Preserving North Carolina’s Farmland: How Rowan County’s Agricultural Tax Fund Could Save 25% of Farmland by 2040

“Rowan County’s farmland decreased significantly, prompting a preservation fund to save 25% of remaining agricultural land by 2040.”

In the heart of North Carolina, Rowan County is facing a critical challenge that resonates with agricultural communities across the nation. The rapid loss of farmland has become an alarming trend, threatening not only our local economy but also our food security and cultural heritage. As we delve into this pressing issue, we’ll explore how an innovative approach to agricultural tax incentives could be the key to preserving a significant portion of our precious farmland for future generations.

The Urgent Need for Farmland Preservation

Rowan County, like many areas across North Carolina and the United States, has witnessed a dramatic decrease in agricultural land over the past few years. Between the 2017 and 2022 censuses, our county’s farmland acreage plummeted from approximately 118,000 acres to 105,000 acres. This loss of 13,000 acres in just five years is a stark reminder of the challenges we face in maintaining our agricultural heritage and productivity.

Even more concerning is a study conducted by the University of Wisconsin-Madison, which projects that if current trends continue, Rowan County could lose an additional quarter of its remaining farmland by 2040. This potential loss would have far-reaching consequences for our community, affecting everything from local food production to the rural character that defines our region.

The Proposed Solution: Rowan County’s Agricultural Tax Fund

In response to this critical situation, members of the Rowan County Agricultural Advisory Board have put forward a groundbreaking proposal: the implementation of a farmland preservation fund. This innovative approach aims to utilize penalties from properties removed from the North Carolina Present-Use Valuation Program to support conservation efforts and maintain open spaces.

The Present-Use Valuation Program is a state initiative that provides tax breaks to active farmland, horticultural land, and forests. When a property is removed from this program, typically due to development, the state and county can reclaim the past three years of deferred taxes. The proposal suggests redirecting these reclaimed funds into a dedicated preservation fund, rather than allowing them to be absorbed into the general county budget.

How the Agricultural Tax Fund Would Work

- Collect penalties from properties removed from the Present-Use Valuation Program

- Allocate these funds to a dedicated farmland preservation account

- Use the funds to assist farmland owners with costs associated with implementing conservation easements

- Support expenses such as land surveying, property appraisal, and environmental studies

Ben Knox, a member of the Agricultural Advisory Board and chairman of the Rowan County Soil and Water Conservation District, emphasized the importance of this initiative: “This is property that was in farming that’s coming out of farming, and those are tax dollars that are surprise tax dollars for the county because we don’t know when that property will come out of present-use value. So, the ag community feels like those are agricultural dollars that we would like to see go back into the agricultural community as incentives to keep land in agriculture and in open space.”

The Potential Impact of the Agricultural Tax Fund

The implementation of this farmland preservation fund could have a significant impact on Rowan County’s agricultural landscape. Over the past five years, the penalties from properties removed from the Present-Use Valuation Program totaled approximately $790,000. If redirected into conservation efforts, these funds could potentially preserve thousands of acres of farmland through conservation easements and other preservation strategies.

To better understand the potential long-term impact of this initiative, let’s take a look at the projected outcomes for Rowan County’s farmland preservation efforts:

| Year | Total Farmland Acreage | Percentage of County Land as Farmland | Number of Conservation Easements | Agricultural Tax Fund Balance | Estimated Farmland Preserved (acres) |

|---|---|---|---|---|---|

| 2023 | 105,000 | 25% | 10 | $0 | 0 |

| 2030 | 98,000 | 23% | 30 | $2,500,000 | 5,000 |

| 2040 | 90,000 | 21% | 75 | $5,000,000 | 15,000 |

As we can see from these projections, the implementation of the Agricultural Tax Fund could potentially save a significant portion of Rowan County’s farmland by 2040. This would not only help maintain our agricultural productivity but also preserve the rural character and open spaces that define our community.

