Maximizing Returns: Smart Strategies for Agricultural Land Investment in California

In the ever-evolving landscape of investment opportunities, agricultural land in California stands out as a compelling option for those seeking to diversify their portfolios and maximize returns. As we delve into the intricacies of this dynamic market, we’ll explore the latest trends, challenges, and innovative strategies that are shaping the future of farmland investment in the Golden State.

Our comprehensive analysis will cover everything from water rights and soil technology to agricultural finance options and sustainable farmland management practices. Whether you’re a seasoned investor or just beginning to explore the potential of agricultural real estate, this guide will provide you with valuable insights to make informed decisions in the California farmland market.

The Current Landscape of Agricultural Land Investment in California

California’s agricultural sector is renowned for its diversity and productivity, making it an attractive option for land investors. With over 25 million acres of farmland, the state produces more than 400 different commodities, contributing significantly to the nation’s food supply and export market. This rich agricultural heritage, combined with advanced farming techniques and favorable climate conditions, creates a unique investment environment.

“California’s agricultural land investment market involves complex water rights considerations, affecting over 9 million acres of irrigated farmland.”

Recent market trends have shown a steady appreciation in farmland values, driven by factors such as:

- Increasing global food demand

- Limited supply of prime agricultural land

- Technological advancements in farming practices

- Growing interest in sustainable and organic agriculture

However, investors must also navigate challenges unique to California, including water scarcity, regulatory complexities, and climate change impacts. Understanding these factors is crucial for developing smart investment strategies that can yield long-term returns.

Water Rights: A Critical Factor in California Farmland Investment

Water availability is perhaps the most critical factor influencing agricultural land values and productivity in California. The state’s complex system of water rights plays a pivotal role in determining the viability and profitability of farmland investments.

Types of Water Rights in California

- Riparian Rights: These rights allow landowners adjacent to water sources to use water on their property.

- Appropriative Rights: These are based on the principle of “first in time, first in right” and allow for water use on non-riparian land.

- Groundwater Rights: These rights govern the use of water from underground aquifers.

Investors should conduct thorough due diligence on the water rights associated with any potential farmland purchase. Properties with secure, senior water rights often command premium prices but offer greater stability and potential for consistent agricultural production.

The Impact of Drought and Water Management Policies

California’s periodic droughts and ongoing water conservation efforts have led to stricter regulations on water use in agriculture. The Sustainable Groundwater Management Act (SGMA), implemented in 2014, requires local agencies to develop plans for sustainable groundwater management. This legislation has significant implications for farmland investors, potentially affecting water availability and land use in certain regions.

To mitigate water-related risks, investors should consider:

- Diversifying investments across regions with different water sources

- Investing in water-efficient irrigation technologies

- Exploring crops with lower water requirements

- Participating in water markets or banking programs

Soil Technology and Agricultural Innovation

Advancements in soil technology and agricultural innovation are revolutionizing farming practices and enhancing the value of agricultural land investments. These technologies offer opportunities for increased productivity, sustainability, and profitability.

