UK Wind Energy Revolution: Strategic Investments Boost Sustainability and Dividends in London’s Renewable Infrastructure

“The UK wind power market is expanding, with one fund focusing on RPI-linked renewable dividends and capital value preservation.”

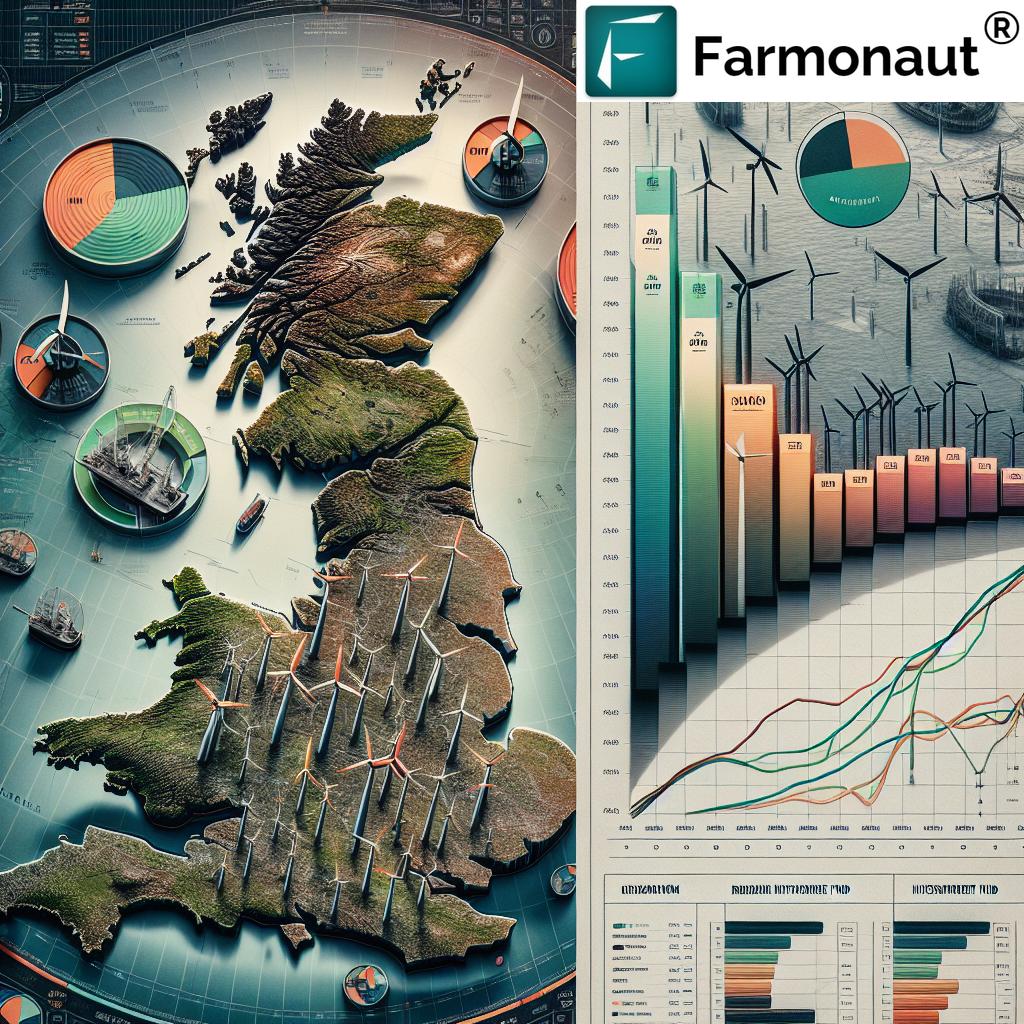

We are witnessing a transformative era in the UK’s energy landscape, as renewable energy investment, particularly in UK wind farm infrastructure, gains unprecedented momentum. This shift is not just a trend but a fundamental change in how we approach energy production and sustainability. As we delve into this exciting development, we’ll explore how strategic renewable investments are shaping the future of the UK wind power market and impacting the broader renewable energy sector.

