Unlocking Farm Value: How Value-Added Agriculture Impacts Property Taxes in Ontario

“Value-added agriculture can significantly impact property taxes, with some Ontario farms seeing up to 30% changes in assessments.”

Welcome to our comprehensive exploration of value-added agriculture and its impact on property taxes in Ontario. As we delve into this crucial topic, we’ll uncover how agricultural diversification strategies are reshaping the farming landscape and influencing farm business taxation. Our journey will take us through the intricacies of on-farm processing, farmland tax implications, and the evolving world of agricultural policy reform.

In the heart of North America, Ontario’s agricultural sector is experiencing a transformation. Farmers across the province are increasingly turning to value-added agriculture as a means to boost farm income and sustainability. However, this shift brings with it complex tax considerations that every farm owner must understand.

At Farmonaut, we’re committed to supporting farmers through technological innovation. Our satellite-based farm management solutions provide valuable insights that can help optimize farming operations while navigating the complexities of modern agriculture. As we explore the intersection of value-added agriculture and property taxes, we’ll also touch on how precision agriculture technology can play a role in this evolving landscape.

Understanding Value-Added Agriculture

Value-added agriculture refers to the process of increasing the economic value and consumer appeal of agricultural commodities. This can involve various activities, from processing raw farm products into consumer goods to offering agritourism experiences. Let’s break down some key aspects:

- On-farm processing: Converting crops or livestock into finished or partially finished products (e.g., turning milk into cheese)

- Direct marketing: Selling produce directly to consumers through farmers’ markets or farm stands

- Agritourism: Offering farm tours, corn mazes, or pick-your-own fruit experiences

- Specialty product development: Creating unique products like artisanal preserves or organic skincare items from farm-grown ingredients

These activities not only diversify farm income but also create new job opportunities and strengthen rural communities. However, they also introduce new considerations when it comes to property tax assessments.

The Intersection of Value-Added Agriculture and Property Taxes

In Ontario, as in many parts of Canada and the USA, property taxes for agricultural land are typically lower than those for commercial or industrial properties. This preferential tax treatment is designed to support the agricultural sector and preserve farmland. However, when farms engage in value-added activities, the lines between agricultural and commercial use can blur, potentially affecting property tax assessments.

Key factors that influence how value-added activities impact property taxes include:

- Scale of the operation: Small-scale processing might be considered part of normal farm operations, while larger facilities could be classified differently

- Nature of the activity: Activities closely tied to primary production (e.g., washing and packaging vegetables) are more likely to be considered agricultural than those further removed (e.g., operating a restaurant on the farm)

- Proportion of income: If value-added activities become the primary source of farm income, it may affect the property’s tax classification

- Use of farm-grown vs. imported inputs: Processing primarily farm-grown products is more likely to be considered agricultural than importing substantial amounts of raw materials

The Crucial Distinction: Value-Added vs. Dual Use

One of the most critical aspects of navigating property taxes in the context of value-added agriculture is understanding the distinction between value-added activities and dual use properties. This differentiation can significantly impact how a farm is assessed for tax purposes.

- Value-Added Activities: These are generally considered an extension of normal farming operations. They involve processing or enhancing farm-grown products to increase their value. Examples include making cheese from milk produced on the farm or creating jams from farm-grown fruit.

- Dual Use: This occurs when a portion of the property is used for non-agricultural purposes that are not directly related to the farm’s primary production. For instance, operating a large-scale brewery that primarily uses imported ingredients or running a full-service restaurant on the farm property.

The distinction is crucial because value-added activities are more likely to be included under the agricultural property tax rate, while dual-use portions of a property may be subject to commercial or industrial tax rates.

Implications for Farm Business Taxation

The impact of value-added agriculture on farm business taxation extends beyond property taxes. Here are some key considerations:

- Income Tax: Value-added activities can create new income streams, potentially affecting the farm’s overall tax liability.

- Sales Tax: Depending on the nature of the value-added products, farms may need to collect and remit sales tax.

- Capital Investments: Investments in processing equipment or facilities may be eligible for tax deductions or credits.

- Employment Taxes: As farms expand into value-added activities, they may hire additional staff, leading to new payroll tax obligations.

Navigating these tax implications requires careful planning and often the assistance of tax professionals familiar with agricultural businesses.

Agricultural Policy Reform and Value-Added Farming

Recognizing the importance of value-added agriculture in sustaining rural economies, policymakers in Ontario and across Canada are exploring reforms to support farmers engaged in these activities. Some key areas of focus include:

- Tax Incentives: Proposals for tax credits or deductions specifically for value-added agricultural investments.

- Zoning Flexibility: Efforts to update land-use regulations to accommodate on-farm processing and agritourism activities.

