Table of Contents

- Introduction: Hemp Products Texas – A 2024 Landscape

- Industry Trivia

- The Federal Context and Texas Hemp Legalization

- Industrial Hemp Farming in Texas: Rise, Reality & Regulation

- Hemp Products Texas: 5 Critical Changes in State THC Laws 2024

- THC Regulations Texas: Impact on Hemp Farmers and Producers

- Consumable Hemp Products and New Compliance Challenges

- From Beverages to Gummies: The Scope of Regulated Hemp Products Texas

- Farmonaut: Empowering Texas Hemp Industry with Precision Technology

- Future Opportunities: Hemp Farming Opportunities Texas

- Frequently Asked Questions

“Texas raised the legal THC limit for hemp products from 0.3% to 1% in 2024, impacting over 2,000 farms.”

Hemp Products Texas: 5 Critical Changes in State THC Laws 2024

Hemp products Texas has become a pivotal search term as our region grapples with the layered impact of sweeping changes in cannabis and THC regulations. In 2024, across the plains and urban hubs of Texas, hemp farmers, producers, and consumers find themselves navigating a transformed environment influenced by both federal and local legislative activity.

As the Texas Tribune reports, the story of Andrew Hill and the first agricultural expo in Dallas illustrates the hopes and miscalculations of the early days following federal hemp legalization. From exuberant projections of $2,500-$3,000 in revenue per acre to the sobering reality of volatile markets and looming legal uncertainty, the hemp industry has matured—and faced hard truths.

In this comprehensive analysis, we will dissect the most impactful Texas hemp laws and their crucial changes for hemp products Texas in 2024. We’ll explore the critical bills advanced in the Senate and House, profile the direct repercussions for farmers and licensed producers, and provide a forward-looking assessment of industry opportunities—including the advanced technological support offered by Farmonaut.

The Federal Context and Texas Hemp Legalization

The journey of hemp products Texas owes its recent history to the landmark decision of federal hemp legalization in 2018. This federal move defined hemp as a cannabis plant containing less than 0.3% THC. In 2019, the Texas Legislature swiftly followed suit, legalizing consumable hemp products and opening doors for a new agricultural sector in the state.

Yet, this era of opportunity was accompanied by regulatory complexity. Hemp-infused beverages, gummies, oils, and other products surged in popularity, resulting in a dynamic but sometimes chaotic marketplace. Despite the positive outlook, those like Andrew Hill who studied and farmed hemp in California were quick to warn that expectations should be tempered by practical realities.

- Texas hemp legalization brought about licensing systems, mandatory THC content testing, and labeling requirements.

- Federal and state law jointly mandated trace amounts of THC (0.3% by weight)—a limit that would shape the entire supply chain, from seed to shelf.

- Industrial hemp farming in Texas expanded rapidly, with over 450 licensed producers by early 2024, according to the Tribune reports.

The stage was set for significant growth, but also for regulatory recalibration. Recent legislative activity, notably Senate Bill 3 (SB 3) and House Bill 28, targeted perceived loopholes, health concerns, and market excesses, fundamentally transforming the industry’s operational landscape in 2024.

Industrial Hemp Farming in Texas: Rise, Reality & Regulation

The industrial hemp farming in Texas has been emblematic of both opportunity and risk. Farmers were promised financial windfalls and a new cash crop to revive rural economies. The adoption curve was steep—over 2,000 hemp farms were estimated to be operational in the wake of Texas hemp legalization.

However, veteran voices like Hill’s—backed by his experience in both California and Texas—cautioned fellow farmers at the inaugural agricultural expo in Dallas not to bank on pie-in-the-sky projections. “Everyone looked at me and asked what was so funny, and they gave me the mic and I said, ‘Ladies and gentlemen, I’ll tell you right now — I haven’t seen over $1,000 an acre since 2015,’” Hill recounted, highlighting the often-misunderstood economics of hemp farming.

