Over 2.7 million Californians live in areas at high risk of wildfires, complicating insurance coverage for many residents.”

Navigating the Crisis: Options for Homeowners

While the situation may seem dire, there are steps that homeowners can take to protect themselves and their properties:

- Act proactively: Don’t wait until your policy is up for renewal. Start exploring new insurance options now.

- Consider the California FAIR Plan: This last-resort option provides basic fire insurance coverage for those who can’t find it elsewhere.

- Implement fire mitigation measures: Taking steps to reduce fire risk on your property may make you more insurable.

- Explore bundling options: Some insurers may be more willing to provide coverage if you bundle multiple policies.

- Work with an independent agent: They can help you navigate the complex market and find available options.

It’s important to note that while these strategies can help, they may not guarantee coverage or affordability in all cases.

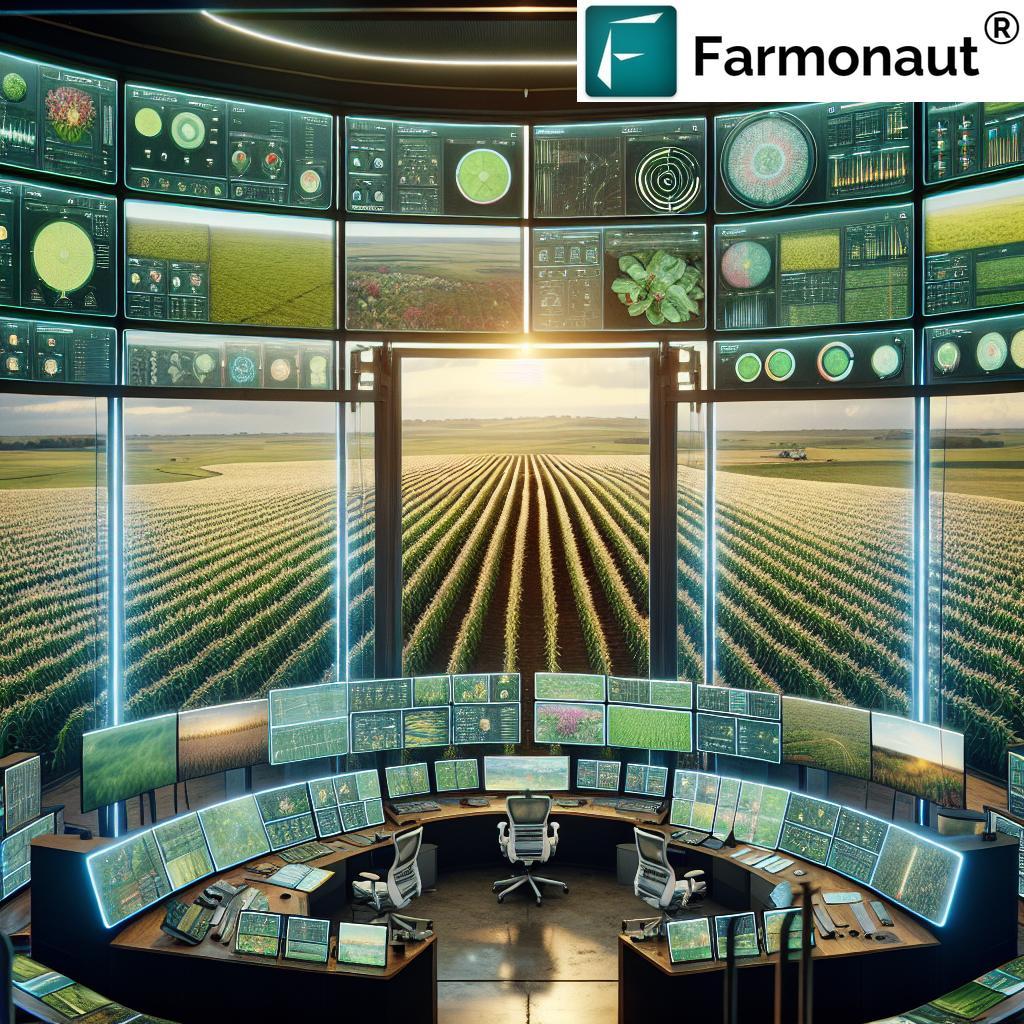

The Role of Technology in Risk Assessment and Management

As the insurance industry grapples with these challenges, technology is playing an increasingly important role in risk assessment and management. Advanced satellite imagery and AI-driven analytics are helping insurers better understand and quantify wildfire risks. This technology-driven approach could potentially lead to more accurate pricing and availability of insurance in high-risk areas.

For example, companies like Farmonaut are leveraging satellite technology and AI to provide valuable insights into land and vegetation changes. While primarily focused on agriculture, such technologies could be adapted to help insurers and homeowners better assess and mitigate wildfire risks.