- Grant Programs: Initiatives to provide financial support for farmers looking to diversify into value-added products.

- Education and Training: Programs to help farmers develop the business skills needed to succeed in value-added agriculture.

These policy efforts aim to strike a balance between encouraging agricultural diversification and maintaining the integrity of farmland preservation goals.

The Role of Technology in Value-Added Agriculture

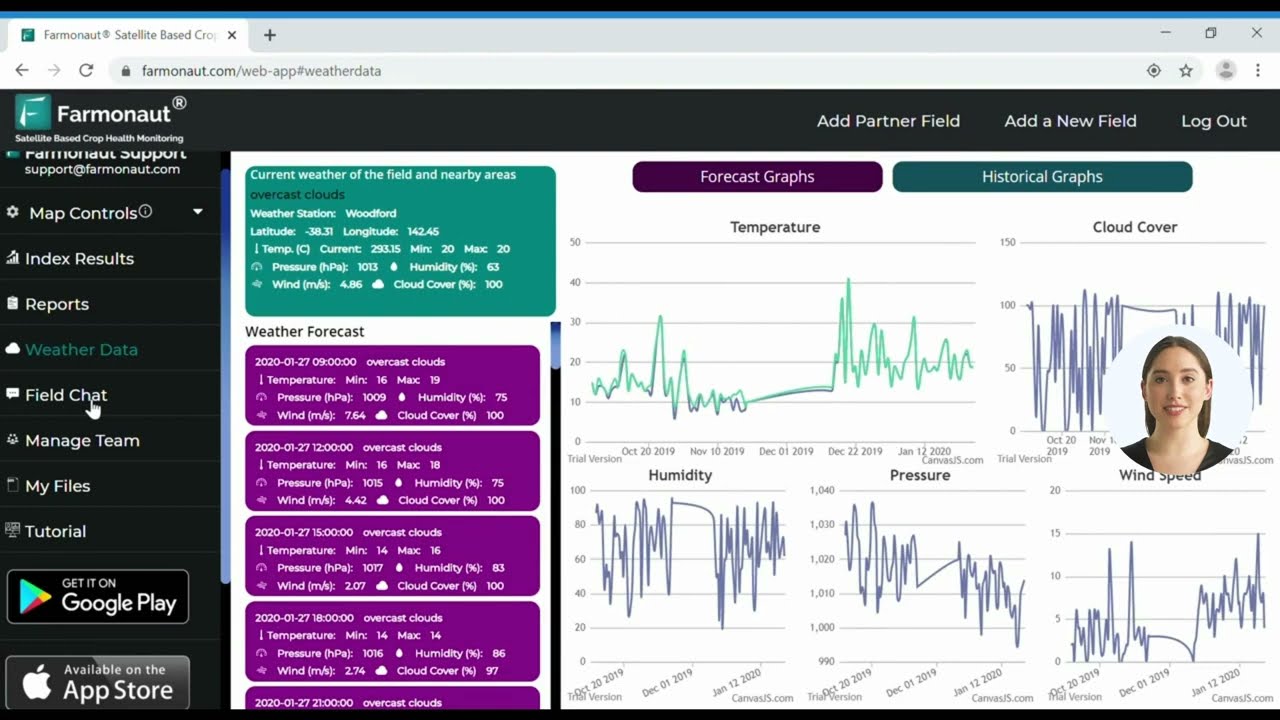

As farms diversify into value-added activities, technology plays an increasingly important role in managing both traditional farming operations and new ventures. At Farmonaut, we offer precision agriculture solutions that can help farmers optimize their operations:

- Satellite-Based Crop Monitoring: Our technology provides real-time insights into crop health, helping farmers make informed decisions about resource allocation.

- GIS and Remote Sensing: These tools aid in land use planning and farm management, crucial for farms balancing traditional and value-added activities.

- Data Analytics: By analyzing production data, farmers can identify opportunities for value-added products and optimize their operations.

Leveraging these technologies can help farmers maximize efficiency in their primary production, potentially freeing up resources for value-added ventures.

Case Studies: Value-Added Agriculture in Ontario

Let’s explore some hypothetical examples of how value-added agriculture might impact property taxes for Ontario farms:

- Apple Orchard to Cidery: A family-owned apple orchard decides to start producing hard cider. They convert an existing barn into a small production facility and tasting room. As the cider operation uses primarily on-farm apples and remains a relatively small part of the overall farm business, it’s likely to be considered a value-added activity and may not significantly impact the property tax assessment.

- Dairy Farm to Artisanal Cheese Production: A dairy farm invests in cheese-making equipment and begins producing artisanal cheeses. They build a small retail space on the farm for direct sales. This value-added activity closely relates to the farm’s primary production and uses on-farm inputs, so it’s likely to be considered part of the agricultural operation for tax purposes.

