Australian Stock Market Tumbles: Tech, Gold, and Industrial Sectors Lead Losses as Commodities Remain Volatile

“The S&P/ASX 200 hit a 6-month low, with the ASX 200 Volatility Index reaching a 6-month high on Tuesday.”

In today’s rapidly evolving financial landscape, staying informed about Australian stock market trends and Sydney stock exchange performance is crucial for investors and market watchers alike. We’ve witnessed a significant downturn in the Australian equities market, with the S&P/ASX 200 hitting a new 6-month low. This development has sent ripples through various sectors, particularly affecting technology, gold, and industrial stocks.

As we delve into the intricacies of this market shift, we’ll explore the factors contributing to the volatility, analyze sector-specific impacts, and provide insights to help navigate these challenging times. Whether you’re an seasoned investor or just beginning to explore the world of Australian equities, this comprehensive analysis will equip you with the knowledge needed to make informed decisions in the current market climate.

Market Overview: A Deep Dive into the ASX’s Recent Performance

The Australian Securities Exchange (ASX) has experienced a significant decline, with the S&P/ASX 200 index closing lower on Tuesday. This downturn has been characterized by substantial losses across multiple sectors, particularly in information technology, gold, and industrials. The market’s performance reflects broader concerns and uncertainties plaguing the global economic landscape.

Key highlights of the market’s recent performance include:

- The S&P/ASX 200 lost 0.91%, reaching a new 6-month low

- Significant declines in the S&P/ASX 200 Information Technology, ASX All Ordinaries Gold, and S&P/ASX 200 Industrials sectors

- The ASX 200 Volatility Index hit a 6-month high, indicating increased market uncertainty

- Mixed results in commodities trading, with gold futures slightly up and crude oil prices dipping

These developments underscore the complex interplay of factors influencing the Australian stock market, from global economic trends to sector-specific challenges. As we navigate through this volatile period, it’s essential to understand the nuances of each sector’s performance and the broader implications for investors.

Sector-by-Sector Analysis: Winners and Losers in the Current Market

To provide a clearer picture of the market’s performance, let’s break down the key sectors and their recent trends:

| Sector | Daily Change (%) | 6-Month Trend |

|---|---|---|

| Technology | -3.5% | Declining |

| Gold | -2.8% | Volatile |

| Industrials | -1.7% | Declining |

| Resources | -1.2% | Mixed |

| Waste Management | +2.1% | Resilient |

| Property | +0.8% | Stable |

Technology Sector: The information technology sector has been hit particularly hard, with many stocks experiencing significant declines. This downturn can be attributed to various factors, including global supply chain disruptions, changing consumer behaviors, and concerns over tech valuations.

Gold and Mining: Despite gold’s traditional role as a safe-haven asset, the ASX All Ordinaries Gold index has seen substantial losses. This paradoxical performance highlights the complex dynamics at play in the commodities market, where factors such as interest rates and currency fluctuations can impact gold prices.

Industrials: The industrial sector’s decline reflects broader economic concerns, including supply chain issues, labor shortages, and inflationary pressures. Companies in this sector are grappling with increased operational costs and uncertain demand forecasts.

Resources: While the resources sector has shown mixed results, it remains a critical component of the Australian economy. Fluctuations in global commodity prices, particularly for key exports like iron ore and coal, continue to influence this sector’s performance.

Waste Management: Interestingly, the waste management sector has shown resilience amidst the broader market downturn. Companies like Cleanaway Waste Management Ltd (ASX:CWY) have seen gains, highlighting the essential nature of these services and their potential as defensive stocks during uncertain times.

Property: The property sector has demonstrated relative stability, with some stocks showing modest gains. This performance may reflect ongoing demand in the real estate market and the sector’s potential as an inflation hedge.

Commodity Markets: A Mixed Bag of Performance

Commodities trading in Australia has presented a complex picture, with various resources showing divergent trends. Understanding these movements is crucial for investors looking to navigate the volatile commodities landscape.

Gold Futures: Despite the broader market downturn, gold futures for April delivery saw a slight increase of 0.09%, reaching $2,901.89 per troy ounce. This modest gain in gold futures price underscores gold’s enduring appeal as a store of value during uncertain times.

Crude Oil: The energy sector faced headwinds, with crude oil prices dipping. The crude oil barrel price for April delivery fell by 0.11% to $65.96 a barrel. Similarly, the May Brent oil contract experienced a marginal decline of 0.01%, trading at $69.27 a barrel. These movements reflect ongoing concerns about global energy demand and supply dynamics.