Policy Solutions and Government Intervention

Addressing the wildfire insurance crisis will likely require a multi-faceted approach involving both private sector innovation and government intervention. Some potential policy solutions being discussed include:

- Creating a state-backed reinsurance program to help stabilize the market

- Implementing stricter building codes and land-use regulations in fire-prone areas

- Investing in large-scale fire prevention and mitigation efforts

- Exploring public-private partnerships to develop new insurance models

California lawmakers are actively debating these and other proposals, but finding a comprehensive solution that balances the needs of homeowners, insurers, and the state’s fiscal health remains a significant challenge.

The Impact on Real Estate and Community Development

The ongoing insurance crisis is having far-reaching effects on California’s real estate market and community development. In fire-prone areas, the difficulty in obtaining insurance is leading to:

- Decreased property values

- Challenges in selling homes

- Barriers to new construction and development

- Potential demographic shifts as residents move to lower-risk areas

These factors could reshape the landscape of many California communities, particularly in rural and suburban areas at high risk for wildfires.

The Future of California’s Insurance Market

As we look to the future, it’s clear that California’s insurance market will need to undergo significant changes to remain viable in the face of increasing wildfire risks. Some potential developments we may see include:

- More sophisticated risk modeling and pricing strategies

- Increased use of technology for risk assessment and claims processing

- New insurance products designed specifically for high-risk areas

- Greater collaboration between insurers, technology companies, and government agencies

While the path forward is uncertain, it’s clear that innovative solutions will be necessary to ensure that California residents can continue to protect their homes and livelihoods in the face of growing wildfire threats.

California Wildfire Insurance Crisis: Key Impacts and Trends

| Factor | Pre-Crisis Status | Current Status | Future Outlook |

|---|---|---|---|

| Insurance Availability | Widely available | Limited availability, especially in high-risk areas | Potential for new models and products |

| Average Premium Costs | Moderate | Estimated 50% increase | Likely continued increase without intervention |

| Number of Insurers in Market | Robust market | Estimated 30% decrease in available insurers | Potential for new entrants with innovative models |

| Policy Cancellation Rates | Low | High, with temporary moratorium in place | Uncertain, dependent on policy solutions |

| State Intervention Measures | Minimal | Increasing (e.g., cancellation moratorium) | Likely expansion of state programs and regulations |

Conclusion: A Call for Action and Innovation

The California wildfire insurance crisis presents a complex challenge that requires immediate attention and innovative solutions. As we’ve explored throughout this article, the impacts of this crisis extend far beyond individual homeowners, affecting entire communities and the state’s economic landscape.

Key takeaways include:

- The urgent need for homeowners to proactively seek insurance options

- The potential for technology to play a crucial role in risk assessment and management

- The necessity of policy interventions to stabilize the insurance market

- The broader implications for real estate and community development in fire-prone areas

As we navigate these challenging times, it’s crucial for all stakeholders – homeowners, insurers, policymakers, and technology innovators – to work together in finding sustainable solutions. The future of California’s communities and its residents’ ability to protect their homes and livelihoods depends on our collective ability to address this crisis head-on.

FAQ: California Wildfire Insurance Crisis

Q: What is causing the California wildfire insurance crisis?

A: The crisis is primarily driven by the increasing frequency and severity of wildfires, which has led to significant losses for insurance companies. This, combined with regulatory challenges in adjusting rates, has caused many insurers to leave the California market.

Q: Can insurance companies cancel my policy if I live in a high-risk area?

A: Currently, there is a moratorium on policy cancellations in certain fire-affected areas. However, this is a temporary measure, and insurers may choose not to renew policies when they expire.

Q: What is the California FAIR Plan?

A: The FAIR Plan is a last-resort insurance option for California residents who cannot obtain coverage in the traditional market. It provides basic fire insurance coverage but is often more expensive and limited in scope compared to standard policies.

Q: How can I make my home more insurable in a high-risk wildfire area?

A: Implementing fire mitigation measures such as creating defensible space around your property, using fire-resistant building materials, and keeping gutters clean can help make your home more insurable. Working with a local fire department or forestry service for a property assessment can also be beneficial.

Q: Will the insurance crisis affect my ability to sell my home?

A: Yes, the difficulty in obtaining insurance can impact property values and make it challenging to sell homes in high-risk areas. Potential buyers may struggle to secure mortgages without proper insurance coverage.

As we continue to grapple with the challenges posed by the California wildfire insurance crisis, staying informed and taking proactive measures remains crucial. We encourage readers to explore additional resources, consult with insurance professionals, and stay engaged with local and state-level policy discussions on this critical issue.

For those interested in learning more about innovative technologies that could play a role in risk assessment and management, consider exploring platforms like Farmonaut:

For developers interested in integrating satellite and weather data into their own systems, check out the Farmonaut API and the comprehensive API Developer Docs.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!