Organic Farmland in Scotland Grows 13% Amid Strong Government Support

“Scotland’s organic farmland expanded by 13% in 2023, reflecting robust government incentives for sustainable agriculture.”

Table of Contents

- Introduction: A Turning Point for Organic Farmland in Scotland

- Current Organic Market Growth Trends in the UK

- Scotland Leads in Organic Farmland Growth

- Government Incentives for Organic Farming: Scotland’s Model

- Organic Land Conversion and Ambitious Scottish Targets

- Comparative Growth & Impact Table: Scotland’s Organic Journey

- England and Wales: Missed Opportunities & Declines

- Environmental Benefits of Nature Friendly Farming Practices

- Organic Food and Drink Demand UK: Capitalising on Opportunities

- How Farmonaut Empowers the Organic Sector

- Technological Innovation: Driving Sustainable Farming Incentives

- Support for New Organic Farmers & Advisory Resources

- The Global Picture: Learning from France, Ireland, and the EU

- FAQ – Organic Farmland Growth Scotland & UK

- Conclusion: A Call to Action for UK Organic Policy

Introduction: A Turning Point for Organic Farmland in Scotland

As we witness organic farmland Scotland expanding by 13% in 2024, it is clear that robust government support and progressive incentives have positioned Scotland as a leader in nature-friendly farming practices in the UK. In contrast, England and Wales face stagnant or declining growth in this rapidly emerging sector, potentially ceding both environmental and market opportunities to European competitors.

This growth in organic land conversion is not just a regional triumph; it is an essential signal for policymakers, farmers, and agribusinesses across Britain. It reflects a crucial moment where environmental responsibility, innovation, and market demand intersect. Our collective choices now—on policy, technology, and market participation—will determine whether the UK & Northern Ireland capitalize on the opportunity to convert farmland to organic production or fall further behind the global standard.

Current Organic Market Growth Trends in the UK

The organic market growth UK demonstrates clear upward momentum, with organic food and drink demand UK rising to £3.7bn in 2024—a 7.3% increase. The beginning of 2025 continues this positive trend, with double-digit percentage rises in both value and unit sales. This powerful consumer demand brings new opportunities for farmers to shift to sustainable production, provided the right legislative and financial environment supports such a transition.

Tragically, England and Wales are failing to capitalize on this expanding organic sector. While Scotland dominates with 102% growth in organic land conversion (from 13,100ha to 26,500ha in 2024), England sees only a marginal 7% increase, and Wales a sharp 45% decline. The implication is clear: without a national organic action plan or sustained government incentives, UK farming businesses risk losing out as production shifts toward imports—especially from European Union (EU) markets.

We must now examine how Scotland’s leadership in policy and practice not only shapes rural economies but also accelerates progress toward environmental targets for agriculture.

“UK organic market trends show increased demand, with Scotland leading in nature-friendly farming due to policy support.”

Scotland Leads in Organic Farmland Growth

Scotland’s organic sector has experienced its sixth consecutive year of organic farmland growth, solidifying its place as a model for sustainable agriculture in the UK. The latest organic production statistics UK reveal a 13% increase in total organic land (including land in conversion), bringing Scotland’s total to 131,500 hectares in 2024.

Compared to just a 1% rise in England and a dramatic 11% decline in Wales, Scotland’s leadership is profound. It results from a clear government commitment to nature-friendly farming and progressive agricultural policies. The Scottish Government’s ambitions are further reflected in the target of 10% of all farmland to be managed organically by 2026.

- Key Drivers in Scotland’s Success:

- Comprehensive incentives for new organic entrants

- Proactive action planning toward environmental and economic targets

- Effective schemes for sustainable farming incentives and ongoing support for organic production

- Strong connections between government policy, research, and public procurement of organic products

Such coordinated momentum demonstrates that with the right plan and governmental backing, organic farming in Scotland can flourish, benefiting farmers, consumers, and the entire agri-food chain.