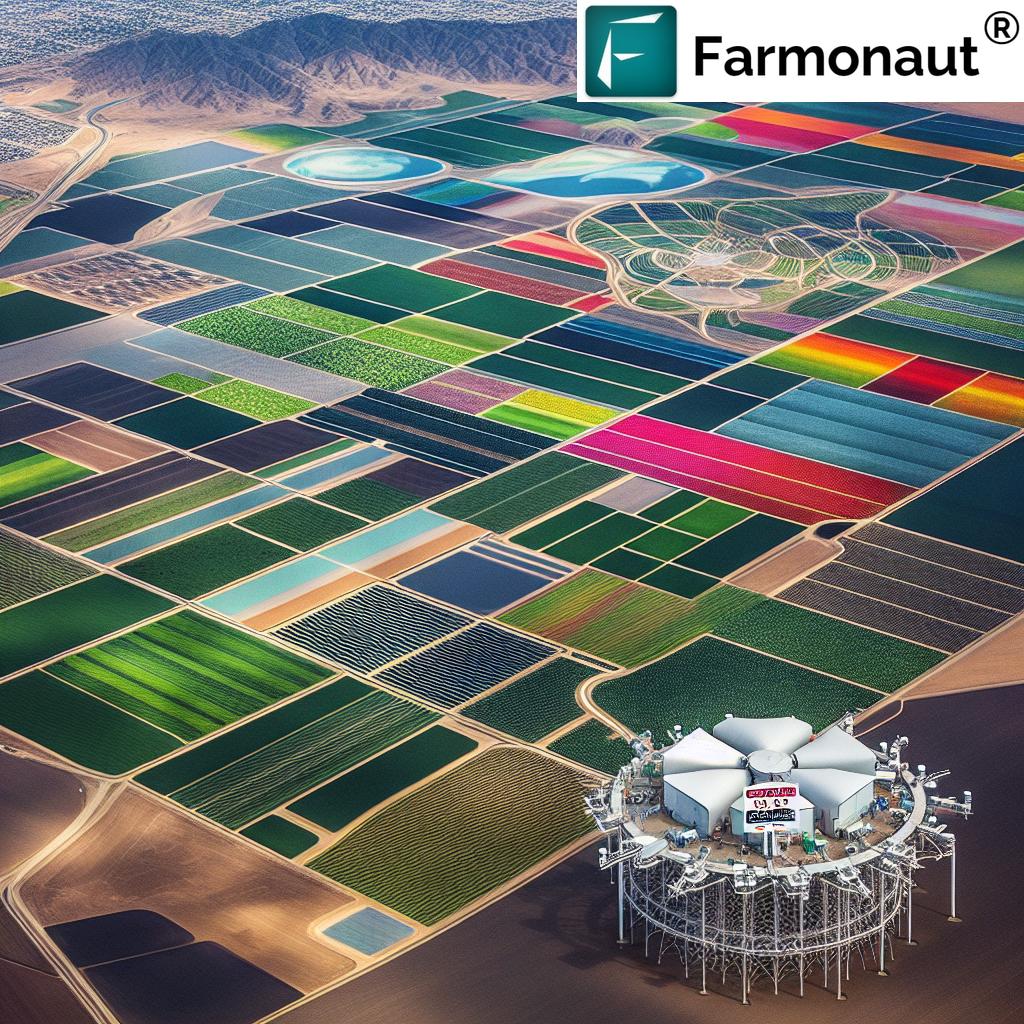

Precision Agriculture and Remote Sensing

Precision agriculture techniques, powered by satellite imagery and data analytics, allow farmers to optimize resource use and maximize yields. Farmonaut, a leading agricultural technology company, offers advanced satellite-based farm management solutions that provide real-time insights into crop health, soil moisture levels, and other critical metrics.

By leveraging Farmonaut’s technology, investors and farm managers can:

- Monitor crop health in real-time

- Make data-driven decisions on irrigation and fertilizer application

- Detect and address pest infestations early

- Optimize harvest timing for maximum yields

These capabilities not only enhance farm productivity but also contribute to the overall value and attractiveness of agricultural land investments.

Soil Health and Regenerative Agriculture

Investing in soil health is increasingly recognized as a crucial strategy for long-term agricultural sustainability and profitability. Regenerative agriculture practices, which focus on improving soil quality, biodiversity, and ecosystem health, are gaining traction among forward-thinking farmers and investors.

Key soil health practices include:

- Cover cropping

- No-till or reduced tillage farming

- Crop rotation and diversification

- Integrated pest management

Implementing these practices can lead to increased soil organic matter, improved water retention, and enhanced resilience to climate stresses. For investors, properties managed with regenerative practices may offer long-term value appreciation and sustainability benefits.

Agricultural Finance Options and Farm Insurance Considerations

Navigating the financial aspects of agricultural land investment requires an understanding of various funding options and risk management strategies. From traditional bank loans to innovative fintech solutions, the agricultural finance landscape is evolving to meet the needs of modern farmers and investors.

Financing Agricultural Land Investments

Several financing options are available for agricultural land investments in California:

- Farm Credit System: A network of borrower-owned lending institutions specializing in agricultural finance.

- Commercial Bank Loans: Traditional lending options from banks with agricultural expertise.

- USDA Farm Service Agency Loans: Government-backed loans for beginning farmers or those unable to secure commercial credit.

- Private Equity and Investment Funds: Specialized funds focusing on agricultural land investments.

