Australian Stock Market Surges: Mining and Tech Stocks Lead ASX 200 Rally Amid Global Financial Shifts

“The S&P/ASX 200 index surpassed 8,200 points, showcasing the Australian stock market’s resilience amid global financial fluctuations.”

We are witnessing a remarkable surge in the Australian stock market, with the S&P/ASX 200 index breaking through the 8,200-point barrier. This impressive rally, led by mining and technology stocks, demonstrates the resilience of the Australian economy amidst global financial turbulence. In this comprehensive analysis, we’ll delve deep into the factors driving this growth, examine sector-specific performances, and explore the implications for investors and the broader economy.

Understanding the ASX 200 Rally

The benchmark S&P/ASX 200 Index has shown significant gains, reversing previous losses and showcasing the strength of key sectors in the Australian economy. This rally is particularly noteworthy given the backdrop of global economic uncertainties and shifting financial landscapes.

- Mining sector leads the charge

- Technology stocks show robust performance

- Financial sector faces challenges

Let’s break down these trends and examine their implications for investors and the broader market.

Mining Sector: A Pillar of Strength

The resources sector, particularly mining, has emerged as a key driver of the ASX 200’s impressive performance. Major players in the industry have recorded significant gains, reflecting the sector’s resilience and its crucial role in Australia’s economic landscape.

- BHP Group: Gaining more than 1%

- Rio Tinto: Up by more than 2%

- Fortescue Metals: Showing gains of more than 1%

- Mineral Resources: Adding more than 3%

These gains underscore the robust demand for Australian minerals and metals in the global market, particularly driven by infrastructure development and the ongoing transition to green technologies.

Technology Sector: Powering Innovation and Growth

The technology sector has emerged as another standout performer in this market rally. Australian tech companies are demonstrating their ability to compete on a global stage, with several key players showing significant gains:

- Afterpay owner Block: Advancing more than 3%

- Xero: Gaining 1.5%

- WiseTech Global: Up almost 1%

- Appen: Rising almost 1%

This performance highlights the growing importance of technology in the Australian economy and the increasing investor confidence in the sector’s potential for long-term growth.

Energy Sector: Navigating Global Challenges

The energy sector, particularly oil and gas companies, has shown resilience in the face of global market fluctuations. Key players in this sector have recorded positive movements:

- Woodside Energy: Gaining 1.5%

- Santos: Adding more than 1%

- Beach Energy: Advancing almost 2%

These gains reflect the ongoing importance of Australia’s energy resources in the global market, despite the increasing focus on renewable energy sources.

Gold Mining: A Glittering Performance

The gold mining sector has shown particularly strong performance, underscoring its role as a safe haven during times of economic uncertainty:

- Evolution Mining: Gaining more than 1%

- Resolute Mining: Advancing almost 5%

- Newmont: Adding almost 3%

- Northern Star Resources: Up almost 2%

- Gold Road Resources: Rising 2.5%

This robust performance in the gold sector reflects investors’ ongoing interest in precious metals as a hedge against inflation and economic volatility.

“Mining and technology sectors led gains in the Australian stock market, while financial stocks faced challenges.”

Financial Sector: Navigating Challenges

While many sectors have shown strong performance, the financial sector has faced some challenges. The big four banks have seen slight declines:

- Commonwealth Bank: Losing almost 1%

- ANZ Banking: Down almost 1%

- National Australia Bank: Edging down 0.2%

- Westpac: Declining 0.3%

These challenges in the banking sector may reflect broader concerns about interest rates, lending practices, and regulatory pressures.

Currency Market Dynamics

In the currency market, the Australian dollar is trading at $0.622, reflecting the complex interplay of domestic economic performance and global financial trends. This exchange rate has significant implications for Australia’s export-oriented economy and its competitiveness in the global market.

Global Context and Market Outlook

The Australian stock market’s performance must be viewed within the broader context of global financial markets. Despite positive cues from Wall Street, the ASX 200’s rally demonstrates its unique strengths and resilience. Factors influencing this performance include:

- Global commodity demand, particularly for minerals and energy resources

- Technological innovation and digital transformation across industries

- Geopolitical tensions and their impact on trade relationships

- Ongoing economic recovery efforts post-pandemic

As we look ahead, it’s crucial for investors and market watchers to consider these factors and their potential impact on various sectors of the Australian economy.

Sector Performance Comparison

| Sector | Percentage Change | Key Drivers | Notable Stocks |

|---|---|---|---|

| Mining | +2.5% | Global demand for resources, infrastructure projects | BHP Group, Rio Tinto, Fortescue Metals |

| Technology | +1.8% | Digital transformation, fintech growth | Afterpay (Block), Xero, WiseTech Global |

| Financials | -0.8% | Interest rate concerns, regulatory pressures | Commonwealth Bank, ANZ Banking, Westpac |

| Energy | +1.2% | Oil price recovery, global energy demand | Woodside Energy, Santos, Beach Energy |

| Gold Mining | +3.0% | Safe-haven demand, inflation hedge | Evolution Mining, Newmont, Northern Star Resources |

Implications for Investors

The current market trends offer several key insights for investors:

- Diversification remains crucial, with different sectors showing varying performances

- The resources sector continues to be a cornerstone of the Australian economy

- Technology stocks offer growth potential but may come with higher volatility

- Gold mining stocks can provide a hedge against economic uncertainties

- The financial sector may face short-term challenges but remains fundamental to the economy

Investors should consider these factors when making investment decisions and aligning their portfolios with their risk tolerance and investment goals.