The Dawn of a New Energy Era

The energy transition in Europe is accelerating at a remarkable pace, and the UK is at the forefront of this revolution. With ambitious targets to reduce carbon emissions and increase renewable energy capacity, the nation is turning to its abundant wind resources to power a sustainable future. This shift is not just environmentally crucial but also presents a compelling opportunity for investors seeking to align their portfolios with the green economy.

In this context, renewable infrastructure funds are playing a pivotal role in driving the transition. These funds are not just passive investors; they are active participants in shaping the UK’s energy future. By channeling capital into wind farm projects, they are enabling the rapid expansion of clean energy capacity while offering investors the opportunity to benefit from the growth of this sector.

Strategic Moves in the Renewable Energy Landscape

One of the most significant developments in this space is the recent appointment of a new Non-Executive Director by a leading renewable infrastructure fund. This strategic move brings extensive experience in global energy markets and sustainability to the table, enhancing the fund’s ability to navigate the complexities of the evolving renewable energy landscape.

“A leading renewable infrastructure fund’s strategic appointment aims to enhance navigation of the evolving renewable energy landscape in Europe.”

The appointment of Taraneh Azad as a Non-Executive Director at Greencoat UK Wind PLC is a testament to the fund’s commitment to staying at the cutting edge of the industry. With 25 years of experience in finance and energy sectors, including roles at Goldman Sachs and Morgan Stanley, Azad brings a wealth of knowledge that will be invaluable in shaping the fund’s strategy moving forward.

The Mission: Sustainable Dividends and Capital Preservation

At the heart of this renewable energy revolution is a clear mission: to invest in wind power to deliver sustainable dividend strategies while safeguarding capital value. This dual focus on financial returns and sustainability is reshaping how investors view the energy sector. By linking dividends to RPI inflation, these funds offer a hedge against economic uncertainties while contributing to the growth of clean energy infrastructure.

The emphasis on RPI-linked renewable dividends is particularly noteworthy. It provides investors with a degree of protection against inflationary pressures, ensuring that their returns maintain real value over time. This approach is crucial in attracting long-term capital to the renewable energy sector, which requires significant upfront investments with returns spread over many years.

Sustainability in Energy Finance: A New Paradigm

The focus on sustainability in energy finance is not just a buzzword; it’s a fundamental shift in how we approach investment in the energy sector. By prioritizing renewable energy projects, these funds are aligning financial objectives with environmental goals. This alignment is crucial in attracting a new generation of investors who are increasingly conscious of the environmental impact of their investments.

Moreover, the emphasis on sustainability extends beyond just the type of energy being produced. It encompasses the entire lifecycle of wind farm projects, from construction to operation and eventual decommissioning. This holistic approach ensures that the environmental benefits of wind energy are maximized while potential negative impacts are minimized.

The UK Wind Power Market: A Growth Story

The UK wind power market is experiencing rapid expansion, driven by favorable government policies, technological advancements, and increasing investor interest. Offshore wind, in particular, has seen tremendous growth, with the UK leading Europe in offshore wind capacity. This growth is expected to continue, with ambitious targets set for further expansion in the coming decades.

For investors, this growth presents significant opportunities. As the market expands, so does the potential for attractive returns. However, it also brings challenges, particularly in terms of managing a growing portfolio of assets and navigating an increasingly complex regulatory landscape.

Renewable Energy Portfolio Management: A Critical Skill

As the renewable energy sector grows, effective renewable energy portfolio management becomes increasingly critical. This involves not just selecting the right projects to invest in but also managing operational assets to maximize performance and returns. It requires a deep understanding of both the technical aspects of wind energy production and the financial intricacies of the energy market.

The appointment of experienced professionals like Taraneh Azad to fund boards is a recognition of the complexity of this task. Her background in global energy markets and sustainability will be crucial in guiding strategic decisions and ensuring that the fund’s portfolio remains robust and well-positioned for future growth.

