Australian Pulse Exports 2024: Key Trends, Tariffs & Opportunities

Introduction: The Pulse of Australian Exports in 2024

Australian pulse exports have always played a pivotal role in shaping the country’s agribusiness landscape, with robust demand from South Asian and Middle Eastern regions—especially India. As we move through 2024, this vibrant sector faces a dynamic environment shaped by new tariffs, evolving freight challenges, and fluctuating global demand. According to Rabobank’s pulse market analysis, Australia’s pulse trade remains resilient, particularly as trade wars impact competitors. This comprehensive guide delves into pulse market trends 2024, tariffs, shipping costs, and emerging opportunities, ensuring both seasoned traders and agribusiness newcomers stay ahead in the ever-changing global pulse trade.

Pulse Market Overview: Australia’s Position Amid Shifting Global Trade

As agribusiness specialists, we know that Australia has cemented its reputation as a leading pulse exporter, leveraging a favorable climate, innovative farming practices, and strategic relationships. Our pulse export portfolio is primarily concentrated around lentils, chickpeas, and faba beans, targeting South Asian powerhouses—above all, India.

The Rabobank RaboResearch division has identified that, in contrast to other major exporters, Australian pulse exports benefit from relative insulation regarding major trade conflicts. Our primary export markets are largely outside the US-China tariff crossfire, maintaining dependable export margins and farm gate prices.

- Australian pulse exports topped an estimated 4.0 million tonnes in 2024, far outstripping US volumes.

- The Middle East and South Asian regions, including India, Pakistan, and Bangladesh, remain our top destinations.

- Peas account for less than 3% of our total pulse export volume, giving us a strategic buffer against major disruptions in the pea market.

India Pulse Import Demand: Trends & Impacts

“India accounts for over 40% of Australian pulse exports, driving strong demand in 2024 despite rising shipping costs.” This fact remains central to our outlook.

During the 2024/25 financial year, India’s pulse import demand is projected to surge—reaching a staggering 6.7 million tonnes, an increase of 52% year-on-year. India’s rapidly growing population, food inflation, and recurring production shortfalls underpin these numbers. The Indian government has instituted a 10% import tariff on both chickpeas and lentils, aiming to balance farm gate prices and contain inflation. These tariffs, though modest compared to previous years’ fluctuations, indicate India’s need for substantial imports to stabilize its domestic supply.

- Australian chickpeas and lentils exports to India maintain their crucial role given India’s unreliable domestic production and persistent demand for high-protein pulses.

- India’s recent relaxation of the duty-free imports of yellow peas is set to expire, likely bolstering demand for alternative pulses like lentils and chickpeas from Australia.

- Close monitoring of Indian crop yields and price trends is fundamental in forecasting shifts in demand, especially moving into the second half of 2025.

India’s government leverages import tariffs as a flexible tool to ensure domestic producers are protected, while also supporting affordable food supplies for the population. For us, this landscape means well-timed opportunities and occasional, manageable headwinds.

2024 Tariffs and Trade Environment: The Rabobank Perspective

The international trade environment in 2024 is more complex than ever, with Rabobank pulse market analysis highlighting how the landscape has shifted for pulse exporters. Notably:

- China has imposed a 100% import tariff on Canadian peas, largely excluding Australia due to our minor role in the pea export market.

- India’s 10% tariff on lentils and chickpeas is, according to Vitor Pistoia (Rabobank Senior Analyst), a clear sign that imports remain essential for India’s food security.

- US tariffs and shipping fees, especially those proposed on Chinese-built and operated vessels, may add inflationary pressure and affect shipping costs for pulses globally.

For us, the burden of new tariffs falls primarily on Canada—one of our main competitors—leaving Australia in a relatively strong position to maintain and even expand our footprint in critical markets.

Shipping Costs for Pulses: Peas, Lentils, Chickpeas & Export Margins

Shipping remains a dominant variable in the pulse export equation. As Rabobank’s research underscores, shipping costs for pulses are rising, especially for containerized exports. Factors contributing to increased costs include:

- Proposed US shipping fees on Chinese vessels (which could drive up global shipping costs).

- Inflationary effects from new tariffs that ripple across the logistics sector.

- Changes in global container availability, especially compared to previous La Niña-driven bumper crop years when Australian shipping capacity was stretched.

However, the outlook for Australia is relatively favorable in 2024. Our reliance on containers has lessened since the La Niña-induced bumper harvests, and with exports more balanced with available capacity, we are better positioned to weather increases in shipping costs compared to major competitors.

Key Insight: Despite higher logistics costs, strong Indian demand and the lack of direct involvement in global trade wars ensure that Australian pulse exports retain healthy export margins and price competitiveness.

Navigating North American and Chinese Tariffs: Canadian Pea Tariffs and Global Pulse Trade

Trade relations between Canada, China, and the US continue to impact the global pulse trade—but for Australian exporters, these shifts offer both challenges and competitive openings.

In early 2024, the Chinese government imposed a 100% tariff on various Canadian agricultural imports, targeting peas in particular. This move has had a marked effect:

- Canadian pea exports to China shrank from 1.56 million tonnes in 2023 to just 0.5 million tonnes in 2024.

