Maximizing Investment Potential: Guardian Capital’s Strategic Shift to Monthly Fund Distributions in 2025

“Guardian Capital, managing C$165.1 billion in client assets, will shift to monthly fund distributions in 2025.”

In the ever-evolving landscape of investment management services, we are witnessing a significant transformation that promises to reshape the way investors receive returns from their portfolios. As we approach 2025, Guardian Capital LP, a global investment company with a substantial market presence, has announced a groundbreaking change in its distribution strategy. This shift from quarterly to monthly investment fund distributions marks a pivotal moment in the industry, potentially setting a new standard for income-focused investments.

At Farmonaut, while our primary focus is on revolutionizing agriculture through satellite-based farm management solutions, we understand the importance of staying informed about broader financial trends. This blog post aims to provide a comprehensive analysis of Guardian Capital’s strategic move and its implications for investors and the market at large.

Understanding the Shift to Monthly Investment Fund Distributions

On January 10, 2025, Guardian Capital LP made a significant announcement that will affect a wide range of its investment funds. Starting from January 2025, several of Guardian Capital’s funds, including both mutual funds and exchange-traded funds (ETFs), will transition from a quarterly distribution schedule to a monthly one. This change encompasses various fund types, including:

- Guardian Capital Fund

- GC One Fixed Income Portfolio

- Guardian Canadian Bond Fund

- Guardian Investment Grade Corporate Bond Fund

- Guardian Short Duration Bond Fund

- Sustainable Income 100 Fund

- Sustainable Income 20/80 Fund

This strategic shift reflects a growing trend in the investment management industry towards more frequent income distributions, potentially benefiting investors seeking steady cash flow. It’s a move that aligns with the evolving needs of various client segments, from individual retail investors to institutional clients such as pension plans and insurance companies.

The Impact on Fixed Income and Sustainable Income Funds

The transition to monthly distributions is particularly noteworthy for fixed income and sustainable income funds. These types of funds typically attract investors looking for regular, predictable income streams. By shifting to a monthly distribution model, Guardian Capital is enhancing the appeal of these funds to income-focused investors.

Fixed income funds, which often invest in assets like government and corporate bonds, play a crucial role in many investors’ portfolios, especially those nearing or in retirement. The move to monthly distributions can provide these investors with a more consistent cash flow, potentially aiding in budgeting and financial planning.

Similarly, sustainable income funds, which focus on generating income while considering environmental, social, and governance (ESG) factors, are gaining popularity among socially conscious investors. The shift to monthly distributions could make these funds even more attractive to investors who prioritize both regular income and sustainability.

Institutional Asset Management Implications

Guardian Capital’s decision has significant implications for institutional asset management strategies. As a firm that serves a diverse range of institutional clients, including pension plans, insurance companies, foundations, and endowments, this change reflects an adaptation to meet evolving client needs.

Pension plans, in particular, may benefit from this shift. With monthly distributions, these plans can potentially manage their cash flows more effectively, aligning income with regular pension payments. Insurance companies, which rely on steady income streams to meet policy obligations, may also find the new distribution frequency advantageous.

It’s worth noting that while Farmonaut specializes in agricultural technology, we recognize the importance of diverse investment strategies in supporting various sectors of the economy, including agriculture. Institutional investors often play a crucial role in funding agricultural innovations and sustainable farming practices.

