California’s Wildfire Insurance Crisis: How Climate Change Is Reshaping Homeowners Coverage

“California’s FAIR Plan faces potential financial collapse with hidden losses potentially exceeding $1 trillion nationwide.”

In recent years, we’ve witnessed a dramatic shift in California’s insurance landscape, particularly concerning wildfire coverage. As climate change intensifies the frequency and severity of natural disasters, homeowners in the Golden State are grappling with a complex and increasingly precarious insurance market. In this comprehensive analysis, we’ll explore how climate change is reshaping homeowners coverage in California, the challenges faced by both insurers and policyholders, and the potential solutions on the horizon.

The Escalating Wildfire Threat in California

California has long been known for its natural beauty and diverse landscapes. However, in recent years, the state has also become synonymous with devastating wildfires. The increase in wildfire activity can be attributed to several factors, with climate change playing a significant role.

- Rising temperatures and prolonged droughts have created ideal conditions for wildfires to ignite and spread rapidly.

- Changes in precipitation patterns have led to drier vegetation, providing ample fuel for fires.

- Human development in wildland-urban interface areas has increased the risk of fire ignition and property damage.

These factors have culminated in a series of record-breaking fire seasons, with the most recent Los Angeles wildfires causing catastrophic damage to tens of thousands of homes and businesses. The projected losses from these fires alone are estimated at a staggering $150 billion, highlighting the enormous financial impact of this growing crisis.

The Insurance Market’s Response to Increasing Risks

As the wildfire threat has grown, we’ve seen a seismic shift in the California insurance market. Major insurers, faced with mounting losses and unpredictable risks, have begun to withdraw from high-risk areas across the state. This exodus has left many homeowners struggling to find affordable coverage, creating a domino effect of consequences:

- Reduced availability of traditional insurance options in fire-prone areas

- Skyrocketing premiums for those who can still obtain coverage

- Increased reliance on California’s FAIR Plan, the state’s insurer of last resort

- Potential financial instability for both insurers and the state-backed FAIR Plan

The situation has become so dire that over 450,000 Californians now rely on the FAIR Plan for coverage, with its exposure ballooning to $458 billion. This unprecedented demand has raised serious concerns about the plan’s ability to withstand a major wildfire event, potentially leading to a financial collapse that could reverberate throughout the state’s economy.

The FAIR Plan: A Last Resort Under Strain

California’s FAIR (Fair Access to Insurance Requirements) Plan was originally designed as a safety net for homeowners who couldn’t obtain coverage in the traditional market. However, it has increasingly become the primary option for many residents in high-risk areas. The plan’s growing prominence has exposed several key issues:

- Limited coverage options compared to traditional policies

- Higher premiums and deductibles for policyholders

- Increased financial burden on the state as more homeowners turn to the FAIR Plan

- Potential for systemic failure if claims exceed the plan’s capacity

Governor Gavin Newsom has prioritized strengthening the FAIR Plan to provide more reliable insurance for residents. However, the reality is that the system faces potential financial collapse under the weight of growing demand and escalating risks.

Climate Change: The Catalyst for Insurance Market Disruption

At the heart of California’s insurance crisis lies the undeniable impact of climate change. The increasing frequency and intensity of wildfires have rendered traditional risk assessment models obsolete, forcing insurers to reevaluate their approach to coverage in fire-prone areas.

Climate change has affected the insurance market in several ways:

- Increased unpredictability of natural disasters, making risk assessment more challenging

- Higher potential for catastrophic losses, straining insurers’ financial reserves

- Need for more sophisticated modeling techniques to accurately price policies

- Growing concern over the long-term viability of insuring properties in high-risk zones

As a result, we’re seeing a fundamental shift in how insurers approach wildfire risk, with many opting to limit their exposure in vulnerable areas or exit the market entirely.

Recent Reforms: A Step Towards Market Stabilization?

