Navigating USMCA Challenges: How US Tariffs Impact North American Agricultural Trade and Supply Chains

“US tariffs on Canada and Mexico imports affect nearly $900 billion worth of goods, impacting various sectors including agriculture.”

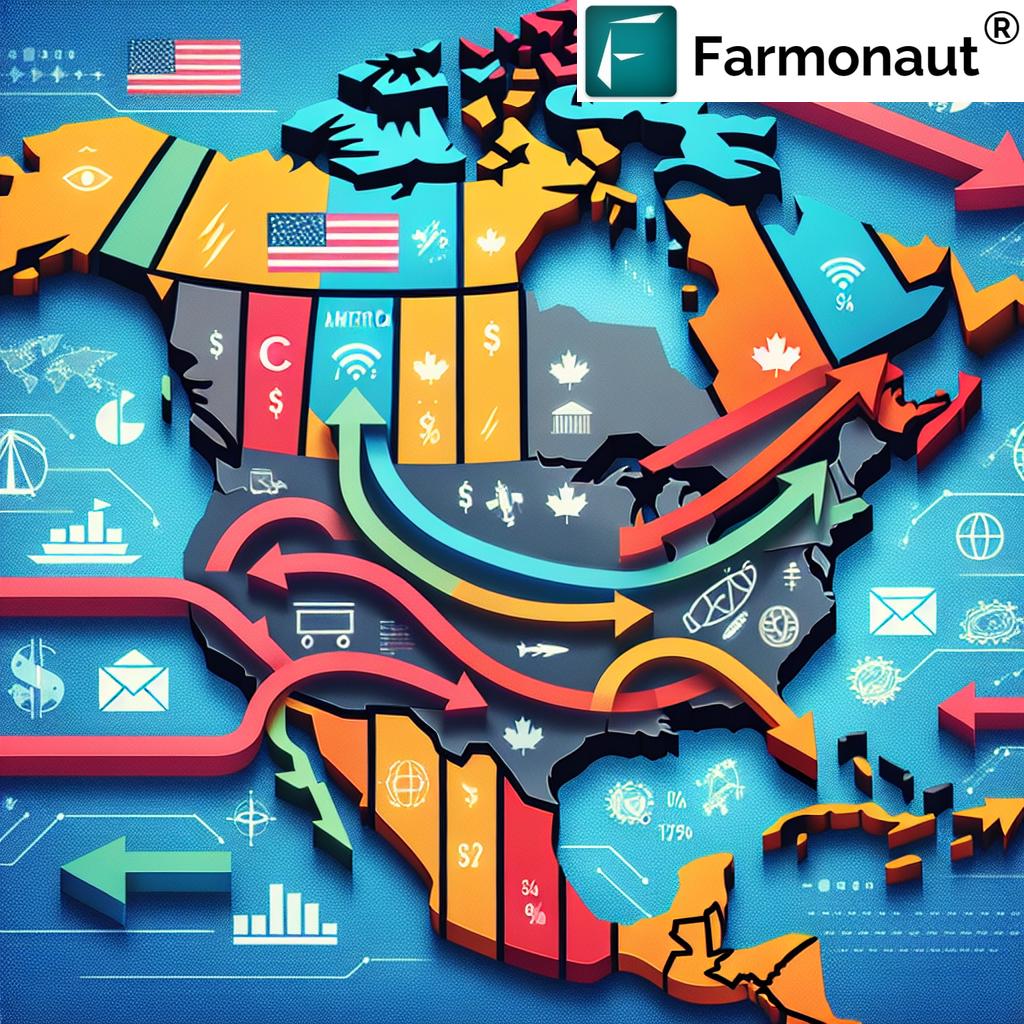

In recent developments that have sent shockwaves through North American trade relations, the United States has implemented a 25% tariff on imports from Canada and Mexico. This move, enacted under the USMCA (United States-Mexico-Canada Agreement) trade framework, has sparked widespread concern about potential disruptions to supply chains and trade dynamics across the continent. As we delve into this complex issue, we’ll explore the far-reaching consequences of these tariffs on North American trade, offering insights into the economic impacts and industry-specific effects that are likely to reverberate across the United States, Canada, and Mexico.

The Scale of Impact: A $900 Billion Trade Relationship

To understand the magnitude of these tariffs, we must first grasp the scale of trade between the United States and its North American neighbors. As of early 2023, imports from Canada and Mexico amount to nearly $900 billion, a figure that underscores the deep integration of the U.S. economy with its northern and southern trade partners. This vast sum encompasses a wide array of goods and services, from automotive parts and electronics to agricultural products and energy resources.

