Illinois Passes Game-Changing Ethanol Tax Incentives: Boosting Agriculture and Renewable Fuel Demand

“Illinois’ new ethanol tax incentives aim to boost renewable fuel demand, potentially impacting over 71,000 farms in the state.”

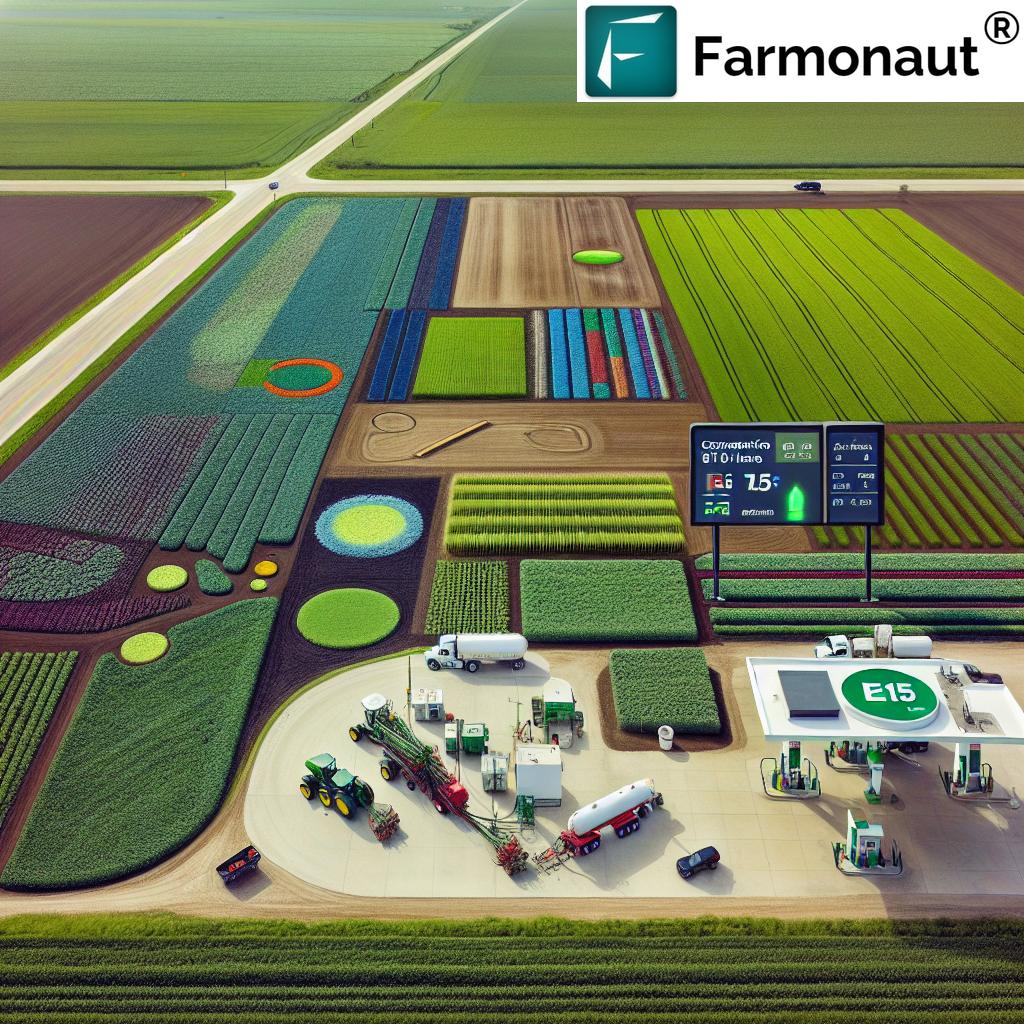

In a landmark move that promises to reshape the agricultural landscape of Illinois, the state has recently passed groundbreaking legislation introducing ethanol tax incentives. This progressive step forward in Illinois agriculture policy is set to have far-reaching implications for farmers, the rural economy, and the renewable energy sector. As we delve into the intricacies of this new bill, we’ll explore how these incentives are poised to boost renewable fuel demand while simultaneously supporting the state’s vast agricultural community.

The Dawn of a New Era in Illinois Agriculture

Illinois has long been known as a cornerstone of American agriculture, with its fertile fields stretching across the Prairie State. Now, with the introduction of these new ethanol tax incentives, we’re witnessing a significant leap forward in the state’s commitment to both agricultural prosperity and environmental sustainability. This legislation marks a pivotal moment in the ongoing efforts to align farming practices with renewable energy goals, creating a symbiotic relationship between crop production and fuel consumption.

The new bill, which has garnered widespread support from both agricultural advocates and environmental groups, introduces a series of tax exemptions and incentives designed to stimulate the production and use of ethanol fuel. At the heart of these measures are the E15 fuel exemptions, which are expected to have a significant impact on the corn industry—a cornerstone of Illinois agriculture.