In response to the growing crisis, California Insurance Commissioner Ricardo Lara has introduced a series of reforms aimed at stabilizing the insurance market and improving access to coverage for homeowners. These reforms include:

- Allowing insurers to use advanced catastrophe models for rate-setting

- Permitting premium adjustments based on fire-prevention measures taken by homeowners

- Implementing a temporary one-year moratorium on policy cancellations in affected areas

While these reforms represent a step in the right direction, they may not fully address the systemic vulnerabilities within California’s insurance framework. The temporary nature of some measures, such as the moratorium on cancellations, leaves many homeowners uncertain about their long-term insurance prospects.

The Economic Ripple Effect

The wildfire insurance crisis extends far beyond individual homeowners, potentially impacting California’s broader economy. With hidden losses potentially exceeding $1 trillion nationwide, the stakes are incredibly high. Some of the economic implications include:

- Decreased property values in high-risk areas

- Reduced investment in fire-prone regions

- Increased burden on state resources to manage wildfire risk and provide insurance solutions

- Potential for widespread financial instability if the FAIR Plan were to collapse

These economic vulnerabilities underscore the urgent need for comprehensive solutions that address both the immediate insurance crisis and the long-term challenges posed by climate change.

Rethinking Development in Fire-Prone Areas

As we grapple with the insurance crisis, a broader conversation is emerging about the wisdom of continued development in California’s most fire-prone regions. This discussion raises several important questions:

- Should rebuilding be allowed in areas repeatedly devastated by wildfires?

- Can we create incentives for development in safer, less fire-prone locations?

- How can we balance the state’s housing needs with the realities of increasing wildfire risk?

These questions challenge policymakers, insurers, and residents to reconsider long-held assumptions about land use and development in California’s wildland-urban interface areas.

