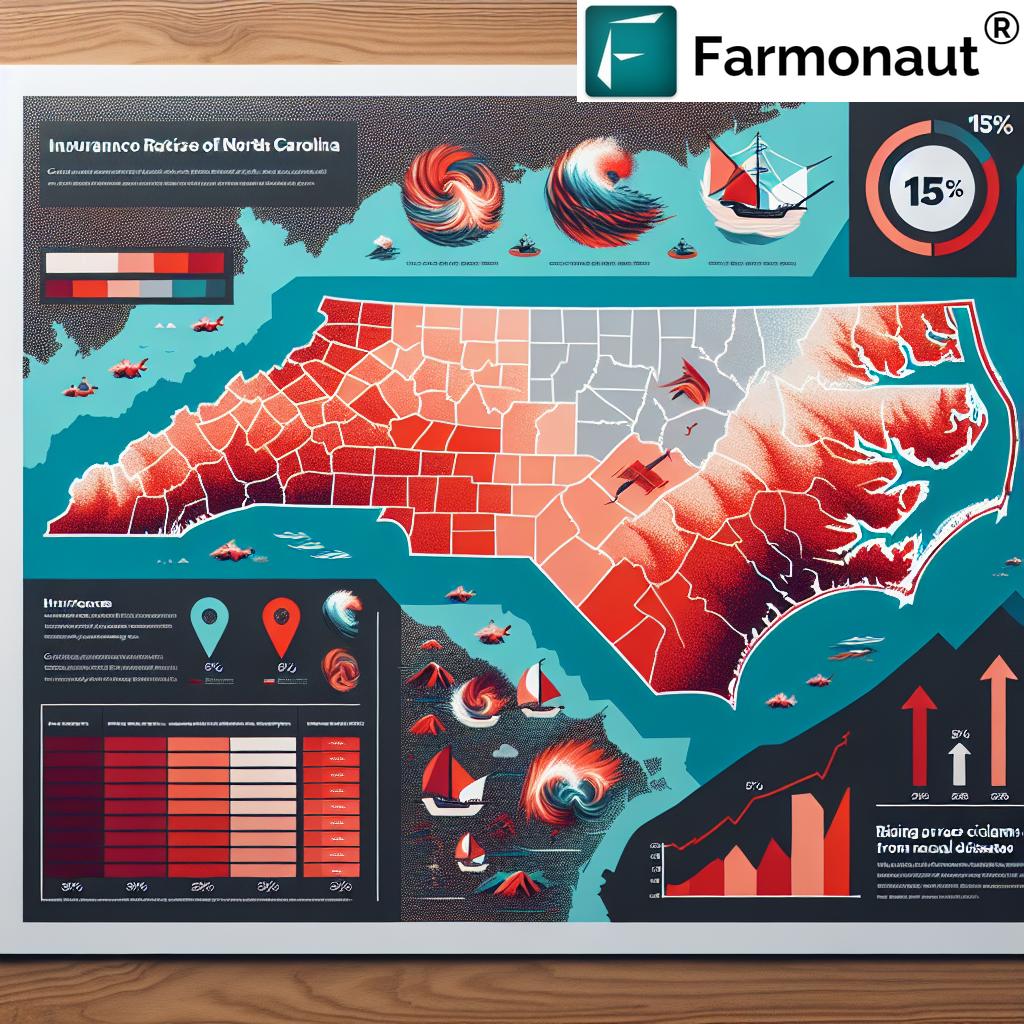

North Carolina Homeowners Face 15% Insurance Rate Hike by 2026: Understanding the Impact and County-Specific Changes

“North Carolina’s 15% average insurance rate hike by 2026 affects 7 million residents across 100 counties.”

As representatives of Farmonaut, a leading agricultural technology company, we understand the importance of staying informed about significant changes that impact our communities. Today, we’re diving into a crucial topic that affects millions of North Carolina homeowners: the upcoming 15% insurance rate increase by 2026. While our primary focus at Farmonaut is on revolutionizing agriculture through satellite-based farm management solutions, we recognize the broader implications of such policy changes on our clients and the general public.