The implementation of a 25% tariff on this enormous volume of trade is poised to have significant ramifications across multiple sectors. Analysts predict that industries heavily reliant on cross-border trade, such as the automobile and electronics sectors, will bear a substantial burden from these new tariffs. Moreover, the energy sector, which has long enjoyed preferential treatment, now faces a new reality as tariffs extend to Canadian oil and gas exports, marking a departure from the previous zero-rate treatment.

Canada: A Vulnerable Trade Partner

Canada’s economy is particularly susceptible to the effects of these tariffs, given that approximately 80% of its goods exports, totaling around $410 billion, are directed to the United States. The automotive sector, especially in Ontario, faces unique challenges due to the integrated nature of production across the U.S.-Canada border. Components often cross the border multiple times before a vehicle is completed, potentially incurring tariffs at each crossing.

Beyond the auto industry, the construction sector is bracing for significant impacts. Over 70% of U.S. imports of critical materials like softwood lumber and gypsum are sourced from Canada and Mexico. The imposition of tariffs on these materials is likely to inflate housing costs and potentially curb new development, affecting home builders and buyers alike.

Mexico: Agricultural Exports in the Crosshairs

Mexico’s export economy, with 84% of its globally sold goods ending up in the United States—amounting to over $510 billion—is equally vulnerable to these tariff measures. Key sectors impacted include automobiles, electronics, and notably, agriculture. Mexico is a significant supplier of U.S. vegetable and fruit imports, and the potential rise in import costs could lead to higher prices for essential food items.

“The 25% tariffs under USMCA could significantly increase prices for Mexican agricultural exports like avocados and tomatoes.”

One striking example is the avocado market, where Mexico supplies more than 80% of U.S. imports. The implementation of tariffs threatens to inflate costs for popular products like guacamole, potentially impacting consumer behavior and restaurant menus across the United States.

USMCA: A Trade Agreement Under Strain

The imposition of these tariffs raises serious questions about adherence to the USMCA trade agreement, potentially undermining its foundational principles. The USMCA, which replaced NAFTA (North American Free Trade Agreement), was designed to foster free trade and economic cooperation between the United States, Canada, and Mexico. However, the recent tariff measures seem to contradict the spirit of this agreement.

Some analysts suggest that the tariff strategy could be a tactic for the United States to strengthen its position ahead of the upcoming 2026 USMCA review deadline. This approach, however, risks straining diplomatic relations and could lead to retaliatory measures from Canada and Mexico.

Economic Implications and Potential Retaliation

The economic implications of these tariffs are far-reaching. EY’s chief economist, Daco, warns that retaliatory measures from Canada and Mexico could potentially push their economies into recession. Even the United States is not immune to the risks, with the possibility of a shallow downturn looming on the horizon.

These tariffs are viewed as an extension of the “America First” policy, using trade as a geopolitical tool against neighboring countries. However, this approach may have unintended consequences, potentially disrupting supply chains and increasing costs for U.S. businesses and consumers.

In response to the U.S. tariffs, Mexican President Claudia Sheinbaum has indicated plans for retaliatory measures. Both Mexico and Canada are considering legal challenges under USMCA guidelines, highlighting the potential for prolonged economic conflicts and market uncertainty.

Sector-Specific Impacts

- Automotive Industry: The integrated nature of the North American auto industry means that vehicles and parts often cross borders multiple times during production. The new tariffs could significantly increase costs and disrupt established supply chains.

- Agriculture: U.S. farmers may face challenges as retaliatory tariffs could reduce demand for their exports. Simultaneously, U.S. consumers might see higher prices for imported produce like avocados and tomatoes from Mexico.

- Energy Sector: The tariffs on Canadian oil exports mark a significant shift from previous zero-rate treatments, potentially impacting energy prices and supply dynamics in the United States.

- Construction: With tariffs affecting key materials like lumber, the construction industry may face rising costs, potentially slowing down new housing developments and renovations.

The Role of Technology in Navigating Trade Challenges

In these turbulent times, technology plays a crucial role in helping businesses adapt to changing trade dynamics. Platforms like Farmonaut offer innovative solutions for agricultural management and supply chain optimization. By leveraging satellite imagery and AI-driven insights, Farmonaut helps farmers and agribusinesses make informed decisions, potentially mitigating some of the challenges posed by trade disruptions.