Nickel: The nickel market saw significant volatility, with Nickel Mines Ltd (ASX:NIC) experiencing a substantial drop of 18.21%. This decline highlights the challenges facing the metals and mining sector, including fluctuating global demand and regulatory pressures.

For investors considering investing in Australian equities with exposure to commodities, it’s essential to closely monitor these trends and understand the factors driving price movements in each resource category.

Volatility and Market Sentiment: Understanding the ASX 200 Volatility Index

The ASX 200 Volatility Index serves as a crucial barometer of market sentiment and investor anxiety. On Tuesday, this index reached a 6-month high, signaling increased uncertainty and risk perception among market participants.

Key points to consider regarding market volatility:

- The ASX 200 VIX rose by 6.59% to 15.26, marking a new 6-month peak

- Elevated volatility levels often correlate with increased market uncertainty and potential selling pressure

- Investors may need to reassess their risk management strategies in light of heightened volatility

Understanding and interpreting the ASX 200 Volatility Index can provide valuable insights for investors looking to navigate these turbulent market conditions. It’s important to note that while high volatility can present risks, it can also create opportunities for well-informed and strategic investors.

“Australian tech, gold, and industrial sectors led losses, while some waste management and property stocks showed resilience.”

Spotlight on Key Stocks: Gainers and Losers

Amidst the broader market decline, certain stocks stood out for their performance, both positive and negative. Let’s examine some of the notable movers:

Top Gainers

- Resmed Inc DRC (ASX:RMD): Rose 3.11% to close at 37.58

- Cleanaway Waste Management Ltd (ASX:CWY): Added 2.17% to end at 2.60

- Domain Holdings Australia Ltd (ASX:DHG): Up 2.04% to 4.50, reaching a 3-year high

Biggest Losers

- Nickel Mines Ltd (ASX:NIC): Fell 18.21% to 0.62, hitting a 52-week low

- Ramelius Resources Ltd (ASX:RMS): Declined 16.85% to close at 2.32

- Pro Medicus Ltd (ASX:PME): Down 10.58% to 228.86

These stock movements highlight the diverse range of factors influencing individual company performances, from sector-specific challenges to company-level developments.

Technology Sector Deep Dive: Challenges and Opportunities

The technology sector has been particularly volatile, with technology sector stocks in Australia facing significant headwinds. Several factors contribute to this sector’s current challenges:

- Global supply chain disruptions affecting hardware production and distribution

- Concerns over tech stock valuations and potential market corrections

- Increasing regulatory scrutiny on tech companies both domestically and internationally

- Shifting consumer behaviors and demand patterns in the post-pandemic landscape

Despite these challenges, the technology sector remains a crucial driver of innovation and economic growth. Investors looking at tech stocks should consider both the short-term volatility and the long-term potential of companies in this space.

Mining and Resources: Navigating Commodity Price Fluctuations

Australian mining stocks have experienced mixed fortunes, reflecting the complex dynamics of global commodity markets. Key considerations for this sector include:

- Fluctuations in iron ore prices, a critical export for Australia

- The impact of global economic recovery on demand for industrial metals

- Environmental regulations and the shift towards sustainable mining practices

- Geopolitical factors affecting international trade and commodity flows

Investors in the mining and resources sector should closely monitor global economic indicators, commodity price trends, and company-specific factors when making investment decisions.

Resilient Sectors: Waste Management and Property

While many sectors faced losses, waste management investments and certain property stocks showed resilience. This performance highlights the defensive nature of these sectors and their potential appeal during uncertain market conditions.

Waste Management: Companies in this sector, such as Cleanaway Waste Management Ltd, have demonstrated stability and even growth. Factors contributing to this sector’s resilience include:

- Essential nature of waste management services

- Increasing focus on environmental sustainability and waste reduction

- Potential for technological innovation in waste processing and recycling

Property: Some property stocks have shown resilience, potentially driven by:

- Ongoing demand in the real estate market

- Property’s role as a potential hedge against inflation

- Diversification benefits for investors seeking to balance their portfolios

Investment Strategies in Volatile Markets

Given the current market volatility, investors may need to adjust their strategies. Here are some approaches to consider:

- Diversification: Spread investments across various sectors and asset classes to mitigate risk

- Dollar-Cost Averaging: Invest consistently over time to average out market fluctuations

- Focus on Fundamentals: Prioritize companies with strong balance sheets and sustainable business models

- Stay Informed: Keep abreast of market news, economic indicators, and company-specific developments

- Consider Defensive Sectors: Explore investments in sectors that have shown resilience, such as waste management

It’s important to align investment strategies with individual risk tolerance and financial goals. Consulting with a financial advisor can provide personalized guidance in navigating these challenging market conditions.