Investors should carefully consider the terms, interest rates, and eligibility requirements of each option. Additionally, Farmonaut’s API can provide valuable data for lenders and investors to assess the potential of agricultural properties, potentially streamlining the financing process.

Farm Insurance and Risk Management

Protecting agricultural investments through comprehensive insurance coverage is essential in mitigating risks associated with weather events, pests, and market fluctuations. Key insurance considerations include:

- Crop Insurance: Protects against yield losses due to natural disasters or price declines.

- Property Insurance: Covers buildings, equipment, and other farm assets.

- Liability Insurance: Protects against claims related to farm operations or products.

Investors should work with insurance providers specializing in agricultural risks to develop comprehensive coverage tailored to their specific investments. Farmonaut’s satellite-based monitoring can also play a role in risk assessment and claims verification, potentially leading to more accurate and fair insurance processes.

Sustainable Farmland Management and Environmental Considerations

As environmental concerns take center stage in agricultural discussions, sustainable farmland management has become a critical factor in long-term investment success. Implementing environmentally friendly practices not only contributes to soil health and ecosystem preservation but can also enhance the marketability and value of agricultural properties.

Sustainable Farming Practices

Investors should consider properties that implement or have the potential to adopt sustainable farming practices, such as:

- Organic farming methods

- Water conservation techniques

- Renewable energy integration (e.g., solar panels on farm buildings)

- Habitat preservation for pollinators and beneficial insects

These practices can lead to premium pricing for crops, reduced input costs, and potential eligibility for environmental incentives or certifications.

Carbon Sequestration and Environmental Markets

Emerging opportunities in carbon markets present an additional revenue stream for agricultural landowners. By implementing practices that sequester carbon in the soil, farmers can potentially sell carbon credits to companies looking to offset their emissions.

Farmonaut’s developer documentation provides insights into how their technology can assist in monitoring and quantifying carbon sequestration efforts, potentially facilitating participation in these emerging markets.

High-Value Agricultural Properties and Specialty Crops

California’s diverse climate and soil conditions support a wide range of high-value specialty crops, offering unique investment opportunities. These crops often command premium prices and can significantly boost the returns on agricultural land investments.

Identifying High-Value Crop Opportunities

Some of California’s most lucrative specialty crops include:

- Almonds and pistachios

- Wine grapes

- Avocados

- Berries (strawberries, blueberries, raspberries)

- Citrus fruits

When considering investments in properties suitable for these crops, factors such as microclimate, soil quality, and water availability are crucial. Farmonaut’s satellite-based crop monitoring can provide valuable insights into the suitability of land for specific high-value crops.

“Agricultural real estate investment trusts (REITs) can offer monthly dividend yields, potentially providing regular income streams for investors.”

Value-Added Opportunities

Investors should also consider properties with potential for value-added activities, such as:

- On-site processing facilities

- Agritourism opportunities (e.g., farm stays, u-pick operations)

- Direct-to-consumer sales channels

These additional revenue streams can enhance the overall profitability of agricultural land investments.

Farmland Real Estate Investment Trusts (REITs)

For investors looking to gain exposure to agricultural land without directly purchasing and managing properties, farmland Real Estate Investment Trusts (REITs) offer an attractive alternative. These investment vehicles allow individuals to invest in diversified portfolios of agricultural properties managed by professional teams.

Benefits of Farmland REITs

- Diversification across multiple properties and regions

- Professional management and expertise

- Liquidity through publicly traded shares

- Potential for regular income through dividends

One notable example in the farmland REIT space is Gladstone Land Corporation (NASDAQ: LAND), which focuses on high-value farmland and farm-related properties across the United States, including California.

Considerations for REIT Investments

When evaluating farmland REITs, investors should consider:

- The REIT’s property portfolio and geographic diversification

- Management team’s experience and track record

- Dividend yield and payout ratio

- Fees and expense ratios

It’s important to note that while REITs offer exposure to agricultural land, they may not provide the same level of control or potential for value-add strategies as direct property ownership.

Leveraging Technology for Informed Investment Decisions

In today’s digital age, leveraging technology is crucial for making informed agricultural land investment decisions. Advanced tools and platforms can provide valuable insights into property characteristics, market trends, and potential returns.

