“Omaha ports now face Chinese ship fees soaring up to $140 per ton, reshaping global shipping costs.”

Chinese Ship Fees Surge: Omaha Ports Face Up to $140 Per Ton

Introduction

The global maritime industry is witnessing significant transitions as new fees and tariffs target Chinese ships docking at US ports, with a profound impact on Omaha and other major US entry points. For stakeholders in shipping logistics, manufacturing, and agriculture, these new charges not only reshape the financial landscape, but also the operational paradigm across international trade routes.

This development comes as the Trump administration resolutely advances its plan to implement a soaring fee structure—culminating at $140 per ton—for Chinese vessels making a port of call in the United States. With Chinese container ships making up a substantial portion of global maritime traffic—China controlling nearly one-fifth of the world’s shipping containers, as cited by the USTR—the consequence for global logistics and adjacent industries is immense.

However, beneath the headline figures lies a complex web of concerns for trade partners, manufacturers, and export-driven sectors such as agriculture, which have ardently requested exemptions through multiple channels, but with no guarantees of relief as yet. This in-depth blog post explores every layer of this pivotal industry shake-up—including an analytic comparison for readers seeking clarity—while highlighting how technology platforms like Farmonaut are enabling the agriculture industry to adapt during periods of uncertainty.

Background: US Maritime Industry Tariffs and Fees on Chinese Ships

In recent years, US-China trade relations have become a focal point of economic strategy, with maritime industry tariffs and shipping container fees developing into key battlegrounds. The latest plan to impose stringent fees on Chinese ships—affecting each voyage rather than every port of call—signifies an expansion in the US approach, targeting not just imported goods but also the means by which these products reach American shores.

- Original Proposal: USTR initially suggested a $1.5 million flat fee per port of call for Chinese ships.

- Revised Order: The latest order updates the model to a per-ton fee, with an incremental rise over multiple years, without specifying a maximum cap per ship, but focusing on tonnage.

- Chinese Control: China’s dominance in both global ship manufacturing and management of shipping containers is noted as a reason for this targeted response.

The rationale, as outlined by the U.S. Trade Representative (USTR), is to counteract what it sees as China’s unfair practices aimed at harming US-based ship manufacturing and the broader American shipping ecosystem. For the global economy, these tariffs and fees are not merely administrative—they reengineer trade flows and recalibrate costs for every player in the world shipping logistics chain.

Breakdown of the New Fee Structure: Container Ship Fees Per Ton and Tonnage Fee Increase

Let’s explore the granular details of this evolving fee landscape, with an emphasis on Omaha ports and implications for the maritime industry nationwide. The new US policy reorganizes port charges into a per ton scale, with phase-in increases over time:

- No-fee Window: 180 days from issuance (until October 24, 2025)

- October 24, 2025: $50 per ton fee on ships based out of China

- April 17, 2026: Increase to $80 per ton

- April 17, 2027: Increase to $110 per ton

- April 17, 2028: Maximum fee reaches $140 per ton

- For companies not based in China but using Chinese-built ships: $18 per ton or $120 per container, whichever is higher

- Container ship capacity: Typical vessels hold between 12,000 and 24,000 containers

For context, imagine a large container ship holding 20,000 containers: at $140 per ton, with each container averaging two tons, the resulting fee adds up to an astronomical sum per voyage. These surges magnify operational expenditures for Chinese companies and those utilizing Chinese ship manufacturing, representing the core focus of this intensified US policy drive.

Timeline of Key Fee Increases

- 2025 (October): Chinese ship fees per ton set at $50

- 2026 (April): Bumped to $80 per ton

- 2027 (April): Further raised to $110 per ton

- 2028 (April): Peaks at $140 per ton

These changes are not isolated to Omaha ports; West Coast entry points and the entire US coastline will experience ripple effects, fundamentally altering the economic calculus for industries reliant on affordable shipping and fast turnaround.

Impact on Omaha Ports and Shipping Logistics: Port of Call Charges & Global Supply Chain Shift

Omaha, strategically located within North America’s agricultural heartland, is heavily dependent on robust and affordable shipping logistics to sustain both import and export flows. The spike in fees on Chinese ships directly translates to a shock across the region’s ports—a scenario mirrored at major coastal hubs.

To visualize the magnitude of the cost impact:

- Port of call charges have grown from effectively zero to as much as $140 per ton over a short window.

- Shipping container fees for companies using Chinese-built ships skyrocket, fundamentally altering competitive dynamics.