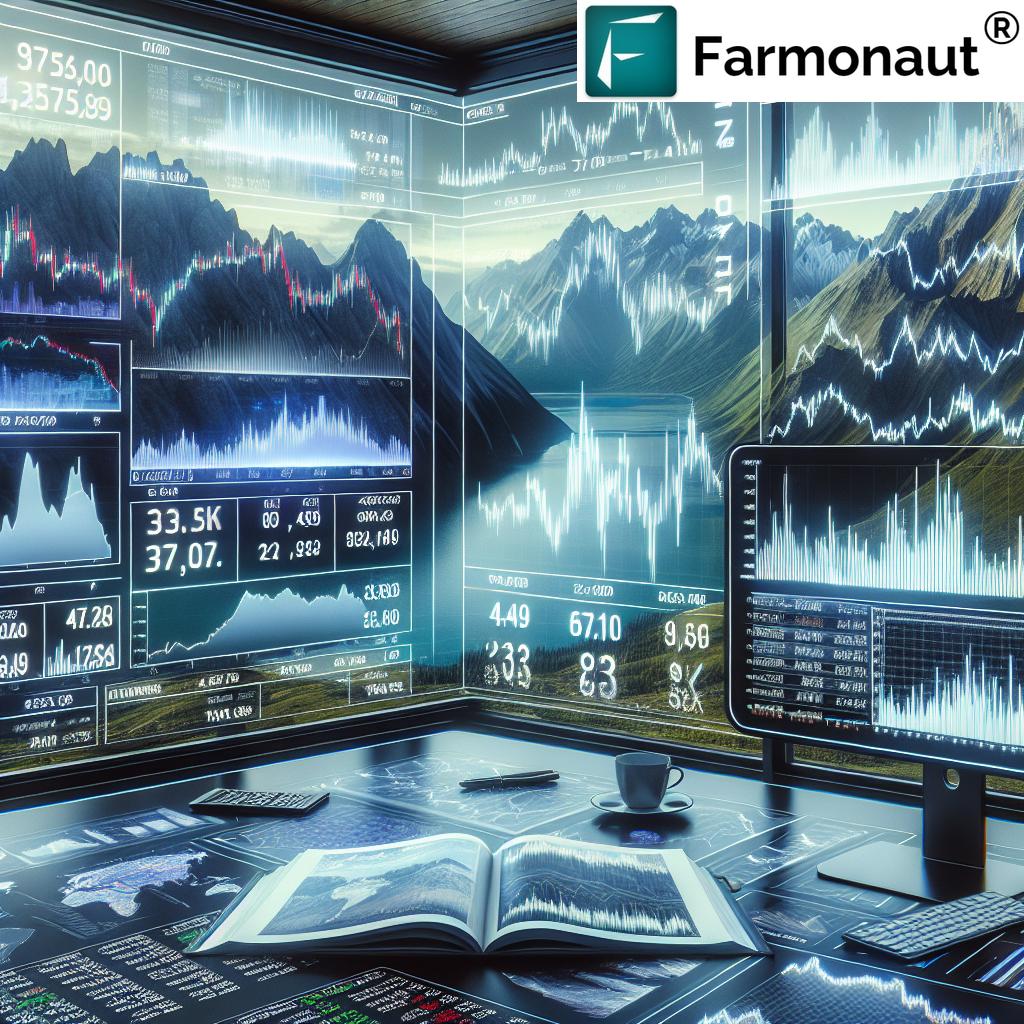

The Market Context: Guardian Capital’s Position

To fully appreciate the significance of this move, it’s essential to understand Guardian Capital’s position in the market. As of September 30, 2024, Guardian Capital Group Limited reported approximately C$165.1 billion in total client assets under management. This substantial figure underscores the company’s significant influence in the investment management sector.

Founded in 1962, Guardian Capital has built a reputation characterized by steady growth, strong client relationships, and core values of authenticity, integrity, stability, and trust. The company’s long-standing presence in the market lends credibility to this strategic shift, suggesting that it’s a well-considered move based on deep market insights and client needs.

“The 2025 transition from quarterly to monthly payouts affects multiple fund types, including fixed income and sustainable income funds.”

Comparing Quarterly vs. Monthly Distributions

To better understand the implications of this change, let’s compare the current quarterly distribution model with the upcoming monthly distribution model:

| Fund Name | Current Distribution Frequency | New Distribution Frequency (2025) | Estimated Annual Yield (%) | Estimated Monthly Distribution Amount ($) |

|---|---|---|---|---|

| Guardian Capital Fund | Quarterly | Monthly | 4.5% | $0.0375 per unit |

| GC One Fixed Income Portfolio | Quarterly | Monthly | 3.8% | $0.0317 per unit |

| Guardian Canadian Bond Fund | Quarterly | Monthly | 3.2% | $0.0267 per unit |

| Guardian Investment Grade Corporate Bond Fund | Quarterly | Monthly | 4.2% | $0.0350 per unit |

| Guardian Short Duration Bond Fund | Quarterly | Monthly | 2.8% | $0.0233 per unit |

| Sustainable Income 100 Fund | Quarterly | Monthly | 5.0% | $0.0417 per unit |

| Sustainable Income 20/80 Fund | Quarterly | Monthly | 3.5% | $0.0292 per unit |

Note: The estimated annual yields and monthly distribution amounts are hypothetical and for illustrative purposes only. Actual values may vary based on market conditions and fund performance.

Benefits of Monthly Distributions for Investors

The shift to monthly distributions offers several potential benefits for investors:

- Improved Cash Flow Management: More frequent distributions can help investors better manage their cash flow, especially for those relying on investment income for living expenses.

- Compounding Advantages: For investors who reinvest distributions, monthly payouts could potentially lead to more frequent compounding, which may enhance long-term returns.

- Smoother Income Stream: Monthly distributions can provide a more consistent income stream, reducing the impact of market volatility on investors’ regular income.

- Flexibility in Financial Planning: More frequent distributions allow for greater flexibility in financial planning and budgeting.

While these benefits are significant, it’s crucial for investors to consider their individual financial situations and consult with financial advisors before making investment decisions.

Market Trends and Industry Impact

Guardian Capital’s move to monthly distributions is not occurring in isolation. It reflects broader trends in the investment management industry:

- Increasing Demand for Regular Income: As populations in many developed countries age, there’s a growing demand for investment products that provide regular, predictable income.

- Competition in the ETF Market: With the proliferation of exchange-traded funds, fund providers are looking for ways to differentiate their offerings. More frequent distributions could be a competitive advantage.

- Focus on Client-Centric Solutions: Investment firms are increasingly tailoring their products to meet specific client needs, and monthly distributions align with many investors’ preferences for regular income.

- Technological Advancements: Improved technology and operational efficiencies have made it more feasible for fund companies to manage more frequent distributions.