The Role of Technology in Wildfire Risk Management

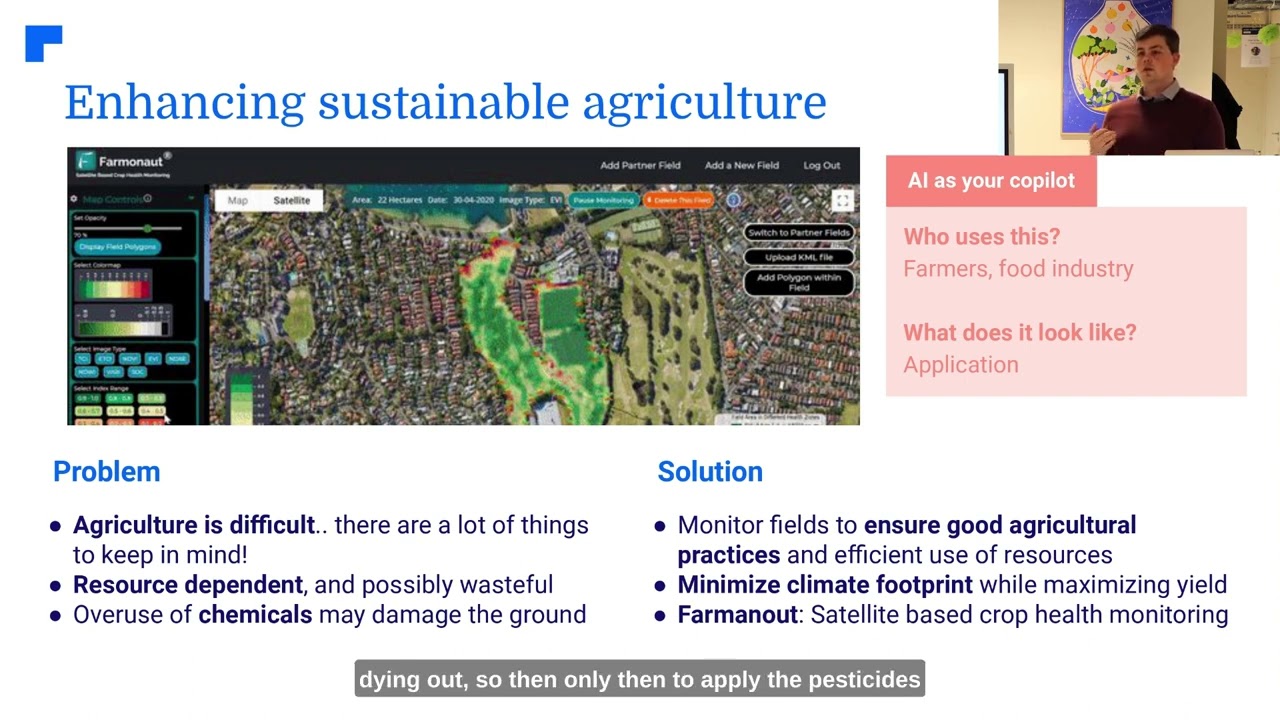

As we search for solutions to California’s wildfire insurance crisis, technology is emerging as a crucial tool for risk assessment and management. Advanced satellite imagery and AI-driven analytics are revolutionizing how we understand and mitigate wildfire risks.

One company at the forefront of this technological revolution is Farmonaut. While primarily focused on agricultural applications, Farmonaut’s satellite-based monitoring and AI advisory systems offer valuable insights that could be adapted for wildfire risk assessment.

For more information on Farmonaut’s innovative technologies, visit their web app or explore their API for developers.

The Future of Homeowners Insurance in California

As we look to the future, it’s clear that California’s insurance landscape will continue to evolve in response to climate change and wildfire risks. Some potential developments we may see include:

- More widespread use of parametric insurance products tied to specific wildfire-related triggers

- Increased integration of climate data and predictive modeling in policy pricing

- Greater emphasis on community-level fire prevention and mitigation efforts

- Exploration of public-private partnerships to address insurance gaps

While the challenges are significant, there are also opportunities for innovation and collaboration that could help create a more resilient and sustainable insurance market in California.

California Wildfire Insurance Crisis Timeline

| Year | Event | Impact on Insurance Market | Estimated Financial Cost |

|---|---|---|---|

| 2015 | Valley Fire | Insurers begin reassessing wildfire risk | $1.5 billion |

| 2017 | Wine Country Fires | Major insurers start withdrawing from high-risk areas | $9.5 billion |

| 2018 | Camp Fire | Widespread policy non-renewals, FAIR Plan expansion | $16.5 billion |

| 2020 | August Complex Fire | Insurance crisis deepens, FAIR Plan exposure grows | $12 billion |

| 2022 | Insurance reforms introduced | Insurers allowed to use advanced catastrophe models | N/A |

| 2025 (Projected) | FAIR Plan reaches capacity | Potential market instability, new solutions needed | $500 billion (potential exposure) |

| 2030 (Projected) | Climate adaptation measures implemented | Possible stabilization of insurance market | TBD |

“Major insurers’ withdrawal from high-risk areas in California leaves thousands of homeowners struggling to find affordable wildfire coverage.”

The Role of Homeowners in Mitigating Risk

While much of the focus has been on insurers and policymakers, homeowners also play a crucial role in addressing the wildfire insurance crisis. By taking proactive steps to reduce their property’s vulnerability to fire, homeowners can potentially improve their insurance options and contribute to community-wide resilience.

Some key actions homeowners can take include:

- Creating defensible space around their property

- Using fire-resistant building materials for renovations or new construction

- Installing fire-resistant landscaping

- Participating in community-wide fire prevention efforts

These measures not only help protect individual properties but can also contribute to more favorable insurance terms and potentially influence insurers’ willingness to offer coverage in high-risk areas.

The Intersection of Insurance and Climate Policy

As we navigate the complexities of California’s wildfire insurance crisis, it’s becoming increasingly clear that insurance and climate policies are inextricably linked. Addressing the insurance challenges will require a holistic approach that considers both immediate market stability and long-term climate resilience.

Some key areas where insurance and climate policy intersect include:

- Incentivizing climate-adaptive building practices through insurance pricing

- Using insurance data to inform land-use planning and development decisions

- Integrating climate projections into long-term insurance risk models

- Developing public-private partnerships to fund large-scale climate adaptation projects

By aligning insurance and climate policies, California has the opportunity to create a more sustainable and resilient approach to wildfire risk management.