In this comprehensive blog post, we’ll explore the reasons behind the North Carolina insurance rate increase, its varying impact across different counties, and what it means for homeowners across the state. We’ll also touch on how modern technology, like the solutions we offer at Farmonaut, can help mitigate risks and potentially influence insurance premiums in the agricultural sector.

Understanding the North Carolina Insurance Rate Increase

The North Carolina Department of Insurance recently reached a settlement with the insurance industry that will result in a statewide average premium hike of 15% for homeowners by mid-2026. This decision comes after extensive hearings and negotiations, balancing the needs of the insurance industry with the financial burdens faced by homeowners in disaster-prone areas.

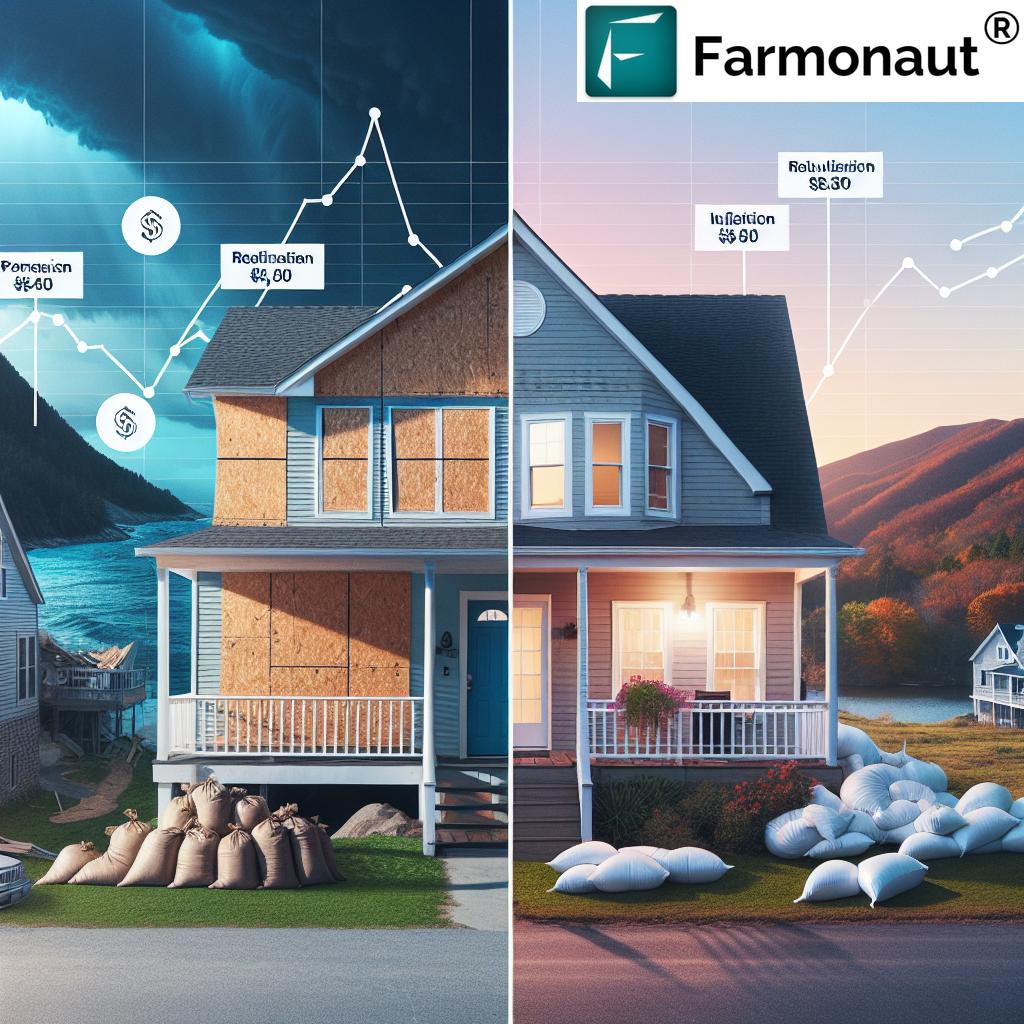

Key factors driving these increases include:

- Rising claims from natural disasters

- Increasing reinsurance costs

- Inflation, particularly in building material costs

- Significant losses from recent storms

Insurance Commissioner Mike Causey, who initially rejected a request from the North Carolina Rate Bureau for a substantial 42.2% increase, stated that the agreed-upon increases would provide insurance companies with adequate funds to cover claims stemming from recent natural disasters and rising reinsurance costs.

