Precision Agriculture Technology: Analyzing Agritech Investment Strategies for Smart Farming Solutions

“Precision agriculture technology has led to a 15% increase in crop yields for early adopters over the past 5 years.”

In the rapidly evolving landscape of modern agriculture, precision agriculture technology and agricultural stock analysis have become pivotal elements in shaping the future of farming. As we delve into the world of agritech investment strategies and smart farming techniques, we’ll explore how these innovations are revolutionizing the industry and providing new opportunities for investors and farmers alike.

The Rise of Precision Agriculture Technology

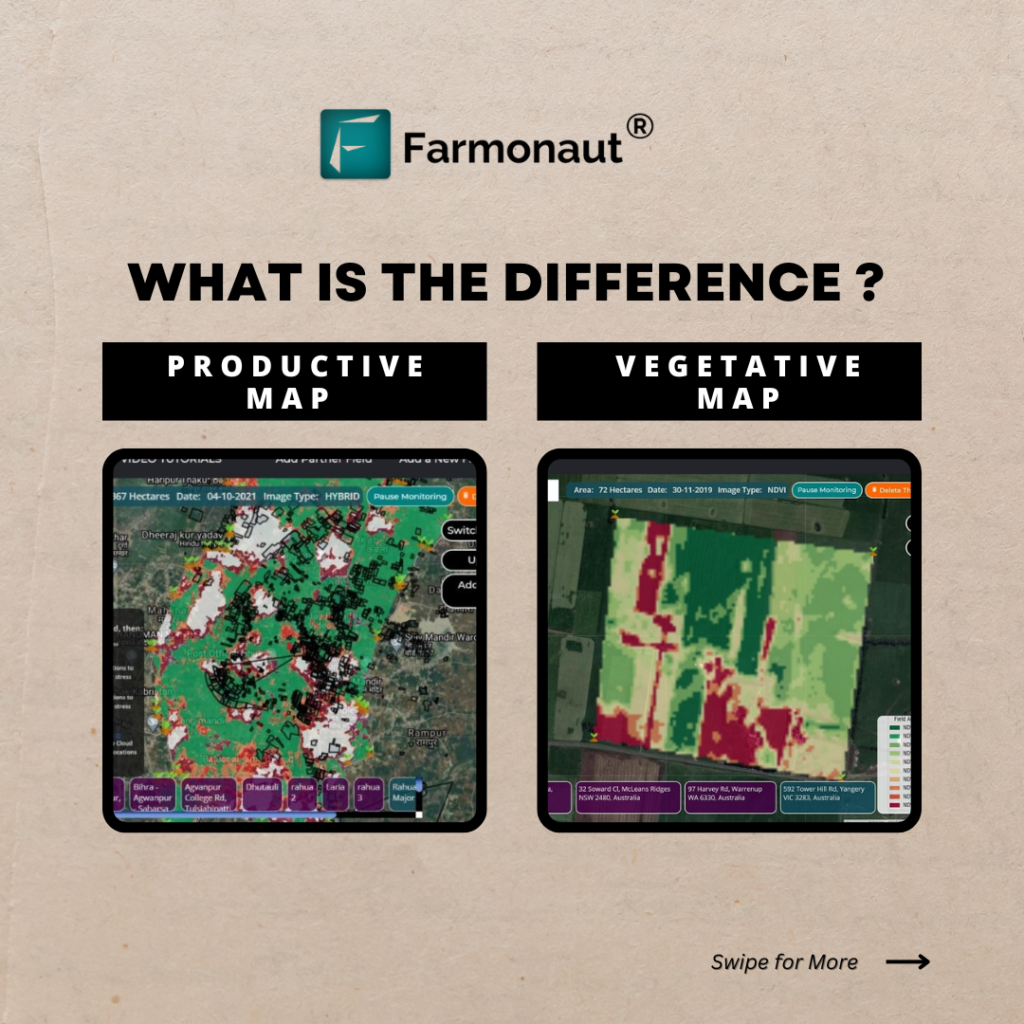

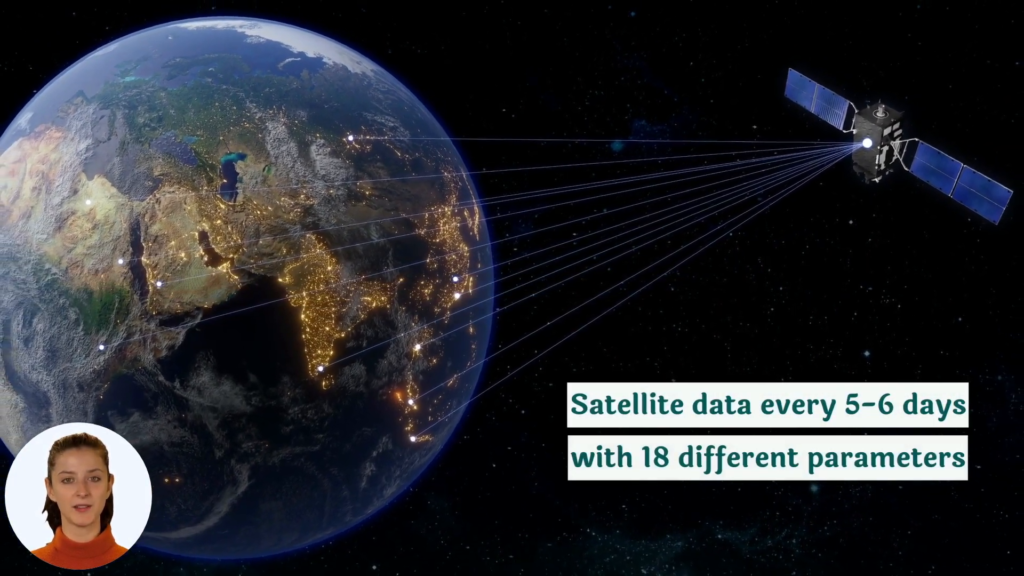

Precision agriculture technology has emerged as a game-changer in the farming industry. By leveraging advanced tools such as satellite crop monitoring, IoT sensors, and data analytics, farmers can now make more informed decisions about their crops and resources. This shift towards data-driven farming has not only improved crop yields but has also contributed to more sustainable farming practices.