The Global Context: Lessons from Other Regions

While California’s wildfire insurance crisis is unique in many ways, it’s not the only region grappling with climate-related insurance challenges. By examining approaches taken in other parts of the world, we can gain valuable insights and potential solutions.

Some international examples worth considering include:

- Australia’s use of catastrophe pools for cyclone and flood insurance

- Japan’s earthquake insurance program, which combines public and private sector involvement

- European efforts to integrate nature-based solutions into flood risk management and insurance

These global perspectives can help inform California’s approach to creating a more resilient and equitable insurance system in the face of increasing wildfire risks.

The Path Forward: Balancing Affordability and Sustainability

As we look to the future of homeowners insurance in California’s wildfire-prone regions, the central challenge will be striking a balance between affordability for consumers and long-term sustainability for insurers. This delicate equilibrium will require innovative thinking, collaboration across sectors, and a willingness to embrace new approaches to risk management.

Some potential strategies for achieving this balance include:

- Exploring risk-sharing mechanisms that distribute the burden of catastrophic losses more equitably

- Developing new insurance products that better align with the realities of climate change

- Investing in large-scale climate adaptation and wildfire prevention measures

- Leveraging technology and data analytics to create more accurate and dynamic risk assessments

By pursuing these and other innovative solutions, California can work towards a more stable and sustainable insurance market that serves the needs of both homeowners and insurers in the face of evolving climate risks.

Conclusion: A Call to Action

California’s wildfire insurance crisis represents a complex challenge at the intersection of climate change, financial stability, and public policy. As we’ve explored throughout this analysis, the impacts of this crisis extend far beyond individual homeowners, potentially threatening the economic foundation of entire communities and the state as a whole.

Addressing this crisis will require a multifaceted approach that combines:

- Innovative insurance products and risk assessment tools

- Proactive climate adaptation and wildfire prevention measures

- Thoughtful policy reforms that balance market stability with consumer protection

- Increased collaboration between insurers, policymakers, and communities

The path forward will not be easy, but the stakes are too high to ignore. By taking decisive action now, California has the opportunity to create a more resilient and sustainable insurance framework that can serve as a model for other regions facing similar climate-related challenges.

As we confront this crisis, it’s clear that technology will play a crucial role in understanding and mitigating wildfire risks. Companies like Farmonaut, with their advanced satellite-based monitoring and AI-driven analytics, offer valuable tools that could be adapted to support wildfire risk assessment and management efforts.

To learn more about how technology is revolutionizing risk assessment and management, explore Farmonaut’s innovative solutions:

By embracing innovative technologies and collaborative approaches, we can work towards a future where California’s communities are both insurable and resilient in the face of growing wildfire risks.

FAQ: California’s Wildfire Insurance Crisis

- Q: Why are insurance companies withdrawing from high-risk areas in California?

A: Insurers are withdrawing due to the increasing frequency and severity of wildfires, which have led to unprecedented losses and made it difficult to accurately assess and price risk in these areas. - Q: What is the California FAIR Plan, and why is it under strain?

A: The FAIR Plan is California’s insurer of last resort, providing coverage to homeowners who can’t obtain it in the traditional market. It’s under strain due to the growing number of policyholders and the increasing risk of catastrophic losses from wildfires. - Q: How is climate change affecting wildfire risk in California?

A: Climate change is leading to hotter, drier conditions and longer fire seasons, which increase the frequency and intensity of wildfires in California. - Q: What can homeowners do to improve their chances of obtaining affordable wildfire insurance?

A: Homeowners can take steps like creating defensible space, using fire-resistant building materials, and participating in community-wide fire prevention efforts to potentially improve their insurance options. - Q: Are there any new technologies being used to assess wildfire risk?

A: Yes, advanced technologies like satellite imagery, AI-driven analytics, and sophisticated climate models are being developed to more accurately assess and predict wildfire risks.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!