The Role of Technology in Modern Investing

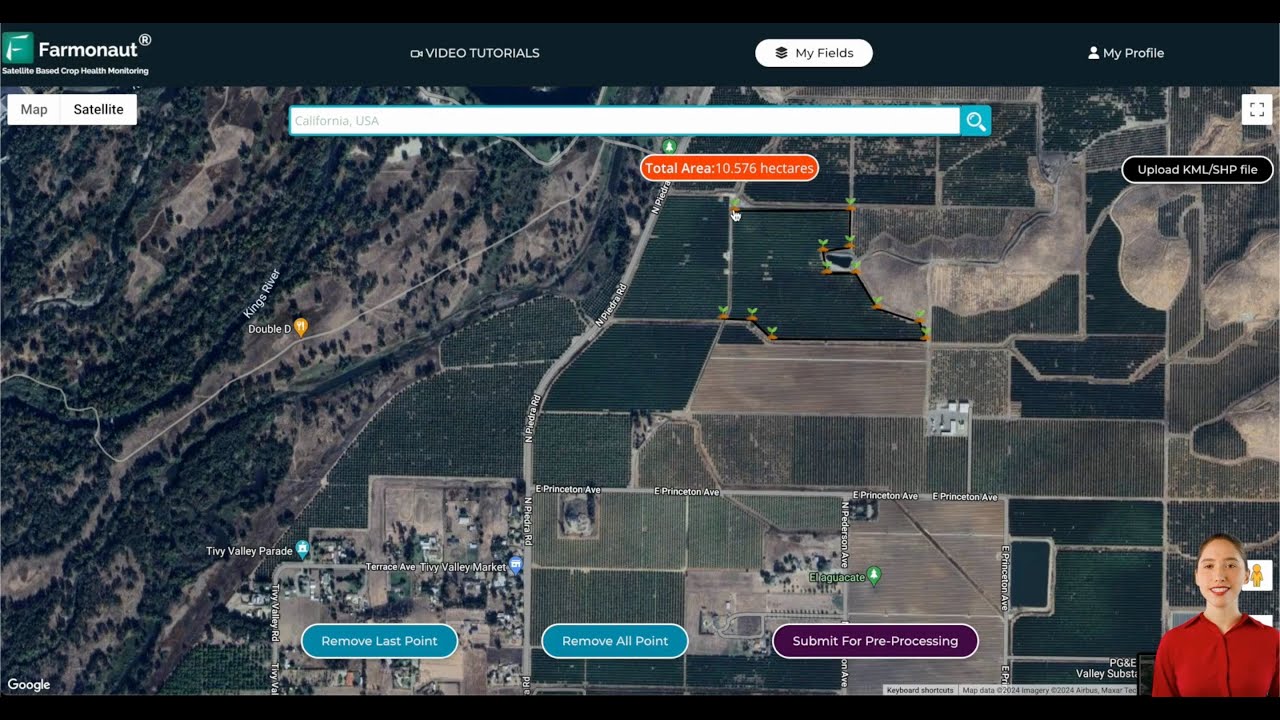

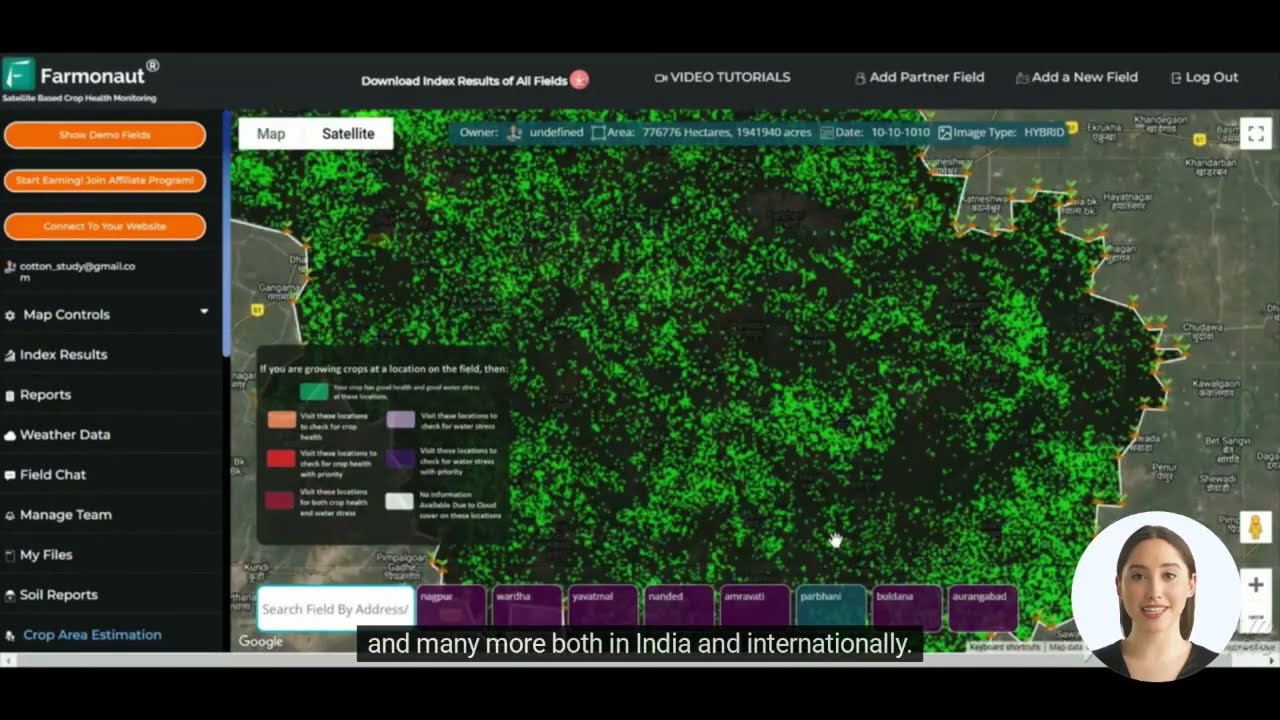

In today’s digital age, technology plays a crucial role in investment decision-making and portfolio management. Platforms like Farmonaut, while primarily focused on agricultural technology, demonstrate the growing importance of data-driven insights across various sectors.

For investors interested in leveraging technology for market analysis and decision support, consider exploring tools that offer:

- Real-time market data and analytics

- Advanced charting and technical analysis capabilities

- AI-driven market sentiment analysis

- Portfolio tracking and optimization tools

While Farmonaut specializes in agricultural solutions, its use of satellite imagery and AI exemplifies the kind of innovative approaches that are increasingly valuable across various industries, including finance and investment.

Global Economic Factors Influencing the Australian Market

The performance of the Australian stock market is intricately linked to global economic trends. Key factors currently influencing market dynamics include:

- Global inflation concerns and central bank policies

- Ongoing supply chain disruptions and their impact on various industries

- Geopolitical tensions and their effects on international trade

- The pace of global economic recovery post-pandemic

- Shifts in energy markets and the transition towards renewable sources

Investors should consider these global factors alongside domestic trends when analyzing the Australian market and making investment decisions.

Looking Ahead: Market Outlook and Potential Catalysts

As we look to the future of the Australian stock market, several potential catalysts could influence its direction:

- Monetary policy decisions by the Reserve Bank of Australia

- Government fiscal policies and economic stimulus measures

- Developments in key export markets, particularly China

- Progress in global vaccination efforts and pandemic recovery

- Technological innovations and their impact on traditional industries

While short-term volatility may persist, the Australian market’s long-term prospects remain tied to the country’s economic fundamentals, global trade relationships, and ability to adapt to changing market conditions.