- Supply chain costs for finished goods, parts, and raw materials see an inevitable upward tick, with downstream impacts on consumer prices and production schedules.

Many companies are forced to reevaluate routes, shipment sizes, and even options to bypass specific ports or rethink the source of their container ships and containers. The new tariff regime further compounds the prior escalation of imported goods tariffs (145%, with a proposal to move to 245%), signaling an era where global trade is increasingly complex—every container and ton has amplified strategic and cost implications.

Omaha Ports: Special Challenges and Opportunities

- Being a critical node for agricultural exports, Omaha faces a unique balancing act between global trade resilience and production cost control.

- Rising shipping logistics fees are likely to influence port handling charges, warehouse costs, and inventory turnover for all sectors, but especially for bulk agricultural commodities.

- The need for real-time decision-making and intelligent routing is at an all-time high, making digital and satellite-driven logistics essential for business continuity.

Technological solutions like Farmonaut’s Fleet Management Tools are becoming increasingly popular among agribusinesses and export coordinators. These enable smarter fleet resource deployment, efficient vehicle usage, and improved safety—essential features for companies striving to offset rising operating expenses from new shipping and port fees.

“New maritime tariffs on Chinese vessels directly impact logistics, with agriculture exemptions influencing trade flow dynamics.”

Manufacturing Implications and Global Ship Manufacturing Rates

The new fees and tariffs on Chinese ships have a multidimensional impact on US manufacturing:

- Manufacturers that rely on global components—shipped via containerized freight—will face steeper input costs.

- The US aims to spur local shipbuilding by making Chinese-built ships less attractive through costlier shipping logistics fees.

- There is an anticipated shift in the global ship manufacturing rates, as more companies seek alternatives to China for their fleets and containers; this could open new investment into regions formerly less competitive.

Yet, the scale of China’s control—almost 20% of global shipping container capacity—means these shifts will not happen overnight. The increase in tonnage fees is a calculated move to gradually rebalance production incentives and prompt manufacturers to re-assess their long-term sourcing strategies.

It is crucial for both large companies and smaller entrants to improve transparency and traceability within their supply and value chains. Utilizing blockchain and digital traceability solutions can secure goods verification and boost consumer confidence—a field where Farmonaut’s Product Traceability Platform provides robust options, especially for those in the food and textile processing sectors.

Agriculture Sector: Exemptions for Agriculture Industry and Farm Groups’ Response

A focal point of advocacy and negotiation has been the potential exemptions for the agriculture industry. Since the initial announcement of proposed maritime tariffs and shipping logistics fees on Chinese ships, farm groups and export-focused organizations have voiced urgent concerns:

- Farm groups: Have repeatedly requested clear exemptions to safeguard US agricultural exports from punitive cost increases.

- USTR response: While the agency acknowledged these requests in its order, no explicit exemptions have been granted to date.

- Bilateral pressure: Both government and private industry lobbyists continue to press the need for protecting the international competitiveness of US-grown products, especially those supplied via Omaha and other inland and coastal ports.

For agricultural business owners, uncertainty looms over whether their supply chains will be shielded from the most severe fee hikes—or if rising container ship fees per ton will erode margins and reduce export attractiveness. As the world’s appetite for US grains, meat, and produce remains robust, ensuring global visibility and compliance is non-negotiable.

Digital tools have emerged as a critical ally: for example, Farmonaut’s Carbon Footprinting Service helps businesses measure and mitigate emissions amid rising transportation costs, supporting sustainability commitments and regulatory compliance.

Key Points for Agriculture in the Face of Rising Fees

- Fee escalation may be unsustainable for exporters without timely exemptions or logistics innovation.

- Technology-driven fleet, warehouse, and shipment orchestration can offset cost pressures for top-performing agribusinesses.

- Sustainability and digital traceability will differentiate resilient US agricultural exporters on global stages.