- Initial investment requirements were substantial. Farmers like Hill put millions of dollars into seeds, licenses, facilities, and the production means.

- Profitability was challenged by oversupply, volatile sales channels, and an ever-changing regulatory environment.

- The compliance burden—ensuring each crop contained only trace amounts of THC—was and remains punishing for many operations.

Despite these challenges, the sector continued to innovate, exploring new value-added products—such as hemp hearts, oils, and salad dressings—that are not traditionally associated with psychoactive effects.

Hemp Products Texas: 5 Critical Changes in State THC Laws 2024

The most seismic shifts for hemp products Texas in 2024 arose from key legislative changes in the Senate and House. The state’s regulatory climate is now shaped by a suite of bills targeting everything from product content to marketing restrictions. Here we present Texas Senate Bill 3 hemp and related legislation, identifying the five critical areas of impact.

Overview of the 5 Critical Legal Changes:

- Stricter THC Thresholds and Testing: Stringent enforcement of the 0.3% THC limit (with modifications for some product categories) and rigorous testing for all consumable hemp products, targeting not just the flower but also derivatives and edibles. Many farmers have reported difficulties producing compliant crops without accidental breaches of this narrow band, making the necessity of advanced monitoring and traceability essential.

- Ban on Synthetic & High-THC Products: SB 3 and HB 28 propose a sweeping ban on any products containing synthetic THC, including certain gummies, vapes, and high-THC beverages, regardless of origin.

- Sales and Marketing Restrictions: Hemp-infused products, especially those that may appeal to minors (i.e., flavored edibles and drinks), must now adhere to strict packaging, marketing, and sales restrictions. All goods must be in tamper-evident and child-resistant packaging, with explicit limiting of sales to those over 21.

- Regulatory Assignment to Alcohol Commission: The House’s proposal delegates regulation of hemp-infused beverages to the Texas Alcoholic Beverage Commission—adding another layer of compliance and redefining distribution models.

- Caps on Purchase and Daily Dosage: State law now restricts individual purchases to no more than 10 milligrams of THC in a single transaction and maintains a federal restriction on product content.

Below is a data-driven table summarizing the direct and potential impact of each of these law changes.

Law Change Impact Comparison Table

| Law/Regulation Name | Key Change (2024) | Estimated Impact on Hemp Farmers (% eligible acreage affected) |

Estimated Impact on Product Availability (# of SKUs affected) |

Potential Economic Effect ($ million market shift) |

|---|---|---|---|---|

| SB 3: THC Threshold Enforcement | Stricter testing for all products; 0.3% THC cap reinforced | 60%—80% of acreage needs new compliance protocols | ≈3,000 SKUs risk discontinuation/reformulation | $40M–$60M risk of lost revenue statewide |

| HB 28: Synthetic THC Ban | Prohibits synthetic THC products (gummies, vapes, beverages) | 10% of farmers/acreage producing for these markets affected | 1,100+ SKUs impacted, especially in retail chains | $15M direct revenue decline |

| SB 3: Sales & Packaging Restrictions | Limits marketing to adults; requires child-resistant packaging | 100% of producers must update packaging/marketing | Over 5,000 SKUs require compliance change | $5M–$12M compliance cost (one-time transition) |

| HB 28: Alcohol Industry Regulation Assignment | Shifts enforcement of beverages to TABC; new retail restrictions | 12%–20% of acreage focused on beverage-grade hemp affected | 400+ beverage SKUs regulated differently | $7M–$10M market shift into alcohol retail sector |

| SB 3: Purchase & Daily Dosage Caps | Consumers limited to 10mg THC per day/purchase | Minimal direct farm impact, but affects high-volume product contracts | All edible and beverage SKUs adjusted | $8M–$20M possible reduction in retail sales |

“In 2024, Texas introduced 5 major regulatory bills affecting hemp product labeling, testing, and distribution statewide.”