Impact on Agricultural Trade: A Closer Look

| Agricultural Product | Exporting Country | Estimated Annual Export Value (Pre-tariff) | Potential Price Increase (%) |

|---|---|---|---|

| Softwood Lumber | Canada | $5.7 billion | 20-25% |

| Avocados | Mexico | $2.8 billion | 15-20% |

| Tomatoes | Mexico | $2.3 billion | 18-22% |

| Beef | Canada | $2.1 billion | 10-15% |

| Berries | Mexico | $1.9 billion | 12-18% |

This table illustrates the potential impact of the 25% tariffs on key agricultural products traded within North America. The significant price increases across various commodities underscore the far-reaching effects of these trade measures on the agricultural sector.

Challenges and Opportunities for Farmers

For farmers across North America, these tariffs present both challenges and opportunities. While some may face increased competition or reduced market access, others might find new domestic markets as imported goods become more expensive. In this evolving landscape, the ability to adapt quickly and make data-driven decisions becomes crucial.

Technological solutions like Farmonaut’s satellite-based farm management tools can provide valuable insights to help farmers navigate these changes. By offering real-time crop health monitoring and AI-driven advisory services, Farmonaut empowers farmers to optimize their operations in the face of market uncertainties.

The Future of North American Trade

As the United States, Canada, and Mexico grapple with these new tariff measures, the future of North American trade remains uncertain. The potential for escalating trade tensions and retaliatory measures looms large, threatening to disrupt the integrated supply chains that have developed over decades of free trade.

However, this period of change also presents opportunities for innovation and adaptation. Businesses that can quickly adjust their strategies and leverage technology to optimize their operations may find themselves better positioned to navigate the new trade landscape.

The Role of Data in Agricultural Decision-Making

In an era of trade uncertainty, access to accurate and timely data becomes more critical than ever for agricultural businesses. Farmonaut’s suite of tools, including its API for developers, provides valuable resources for farmers and agribusinesses looking to make informed decisions in a volatile market environment.

Adapting to the New Normal

As businesses and consumers alike grapple with the realities of these new tariffs, adaptation will be key. This may involve:

- Diversifying supply chains to reduce reliance on single sources

- Investing in technology to improve efficiency and reduce costs

- Exploring new markets to offset potential losses in traditional trade relationships

- Engaging in collaborative efforts to navigate regulatory challenges

The Importance of Sustainable Practices

In times of economic uncertainty, the importance of sustainable agricultural practices becomes even more pronounced. Farmonaut’s technology supports farmers in implementing sustainable methods, helping to reduce resource usage and improve long-term resilience in the face of market fluctuations.

Looking Ahead: The 2026 USMCA Review

As we navigate the immediate impacts of these tariffs, it’s important to keep an eye on the horizon. The upcoming 2026 USMCA review presents an opportunity for all parties to reassess and potentially renegotiate the terms of North American trade. How the current tariff situation unfolds will likely play a significant role in shaping the discussions and outcomes of this review.

Conclusion

The implementation of 25% tariffs on imports from Canada and Mexico marks a significant shift in North American trade dynamics. As we’ve explored, the impacts of these measures are far-reaching, affecting industries from automotive to agriculture, and potentially reshaping supply chains across the continent.

While challenges abound, there are also opportunities for businesses that can adapt quickly and leverage technology to navigate this new landscape. Tools like Farmonaut’s satellite-based farm management solutions can provide valuable insights and support for agricultural businesses looking to thrive in uncertain times.

As we move forward, it will be crucial for stakeholders across all sectors to stay informed, remain flexible, and seek innovative solutions to the challenges posed by these trade measures. The future of North American trade may be uncertain, but with the right approach and tools, businesses can position themselves to weather the storm and emerge stronger on the other side.

FAQ Section

- Q: What is the USMCA and how does it differ from NAFTA?

A: The USMCA (United States-Mexico-Canada Agreement) is the trade agreement that replaced NAFTA in 2020. While it maintains many of NAFTA’s core principles, USMCA includes updated provisions on digital trade, intellectual property, and labor standards. - Q: How might these tariffs affect consumer prices in the US?

A: Consumers may see price increases on a range of products, from automobiles to fresh produce, as businesses pass on the increased costs of imports. - Q: Are there any exemptions to these tariffs?

A: While the details are still evolving, typically, certain essential goods or strategic products may be exempted. It’s important to stay updated on official announcements for specific exemptions. - Q: How might these tariffs impact the automotive industry?

A: The automotive industry, with its deeply integrated North American supply chains, could face significant disruptions. Increased costs may lead to higher vehicle prices and potential job losses in the sector. - Q: What options do Canada and Mexico have to respond to these tariffs?

A: Canada and Mexico may consider retaliatory tariffs, legal challenges under USMCA provisions, or diplomatic negotiations to address their concerns.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!