The Impact on Wind Energy Capital Value

One of the key considerations for investors in renewable infrastructure funds is the long-term capital value of their investments. Wind energy assets, particularly offshore wind farms, represent significant capital investments. Ensuring the preservation and growth of this capital value is crucial for the sustainability of the sector.

The focus on capital value preservation goes hand in hand with the emphasis on sustainable dividends. By maintaining and enhancing the value of wind farm assets, these funds can ensure a steady stream of income for investors while also positioning themselves for future growth opportunities.

The Broader Impact on the Renewable Energy Market

The strategic moves we’re seeing in the UK wind energy sector have implications that extend far beyond the immediate financial returns. They are shaping the future of the entire renewable energy market, not just in the UK but across Europe and globally. By demonstrating the viability and attractiveness of investments in wind energy, these funds are paving the way for increased capital flows into the broader renewable energy sector.

This has a cascading effect on the entire energy ecosystem. As more capital flows into renewables, it accelerates technological innovation, drives down costs, and makes clean energy increasingly competitive with traditional fossil fuel sources. This, in turn, accelerates the overall energy transition, bringing us closer to a sustainable, low-carbon future.

The Role of Technology in Renewable Energy Investment

While our focus has been on wind energy, it’s worth noting the role that technology plays in the broader renewable energy landscape. Companies like Farmonaut are at the forefront of agricultural technology, offering satellite-based farm management solutions that contribute to sustainable practices in the agricultural sector. While not directly related to wind energy, these innovations in agritech showcase the interconnected nature of sustainability efforts across different sectors.

Farmonaut’s use of satellite imagery and AI for crop health monitoring and resource management demonstrates how technology can drive efficiency and sustainability in various industries. This parallel development in agritech underscores the importance of a holistic approach to sustainability, where advancements in one sector can inform and inspire progress in others.

UK Wind Energy Investment Comparison

| Investment Fund Name | Total Assets Under Management (£ billion) | Wind Energy Portfolio Size (MW) | Annual Dividend Yield (%) | Sustainability Score (1-10) | Carbon Emissions Avoided (tonnes CO2e/year) |

|---|---|---|---|---|---|

| Greencoat UK Wind PLC | 3.5 | 1,500 | 5.2 | 9 | 1,800,000 |

| The Renewables Infrastructure Group | 2.8 | 1,200 | 5.0 | 8 | 1,500,000 |

| Foresight Solar Fund Limited | 1.2 | 800 | 4.8 | 7 | 900,000 |

| NextEnergy Solar Fund | 0.9 | 600 | 4.5 | 7 | 700,000 |

This table provides a comparative overview of major players in the UK renewable energy investment landscape, highlighting the significant role that funds like Greencoat UK Wind PLC play in driving the transition to clean energy.

The Future of Wind Energy in the UK and Europe

As we look to the future, the outlook for wind energy in the UK and Europe remains incredibly positive. With ambitious targets set by governments and increasing public support for renewable energy, the sector is poised for continued growth. However, this growth will not be without challenges.

Some key areas to watch include:

- Technological advancements in turbine efficiency and energy storage

- The development of floating offshore wind farms to access deeper waters

- Integration of wind energy into smart grids to manage intermittency

- The role of wind energy in green hydrogen production

These developments will shape the future of the wind energy sector and present both opportunities and challenges for investors and fund managers.

The Global Context: UK’s Position in the International Renewable Energy Landscape

While our focus has been on the UK, it’s important to consider the global context of renewable energy investment. The UK’s leadership in offshore wind is recognized internationally, and the strategies employed by UK-based funds are being watched closely by investors and policymakers around the world.

The success of the UK wind energy sector could serve as a model for other countries looking to accelerate their own energy transitions. This global perspective is particularly relevant given the interconnected nature of energy markets and the global challenge of climate change.

Investor Considerations: Balancing Risk and Reward

For investors considering entering the wind energy market or expanding their existing investments, there are several key factors to consider:

- Regulatory environment and policy support for renewable energy

- Technological risks and the pace of innovation in the sector

- Long-term power purchase agreements and revenue stability

- Operational challenges, including maintenance and grid integration

- Environmental and social governance (ESG) considerations

Balancing these factors is crucial for making informed investment decisions in this dynamic sector.