- Grain Farm to Craft Brewery: A grain farm decides to open a large craft brewery and restaurant on their property. While they use some of their own grain, they also import significant amounts of hops and other ingredients. The scale of the operation and its reliance on non-farm inputs might lead to this portion of the property being classified as commercial, potentially increasing the overall property tax assessment.

These examples illustrate the nuanced nature of how value-added activities can impact property taxes. Each situation is unique and requires careful consideration of various factors.

“Over 65% of Ontario farmers engage in some form of value-added activity, diversifying income streams and affecting tax structures.”

Navigating Property Tax Assessments for Value-Added Agriculture

For farmers considering or already engaged in value-added agriculture, here are some strategies for navigating property tax assessments:

- Document Agricultural Use: Keep detailed records of how value-added activities relate to your primary agricultural production.

- Understand Local Regulations: Familiarize yourself with local zoning laws and tax assessment criteria for agricultural properties.

- Consult Experts: Work with tax professionals and legal advisors who specialize in agricultural businesses.

- Engage with Assessors: Be proactive in communicating with tax assessors about the nature of your value-added activities.

- Consider Separate Structures: When possible, house value-added activities in separate structures to simplify tax assessments.

- Stay Informed: Keep up-to-date with changes in agricultural policy and tax regulations that may affect your operation.

By taking these steps, farmers can better position themselves to benefit from value-added agriculture while managing potential property tax implications.

Explore Farmonaut’s API for advanced agricultural data solutions

The Future of Value-Added Agriculture and Property Taxes

As we look to the future, several trends are likely to shape the intersection of value-added agriculture and property taxes:

- Increased Policy Support: We anticipate more targeted policies to support value-added agriculture, potentially including more nuanced tax structures for these activities.

- Technology Integration: Advanced technologies like blockchain for traceability and AI for production optimization will become more prevalent, potentially influencing how value-added activities are assessed.

- Sustainability Focus: Value-added activities that promote sustainable farming practices may receive preferential treatment in future tax policies.

- Consumer Demand: Growing consumer interest in local, artisanal products will likely drive further expansion of value-added agriculture, necessitating evolving tax frameworks.

As these trends unfold, it will be crucial for farmers, policymakers, and agricultural technology providers like Farmonaut to work together in creating a supportive environment for value-added agriculture.

Comparative Analysis: Value-Added Agriculture Impact on Property Taxes

| Value-Added Activity | Classification | Estimated Tax Impact | Potential Benefits to Farm Income | Considerations for Tax Assessment |

|---|---|---|---|---|

| On-farm dairy processing | On-farm processing | Low | High | Closely tied to primary production, likely to be considered agricultural |

| Farm-to-table restaurant | Agritourism | High | High | May be considered commercial, especially if using significant non-farm inputs |

| Corn maze and pumpkin patch | Agritourism | Low | Medium | Seasonal nature and use of farm products likely to keep it agricultural |

| Direct-to-consumer meat sales | On-farm processing | Low | Medium | If processing is small-scale, likely to be considered part of farm operations |

| Winery with tasting room | On-farm processing / Agritourism | Medium | High | Scale of operation and proportion of on-farm vs. imported inputs are key factors |

This table provides a snapshot of how different value-added activities might impact property taxes and farm income. It’s important to note that actual impacts can vary based on specific circumstances and local regulations.

Leveraging Technology for Value-Added Agriculture

As farms diversify into value-added activities, leveraging technology becomes increasingly important. Farmonaut’s precision agriculture solutions can play a crucial role in optimizing both traditional farming operations and new value-added ventures:

- Crop Monitoring: Our satellite-based technology provides real-time insights into crop health, helping farmers make informed decisions about resource allocation. This can be particularly valuable when balancing resources between primary production and value-added activities.

- Yield Prediction: Accurate yield predictions can help farmers plan their value-added production, ensuring they have the right amount of raw materials for processing.

- Resource Management: Our tools can help optimize irrigation and fertilizer use, potentially reducing costs and improving sustainability – factors that can be highlighted in marketing value-added products.

- Data-Driven Decision Making: By analyzing production data, farmers can identify opportunities for new value-added products and optimize their operations.

By integrating these technological solutions, farmers can enhance their efficiency in primary production, potentially freeing up resources for value-added ventures while also gathering valuable data to inform their diversification strategies.

Sustainable Practices and Value-Added Agriculture

Sustainability is becoming increasingly important in agriculture, and it can play a significant role in value-added activities. Here’s how sustainable practices can intersect with value-added agriculture and property taxes:

- Eco-Friendly Processing: Implementing sustainable processing methods for value-added products can potentially qualify for green energy tax credits or incentives.