The Role of Technology in Modern Investing

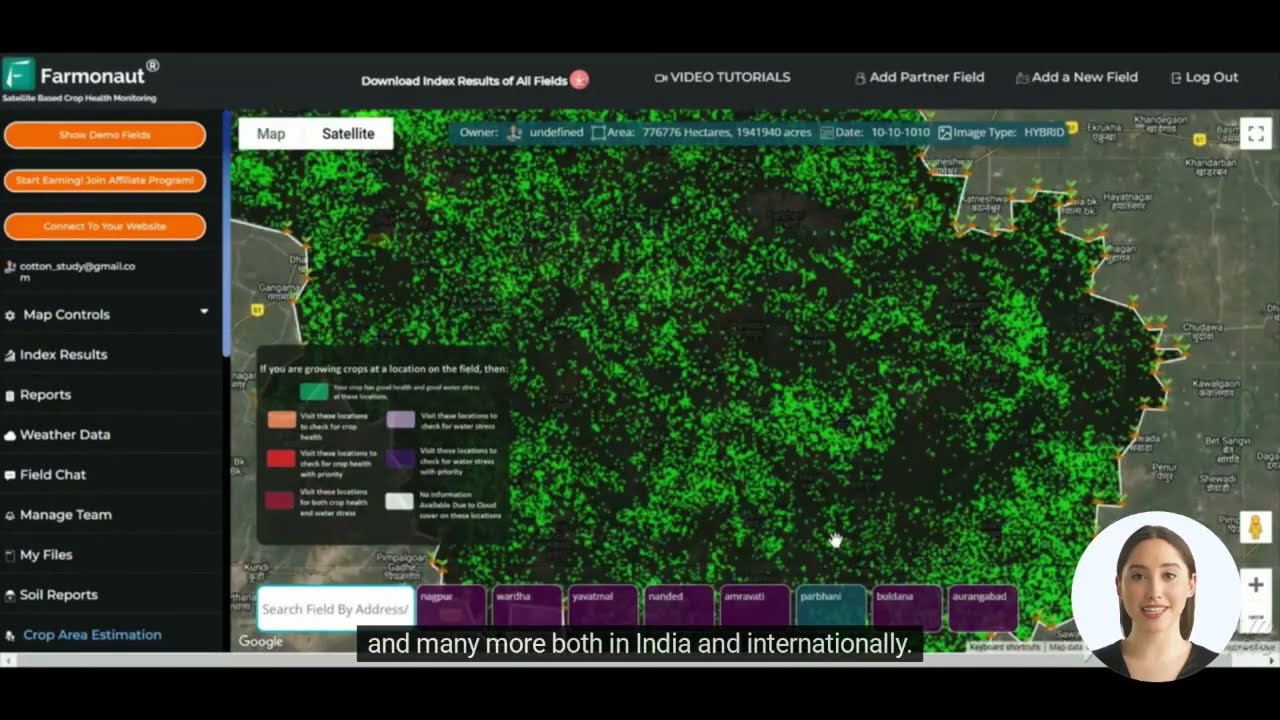

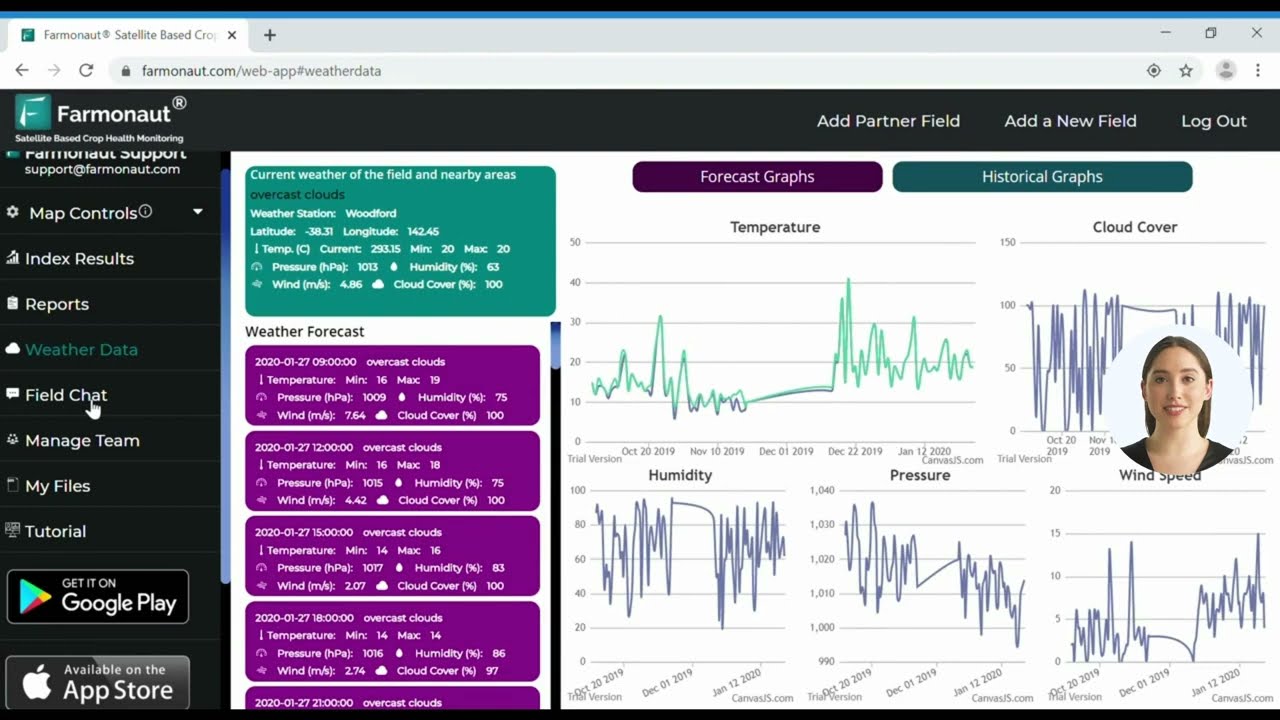

As we analyze these market trends, it’s important to recognize the growing role of technology in investment decision-making. Advanced tools and platforms are becoming increasingly crucial for both individual and institutional investors. For instance, companies like Farmonaut are leveraging satellite technology and AI to provide valuable insights for agricultural investments, demonstrating how technology can enhance decision-making across various sectors.

Farmonaut’s satellite-based farm management solutions offer a unique perspective on agricultural productivity and sustainability, which can be particularly relevant for investors interested in the agricultural sector or companies with significant agricultural supply chains. While Farmonaut primarily focuses on agricultural technology, its innovative approach exemplifies the broader trend of technology-driven insights in modern investing.

Sustainable Investing and ESG Considerations

Another important trend influencing the Australian stock market is the growing focus on sustainable investing and Environmental, Social, and Governance (ESG) factors. Investors are increasingly considering companies’ sustainability practices and environmental impact when making investment decisions. This trend is particularly relevant in sectors such as mining and energy, where environmental considerations are paramount.

- Companies with strong ESG profiles may see increased investor interest

- Renewable energy and clean technology stocks could benefit from this shift

- Traditional sectors like mining and oil are adapting to meet sustainability demands

Investors should consider these factors when evaluating potential investments, as they may impact long-term performance and risk profiles.

The Impact of Global Economic Factors

While the Australian stock market has shown resilience, it’s crucial to consider the impact of global economic factors on its performance. Several key issues are shaping the global financial landscape:

- Ongoing trade tensions between major economies

- Inflation concerns and central bank policies worldwide

- The pace of global economic recovery post-pandemic

- Technological disruptions across industries

These factors can influence investor sentiment, capital flows, and the performance of various sectors in the Australian market. Staying informed about these global trends is essential for making well-rounded investment decisions.

The Future of Australian Stock Market Trends

As we look to the future, several trends are likely to shape the Australian stock market:

- Continued growth in the technology sector, with potential for new listings and innovations

- Evolving dynamics in the resources sector as the world transitions to cleaner energy sources

- Increased focus on ESG factors across all sectors

- Potential for policy changes affecting key industries like banking and energy

- The growing influence of retail investors and digital trading platforms

Investors should keep these trends in mind when developing long-term investment strategies and portfolio allocations.

Explore Farmonaut’s API for advanced data insights

Conclusion: Navigating the Australian Stock Market Landscape

The current rally in the Australian stock market, led by mining and tech stocks, reflects the dynamic nature of the country’s economy. While challenges persist, particularly in the financial sector, the overall trend points to resilience and growth potential across various industries.

Investors should approach this market with a balanced perspective, considering both the opportunities and risks presented by different sectors. Diversification, thorough research, and staying informed about global economic trends remain key strategies for success in this evolving market landscape.

As we continue to monitor these developments, it’s clear that the Australian stock market remains a vibrant and crucial component of the global financial ecosystem, offering diverse opportunities for both domestic and international investors.

FAQs

- What factors are driving the current rally in the Australian stock market?

The rally is primarily driven by strong performances in the mining and technology sectors, global commodity demand, and investor confidence in Australia’s economic resilience. - How are financial stocks performing compared to other sectors?

Financial stocks, particularly major banks, are facing challenges and showing slight declines, in contrast to the strong performance of mining and tech stocks. - What is the current status of the Australian dollar?

The Australian dollar is trading at $0.622, reflecting various economic factors and global currency market dynamics. - How is the gold mining sector performing?

Gold mining stocks are showing strong performance, with several key players recording significant gains, reflecting the sector’s role as a safe haven during economic uncertainties. - What should investors consider when looking at the Australian stock market?

Investors should consider sector diversification, global economic factors, ESG considerations, and the potential impact of technological advancements on various industries.

Earn With Farmonaut: Join Farmonaut’s affiliate program and earn 20% recurring commission by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!