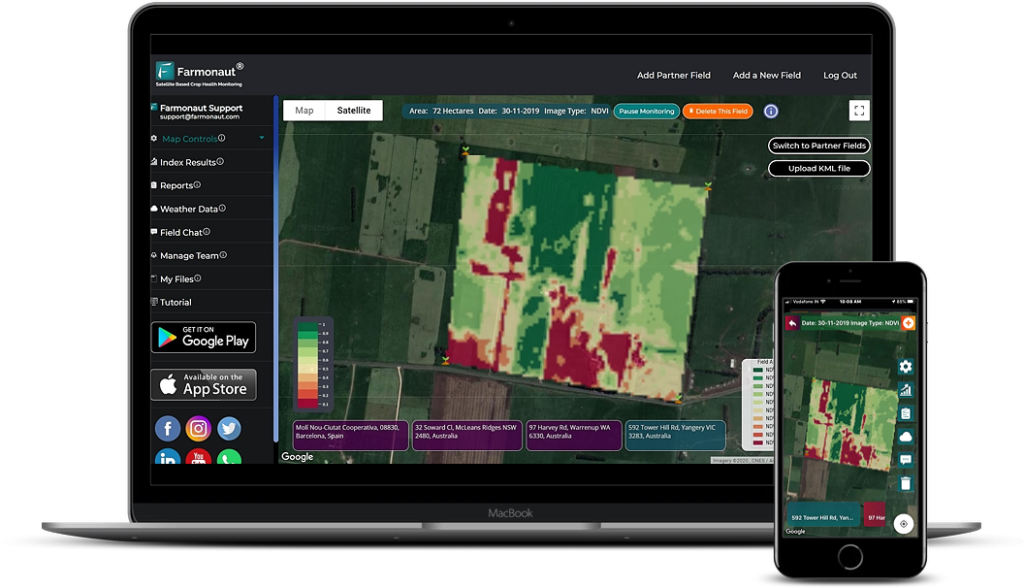

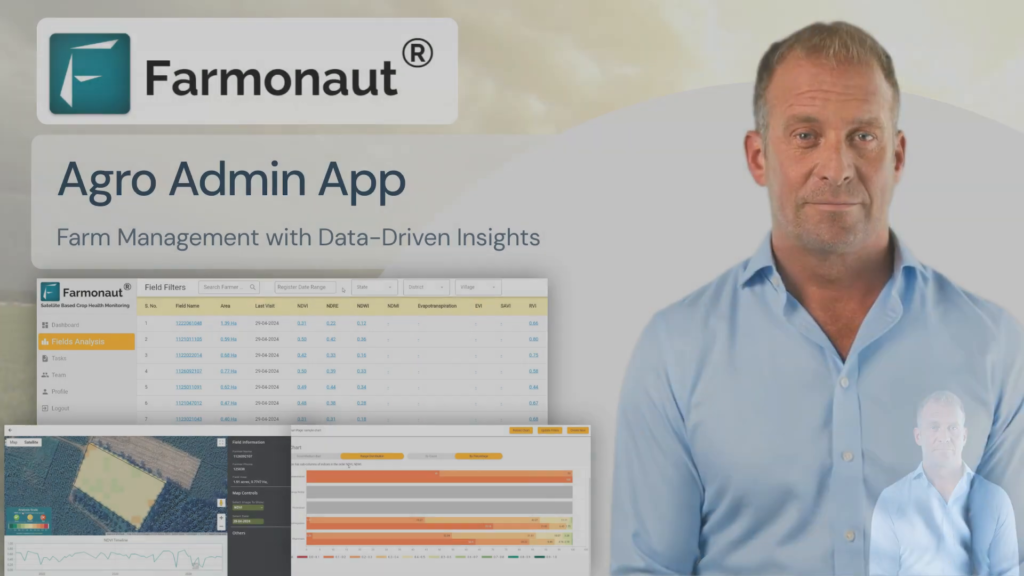

At the forefront of this agricultural revolution is Farmonaut, a company that offers cutting-edge satellite-based farm management solutions. Through their innovative platform, farmers can access real-time crop health monitoring, AI-based advisory systems, and resource management tools. This technology empowers farmers to optimize their operations and maximize their yields while minimizing environmental impact.

Agricultural Stock Analysis: A New Frontier for Investors

As the agritech sector continues to grow, investors are increasingly turning their attention to agricultural technology stocks. The potential for high returns in this innovative field has sparked a surge in agritech investment strategies. Let’s take a closer look at some key players in the market and their recent performance.

Harrow, Inc. (NASDAQ:HROW): A Case Study in Agritech Investment

Harrow, Inc., a company primarily focused on the ophthalmics sector, has recently caught the attention of investors and analysts alike. Despite a recent 2.5% decline in share price, the company has seen significant interest from institutional investors and hedge funds. Let’s break down some key financial metrics and recent developments:

- Market Capitalization: $1.20 billion

- P/E Ratio: -35.70

- Beta: 0.69

- Quick Ratio: 1.44

- Current Ratio: 1.55

- Debt-to-Equity Ratio: 3.23

Recent analyst reports have provided mixed insights on Harrow’s stock. While some firms like Craig Hallum and Lake Street Capital have raised their price targets, others like B. Riley have revised their targets downwards. This highlights the complexity and volatility often associated with agritech investments.

Smart Farming Techniques: The Future of Agriculture

Smart farming techniques are at the heart of the precision agriculture revolution. These innovative approaches combine traditional farming practices with cutting-edge technology to optimize crop production and resource management. Some key components of smart farming include:

- Crop Health Monitoring: Using satellite imagery and AI algorithms to assess crop health in real-time

- Farm Management Software: Integrated platforms that help farmers manage all aspects of their operations

- IoT Sensors: Devices that collect data on soil moisture, temperature, and other critical factors

- Precision Irrigation: Systems that deliver water and nutrients exactly where and when they’re needed

- Automated Machinery: Self-driving tractors and drones for more efficient planting and harvesting

Farmonaut’s platform integrates many of these smart farming techniques, providing farmers with a comprehensive solution for managing their operations. Their satellite crop monitoring technology, in particular, has been a game-changer for many farmers, allowing them to identify potential issues before they become major problems.