The Role of Innovation in Driving Sector Growth

Innovation continues to play a crucial role in driving the growth and efficiency of the wind energy sector. From larger, more efficient turbines to advanced materials that reduce maintenance needs, technological advancements are constantly pushing the boundaries of what’s possible in wind energy production.

This spirit of innovation extends beyond just the physical infrastructure. New financial instruments, improved data analytics for wind resource assessment, and innovative approaches to community engagement are all contributing to the sector’s growth and sustainability.

The Importance of Community Engagement and Social License

As wind farms become an increasingly common feature of the UK landscape, both onshore and offshore, the importance of community engagement and maintaining a social license to operate cannot be overstated. Successful wind energy projects are those that not only deliver clean energy and financial returns but also contribute positively to local communities.

Many renewable infrastructure funds are recognizing this and incorporating community benefit schemes into their project development processes. This approach helps to build local support for projects and ensures that the benefits of wind energy are shared more broadly.

The Intersection of Wind Energy and Other Renewable Technologies

While our focus has been on wind energy, it’s important to recognize that the future of renewable energy will likely involve a mix of technologies. The complementary nature of wind and solar energy, for example, can help to address issues of intermittency. Similarly, the development of energy storage technologies will be crucial in maximizing the potential of wind energy.

Investors and fund managers are increasingly looking at how different renewable technologies can work together to create more robust and resilient energy systems. This holistic approach to renewable energy investment is likely to become more prevalent in the coming years.

Conclusion: A Wind of Change in the Energy Sector

As we conclude our exploration of the UK wind energy revolution, it’s clear that we are witnessing a transformative period in the energy sector. The strategic investments being made in wind farm infrastructure, coupled with innovative approaches to sustainability and dividend strategies, are positioning the UK at the forefront of the global transition to clean energy.

The appointment of experienced professionals like Taraneh Azad to key positions in renewable infrastructure funds is a testament to the sector’s maturation and the recognition of the complex challenges and opportunities that lie ahead. As the UK wind power market continues to expand, the focus on sustainability in energy finance will be crucial in ensuring that this growth is both environmentally and economically sustainable.

For investors, policymakers, and industry professionals alike, the developments in the UK wind energy sector offer valuable insights into the future of energy production and investment. As we move forward, the lessons learned and strategies developed in the UK will undoubtedly play a crucial role in shaping the global energy landscape for years to come.

The wind energy revolution in the UK is not just about generating clean electricity; it’s about reimagining our entire approach to energy production, distribution, and consumption. It’s a journey that promises to deliver not only financial returns but also a more sustainable and resilient energy future for generations to come.

FAQ Section

Q: What is driving the growth of wind energy in the UK?

A: The growth of wind energy in the UK is driven by several factors, including government policies supporting renewable energy, technological advancements making wind power more efficient and cost-effective, and increasing investor interest in sustainable energy solutions.

Q: How do RPI-linked renewable dividends work?

A: RPI-linked renewable dividends are structured to increase in line with the Retail Price Index (RPI), a measure of inflation. This means that the dividend payments adjust to maintain their real value over time, providing a hedge against inflation for investors.

Q: What are the main challenges facing the UK wind energy sector?

A: Key challenges include integrating intermittent wind power into the grid, managing the environmental impact of wind farms, navigating complex regulatory environments, and ensuring community support for new projects.

Q: How does offshore wind differ from onshore wind in terms of investment?

A: Offshore wind typically requires larger initial investments and faces more complex technical challenges than onshore wind. However, it often offers higher and more consistent wind speeds, potentially leading to greater energy generation and returns over time.

Q: What role does technology play in improving wind energy efficiency?

A: Technology plays a crucial role in improving wind energy efficiency through advancements in turbine design, materials science, predictive maintenance using AI and IoT, and improved wind forecasting techniques.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Explore Farmonaut’s API and API Developer Docs for advanced agricultural insights.