The Role of Technology in Farmland Preservation

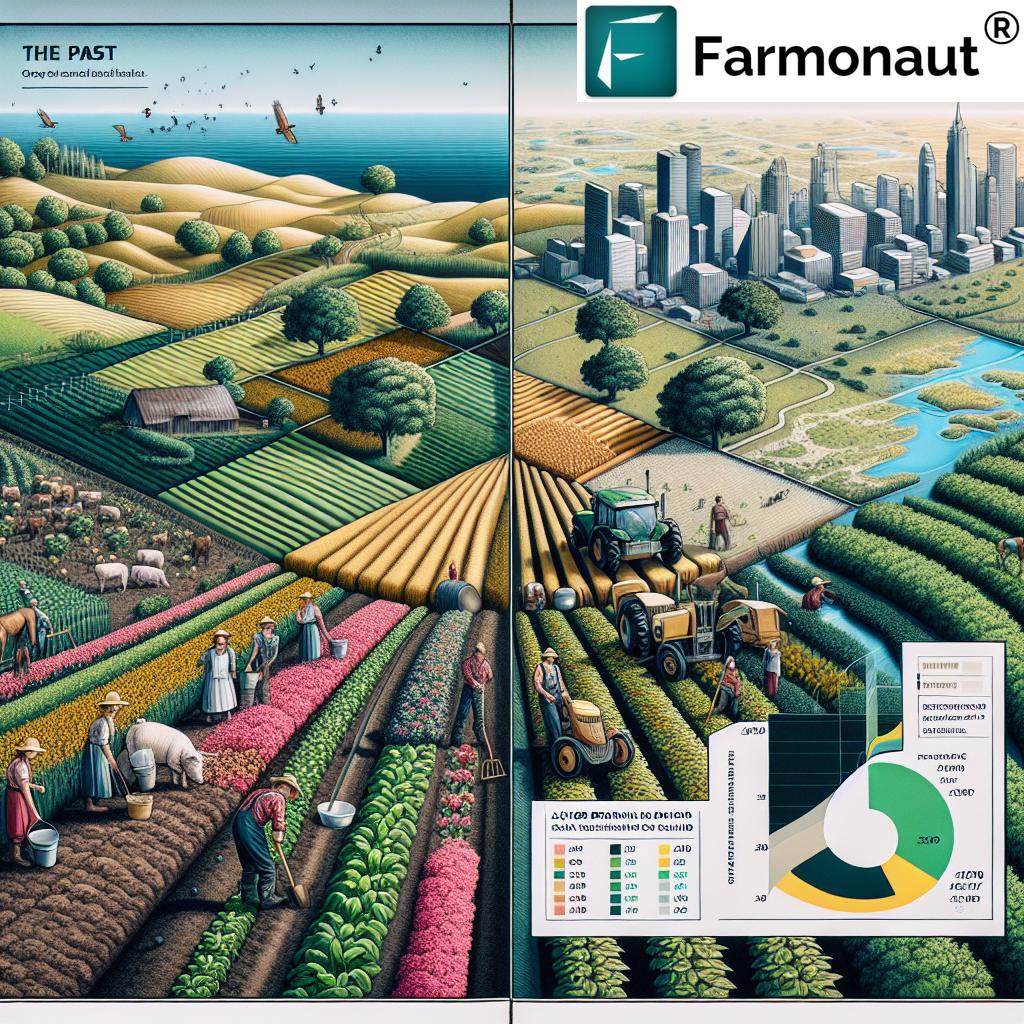

While policy initiatives like the Agricultural Tax Fund are crucial for preserving farmland, technology also plays a vital role in supporting these efforts. Advanced agricultural technologies can help farmers maximize their productivity on existing farmland, reducing the pressure to expand or sell their land for development.

One such technology that’s making waves in the agricultural sector is Farmonaut, a pioneering agricultural technology company that offers advanced, satellite-based farm management solutions. Farmonaut’s mission aligns closely with the goals of farmland preservation, as it aims to make precision agriculture affordable and accessible to farmers worldwide.