Satellite-Based Farm Management Solutions

Farmonaut’s satellite-based farm management solutions offer investors and farm managers powerful tools for property assessment and ongoing management. Key features include:

- Real-time crop health monitoring

- Soil moisture analysis

- Historical yield data

- Weather forecasting and climate trend analysis

These tools can help investors evaluate potential properties, monitor farm performance, and make data-driven decisions to optimize returns.

Download Farmonaut’s mobile apps for on-the-go farm monitoring:

AI-Powered Analytics and Predictive Modeling

Artificial intelligence and machine learning algorithms are increasingly being applied to agricultural data, offering predictive insights that can inform investment strategies. These technologies can help:

- Forecast crop yields based on historical data and current conditions

- Predict market trends and commodity prices

- Optimize crop rotation and resource allocation

- Assess the potential impact of climate change on specific regions

By incorporating these advanced analytics into their decision-making process, investors can gain a competitive edge in identifying and evaluating agricultural land opportunities.

Regional Analysis: Agricultural Investment Opportunities Across California

California’s diverse geography and climate create a variety of agricultural investment opportunities across different regions. Understanding the unique characteristics and potential of each area is crucial for developing targeted investment strategies.

| Region | Primary Crop Types | Average Land Value ($/acre) | Water Rights Status | Soil Quality Rating | Technology Adoption Level | Estimated Annual ROI (%) |

|---|---|---|---|---|---|---|

| Central Valley | Almonds, Grapes, Tomatoes | $20,000 – $30,000 | Varied, Complex | High | Medium-High | 5-8% |

| Napa Valley | Wine Grapes | $300,000 – $400,000 | Generally Secure | Very High | High | 3-6% |

| Imperial Valley | Leafy Greens, Alfalfa | $10,000 – $15,000 | Primarily Colorado River | Medium-High | Medium | 6-9% |

| Salinas Valley | Lettuce, Strawberries | $60,000 – $70,000 | Generally Secure | Very High | High | 4-7% |

| San Joaquin Valley | Citrus, Pistachios | $25,000 – $35,000 | Varied, Some Challenges | High | Medium-High | 5-8% |

Note: Values are estimates and can vary significantly based on specific property characteristics and market conditions.

Central Valley

The Central Valley, California’s agricultural heartland, offers diverse investment opportunities in a range of crops, from almonds and pistachios to tomatoes and cotton. Key considerations for this region include:

- Complex water rights issues and ongoing groundwater management challenges

- Potential for high returns on well-managed properties with secure water access

- Opportunities for technology adoption to improve efficiency and yields

Coastal Regions (e.g., Salinas Valley, Santa Maria Valley)

Coastal agricultural areas benefit from mild climates and are known for high-value crops such as strawberries, leafy greens, and wine grapes. Investment considerations include:

- Higher land values due to prime growing conditions and proximity to urban markets

- Potential for year-round production in some areas

- Challenges related to urban encroachment and labor availability

Wine Regions (e.g., Napa Valley, Sonoma County)

California’s renowned wine regions offer unique investment opportunities in high-value vineyards. Key factors to consider:

- Extremely high land values, particularly in premium appellations

- Potential for value-added operations such as wineries and tasting rooms

- Brand value associated with specific regions

Southern California (e.g., Imperial Valley)

The arid regions of Southern California present distinct agricultural investment opportunities, particularly in areas with access to Colorado River water. Considerations include:

- Lower land values compared to other agricultural regions in the state

- Potential for high-value crops such as winter vegetables and dates

- Ongoing water supply challenges and the need for efficient irrigation systems

Strategies for Maximizing Returns on Agricultural Land Investments

To maximize returns on agricultural land investments in California, investors should consider a multifaceted approach that leverages technology, sustainable practices, and market trends. Here are key strategies to consider:

1. Diversification

Spread investments across different regions and crop types to mitigate risks associated with weather events, market fluctuations, and regulatory changes. This could include:

- Investing in properties across multiple California regions

- Balancing annual and permanent crops in your portfolio

- Considering a mix of conventional and organic production

2. Technology Integration

Leverage advanced agricultural technologies to improve efficiency and productivity. This can include:

- Implementing precision agriculture techniques using Farmonaut’s satellite-based monitoring

- Adopting water-efficient irrigation systems

- Utilizing AI-powered predictive analytics for crop management

Access Farmonaut’s web application for comprehensive farm management and monitoring tools.

