Bone Creek Art Expansion: 7 Ways It Inspires Nebraska’s Community

Discover the inspiring city museum Nebraska restoration—a community-driven expansion of agrarian art in Lincoln area, blending history and future vision.

Tariffs Impact on Mendocino: 7 Powerful Ways Local Shops Are Hit

Explore how recent tariffs drive food price increases, affect Mendocino local businesses, supply chain, and the small restaurant economy. Read

Oklahoma City Bombing: 5 Powerful Lessons on Resilience Today

Explore how the oklahoma city bombing shaped federal agencies, city resilience, real estate, and domestic terrorism in america. Uncover key

Lakeshore Property Owners: 5 Powerful Shoreline Practices in Minnesota

Discover shoreline best practices, water conservation tips, and landowner tools for preserving Minnesota lakeshores. Learn more about local improvement projects!

Short Interest Ratio Drops 19%: Key Trends in Specialty Chemicals

Explore quarter trends, short interest ratio changes, and institutional investors’ stocks in specialty chemicals and agricultural investment market analysis.

1,100 Wildland Firefighter Jobs Open in the Rocky Mountain Region

Explore wildland firefighter jobs, permanent fire management careers, and support staff hiring in the Rocky Mountain region—learn how to apply

Top 7 Investment Insights for Iowa Financial Services

Explore financial services, dividend yield, and institutional ownership with expert risk, profitability, and valuation analysis for smart investment decisions.

Cape Coral Burrowing Owls: 5 Powerful Ways to Protect Habitat

Discover Cape Coral’s thriving burrowing owl habitat, wildlife conservation, and ways volunteers protect urban bird spaces and nesting sites in

Palm Beach County: 7 Key Updates on Housing, Legal Aid & Careers

Explore Palm Beach County housing authority, legal aid services, and Florida nonprofit organizations making positive impact in business, health, and

Utility Line Repairs: Top 5 Critical Updates in Stephens City

Discover how town utility line repairs, water line replacement, and addressing pipe corrosion issues drive ongoing local infrastructure improvement.

Wild Foraging in Montana: 7 Powerful Health Benefits Revealed

Discover wild foraging in Montana—learn foraging diet benefits, edible plants in Missoula, and practical skills for sustainable, healthy living. Read

Kirtland’s Snake Indiana: 7 Ways Residents Can Help Conservation

Discover Kirtland’s snake Indiana: learn how to identify this endangered reptile, report sightings, and support vital conservation efforts across the

Kansas City Federal Job Cuts: 5 Urgent Impacts on Health & Food Aid

Explore how government job cuts in Kansas City are impacting public health, food aid programs, and the local economy—discover solutions

Maine Historical Sites: Discover Hidden Art in Stone Wall Churches

Explore Maine historical sites & stone wall structures in pine forest hills—discover hidden art, local community, and New England church

Louisiana Immigration Detention: 7 Shocking Facts on Overcrowding & Courts

Explore Louisiana’s rural immigration detention centers, overcrowding, and court conditions as the US expands its deportation system and facility capacity

7 Effective Ways Corpus Christi Recycles E-Waste in Texas

Discover how e-waste recycling in Texas protects soil, water, wildlife, and community health while raising environmental awareness in South communities.

7 Urgent Trends in California’s Political Leadership Crisis

Explore california’s history in congress, american political leadership, government spending and deficit, and the urgent need for civic education. Read

Springport Michigan: 5 Inspiring Rural School Health Successes

Explore Springport, Otsego, and rural Jackson County’s success with in-school health centers, agricultural education, and healthy families in Michigan.

7 Major Effects of National Forest Logging on Oregon’s Land & Wildlife

Explore national forest logging, wildfire risk reduction strategies, forest management plans, and the impact on wildlife habitat and domestic timber

7 Earth Day Activities for Kids to Protect the Planet in Ocean Springs

Explore Earth Day activities for children, sustainable farming, marine education, and protecting natural resources for future generations. Read more!

Alabama Farmland Challenges: 5 Powerful Trends Shaping 2025

Explore regional differences in alabama and nebraska farms, crop conditions, urban sprawl impact, and challenges in generational agricultural operations.

Chicago Rail Hub: 7 Powerful Facts Shaping America’s Rail Network

Discover how Chicago’s rail hub drives freight movement across America, advances rail infrastructure modernization, and shapes the national transportation network.

Hemp Products Texas: 5 Critical Changes in State THC Laws 2024

Explore Texas hemp products, new laws, and industry trends. Learn how regulatory bills impact hemp farming, THC regulations, and future

New Zealand Tire Market 2025: Key Pricing & Demand Shifts

Explore New Zealand Tire market trends: sustainable tires NZ, precision farming, regulatory shifts, pricing, and regional adoption shaping agricultural growth.

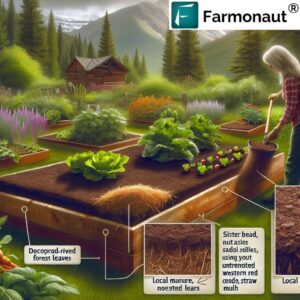

Create Powerful Montana Garden Soil: 7 Eco-Friendly Tips to Grow Food

Discover how to create garden soil from native materials, use natural fertilizers, and get eco-friendly gardening tips to grow healthy

USDA Grants for Farmers: 7 Powerful Impacts in New Mexico Today

Discover how shifting federal policies and changing USDA grants impact Northern New Mexico farmers, research funding, and water conservation programs.