Through its innovative platform, Farmonaut provides valuable services such as:

- Real-time crop health monitoring

- AI-based advisory systems

- Blockchain-based traceability

- Resource management tools

These technologies can help farmers in Rowan County and beyond to optimize their operations, potentially increasing yields while reducing resource usage. This efficiency can make farming more profitable and sustainable, encouraging farmers to keep their land in agriculture rather than selling it for development.

“The Present-Use Valuation Program’s penalties could fund conservation easements, potentially preserving thousands of acres of farmland.”

Challenges and Considerations

While the proposed Agricultural Tax Fund offers a promising solution to farmland preservation in Rowan County, there are several challenges and considerations that need to be addressed:

Aging Farmer Population

One of the significant challenges facing farmland preservation is the aging farmer population. As older generations of farmers retire or pass away, there’s a risk that their land will be sold for development if younger generations are not interested in continuing the farming tradition. The Agricultural Tax Fund could potentially address this issue by providing incentives for younger farmers to take over these properties or for families to place their land in conservation easements.

Development Pressures

Rowan County, like many areas in North Carolina, faces increasing development pressures. The economic incentives for landowners to sell their property for residential or commercial development can be substantial. The Agricultural Tax Fund will need to offer compelling financial incentives to compete with these development pressures and encourage landowners to keep their land in agriculture.

Long-term Funding Sustainability

While the penalties from the Present-Use Valuation Program provide a source of funding for the Agricultural Tax Fund, it’s important to consider the long-term sustainability of this funding model. As more land is preserved, there may be fewer properties leaving the program, potentially reducing the fund’s income over time. County officials will need to explore additional funding sources or mechanisms to ensure the long-term viability of the preservation efforts.

The Importance of Local Government in Sustaining Rural Economies

The proposed Agricultural Tax Fund highlights the critical role that local government plays in sustaining rural economies and preserving farmland. By taking proactive measures to support the agricultural community, Rowan County can set an example for other counties across North Carolina and the nation.

Some key ways local government can support farmland preservation include:

- Implementing supportive zoning policies

- Offering tax incentives for conservation easements

- Providing resources and education for farmers on preservation options

- Collaborating with state and federal agencies on preservation initiatives

- Supporting local food systems and farm-to-table programs

By taking a holistic approach to farmland preservation, local governments can help ensure the long-term viability of their agricultural sectors while maintaining the rural character and open spaces that define their communities.

The Role of Technology in Supporting Farmland Preservation

While policy initiatives like the Agricultural Tax Fund are crucial, technology also plays a vital role in supporting farmland preservation efforts. Advanced agricultural technologies can help farmers maximize their productivity on existing farmland, reducing the pressure to expand or sell their land for development.

Farmonaut, for example, offers a range of tools that can support farmers in Rowan County and beyond:

- Satellite-Based Crop Health Monitoring: By providing real-time insights into crop health, soil moisture levels, and other critical metrics, Farmonaut helps farmers optimize their resource usage and improve yields.

- AI Advisory System: The Jeevn AI system offers personalized farm advisory services, helping farmers make informed decisions about crop management.

- Blockchain-Based Traceability: This technology can help farmers add value to their products by providing transparent supply chain information to consumers.

- Resource Management Tools: By optimizing resource usage, these tools can help make farming more profitable and sustainable.

By leveraging these technologies, farmers can potentially increase their profitability and efficiency, making it more attractive to keep their land in agriculture rather than selling it for development.

The Broader Impact: Food Security and Environmental Conservation

The preservation of farmland in Rowan County has implications that extend far beyond our local community. As Vice-Chairman Jim Greene pointed out during the county commissioners’ meeting, the loss of farmland could make the nation more reliant on importing food from other countries. This raises important questions about food security and self-sufficiency.