The Two-Phase Approach to Rate Adjustments

The settlement implements a two-phase approach to rate adjustments:

- A 7.5% increase starting on June 1, 2025

- Another 7.5% increase on June 1, 2026

It’s important to note that these adjustments will not be uniform across the state. Areas most affected by recent storms will see the largest rate hikes, while other regions may experience lower-than-average increases.

County-Specific Changes: A Closer Look

To better understand how these changes will affect different parts of North Carolina, let’s examine the projected increases for various regions:

| County Name | Region | Estimated Current Average Premium | Projected Premium Increase (%) | Estimated New Average Premium (by 2026) |

|---|---|---|---|---|

| Dare County | Coastal | $2,500 | 31.9% | $3,297 |

| New Hanover County | Coastal | $2,200 | 31.9% | $2,902 |

| Buncombe County | Mountain | $1,200 | 8.9% | $1,307 |

| Watauga County | Mountain | $1,100 | 8.9% | $1,198 |

| Wake County (Raleigh) | Urban | $1,500 | 15% | $1,725 |

| Mecklenburg County (Charlotte) | Urban | $1,600 | 18.5% | $1,896 |

As we can see from this table, coastal areas like Dare and New Hanover counties will face the highest increases, while mountain regions such as Buncombe and Watauga counties will see more modest hikes. Urban centers like Raleigh and Charlotte fall somewhere in between.

The Impact on Coastal Areas

“Coastal areas in North Carolina, comprising 20% of the state’s population, will face higher insurance rate increases than inland regions.”

Coastal regions, which have been severely impacted by hurricanes like Matthew and Florence, are set to experience the most significant rate hikes. For instance:

- An average increase of 16% in mid-2025

- Followed by a 15.9% rise in mid-2026

These substantial increases reflect the higher risk associated with coastal properties and the need for insurance companies to maintain adequate reserves for future catastrophic events.

Mountain Regions: A More Modest Increase

In contrast to the coastal areas, mountain regions like Buncombe, Watauga, and Yancey counties will experience lower-than-average hikes:

- Approximately 4.4% increase in 2025

- About 4.5% rise in 2026

While these areas have faced their own challenges, such as historic flooding during Hurricane Helene, they generally pose a lower risk profile compared to coastal regions.

Urban Centers: Moderate Increases

Urban areas will see increases that fall between those of coastal and mountain regions:

- Raleigh and Durham: 7.5% increase for each year

- Charlotte: 9.3% in 2025 and 9.2% in 2026

These moderate increases reflect the balanced risk profile of urban areas, which are less prone to catastrophic natural disasters but still face significant property values and population density challenges.

The Role of the “Consent-to-Rate” Provision

One crucial aspect of North Carolina’s insurance landscape is the “consent-to-rate” provision. This regulation allows high-risk homeowners to be insured at significantly elevated rates—up to 250% of the bureau’s standard rates. This provision plays a vital role in maintaining insurance availability in high-risk areas, particularly along the coast.

As of 2022, approximately 40% of policies in North Carolina were set under these consent-to-rate agreements. This high percentage underscores the challenges faced by both insurers and homeowners in balancing risk and affordability.

The Insurance Industry’s Perspective

While the settlement represents a significant increase for homeowners, it’s important to understand the insurance industry’s perspective. Jarred Chappell, Chief Operating Officer of the North Carolina Rate Bureau, acknowledged that while the settlement was a positive progression, the initially requested increase of 42.2% was more reflective of current claims data and ongoing cost pressures.