Comparative Growth & Impact Table: Scotland’s Organic Journey

| Year | Estimated Organic Farmland Area (ha, % change) | Major Government Initiatives / Support | Estimated Environmental Impact |

|---|---|---|---|

| 2020 | 104,500 ha (+8%) | Enhanced organic support within Rural Payments; farmer training schemes launched | Estimated 30,000 tonnes CO₂eq saved; increased pollinator and bird diversity in pilot regions |

| 2021 | 116,600 ha (+12%) | Scottish Organic Action Plan announced; new conversion/maintenance grants | Soil organic matter up 2%; increases in farmland birds; 33,000 tonnes CO₂eq avoided |

| 2022 | 119,000 ha (+2%) | Expansion of agri-environment schemes; cluster support for organic groups | Increase in soil carbon stocks; measurable boosts in insect biodiversity |

| 2023 | 116,200 ha (-2%)* *(minor fluctuations in reported data) |

Increased marketing of Scottish organic produce; enhanced advisory & training | Nitrate leaching rates reduced; 35,000 tonnes CO₂eq saved |

| 2024 | 131,500 ha (+13%) | Major incentives for organic land conversion; procurement targets in public sector | All-time low pesticide residues; 40,000 tonnes CO₂eq saved; record biodiversity uptick |

This table illustrates the tight interplay between government policies, organic farmland area growth, and key environmental metrics—making Scotland a pivotal case study for sustainable farming success.

Government Incentives for Organic Farming: Scotland’s Model

Scotland’s government incentives for organic farming set a benchmark for the rest of the UK. The approach combines financial support, skill-building programs, market development, and proactive promotion—making it easier for farmers to commit to organic land conversion and maintain sustainable practices in the long run.

- Direct support for organic conversion and ongoing maintenance payments

- Use of public procurement to boost organic food and drink

- Promotion campaigns and improved supply chain capability (processing, packaging, logistics)

- Investment in research, advice, and training to support nature-friendly farming

These incentives not only lower barriers to entry for new organic entrants, but also deliver market stability and confidence—allowing Scottish farmers to respond nimbly to consumer demand and policy shifts.

If the UK is to meet its “30 by 30” environmental targets for agriculture (30% of land for nature by 2030), such a policy plan must be central.

Organic Land Conversion and Ambitious Scottish Targets

The Scottish Government’s ambitious targets aim to double the share of organic land to 10% by 2026, a move underscored by the doubling of land in conversion (102% growth) over the past year. Such targets send a clear signal to farmers and the supply chain—organic is no longer a niche but a national development priority.

Key current metrics:

- Total organic land (including land in conversion) now at 131,500 ha

- Land in conversion alone has surged from 13,100 ha (2023) to 26,500 ha (2024)

- Number of certified organic operators (producers and processors) risen to 530 (2024)

- Total land share for organic has increased to 2.6%, up from 1.8% since 2021

Such rapid expansion is only possible with government support and integrated policy that offers economic incentives for new conversions, as well as the security of ongoing support for those already operating organically.

England and Wales: Missed Opportunities & Declines in Organic Farmland

While Scotland continues to enjoy robust growth, England and Wales lag behind due to a host of policy gaps and missed opportunities:

- England: Just 1% rise in total organic farmland to 502,800ha; only a 7% uptake in land under conversion; no significant growth in a decade.

- Wales: 11% decline in total organic farmland, with land in conversion falling by 45% over 12 months.

The freezing of Sustainable Farming Incentives (SFI) and the absence of a dedicated organic action plan have directly discouraged farmers from making the switch to organic. As a result, imports are increasingly filling the gap in the growing UK market, underlining the urgent need for coordinated policies and incentives.

Environmental Benefits of Nature Friendly Farming Practices

Growth in organic farmland Scotland goes hand-in-hand with considerable environmental benefits:

- Soil Health: Improved organic matter, increased microbial activity, and stronger carbon sequestration boost resilience and fertility.

- Biodiversity: Nature-friendly farming practices create diverse habitats for pollinators, farmland birds, and beneficial insects.