Moreover, farmland preservation plays a crucial role in environmental conservation. Agricultural lands provide important ecosystem services, including:

- Carbon sequestration

- Habitat for wildlife

- Water filtration and groundwater recharge

- Flood mitigation

- Preservation of open spaces and scenic landscapes

By implementing the Agricultural Tax Fund and supporting farmland preservation, Rowan County can contribute to broader environmental goals while securing its agricultural heritage.

Next Steps: Implementing the Agricultural Tax Fund

While the Rowan County Board of Commissioners has not yet taken official action on the proposed Agricultural Tax Fund, the next steps in the process are clear:

- Further discussion and refinement of the proposal by the Agricultural Advisory Board and county officials

- Public hearings to gather input from farmers, landowners, and other stakeholders

- Development of a detailed implementation plan, including criteria for fund disbursement

- Formal proposal presentation to the Board of Commissioners

- Potential inclusion in the county’s budget approval process in July

As these steps unfold, it will be crucial for all stakeholders to remain engaged in the process, providing input and support to ensure the success of this innovative farmland preservation initiative.

The Role of Community Support in Farmland Preservation

While government initiatives and technological advancements play crucial roles in farmland preservation, community support is equally important. Residents of Rowan County can contribute to these efforts in several ways:

- Supporting local farmers by purchasing locally grown produce and products

- Participating in community-supported agriculture (CSA) programs

- Advocating for farmland preservation policies at local government meetings

- Educating others about the importance of maintaining agricultural land

- Volunteering with local conservation organizations

By fostering a community-wide commitment to farmland preservation, we can create a supportive environment that encourages farmers to keep their land in agriculture and resist development pressures.

Conclusion: A Vision for Rowan County’s Agricultural Future

The proposed Agricultural Tax Fund represents a bold step towards preserving Rowan County’s agricultural heritage and securing its future as a vibrant farming community. By redirecting penalties from the Present-Use Valuation Program into conservation efforts, we have the potential to save a significant portion of our remaining farmland by 2040.

This initiative, combined with technological advancements in agriculture and strong community support, can create a sustainable model for farmland preservation that balances economic development with the need to maintain our agricultural resources. As we move forward, it will be crucial for all stakeholders – from farmers and landowners to local officials and residents – to work together in support of this vital cause.

The preservation of Rowan County’s farmland is not just about maintaining our agricultural productivity; it’s about preserving our way of life, ensuring food security for future generations, and maintaining the rural character that defines our community. By taking action now, we can ensure that the fields and farms that have long been a part of our landscape continue to thrive for generations to come.

FAQ Section

Q: What is the North Carolina Present-Use Valuation Program?

A: The Present-Use Valuation Program is a state initiative that provides tax breaks to active farmland, horticultural land, and forests. It aims to encourage the preservation of these lands by reducing the tax burden on property owners who keep their land in agricultural or forestry use.

Q: How would the proposed Agricultural Tax Fund work?

A: The fund would collect penalties from properties removed from the Present-Use Valuation Program and allocate these funds to a dedicated farmland preservation account. This money would then be used to assist farmland owners with costs associated with implementing conservation easements, such as land surveying, property appraisal, and environmental studies.

Q: Why is farmland preservation important for Rowan County?

A: Farmland preservation is crucial for maintaining food security, preserving the county’s rural character, supporting the local economy, and providing environmental benefits such as wildlife habitat and water filtration. It also helps to control urban sprawl and maintain the quality of life for residents.

Q: How can technology support farmland preservation efforts?

A: Advanced agricultural technologies, such as those offered by Farmonaut, can help farmers optimize their operations, potentially increasing yields while reducing resource usage. This efficiency can make farming more profitable and sustainable, encouraging farmers to keep their land in agriculture rather than selling it for development.

Q: What role can community members play in supporting farmland preservation?

A: Community members can support farmland preservation by purchasing locally grown produce, participating in CSA programs, advocating for preservation policies, educating others about the importance of maintaining agricultural land, and volunteering with local conservation organizations.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!