Understanding E15 Fuel Exemptions

E15 fuel, a blend containing 15% ethanol and 85% gasoline, is at the center of this legislative push. The new exemptions are designed to make E15 more attractive to both producers and consumers, potentially leading to a substantial increase in demand for corn-based ethanol. This move is not just about fuel; it’s about reinvigorating the rural economy and providing new market opportunities for farmers across the state.

“E15 fuel exemptions in Illinois could increase corn demand by millions of bushels annually, supporting the state’s $19 billion corn industry.”

Let’s break down the key components of the E15 fuel exemptions:

- Tax breaks for fuel retailers who offer E15 at their pumps

- Incentives for consumers who choose E15 over traditional gasoline

- Grants for infrastructure upgrades to support increased E15 distribution

- Streamlined regulations to facilitate the expansion of E15 availability

These measures are expected to create a ripple effect throughout the agricultural supply chain, from corn farmers to ethanol producers and ultimately to consumers at the pump.

The Environmental Impact of Ethanol Incentives

While the economic benefits of these incentives are clear, it’s crucial to consider the environmental implications as well. Ethanol, as a renewable fuel source, has the potential to reduce greenhouse gas emissions when compared to traditional fossil fuels. By promoting the use of E15, Illinois is taking a significant step towards reducing its carbon footprint and promoting environmental sustainability in farming.

The legislation also includes provisions for soil health initiatives, recognizing the critical role that sustainable farming practices play in both agricultural productivity and environmental conservation. These initiatives aim to:

- Promote cover cropping to reduce soil erosion and improve soil quality

- Encourage no-till farming methods to preserve soil structure and biodiversity

- Support precision agriculture techniques to optimize resource use and minimize environmental impact

By linking ethanol production with sustainable farming practices, Illinois is creating a holistic approach to agricultural and environmental policy.

Boosting the Rural Economy

The impact of these ethanol tax incentives extends far beyond the fuel pump. By stimulating demand for corn-based ethanol, the legislation is expected to provide a significant boost to rural economies across Illinois. This economic development is projected to manifest in several ways:

- Increased corn prices due to higher demand from ethanol producers

- Job creation in ethanol production facilities and related industries

- Improved infrastructure in rural areas to support expanded ethanol production and distribution

- Enhanced economic stability for farming communities

The ripple effects of this economic stimulus are expected to benefit a wide range of rural businesses and services, from equipment suppliers to local retailers.

Agricultural Education and Innovation

Recognizing that the future of agriculture lies in education and innovation, the new legislation also includes provisions for strengthening agricultural education programs. These programs are designed to equip the next generation of farmers with the knowledge and skills needed to thrive in an evolving agricultural landscape.

Key aspects of the educational initiatives include:

- Enhanced funding for agricultural education in schools and universities

- Scholarships for students pursuing careers in agriculture and related fields

- Support for research and development in agricultural technologies

- Training programs for farmers on sustainable practices and new technologies

By investing in education and innovation, Illinois is laying the groundwork for long-term agricultural success and sustainability.

The Role of Technology in Modern Agriculture

As we discuss the future of agriculture in Illinois, it’s important to highlight the role of technology in driving efficiency and sustainability. Farmonaut, a leading agricultural technology company, offers innovative solutions that align perfectly with the goals of this new legislation. Through its satellite-based farm management platform, Farmonaut provides farmers with valuable tools for crop health monitoring, resource management, and sustainable farming practices.

Farmers can leverage Farmonaut’s technology to:

- Monitor crop health in real-time using satellite imagery

- Optimize resource use through precision agriculture techniques

- Track and reduce carbon footprints in farming operations

- Access AI-driven advisory services for improved decision-making

These technological advancements complement the state’s efforts to promote sustainable and efficient farming practices.

Explore Farmonaut’s innovative solutions:

Impact on Supply Chain Dynamics

The introduction of ethanol tax incentives is set to have a significant impact on agricultural supply chains in Illinois. As demand for corn-based ethanol increases, we can expect to see shifts in:

- Corn production and distribution patterns

- Transportation and logistics for ethanol and related products

- Storage and processing facilities for increased ethanol production

- Market dynamics between food, feed, and fuel uses of corn

These changes will require careful management and coordination among farmers, processors, distributors, and retailers to ensure a smooth transition and maximize the benefits of the new incentives.

Implications for Farm Tax Structures

The new legislation also brings changes to farm tax structures, which could have significant implications for farmers across Illinois. Some key considerations include:

- Tax credits for farmers who dedicate a portion of their crop to ethanol production

- Deductions for investments in ethanol-related infrastructure on farms

- Incentives for adopting sustainable farming practices that support ethanol production

- Potential changes in property tax assessments for farmland used in ethanol production

Farmers are encouraged to consult with tax professionals to fully understand how these changes may affect their individual operations and to take full advantage of the available incentives.