- Reduced Inputs: Lower reliance on synthetic pesticides and fertilizers mitigates river/lake pollution and helps restore natural cycles.

- Climate Action: Measurable CO₂ emissions reductions support net-zero targets and slow atmospheric carbon accumulation.

Soil Association and other stakeholder organizations stress that to scale these benefits across the UK, government support, accessible technology, and continuous advisory services are non-negotiable.

Organic Food and Drink Demand UK: Capitalising on Opportunities

The organic food and drink demand UK has reached record highs, with value growth (+8.9% year-over-year as of March 2025) vastly outpacing many other agri-food sectors. The market stands at over £3.7bn in annual sales, reinforcing that consumer demand for healthy, sustainably sourced, and traceable foods is not just a passing trend but a durable shift.

This thriving market is a direct chance for farmers to tap into premium pricing and resilient demand, provided support and incentives de-risk the move to organic production.

- Key Takeaway: Policy gaps mean the current boom is at risk of being capitalized on by EU competitors and imports, rather than UK and Northern Irish businesses.

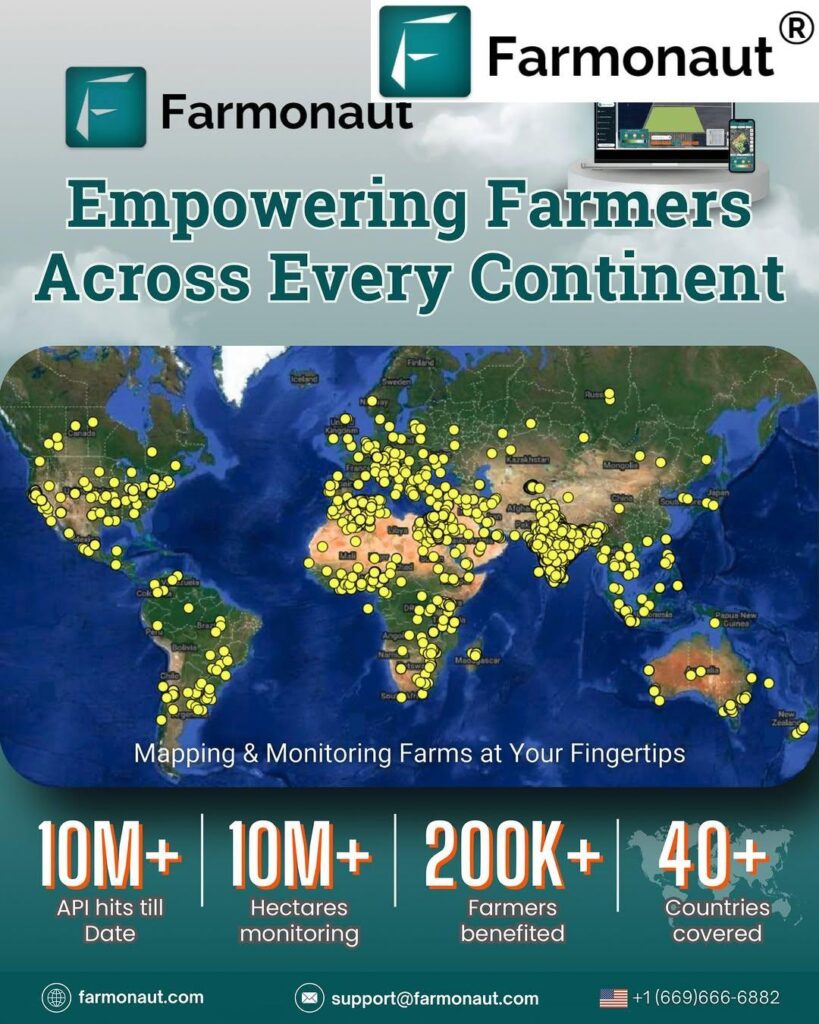

How Farmonaut Empowers the Organic Sector

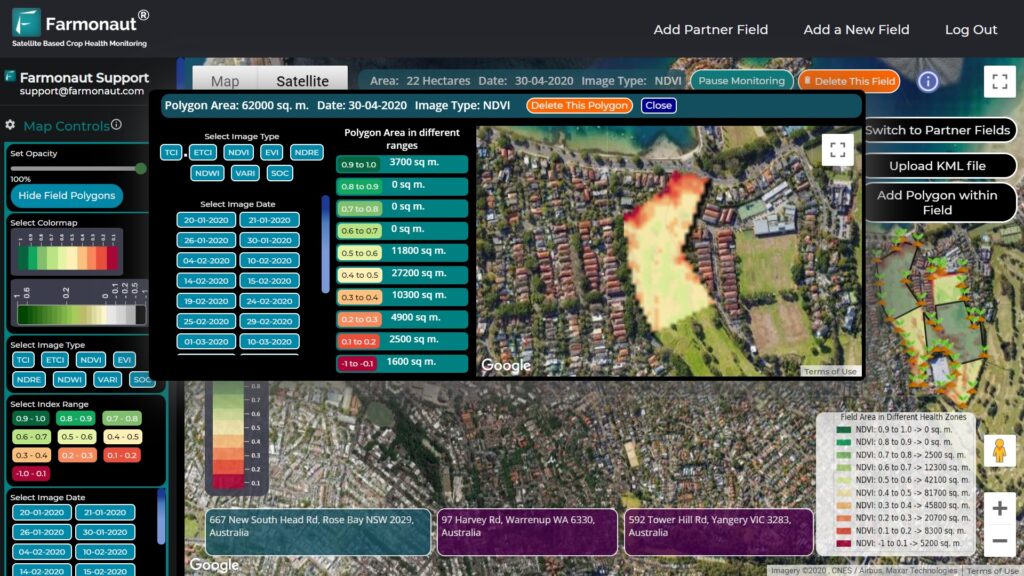

As organic producers and agribusinesses seek to thrive in a changing environment, access to accurate, real-time data is paramount. Farmonaut—leveraging satellite-based technology, artificial intelligence, and blockchain—offers:

- Satellite-based Crop Health Monitoring: Real-time NDVI and soil moisture data inform optimal irrigation, fertilizer use, and pest management for sustainable outcomes.

- AI & Advisory Systems: The Jeevn AI delivers crop management insights, weather forecasts, and personalized guidance directly to mobile devices.

- Blockchain Traceability: Assures organic certification from farm to table, reducing fraud and enhancing consumer trust. (Explore traceability here.)