Conclusion: Navigating Uncertain Waters

The recent tumble in the Australian stock market, led by losses in the tech, gold, and industrial sectors, underscores the complex and volatile nature of today’s financial landscape. As commodities remain volatile and global economic factors continue to exert influence, investors must stay vigilant and adaptable.

Key takeaways from our analysis include:

- The importance of sector diversification to mitigate risks

- The potential of defensive sectors like waste management during market downturns

- The need for ongoing monitoring of global economic trends and their impact on the Australian market

- The value of leveraging technology and data-driven insights in investment decision-making

As we navigate these uncertain waters, staying informed, maintaining a long-term perspective, and adapting strategies to changing market conditions will be crucial for investors seeking to thrive in the Australian equities market.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Frequently Asked Questions (FAQ)

- What caused the recent tumble in the Australian stock market?

The market decline was driven by various factors, including global economic concerns, sector-specific challenges, and increased market volatility. - Which sectors were most affected by the market downturn?

The technology, gold, and industrial sectors experienced significant losses, while some waste management and property stocks showed resilience. - How does the ASX 200 Volatility Index impact investment decisions?

The ASX 200 VIX provides insights into market sentiment and risk perception, helping investors adjust their strategies during periods of increased volatility. - What strategies can investors consider in the current market environment?

Diversification, dollar-cost averaging, focusing on fundamentals, and staying informed are key strategies for navigating volatile markets. - How are global economic factors influencing the Australian market?

Factors such as inflation concerns, supply chain disruptions, geopolitical tensions, and the pace of global economic recovery are significantly impacting the Australian market.