THC Regulations Texas: Impact on Hemp Farmers and Producers

The real shockwaves from these THC regulations Texas are felt by every stakeholder in the value chain. For hemp farmers—many of whom studied best practices in states like California and invested heavily in production and sales facilities—the laws pose existential questions:

- Testing Frequency and Failures: Frequent and advanced testing protocols must now be implemented at every stage. In some cases, crops destined for hearts, oils, or even non-consumable products (textiles, paper) are at risk of disqualification due to naturally occurring trace amounts of THC.

- Risk of Criminalization: The Senate bill creates harsh penalties for manufacturing or knowingly selling non-compliant goods—up to a year in jail for possession and up to 10 years for producers.

- Uncertainty for Licensed Producers: About 450 licensed producers in the Texas Industrial Hemp Program must re-evaluate their business models, supply contracts, and even acreage allocation in light of the new regulations.

- Investment at Risk: SPIKED compliance costs around new packaging, product testing, and potential crop destruction (for those failing to meet updated standards).

- Potential Ban on Mainstream Food Products: As highlighted by Hill, even health-focused, non-intoxicating foods like hemp salad dressings and hearts may unintentionally fall under the “illegal” category if they contain any detectable cannabinoid residue.

In response, many in the sector have turned to advanced agronomic technologies, like Farmonaut’s satellite-based crop health platform. Real-time crop monitoring and AI-driven advisories help precision-manage field inputs, minimize THC compliance risk, and optimize resource usage—necessary tools for any Texas grower trying to stay competitive amid regulatory flux.

For those seeking regulatory peace of mind and sustainable profitability, advanced digital tools like Farmonaut’s Large Scale Farm Management and blockchain product traceability enable compliance tracking, record keeping, and real-time notifications about crop stress or environmental issues. This puts the grower in command of both field health and legal risk.

Consumable Hemp Products and New Compliance Challenges

The 2024 legislative session in Austin redefined what is legal for consumable hemp products in Texas. Previously, the state allowed sales of low-THC hemp derivatives as long as they contained less than the federal-mandated 0.3% THC. With the regulatory overhaul:

- Tamper-Evident, Child-Resistant Packaging: All hemp edibles, beverages, gummies, and vapes must be in secure packaging that meets new state standards.

- Marketing to Minors Banned: No branding, advertising, or package design can target individuals under 21 years old. Vendors who violate these rules risk severe penalties and product bans.

- Daily Dosage Limitation: Retailers are now responsible for ensuring that each purchase contains a maximum of 10mg of THC, further tightening compliance controls.

- Restriction on Product Formats: Gummies, vapes, and similar items are at the center of the House and Senate’s proposals, due to youth risk and potential for misuse.

Compliance for these rules means that manufacturers and retailers are investing significantly in supply chain monitoring, traceability, and quality assurance.

Blockchain-based traceability solutions ensure every step—from seed acquisition, planting, and harvesting to processing, packaging, and sales—is securely logged and verifiable. Learn more about Farmonaut’s product traceability technology for hemp and agricultural producers.

From Beverages to Gummies: The Scope of Regulated Hemp Products Texas

Hemp-infused beverages have emerged as a game-changing category. Easily accessible and a substitute for traditional alcohol drinks, these products sit at the intersection of health trends and recreational markets. The new bills specifically:

- Assign regulatory oversight to the alcohol authority for these beverages

- Require beverage producers to comply with detailed labeling, testing, and marketing restrictions

- Limit distribution to merchants licensed for alcohol sales, fundamentally altering the retail chain

- Impose daily purchase limits and require on-site age verification

Outside of drinks, the rules for gummies and vapes—two segments often targeted for their appeal to youth—are even stricter. The manufacturing or sale of products containing any synthetic THC is banned under both SB 3 and the House proposal.

Retailers and processors seeking to remain viable must use advanced compliance tools. For example, Farmonaut’s carbon footprinting system can help monitor and reduce environmental impact, a key selling point for health- and climate-conscious consumers.