Explore Farmonaut’s API for advanced agricultural data analytics

Agricultural Market Trends: What Investors Need to Know

Understanding agricultural market trends is crucial for investors looking to capitalize on the growing agritech sector. Some key trends to watch include:

- Increased Adoption of Precision Agriculture: More farmers are embracing technology to improve efficiency and yields

- Focus on Sustainability: Growing demand for eco-friendly farming solutions

- Rise of Vertical Farming: Urban agriculture is gaining traction, especially in densely populated areas

- Blockchain in Agriculture: Improving traceability and transparency in the food supply chain

- AI and Machine Learning: Advanced algorithms are being used to predict crop yields and optimize farm management

“The global agritech market is projected to reach $22.5 billion by 2025, growing at a CAGR of 11.3% from 2020.”

The Impact of Satellite Crop Monitoring on Sustainable Farming Solutions

Satellite crop monitoring has emerged as a powerful tool in the pursuit of sustainable farming solutions. By providing farmers with detailed, real-time information about their crops, this technology enables more efficient use of resources and reduces environmental impact. Here’s how satellite crop monitoring is making a difference:

- Precision Resource Application: Farmers can apply water, fertilizers, and pesticides only where needed, reducing waste and runoff

- Early Problem Detection: Issues like pest infestations or nutrient deficiencies can be identified and addressed quickly

- Improved Crop Rotation: Data-driven decisions about crop rotation help maintain soil health and biodiversity

- Reduced Carbon Footprint: Optimized farm operations lead to fewer tractor passes and lower fuel consumption

- Enhanced Biodiversity: Precise management allows for the creation of wildlife corridors and conservation areas within farmland

Farmonaut’s satellite crop monitoring technology plays a crucial role in promoting sustainable farming practices. By providing farmers with actionable insights, Farmonaut empowers them to make environmentally responsible decisions without sacrificing productivity.

Check out Farmonaut’s API Developer Docs for integration options

Agricultural Data Analytics: Driving Informed Decision-Making

Agricultural data analytics is revolutionizing the way farmers and investors approach decision-making in the agricultural sector. By leveraging big data and advanced analytics, stakeholders can gain valuable insights into various aspects of farming operations. Some key applications of agricultural data analytics include:

- Yield Prediction: Using historical data and machine learning to forecast crop yields

- Risk Assessment: Identifying potential risks such as weather events or market fluctuations

- Resource Optimization: Analyzing data to determine the most efficient use of water, fertilizers, and other inputs

- Market Analysis: Predicting crop prices and demand to inform planting and selling decisions

- Performance Benchmarking: Comparing farm performance against industry standards and best practices

Farmonaut’s platform incorporates advanced data analytics to provide farmers with actionable insights. By combining satellite imagery, weather data, and AI algorithms, Farmonaut offers a comprehensive view of farm performance and potential areas for improvement.

Agritech Investment Strategies: Navigating the Market

For investors looking to capitalize on the growing agritech sector, developing a sound investment strategy is crucial. Here are some key considerations for those interested in agritech investments:

- Diversification: Spread investments across various subsectors of agritech, such as precision farming, vertical farming, and agricultural biotechnology

- Research and Due Diligence: Thoroughly investigate companies’ financial health, market position, and growth potential

- Long-Term Perspective: Agritech investments often require patience as technologies mature and gain widespread adoption

- Monitor Industry Trends: Stay informed about emerging technologies and changing regulations in the agricultural sector

- Consider ETFs: Exchange-traded funds focused on agritech can provide exposure to a diverse range of companies in the sector

When evaluating agritech stocks, investors should pay close attention to financial metrics such as revenue growth, profit margins, and research and development expenditures. Additionally, factors like market share, patent portfolios, and strategic partnerships can provide insights into a company’s competitive position and future prospects.

| Company Name | Stock Symbol | Current Price | 52-Week High/Low | Market Cap | P/E Ratio | YTD Return |

|---|---|---|---|---|---|---|

| John Deere | DE | $380.25 | $450.00 / $320.50 | $110.5B | 18.5 | 12.3% |

| AGCO Corporation | AGCO | $125.75 | $145.50 / $105.25 | $9.4B | 10.2 | 8.7% |

| Trimble Inc. | TRMB | $52.30 | $65.75 / $45.00 | $13.0B | 28.7 | -5.2% |

| Corteva Inc. | CTVA | $55.40 | $68.25 / $50.75 | $39.2B | 22.1 | 3.8% |

| Lindsay Corporation | LNN | $128.15 | $150.00 / $110.50 | $1.4B | 20.5 | 6.9% |