- Fleet and Resource Management: Reduces operational costs, optimizes machinery use, and supports sustainable logistics for larger scale farms.

- Carbon Footprint Tracking: Real-time data on emissions helps businesses monitor and reduce their environmental impact and comply with new environmental targets for agriculture.

All of these technologies are available via Farmonaut’s app (Android, iOS, Web) and through API integrations for businesses and developers:

Farmonaut API | Developer docs

By making precision agriculture affordable, Farmonaut enables both experienced and new organic farmers to optimize their transition—boosting yield, lowering risk, and creating sustainable businesses for the future.

Technological Innovation: Driving Sustainable Farming Incentives

Farmonaut’s suite of tools addresses the core challenges facing organic land conversion and long-term farm management:

- Scalable Monitoring: Satellite imagery and machine learning allow government bodies and cooperatives to monitor compliance and plan incentive schemes more efficiently. Large-scale farms benefit from extensive yet affordable farm management solutions.

- Sustainability Tracking: Carbon and biodiversity metrics empower farmers to document—and be rewarded for—nature-positive actions.

- Risk Reduction: Weather models and crop health forecasts allow farmers to predictively manage stress, leading to more stable yields and easier adherence to organic certification standards.

The confluence of government support, farmer commitment, and technological advancement is indispensable. The wider adoption of these solutions will further Scotland’s progress and make organic growth viable for the broader UK.

Support for New Organic Farmers & Advisory Resources

The critical success factor for the next phase of organic farmland growth is direct, ongoing, and practical support for new organic farmers. As evidenced by recent Soil Association webinars, 9 in 10 potential new entrants cite lack of financial reassurance and policy clarity as major barriers.