- Organic Certification: Transitioning to organic production for value-added goods may impact property assessments and could qualify for certain tax benefits.

- Waste Reduction: Utilizing farm waste for value-added products (e.g., turning corn husks into packaging materials) can demonstrate efficient use of resources in tax assessments.

- Carbon Footprint Reduction: Implementing practices that reduce the farm’s carbon footprint can be a selling point for value-added products and may be viewed favorably in future tax policies.

Farmonaut’s technology can assist in monitoring and documenting these sustainable practices, providing valuable data for both marketing purposes and potential tax considerations.

The Role of GIS and Remote Sensing in Value-Added Agriculture

Geographic Information Systems (GIS) and remote sensing technologies play a crucial role in modern agriculture, including value-added operations. Here’s how these technologies can impact farm management and, indirectly, property tax considerations:

- Land Use Planning: GIS can help farmers optimize their land use, balancing areas for primary production and value-added activities. This efficient use of land can be important in property tax assessments.

- Crop Monitoring: Remote sensing provides detailed information on crop health and yield potential, which is crucial for planning value-added production.

- Resource Allocation: These technologies help in efficient allocation of water, fertilizers, and pesticides, potentially reducing costs and environmental impact – factors that could be relevant in future tax policies.

- Documentation: GIS and remote sensing data can provide detailed documentation of land use and farming practices, which can be valuable in discussions with tax assessors.

Farmonaut’s platform integrates these technologies, providing farmers with powerful tools for optimizing their operations across both traditional and value-added activities.

Market Trends and Value-Added Agriculture

Understanding market trends is crucial for farmers considering value-added activities. Here are some current trends that could influence decisions about value-added agriculture and, consequently, property tax implications:

- Local Food Movement: Growing consumer interest in locally sourced food presents opportunities for value-added products with strong local identity.

- Health and Wellness: Increasing demand for healthy, minimally processed foods could drive development of certain value-added products.

- Sustainability: Consumers are increasingly interested in sustainably produced goods, which could influence the types of value-added activities farms pursue.

- E-commerce: The growth of online sales channels opens new possibilities for direct-to-consumer sales of value-added products.

- Agritourism: There’s growing interest in farm experiences, which could lead to development of on-farm attractions or educational programs.

These trends can influence the types of value-added activities farms choose to pursue, which in turn can impact how these activities are viewed from a property tax perspective.

Conclusion: Navigating the Future of Value-Added Agriculture

As we’ve explored throughout this blog, value-added agriculture presents both opportunities and challenges for Ontario farmers. While it offers potential for increased farm income and rural economic development, it also introduces complexities in terms of property tax assessments and overall farm business taxation.

Key takeaways include:

- The importance of understanding the distinction between value-added activities and dual use properties

- The need for careful planning and documentation when engaging in value-added agriculture

- The potential role of technology, including precision agriculture solutions like those offered by Farmonaut, in optimizing both traditional and value-added farm operations

- The evolving nature of agricultural policy and the potential for future reforms to better support value-added farming

As the agricultural landscape continues to evolve, farmers who stay informed, leverage technology, and adapt to changing market demands will be best positioned to thrive in the world of value-added agriculture. By carefully navigating the tax implications and utilizing available resources, Ontario farmers can unlock new value from their land while contributing to the vitality of rural communities.

FAQ Section

Q: What is considered value-added agriculture?

A: Value-added agriculture refers to activities that increase the consumer value of agricultural products. This can include processing raw farm products into consumer goods, direct marketing to consumers, agritourism activities, or creating unique farm-based experiences.

Q: How might value-added activities affect my farm’s property taxes?

A: The impact on property taxes can vary depending on the nature and scale of the value-added activity. Activities closely tied to primary production are more likely to be considered part of the agricultural operation, while larger-scale processing or commercial activities might be assessed differently for tax purposes.

Q: Are there any tax incentives for engaging in value-added agriculture in Ontario?

A: While specific incentives can change, there are often programs at the provincial and federal levels to support agricultural diversification. These might include grants, tax credits, or preferential loan terms for value-added initiatives. It’s best to consult with agricultural agencies or tax professionals for the most current information.

Q: How can technology help me manage value-added agricultural activities?

A: Technologies like Farmonaut’s precision agriculture solutions can help optimize resource use, monitor crop health, and provide data-driven insights. This can improve efficiency in primary production, potentially freeing up resources for value-added ventures, and provide valuable data for planning and decision-making.

Q: What should I consider before starting a value-added agricultural activity?

A: Key considerations include market demand, required investments, regulatory requirements, potential tax implications, and how the activity fits with your existing farm operations. It’s advisable to create a business plan and consult with agricultural business experts before making significant changes.