Comparative Impact Table: Omaha Ports Shipping, Manufacturing, and Agriculture

The following table encapsulates the major industries impacted by this fee paradigm shift at Omaha ports—enabling at-a-glance understanding of cost increases, exemptions, and associated implications:

| Sector | Previous Fee per Ton (USD) | New Fee per Ton (USD) | Estimated Increase (%) | Direct Impact | Notable Industry Notes |

|---|---|---|---|---|---|

| Shipping Logistics | $0 (pre-fee) | $50 – $140 (by 2028) | 100% to >1000% | Significant cost rise for voyages from China; incentive to reroute or upgrade fleets | Shippers must adapt to per voyage fees and evolving fleet composition |

| Manufacturing | $0 | $18 (non-China firms using Chinese ships) to $140 (by 2028, China-origin ships) | N/A (new fee class) | Upstream material and component costs spike; competitive landscape shifts | Need for alternative shipbuilders; urgency for blockchain traceability and compliance |

| Agriculture | $0 | $50-$140 unless exemptions granted | 100% to >1000% | Potential margin decreases pending official exemption decision | Farm groups lobbying for relief; opportunity for farm management tech |

| Exemptions (if applicable) | $0 | Undetermined | TBD | Potential exemption from logistics fees for key agricultural exports | No official exemptions granted at time of writing |

Technology & Innovation in Agriculture Amid Rising Shipping Logistics Fees

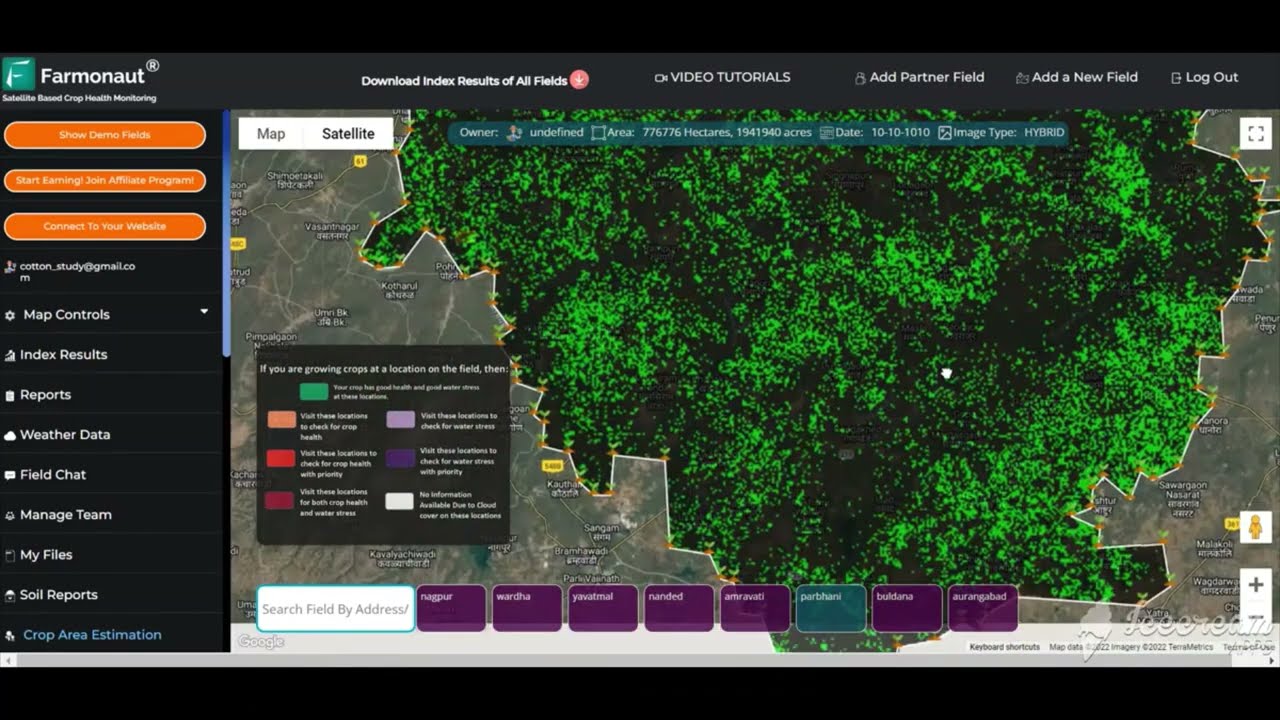

As fee structures and maritime tariffs evolve, the role of precision agriculture technology becomes increasingly central for producers, exporters, and agribusinesses. Platforms like Farmonaut demonstrate the capacity for the industry to leverage digital transformation as both a shield against cost hikes and a lever for efficiency gains.

Farmonaut’s Innovations Responding to Industry Trends

- Satellite-Based Crop Health Monitoring: Enables farmers to visualize vegetation health, soil moisture, and stress events to maximize every acre and reduce input wastage—making it easier to manage risks and boost productivity as port and shipping costs make margins tighter.

- AI-Based Advisory (Jeevn AI): Provides real-time, customized recommendations on crop management, linked to weather and environmental data, allowing farms to optimize operations even as logistical fees become a greater concern.