- This excess is likely to be redirected by Canadian traders to alternative markets, potentially increasing competition in regions like the Middle East and South Asia—where Australia leads.

- Given that peas constitute a minor share of Australian pulse exports, our exposure and risk are limited in this scenario—though careful monitoring is crucial.

For the US, its role in pulses is modest. US pulse exports are less than half those of Australia, and the countries’ export markets have minimal overlap. However, as Canada seeks new trade partners due to Chinese tariffs, competitive dynamics may evolve further—underscoring the importance of building strong, reliable relationships in our current key markets.

Key Export Opportunities: Australian Pulses in South Asian & Middle Eastern Markets

With volatility rising in global grain and oilseeds markets, Australian pulses are poised for robust performance in South Asian and Middle Eastern regions. Despite minor headwinds from tariffs and shipping costs, key opportunities are emerging:

-

India remains a dominant driver of pulse market trends, especially for chickpeas, lentils, and beans.

- India’s low import tariffs (10%) reflect a pragmatic approach to keep food inflation in check while ensuring food security for its vast population.

- Middle East markets continue stable purchasing patterns, with increasing interest in plant-based protein staples.

- Alternative destinations: As Canadian pea tariffs redirect trade flows, new buyers in South Asia and Africa are likely to seek Australian pulses.

- Low exposure to current trade wars ensures that Australia retains its competitive edge in several regions, as reinforced by Rabobank pulse market analysis.

- Supply chain transparency and technological innovation (see Farmonaut’s technology below) offer added value for buyers seeking verified and traceable supply chains.

Comparative Pulse Export Overview Table

| Pulse Type | Major Export Destinations | Estimated Export Volume (2024) (Metric Tons) |

Avg. Tariff Rate (%) | Est. Shipping Cost/Ton (USD) | 2024 Market Trend |

|---|---|---|---|---|---|

| Chickpeas | India, Bangladesh, Middle East | 1,350,000 | 10 | 78 | Growing |

| Lentils | India, Sri Lanka, Egypt | 1,220,000 | 10 | 75 | Stable/Growing |

| Beans (Faba & Others) | Egypt, India, UAE | 880,000 | 0-10 | 72 | Stable |

| Peas | India, Bangladesh, China (limited) | 95,000 | 0 (until May 31), then 10% | 80 | Declining (Vol.) |

| Lupins | Europe, Asia | 45,000 | 0-5 | 77 | Stable |

Note: Volumes, tariffs, and costs are estimated figures for 2024 and may vary due to ongoing trade and shipping dynamics. “Market Trend” reflects current demand and competitive analysis per Rabobank and sector research.

Empowering Pulse Exporters: Farmonaut’s Technological Edge

Facing complex market conditions, exporters are increasingly turning to advanced farm management technologies for resilience and competitive advantage. At Farmonaut, our mission is to make precision agriculture affordable and accessible worldwide. Here’s how our technologies support pulse exporters, agribusinesses, and policymakers:

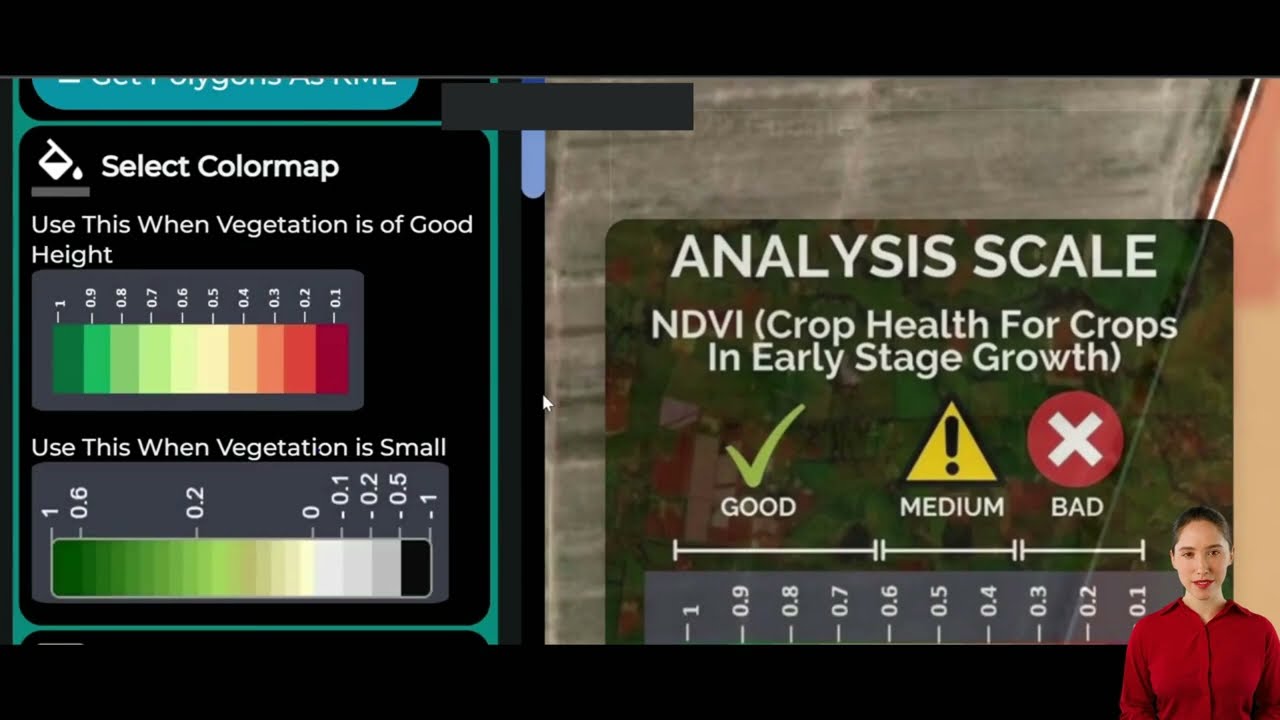

- Satellite-Based Crop Health Monitoring: Leverage real-time, satellite-powered imagery and vegetation indexes to proactively manage pulse crops, optimize irrigation, fertilizer, and pest control—vital for sustaining yields and adapting to shifting climate and market conditions.

- Jeevn AI Advisory System: Personalized, data-driven crop management insights delivered via our mobile, web, and API platforms to enhance productivity.

- Blockchain-Based Traceability: Ensure complete transparency and trust in pulse export supply chains. Learn how Farmonaut’s traceability solutions can help exporters build credibility with global buyers concerned about food origin and integrity.

- Fleet and Resource Management: Optimize shipping, storage, and logistics using Farmonaut’s intuitive fleet management tools—reducing operational costs, improving delivery timelines, and enhancing customer satisfaction.

- Carbon Footprinting: Global buyers expect sustainability. Farmonaut’s carbon tracking enables agribusinesses and traders to monitor, report, and minimize their environmental impact.

- API Access for Integration: Developers and organizations can seamlessly integrate our satellite and weather data using the Farmonaut API. Full documentation is available in our API Developer Docs, empowering agri-tech solutions at scale.

- Large-Scale Plantation Management: Agribusinesses managing extensive pulse acreage can benefit from our large-scale farm management suite, consolidating all data for drone-level precision.

With a simple, subscription-based model for growers, cooperatives, corporations, and government agencies, Farmonaut levels the playing field, making cutting-edge technology accessible for every stakeholder in the Australian pulse export value chain.

Conclusion & Future Outlook: Resilience and Innovation

The pulse export market in 2024 presents Australians with both minor headwinds and substantial opportunities. In reviewing Rabobank’s pulse market analysis and the latest trade shifts, it is clear that we are uniquely positioned:

- Minor exposure to the pea export volatility afflicting Canada and the US.

- Resilient demand from India, the world’s pulse consumption powerhouse, ensures a strong foundation for Australian chickpeas and lentils exports.

- Flexibility in trade tactics, monitoring tariffs and shipping costs while leveraging innovative technology like AI, satellite monitoring, and blockchain for strategic insight and risk mitigation.

By embracing transparency, sustainability, and technological empowerment through platforms such as Farmonaut, our exporters, agribusinesses, and government institutions can confidently navigate existing headwinds, support growers, and secure competitive positions within global pulse trade flows.

We look forward to supporting the Australian pulse export sector as it continues to adapt, innovate, and thrive—turning challenges into new opportunities for years to come.

FAQ: Australian Pulse Exports 2024

-

Q: What are the main drivers of Australian pulse exports in 2024?

A: Strong demand from India, a stable Middle East market, and relatively light exposure to current US-China trade wars. Tariff shifts and shipping cost increases are the main challenges. -

Q: Which pulse varieties are most exported from Australia in 2024?

A: Chickpeas and lentils dominate, followed by beans (including faba beans), peas, and lupins. -

Q: How are Australian pulse exporters responding to new tariffs in 2024?

A: By focusing on alternative markets unaffected by US-China trade disputes, leveraging technology for supply chain efficiency, and closely monitoring tariff changes, especially in India and China. -

Q: What is the outlook for shipping costs in 2024 and beyond?

A: Although higher costs are expected due to global container shortages and new US proposals, Australia, with a more balanced export capacity, may be less affected than others. -

Q: How does Farmonaut support pulse exporters?

A: By providing real-time crop monitoring, AI-based advisory, blockchain-based traceability, carbon footprinting, and fleet/resource management tools—all accessible via web, mobile app, and API. -

Q: Are carbon tracking and traceability important for the pulse export market?

A: Yes. Environmental sustainability and transparency are increasingly valued by global buyers and regulators. Farmonaut’s

carbon footprinting and traceability tools help address these expectations.

-

Q: Where can I access Farmonaut’s services for my pulse business?

A: Download the Android App, iOS App, or use our Web Platform for integrated, real-time digital farm management. -

Q: Where can developers access Farmonaut’s API?

A: API endpoint here and full developer docs here.

For pulse growers, exporters, supply chain professionals, and agri-tech developers, now is the time to adopt the data-driven, transparent, and sustainable tools that define the future of Australian agriculture. Explore all Farmonaut solutions and begin your precision agriculture journey today.