3. Value-Added Opportunities

Explore ways to increase the value of agricultural properties beyond primary crop production:

- Developing on-site processing or packaging facilities

- Creating agritourism experiences

- Implementing direct-to-consumer sales channels

4. Sustainable Practices

Implement sustainable farming practices to improve long-term soil health, reduce input costs, and potentially access premium markets:

- Adopting regenerative agriculture techniques

- Pursuing organic certification where feasible

- Implementing water conservation measures

5. Strategic Partnerships

Forge partnerships with experienced farm operators, technology providers, and marketing experts to optimize farm operations and market access. Consider:

- Leasing to skilled farm operators

- Collaborating with agricultural research institutions

- Partnering with food processors or retailers for secure market channels

6. Market Trend Alignment

Stay informed about consumer trends and align crop selection with growing market demands. This could involve:

- Focusing on health-conscious consumer preferences (e.g., nuts, berries, organic produce)

- Exploring emerging markets for plant-based proteins

- Considering specialty or niche crop opportunities

7. Financial Optimization

Develop a comprehensive financial strategy to maximize returns and manage risks:

- Exploring various financing options to optimize capital structure

- Implementing effective tax planning strategies

- Utilizing crop insurance and other risk management tools

8. Continuous Education and Adaptation

Stay informed about the latest developments in agriculture, technology, and market trends:

- Attending agricultural conferences and seminars

- Engaging with agricultural extension services and research institutions

- Regularly reviewing and adjusting investment strategies based on new information and market conditions

Conclusion: The Future of Agricultural Land Investment in California

As we look to the future, agricultural land investment in California continues to offer significant opportunities for those willing to navigate its complexities. The convergence of technological innovation, sustainable practices, and evolving market demands is reshaping the landscape of farm ownership and management.

Key takeaways for potential investors include:

- The critical importance of water rights and efficient water management

- The potential of technology, such as Farmonaut’s satellite-based solutions, to enhance productivity and decision-making

- The growing emphasis on sustainable and regenerative farming practices

- The opportunities presented by high-value crops and value-added agricultural activities

- The need for a diversified and adaptable investment approach

By leveraging these insights and staying attuned to market trends, investors can position themselves to capitalize on the enduring value of California’s agricultural lands while contributing to the sustainability and innovation of the state’s farming sector.

As you embark on your agricultural land investment journey, remember that success in this field requires a blend of traditional farming wisdom and cutting-edge technological solutions. Platforms like Farmonaut offer invaluable tools for monitoring, analyzing, and optimizing agricultural investments, helping investors make data-driven decisions in an increasingly complex market.

Ready to elevate your agricultural investments with advanced technology? Explore Farmonaut’s solutions today:

FAQ Section

Q1: What are the primary factors to consider when investing in agricultural land in California?

A1: Key factors include water rights, soil quality, climate suitability for desired crops, proximity to markets, and potential for value-added activities. It’s also crucial to consider long-term climate change impacts and regulatory environment.

Q2: How can technology like Farmonaut’s satellite-based solutions benefit agricultural land investors?

A2: Farmonaut’s technology provides real-time crop health monitoring, soil moisture analysis, and yield predictions. This data helps investors make informed decisions about property selection, crop management, and resource allocation, potentially leading to improved yields and returns.

Q3: What are some high-value crops to consider for investment in California?

A3: High-value crops in California include almonds, pistachios, wine grapes, avocados, strawberries, and various organic produce. The choice depends on factors like location, water availability, and market demand.

Q4: How do water rights affect agricultural land investments in California?

A4: Water rights are crucial in California due to frequent droughts and water scarcity. Properties with secure, senior water rights often command higher prices but offer more stability for agricultural production.

Q5: What are some sustainable farming practices that can enhance the value of agricultural investments?

A5: Sustainable practices include regenerative agriculture techniques, organic farming, water conservation methods, and renewable energy integration. These can improve soil health, reduce input costs, and potentially access premium markets.

Earn With Farmonaut: Join our Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Implementing smart investment strategies on agricultural land can improve profitability and sustainability for long-term success.