- Blockchain Traceability: Secures every step of the supply chain with immutable records, essential for industries where proof of origin, transport, and handling add value in the face of higher logistics costs—we highly recommend exploring Farmonaut’s Traceability Platform for food, textiles, and other sensitive sectors.

- Fleet & Resource Management: Optimizes everything from tractor fleets to export trucks, reducing unnecessary journeys and idle time, a key consideration as fuel and route charges escalate under the new port fee plan. See Fleet Management Module.

- Large-Scale Farm Management: Provides unified control for agri-enterprises and government bodies, streamlining operations from planting to logistics. Discover more at Farmonaut’s Agro-Admin App.

- Carbon Footprinting: Helps businesses monitor and reduce greenhouse gas emissions throughout their operations, demonstrating compliance and sustainability for international trade.

Moreover, with rising logistical uncertainty, affordable digital and satellite-powered solutions empower farmers of all scales to sustain yield, quality, and compliance in export markets, regardless of fee volatility. For those navigating insurance or loan verification in a landscape of rising transportation charges, Farmonaut’s Crop Loan & Insurance Solutions deliver fast, accurate verification.

You can access Farmonaut services via our intuitive web app, Android app, or iOS app. For developers and business system integrators, make use of our API and our detailed API Docs to build next-generation farm management platforms.

FAQ: Chinese Ship Fees, Maritime Industry Tariffs, and Agriculture

Q1: What exactly are the new fees on Chinese ships docking at US ports like Omaha?

The United States is implementing a new structure of fees for Chinese ships making a port of call in the US, calculated per ton of shipping cargo. The fees start at $50 per ton in October 2025 and ramp up to $140 per ton by April 2028, with additional charges for companies using Chinese-built vessels.

Q2: Are agricultural exports exempt from these fees?

Farm groups and others have requested clear exemptions for the agriculture industry. While the USTR noted these requests, no official exemptions have been granted as of now.

Q3: How do these shipping container fees affect manufacturing companies?

As new container ship fees per ton are enforced, manufacturing firms relying on imports and exports via Chinese shipping lines or vessels face increased logistical costs. This creates an incentive to diversify supply chains, invest in alternative shipping, or adopt advanced traceability systems like those offered by Farmonaut.

Q4: What can agri-businesses do to manage or offset elevated logistics fees?

Leveraging precision agriculture tools and digital fleet management—such as Farmonaut’s Agro-Admin App—helps optimize operations, reduce wastage, and provide evidence for sustainability initiatives, even as external costs rise.

Q5: What is the time frame for implementation?

The plan allows for a 180-day no-fee window, with new tonnage fees starting on October 24, 2025, and incremental increases each year up to April 2028.

Q6: What role does technology like satellite-based farm management play under these new tariffs?

Digital and satellite-driven solutions—such as those offered by Farmonaut—provide actionable insights on crop health, resource allocation, logistics, traceability, and sustainability, all of which are increasingly necessary as shipping and port access become less predictable and more costly.

Conclusion and Future Outlook

The imposition of steep fees on Chinese ships—from a zero base to as much as $140 per ton—marks a new chapter for Omaha ports, the US maritime industry, and the wider global trade network. These evolving policies are not isolated events; they are part of a broader movement of imported goods tariff escalation, shifting logistics, and technology-induced adaptation.

While manufacturers and shippers face strategic recalibration, it is the agriculture sector—so vital to the economy of Omaha and the Midwest—that finds itself at a crossroads. The next several months will prove pivotal as farm groups, port authorities, and global shipping stakeholders advocate for fair access and feasible logistics fees. The absence of clear exemptions at this stage injects uncertainty but also opens the door for innovation and collaboration.

In response to this new landscape, technology plays a central role. Farmonaut’s mission—making precision agriculture affordable and accessible—takes on renewed urgency in a world of volatile supply chains and rising transactional costs. By providing satellite imagery, AI-driven advisories, blockchain traceability, and digital fleet management, platforms such as Farmonaut enable farms and agribusinesses to not only withstand headwinds, but to thrive in the evolving environment.

Ultimately, as container ship fees per ton and port charges continue to rise, the winners will be those who combine operational excellence, policy agility, and technological savvy. Omaha and its peer ports remain at the heart of this transition—determined, adaptive, and closely watched by the world.

For trusted, scalable solutions in agricultural management, logistics, and traceability—empowering your business amid industry disruption—explore the Farmonaut App today.