Recommended action:

- Restore or expand organic conversion and maintenance payments within rural development schemes

- Offer technical training and peer networking opportunities

- Promote inclusive advisory programs using both traditional (in-person) and digital channels (e.g. AI-based platforms like Jeevn AI in Farmonaut)

Addressing these gaps, particularly through sustainable farming incentives and integrated digital advisory platforms, will not only attract new entrants but also accelerate progress toward national and Scottish targets.

The Global Picture: Learning from France, Ireland, and the EU

Looking to the continent, both France and the Republic of Ireland have demonstrated that with proactive agro-environmental schemes and strong government leadership, rapid national progress is possible:

- France: Successful “Plan Bio” includes cash incentives, advisory support, and dedicated market development funding.

- Ireland: Organic land share has increased steadily—now approaching the EU average—thanks to clear targets, conversion grants, and national policy backing.

- EU-wide: The “Farm to Fork Strategy” calls for at least 25% of EU agricultural land to be organic by 2030.

If England, Wales, and Northern Ireland fail to act quickly, these countries will continue to capture the growing organic market through imports while domestic farmers are left behind. The UK now stands at a crossroads: accelerate policy and incentive reform, or continue its decline in organic conversions and leadership.

“Scotland’s proactive policy support is a blueprint for other regions looking to boost organic farmland and capitalise on fast-growing market demand.”

FAQ – Organic Farmland Growth Scotland & UK

1. What is driving the 13% growth in organic farmland in Scotland?

Government support through sustained incentives, conversion and maintenance payments, and strong policy planning is the primary driver. Scotland’s commitment to doubling organic land by 2026 offers clarity and confidence to new farmers and existing businesses.

2. How does Scotland’s approach differ from England and Wales?

Unlike England, where Sustainable Farming Incentives have stalled and there is no immediate organic action plan, Scotland offers clear targets, direct support, and a consistent policy framework. Wales, despite some reinstated support, faces uncertainty and lacks a comprehensive conversion scheme.

3. What are the main benefits of organic farming for the environment?

Organic practice enhances soil health, increases biodiversity, reduces chemical inputs, lowers fossil fuel use, and accelerates carbon sequestration, all hailed by the Soil Association and environmental experts.

4. How can technology help organic farmers?

Platforms like Farmonaut provide satellite imaging, real-time advisory, blockchain supply chain verification, and sustainability metrics—giving farmers the decision-making tools to optimize production and verify compliance, while reducing risk.

5. With demand for organic food and drink rising, how can UK farmers best capitalise?

By utilising government incentives, seeking digital farm management solutions, and aligning practice with consumer trends, UK farmers can boost income, market share, and environmental performance. However, national policy reform is required for widespread impact.

Conclusion: A Call to Action for UK Organic Policy

Scotland’s organic farmland expansion by 13% in 2024 demonstrates what is possible when government support is firmly aligned with farmer ambition and market forces. With the UK market for organic food and drink growing and nature-friendly practices vital for reaching environmental targets for agriculture, the current divergence between Scotland and England/Wales is untenable.

To capitalise on the organic opportunity, the UK must:

- Implement a national Organic Action Plan inspired by the Scottish and European models

- Restore, expand, and clarify sustainable farming incentive schemes with clear access for new and existing organic farmers

- Promote technology adoption and targeted advisory, fostering resilient, data-driven decisions from field to supply chain

- Commit to ambitious, enforceable targets and celebrate regionally tailored approaches that prioritise sustainability and nature friendly farming practices.

If we act now, the UK can restore its leadership in organic production, empower its businesses and farmers, and make meaningful progress toward environmental and economic success. It’s time to transform both policy and practice—so that the next decade brings shared prosperity and a cleaner, greener countryside for all.

Explore how technology and strategic farm management can boost your organic farming journey—download the Farmonaut app or integrate real-time insights via the Farmonaut API today.