Idaho Sustainable Agriculture: 5 Powerful Grant Criteria Changes

Explore Idaho sustainable agriculture funding, grant criteria for farmers, and cost saving in agriculture amid new USDA initiatives and traceability

Wildfire Season in Oregon: 7 Powerful Tips for Community Safety

Wildfire season in Oregon brings extreme weather risk; learn community wildfire safety, preparedness tips, and how to mitigate wildfire risk

Mountain Fire Ventura County 2025: Urgent Disaster Recovery Guide

Explore mountain fire Ventura County 2025 impact, disaster recovery assistance, fire damage insurance, and community resources for long-term wildfire support.

Chinese Ship Fees Surge: Omaha Ports Face Up to $140 Per Ton

Explore how new fees on Chinese ships and increased maritime industry tariffs impact shipping logistics, manufacturing, and agriculture exemptions.

Continental Divide Trail: 3 Powerful Moves for NM & CO Completion

Explore how the Continental Divide Trail Completion Act advances national scenic trail completion, protected trail areas, and forest service land

Wildland Firefighter Jobs: 7 Powerful Openings in Montana & the North

Explore wildland firefighter jobs, fire management positions, and prevention strategies across the Northern Region. Discover application tips and location info.

Vermont State Police: 7 Powerful Moments Shaping Public Safety

Explore the evolution of Vermont State Police, key legislature, public safety initiatives, and pivotal investigations shaping Vermont government history.

Farm Equipment Safety: 7 Essential Tips for Indiana Motorists

Stay alert on Indiana rural roads this spring—learn motorist safety around farm equipment and tractor safety tips to help save

Ocean Plastic Cleanup: 5 Powerful Ways Boosting Los Angeles Waterways

Discover how ocean plastic cleanup and sustainable water solutions drive circular economy initiatives, reducing waste and enhancing community hydration.

Chicopee School Renovation: 7 Key Community Updates for Residents

Explore chicopee school renovation updates, wetland soils, traffic studies, and community input on elementary site selection—discover how it impacts residents.

Wildland Firefighter Jobs: 26 Permanent Roles in Inyo National Forest

Explore Pacific Southwest wildland firefighter jobs, including permanent fire management positions and fire engine operator hiring—apply now for top wildfire

Madison School District: 7 Key Education Staff Changes This Spring

Discover spring staff changes in Madison public schools, including new hires, board decisions, FFA advisor roles, and education careers in

Soil Testing in Pasadena Parks: 5 Urgent Facts on Lead Risks

Discover crucial updates on soil testing in Pasadena parks, lead levels in soil, and health risks of heavy metals in

Utah Drought: 7 Major Effects on Snowpack & Water Conservation

Utah drought conditions worsen as below-average snowpack and dry soil threaten spring runoff, lake levels, and water supply. Discover key

Illinois Amish Heritage: 7 Powerful Ways Tradition Inspires Visitors

Discover Amish heritage in Illinois with immersive agricultural education, hands-on exhibits, and local tradition at the new living history museum

Idaho Agriculture Unveiled: 7 Powerful Commodities Shaping the Globe

Discover Idaho agriculture’s diverse commodities, Magic Valley irrigation system, top exports, and how climate innovation fuels growth in this industry

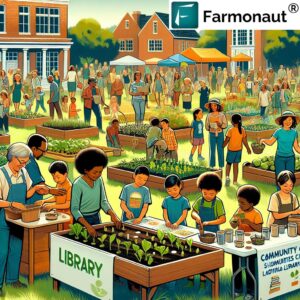

Urban Farm Cleveland: 7 Powerful Ways CSA Transforms Community Lives

Discover urban farm Cleveland: sustainable agriculture, green space, CSA program, fresh locally grown vegetables, and new opportunities for community growth.

Agricultural Workshops Florida: 5 Powerful Ways to Boost STEM Teaching

Discover agricultural workshops in Florida enhancing STEM education for rural schools, improving plant genes, and delivering authentic science classroom lessons.

5 Key Ways Supreme Court Deportation Case Affects Minnesota Agriculture

Explore supreme court deportation case, immigration policy administration, and agriculture committee support shaping key state and congressional election races.

Lead Levels in Pasadena Soil: 5 Urgent Park Safety Risks Exposed

Lead levels in Pasadena soil prompt urgent park closures and testing, raising public health concerns for children’s safety. Learn about

Mississippi River New Orleans: 7 Powerful Ways It Shapes the City

Explore how the Mississippi River shapes New Orleans’ economy, levees, coastal erosion, port trade, and delta restoration amidst climate change

Agriculture Education in Virginia: 7 Powerful Ways Kids Learn to Grow

Discover how interactive agriculture education for children in Virginia inspires classrooms, grows knowledge, and nurtures a love for farming and

5 Ways Agriculture Programs Help Palm Beach County Youth Thrive

Explore how agriculture programs in Palm Beach County spark youth agricultural development through hands-on science learning and collaborative initiatives.

Local Food Access: 7 Powerful Urban Farming Initiatives in Lakewood

Discover how urban farming initiatives and sustainable practices are enhancing local food access, supporting community, and eliminating barriers for farmers.