Farmonaut: Empowering the Texas Hemp Industry with Precision Technology

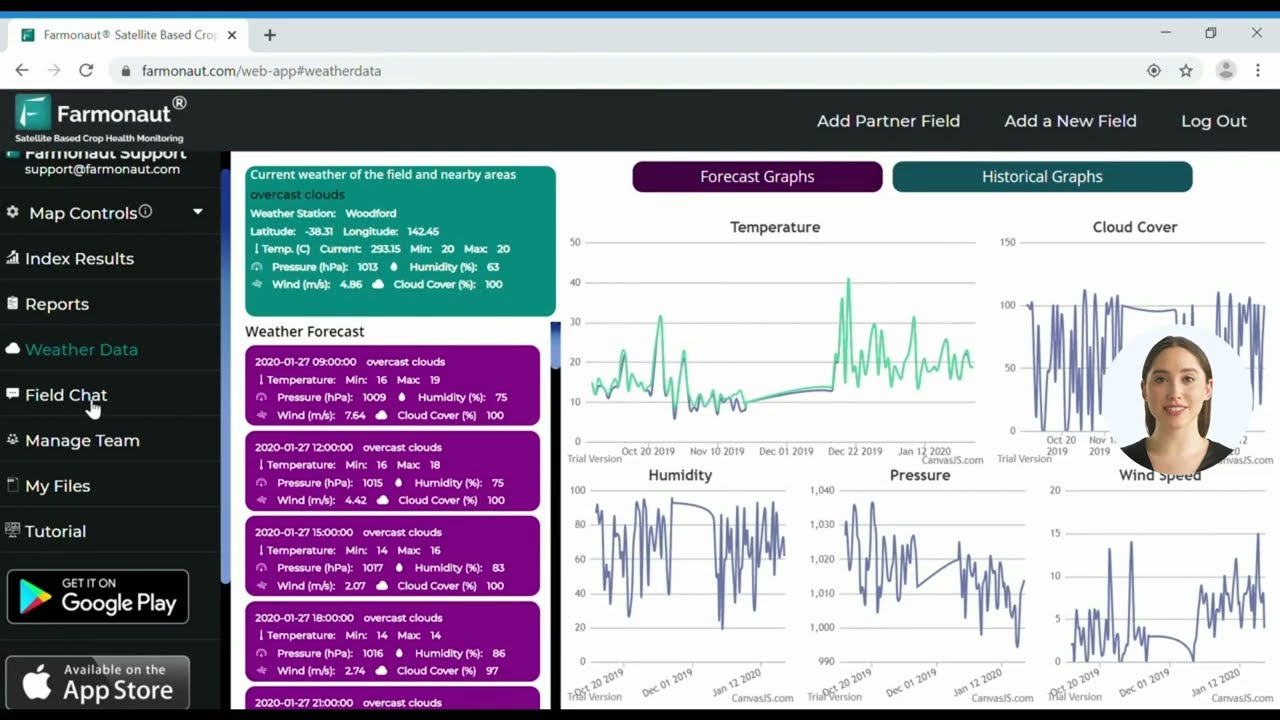

As regulations tighten for hemp products Texas, the need for advanced, cost-effective, and scalable technology solutions—like those provided by Farmonaut—is more acute than ever. Farmonaut offers satellite-enabled crop health monitoring, providing real-time NDVI, soil moisture analytics, and weather-based advisories directly to the hands of farmers and producers.

Our platform is built to:

- Enable real-time identification of problem fields at risk for disease, nutrient stress, or excess THC accumulation.

- Support compliance tracking for licensed producers to ensure legal THC limits are met throughout crop cycles.

- Streamline reporting and documentation, reducing the risk of costly legal missteps or failed audits.

- Optimize water, fertilizer, and pesticide usage—improving yield and sustainability.

- Farmonaut’s blockchain-based traceability (see product details) secures the entire journey from seed to shelf, while the fleet management module enables efficient use and tracking of farm vehicles and equipment.