These pressures include:

- Intensified storms and natural disasters

- Increasing populations in disaster-vulnerable areas

- Soaring reinsurance prices

The settlement aims to strike a balance between these industry needs and the financial realities faced by North Carolina homeowners.

Implications for Homeowners

For North Carolina homeowners, these rate increases will have significant implications:

- Budgeting: Families will need to adjust their budgets to accommodate higher insurance premiums.

- Property Values: The increased cost of insurance may impact property values, particularly in high-risk coastal areas.

- Insurance Shopping: Homeowners may need to shop around more aggressively for competitive rates.

- Risk Mitigation: There may be a greater emphasis on home improvements that reduce risk and potentially lower premiums.

The Role of Technology in Risk Mitigation

At Farmonaut, we believe that technology plays a crucial role in risk mitigation, particularly in the agricultural sector. While our focus is on farm management, many of the principles we apply can be extended to homeowner risk management:

- Satellite-Based Monitoring: Just as we use satellite imagery to monitor crop health, similar technology can be used to assess property risks and changes over time.

- AI-Driven Insights: Our Jeevn AI advisory system provides real-time insights for farmers. Similar AI-driven tools could help homeowners and insurers better understand and mitigate risks.

- Data-Driven Decision Making: By leveraging data, homeowners can make more informed decisions about property improvements and risk reduction strategies.

To learn more about how technology can transform risk assessment and management, visit our API page or check out our API Developer Docs.

Looking Ahead: The Future of Homeowners Insurance in North Carolina

As we look to the future, several factors will likely influence homeowners insurance in North Carolina:

- Climate Change: Increasing frequency and severity of natural disasters may lead to further rate adjustments.

- Technological Advancements: Improved risk assessment tools and home monitoring systems could help mitigate risks and potentially stabilize rates.

- Policy Changes: Future legislative changes may impact how insurance rates are set and regulated.

- Population Shifts: Changes in where people choose to live within the state could affect risk pools and rates.

FAQs About North Carolina’s Insurance Rate Increase

Q: When will the new rates take effect?

A: The rate increases will be implemented in two phases: a 7.5% rise starting on June 1, 2025, followed by another 7.5% increase on June 1, 2026.

Q: Will all homeowners in North Carolina see the same rate increase?

A: No, the rate increases will vary by location. Coastal areas will generally see higher increases, while mountain regions will experience lower-than-average hikes.

Q: What can homeowners do to potentially lower their insurance premiums?

A: Homeowners can consider implementing risk mitigation measures such as installing storm shutters, reinforcing roofs, or upgrading to more resilient building materials. It’s also advisable to shop around for competitive rates and consider bundling policies.

Q: How does the “consent-to-rate” provision work?

A: The “consent-to-rate” provision allows insurers to offer coverage to high-risk properties at rates up to 250% of the standard bureau rates. This helps maintain insurance availability in areas that might otherwise be difficult to insure.

Q: Will there be any further rate increases after 2026?

A: The current settlement prevents the Rate Bureau from pursuing further rate increases until June 1, 2027. However, future increases beyond that date are possible and will depend on various factors including claim data and economic conditions.

Conclusion: Navigating the Changing Insurance Landscape

The upcoming 15% insurance rate hike in North Carolina represents a significant change for homeowners across the state. While these increases will undoubtedly pose challenges, they also reflect the complex realities of insuring properties in areas prone to natural disasters.

As we at Farmonaut continue to innovate in the agricultural sector, we encourage homeowners to stay informed about these changes and explore ways to mitigate risks. By leveraging technology, implementing safety measures, and staying engaged with insurance policies, North Carolina residents can better navigate this evolving landscape.

For those interested in learning more about how technology can play a role in risk assessment and management, we invite you to explore our solutions:

While our focus is on agriculture, the principles of data-driven decision-making and risk assessment can be applied across various sectors, including property insurance.

Earn With Farmonaut: Join Our Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For more information about our affiliate program, visit Earn With Farmonaut.

Farmonaut Subscriptions

As we continue to navigate the changing landscape of insurance and risk management, stay tuned for more updates and insights from Farmonaut. Together, we can build a more resilient and informed community.