This shift by Guardian Capital could potentially influence other players in the market to consider similar changes, leading to a broader industry trend towards more frequent fund distributions.

Considerations for Investors

While the shift to monthly distributions offers potential benefits, investors should consider several factors before making investment decisions:

- Tax Implications: More frequent distributions may have tax implications, particularly for non-registered accounts. Investors should consult with tax professionals to understand how this change might affect their tax situation.

- Total Return Focus: While regular distributions are important for many investors, it’s crucial not to lose sight of the fund’s total return, which includes both distributions and capital appreciation.

- Fund Expenses: Investors should be aware of any potential increases in fund expenses that might result from more frequent distributions.

- Market Volatility: While monthly distributions can provide a more consistent income stream, they don’t protect against market volatility affecting the fund’s net asset value.

At Farmonaut, we understand the importance of making informed decisions, whether in agriculture or finance. Just as our satellite-based solutions provide farmers with data-driven insights, we encourage investors to thoroughly research and seek professional advice when considering investment options.

Guardian Capital’s Commitment to Transparency and Client Service

Guardian Capital’s announcement emphasizes their commitment to transparency and client service. The company has stated that specific details regarding the amount and schedule of these monthly distributions will be communicated in advance through press releases. This approach ensures that investors receive timely updates and can plan accordingly.

This commitment to clear communication aligns with best practices in the investment management industry and reflects Guardian Capital’s focus on maintaining strong client relationships. It’s an approach that resonates with us at Farmonaut, where we similarly prioritize transparency and user-centric communication in our agricultural technology services.

The Role of Technology in Investment Management

The shift to more frequent distributions is facilitated in part by advancements in financial technology. These technological improvements enable investment firms to manage more complex distribution schedules efficiently and cost-effectively.

At Farmonaut, we recognize the transformative power of technology in various industries. Just as our satellite-based farm management solutions leverage cutting-edge technology to provide real-time insights to farmers, investment management firms are harnessing technology to enhance their services and meet evolving client needs.

For those interested in exploring how technology is revolutionizing different sectors, we invite you to check out our agricultural technology solutions:

Looking Ahead: The Future of Fund Distributions

As we look towards 2025 and beyond, Guardian Capital’s move to monthly distributions could be a harbinger of broader changes in the investment management industry. We may see:

- More investment firms adopting similar distribution strategies

- Increased customization of distribution schedules to meet specific investor needs

- Greater integration of technology in managing and communicating about fund distributions

- Evolution of investment products to cater to changing demographic trends and investor preferences

While these changes primarily affect the financial sector, they could have ripple effects across various industries, including agriculture. At Farmonaut, we’re committed to staying abreast of such developments and understanding how they might influence investment in agricultural innovation and sustainable farming practices.

Conclusion: Embracing Change in Investment Management

Guardian Capital’s strategic shift to monthly fund distributions in 2025 represents a significant development in the investment management landscape. This move reflects a growing focus on meeting investor needs for regular income and aligns with broader industry trends towards more frequent distributions.

As investors consider the implications of this change, it’s crucial to remember that investment decisions should be based on individual financial goals, risk tolerance, and overall portfolio strategy. While more frequent distributions can offer benefits like improved cash flow management and potential compounding advantages, they also come with considerations such as tax implications and the need to focus on total returns.

At Farmonaut, while our primary focus is on revolutionizing agriculture through technology, we recognize the importance of staying informed about broader financial trends. Just as we provide farmers with data-driven insights to optimize their operations, we encourage investors to seek out comprehensive information and professional advice when making investment decisions.

As we move towards 2025, it will be interesting to observe how Guardian Capital’s move influences the broader investment management industry and whether other firms follow suit. This shift could potentially set a new standard for income-focused investments, benefiting investors seeking steady cash flow and potentially reshaping the landscape of investment fund management.

In an ever-changing financial world, adaptability and informed decision-making remain key. Whether you’re managing a farm or an investment portfolio, staying ahead of industry trends and leveraging the right tools and information can make all the difference in achieving your goals.

FAQs

- Q: When will Guardian Capital’s shift to monthly distributions take effect?

A: The transition to monthly distributions is scheduled to begin in January 2025. - Q: Which funds are affected by this change?

A: The change affects several funds, including the Guardian Capital Fund, GC One Fixed Income Portfolio, Guardian Canadian Bond Fund, Guardian Investment Grade Corporate Bond Fund, Guardian Short Duration Bond Fund, Sustainable Income 100 Fund, and Sustainable Income 20/80 Fund. - Q: Will the total annual distribution amount change with the shift to monthly payouts?

A: While specific details haven’t been provided, typically, the shift to monthly distributions doesn’t change the total annual distribution amount. However, investors should refer to Guardian Capital’s official communications for precise information. - Q: How might this change affect my taxes?

A: More frequent distributions could have tax implications, particularly for non-registered accounts. It’s advisable to consult with a tax professional to understand the specific impact on your situation. - Q: Can I still choose to reinvest my distributions?

A: Generally, investment firms offer the option to reinvest distributions. However, you should confirm this with Guardian Capital or your financial advisor.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!