The Role of Institutional Investors in Shaping Agritech’s Future

Institutional investors and hedge funds play a significant role in shaping the future of agriculture through their strategic investments in agritech companies. Their involvement brings several benefits to the sector:

- Capital Infusion: Large-scale investments accelerate research and development efforts

- Expertise: Institutional investors often bring valuable industry knowledge and connections

- Long-Term Vision: Many institutional investors take a long-term approach, supporting sustained growth and innovation

- Market Validation: Significant institutional backing can boost confidence in emerging agritech companies

- Corporate Governance: Institutional investors often push for improved governance practices, benefiting all shareholders

The case of Harrow, Inc. demonstrates the impact of institutional investment in the agritech sector. With 72.76% of its shares held by institutional investors and hedge funds, the company has seen increased scrutiny and interest from the financial community.

Innovative Healthcare and Pharmaceutical Technologies in Agriculture

The intersection of healthcare, pharmaceutical technologies, and agriculture is creating exciting opportunities for enhancing crop yields and farm productivity. Some key innovations in this area include:

- Biopesticides: Naturally derived substances that control pests with minimal environmental impact

- Gene Editing: CRISPR and other technologies to develop crops with improved traits

- Biological Soil Treatments: Microorganisms that enhance soil health and nutrient uptake

- Plant-Based Vaccines: Using crops to produce vaccines for both human and animal health

- Precision Livestock Farming: Technologies for monitoring animal health and optimizing nutrition

These advancements not only improve agricultural productivity but also contribute to the development of more sustainable and environmentally friendly farming practices.

The Future of Precision Agriculture and Agritech Investments

As we look to the future, the precision agriculture and agritech sectors are poised for continued growth and innovation. Key trends to watch include:

- Increased Integration of AI and Machine Learning: More sophisticated algorithms for farm management and decision-making

- Expansion of IoT in Agriculture: Greater connectivity and data collection on farms

- Advancements in Robotics: Development of more autonomous farm equipment and harvesting robots

- Focus on Climate-Resilient Agriculture: Technologies to help farmers adapt to changing climate conditions

- Growth of Precision Livestock Farming: Applying precision agriculture principles to animal husbandry

For investors, these trends present both opportunities and challenges. While the potential for high returns exists, the rapidly evolving nature of the sector requires careful analysis and ongoing monitoring of technological developments and market conditions.

Conclusion: Navigating the Agritech Investment Landscape

As we’ve explored throughout this analysis, precision agriculture technology and agritech investments represent a dynamic and potentially lucrative sector for investors. From satellite crop monitoring to innovative healthcare applications in farming, the opportunities for growth and innovation are vast.

However, as with any emerging sector, investors must approach agritech investments with a balanced perspective. While companies like Harrow, Inc. demonstrate the potential for significant institutional interest, they also highlight the volatility and complexity inherent in this market.

By staying informed about the latest technological advancements, market trends, and financial metrics, investors can position themselves to capitalize on the ongoing revolution in agriculture. As the world grapples with challenges such as climate change and food security, the importance of agritech solutions will only continue to grow, making this an exciting space to watch in the coming years.

Frequently Asked Questions (FAQ)

- What is precision agriculture technology?

Precision agriculture technology refers to the use of advanced tools and techniques, such as satellite imagery, IoT sensors, and data analytics, to optimize farming practices and improve crop yields. - How does satellite crop monitoring work?

Satellite crop monitoring uses multispectral imagery from satellites to assess crop health, soil moisture, and other critical factors. This data is then analyzed to provide farmers with actionable insights. - What are some key agritech investment strategies?

Key strategies include diversification across different agritech subsectors, thorough research and due diligence, maintaining a long-term perspective, and staying informed about industry trends. - How is AI being used in agriculture?

AI is used in agriculture for various applications, including crop yield prediction, pest detection, automated machinery operation, and personalized farm management advice. - What role do institutional investors play in agritech?

Institutional investors provide capital, expertise, and long-term vision to agritech companies, helping to accelerate innovation and growth in the sector.

For more information on precision agriculture technology and smart farming solutions, visit Farmonaut’s web application or download their mobile apps for Android and iOS.