- Our crop loan and insurance solutions help farmers gain finance and protect their investment with satellite-verified, fraud-resistant insurance documentation.

For both individual hemp producers and large agribusinesses, Farmonaut delivers seamless access to these powerful tools through web and mobile apps as well as API integration for developers. For full documentation or technical onboarding, consult our API developer docs.

Get started with Farmonaut:

- Web App – For desktop and browser-based management

- Android App – Monitor fields from your phone!

- iOS App – For Apple users anywhere

Future Opportunities: Hemp Farming Opportunities Texas

While the regulatory landscape may be daunting, hemp farming opportunities Texas have not disappeared. Adaptable, forward-looking producers can capitalize on:

- Production Diversification: Moving beyond consumable products, there is renewed interest in industrial hemp applications: textiles, construction materials, and bio-composites, which fall outside certain THC compliance.

- Premium, Traceable Goods: Leveraging blockchain product traceability, brands can target the premium segment by guaranteeing purity and origin, a major selling point for both B2B and retail buyers.

- Climate and Resource Management: Increasing climate volatility means precision agriculture—enabled by platforms like Farmonaut—will become a non-negotiable part of scalable, risk-mitigating operations.

- Expanded Financial Services: Through crop loan and insurance programs, farmers are more likely to enjoy stable access to capital, leveraging satellite-based acreage verification.

- Low- and No-THC Product Development: The innovations in seed genetics, cultivation methods, and supply chain transparency now permit truly legal production of value-added health foods, cosmetics, and materials even under strict scrutiny.

By understanding and anticipating legal shifts, backed by smart investment in compliance technology, the Texas hemp industry can regain its footing and thrive.

Frequently Asked Questions

What is the current legal THC limit for hemp products in Texas?

As of 2024, Texas has increased its legal THC cap for hemp products from 0.3% to 1%. However, for most consumable hemp products, the practical enforcement limit remains extremely close to federal standards, with rigorous testing protocols and severe penalties for violations.

Which hemp products are banned under Texas law in 2024?

Under recent bills, Texas bans any consumable products containing synthetic THC as well as certain formats like gummies and vapes. Non-consumable products (such as textiles) may also be indirectly affected if trace cannabinoids are detected.

How do these new laws affect licensed hemp producers?

Licensed producers must invest in upgraded testing, packaging, and product traceability—all of which increase operational costs. Non-compliance can result in crop destruction, loss of license, and criminal penalties.

Are hemp-infused beverages still allowed?

Yes—however, beverages are now strictly regulated by alcohol authorities and must meet detailed sales and labeling requirements. They can only be sold in licensed alcohol retail outlets, and sales are limited to consumers aged 21+.

How can Texas hemp farmers ensure compliance?

By leveraging advanced digital tools. Farmonaut’s precision agriculture platform aids in real-time compliance monitoring, resource optimization, blockchain traceability, and reporting, helping producers stay within legal limits and demonstrate transparency to regulators.

Summary

As the landscape for hemp products Texas undergoes transformative change, our industry stands at a crossroads. Regulatory bills in 2024 have elevated both compliance risks and operational standards for Texas hemp farmers and licensed producers. From stricter THC regulations Texas to complete bans on certain product types and tighter product sales practices, adaptability is the key to survival.

With the aid of innovative, satellite-based solutions like Farmonaut’s platform, Texas hemp stakeholders can stay at the forefront of compliance, sustainability, and market opportunity. Technology is now a non-negotiable investment for those committed to legal, productive, and transparent hemp farming in the Lone Star State.

Farmonaut continues its mission to deliver affordable, high-tech precision agriculture to farmers, agribusinesses, and the broader agricultural supply chain. We empower Texas and global producers to thrive through changing regulatory landscapes—making compliance easier, reducing risk, and opening the door to sustainable profitability in the modern era of hemp products.

For the latest in technology-driven crop management, try Farmonaut today—and turn compliance into a competitive edge.