The Future of Renewable Energy in Agriculture

Illinois’ bold move in passing these ethanol tax incentives signals a broader shift towards renewable energy in agriculture. This legislation could serve as a model for other states looking to balance agricultural productivity with environmental sustainability. As we look to the future, we can anticipate:

- Increased research and development in biofuel technologies

- Greater integration of renewable energy sources in farming operations

- Development of new crop varieties optimized for biofuel production

- Expansion of the bioeconomy, creating new markets and opportunities for farmers

The synergy between agriculture and renewable energy presents exciting possibilities for innovation and growth in both sectors.

Impact Analysis: Illinois Ethanol Tax Incentives

| Policy Measure | Direct Impact on Agriculture | Environmental Benefits | Economic Implications |

|---|---|---|---|

| E15 Fuel Exemptions | Estimated 15% increase in corn demand | Potential reduction in greenhouse gas emissions | Projected $500 million boost to rural economy annually |

| Soil Health Initiatives | Improved soil quality and crop yields | Reduced soil erosion and increased carbon sequestration | Long-term cost savings for farmers through improved land productivity |

| Agricultural Education Programs | Enhanced farming skills and knowledge | Increased adoption of sustainable farming practices | Higher farm productivity and innovation in the agricultural sector |

Challenges and Considerations

While the new ethanol tax incentives offer numerous benefits, it’s important to address potential challenges and considerations:

- Balancing food and fuel production to ensure food security

- Managing potential impacts on water resources due to increased corn production

- Addressing concerns about land use changes and biodiversity

- Ensuring equitable access to incentives for small and large-scale farmers alike

Addressing these challenges will be crucial for the long-term success and sustainability of the program.

Leveraging Technology for Sustainable Growth

As Illinois farmers adapt to these new incentives, technology will play a crucial role in maximizing benefits while minimizing environmental impact. Farmonaut’s satellite-based solutions offer valuable tools for precision agriculture, helping farmers optimize their operations in line with the new policy landscape.

Key features of Farmonaut’s technology that can support farmers in this transition include:

- Real-time crop health monitoring to optimize yields for ethanol production

- AI-driven advisory systems for sustainable farming practices

- Resource management tools to improve efficiency and reduce environmental impact

- Carbon footprint tracking to align with environmental goals

Explore Farmonaut’s API for advanced agricultural data integration: Farmonaut API

For developers interested in leveraging Farmonaut’s technology: API Developer Docs

The Road Ahead: Implementing the New Incentives

As Illinois moves forward with implementing these game-changing ethanol tax incentives, several key steps will be crucial:

- Establishing clear guidelines and processes for farmers to access the incentives

- Developing infrastructure to support increased ethanol production and distribution

- Monitoring and evaluating the impact of the incentives on both agricultural and environmental metrics

- Providing ongoing education and support to farmers transitioning to new practices

The success of this initiative will depend on close collaboration between government agencies, agricultural organizations, and individual farmers.

Conclusion: A New Chapter for Illinois Agriculture

The passage of these ethanol tax incentives marks the beginning of an exciting new chapter for Illinois agriculture. By aligning economic incentives with environmental goals, the state is positioning itself as a leader in sustainable agriculture and renewable energy. As farmers, policymakers, and technology providers work together to implement these changes, we can look forward to a future where agriculture not only feeds the world but also plays a pivotal role in addressing climate change and energy security.

The road ahead may have its challenges, but with innovative policies, advanced technologies, and the resilience of Illinois farmers, the future of agriculture in the Prairie State looks brighter than ever.

FAQ Section

Q: How will the new ethanol tax incentives benefit Illinois farmers?

A: The incentives are expected to increase demand for corn, potentially leading to higher prices and new market opportunities for farmers. Additionally, they promote sustainable farming practices and offer tax benefits for ethanol-related investments.

Q: What is E15 fuel, and why is it important?

A: E15 is a fuel blend containing 15% ethanol and 85% gasoline. It’s important because it reduces reliance on fossil fuels, potentially lowers emissions, and creates a significant market for corn-based ethanol, supporting the agricultural economy.

Q: How do these incentives contribute to environmental sustainability?

A: The incentives promote the use of renewable fuel, which can reduce greenhouse gas emissions. They also support soil health initiatives and sustainable farming practices, contributing to overall environmental conservation efforts.

Q: Will the focus on ethanol production affect food prices?

A: While there’s potential for some impact on corn prices, the legislation aims to balance food and fuel production. Ongoing monitoring and adjustments will be crucial to ensure food security is not compromised.

Q: How can farmers take advantage of these new incentives?

A: Farmers can benefit by dedicating a portion of their crop to ethanol production, investing in ethanol-related infrastructure, and adopting sustainable farming practices supported by the incentives. Consulting with agricultural advisors and tax professionals is recommended to maximize benefits.