Revolutionizing UK Financial Services: How Mutuality Drives Customer Value in Investment and Pensions

“A major UK mutual investment provider manages significant assets and oversees millions of policies for its members.”

In the ever-evolving landscape of UK financial services, we are witnessing a significant shift towards customer-centric models that prioritize long-term value and financial resilience. At the forefront of this revolution are mutual investment providers, whose unique ownership structure and commitment to member benefits are reshaping the industry. In this comprehensive exploration, we’ll delve into how mutuality is driving unprecedented customer value in investment and pensions, with a special focus on recent leadership changes that signal a new era for one of the UK’s largest mutuals.

The Power of Mutuality in Financial Services

Mutual investment providers in the UK have long been distinguished by their member-owned structure, a fundamental difference that sets them apart from traditional shareholder-owned financial institutions. This unique setup allows mutuals to focus primarily on delivering value to their members rather than maximizing profits for external shareholders. As we navigate through the complexities of modern financial services, it’s crucial to understand how this model translates into tangible benefits for customers.

- Customer-First Approach: Mutuals prioritize member interests above all else

- Long-Term Value: Focus on sustainable growth rather than short-term gains

- Reinvestment of Profits: Surpluses are typically reinvested to improve services or returned to members

- Democratic Governance: Members often have a say in key decisions

The mutual model has proven particularly effective in the realms of investment and pensions, where long-term stability and trust are paramount. By aligning the company’s interests directly with those of its members, mutual providers create a virtuous cycle of value creation and distribution.

Recent Leadership Changes: A Catalyst for Innovation

“The UK’s financial services sector sees a leadership change bringing expertise in insurance, pensions, and regulatory affairs.”

In a move that underscores the commitment to strengthening mutuality in the UK financial sector, a major mutual investment provider has recently appointed a new chair and non-executive director. This strategic decision brings a wealth of experience in insurance, pensions, and regulatory affairs to the company’s board, signaling a renewed focus on delivering enhanced services and reinforcing the organization’s legacy of mutuality.

The incoming chair’s alignment with the customer-owned mutual ethos is expected to drive long-term value for members, leveraging deep market understanding and a diverse portfolio of experience to navigate industry challenges and capitalize on opportunities. This appointment marks a pivotal moment in the company’s history, reflecting a commitment to serving members and strengthening financial resilience strategies in an evolving economic landscape.

The Impact of Leadership on Mutual Investment Providers

Leadership plays a crucial role in shaping the direction and success of mutual investment providers. The recent appointment brings several key advantages:

- Enhanced Expertise: Deep knowledge of insurance and pensions sectors

- Regulatory Insight: Understanding of complex financial regulations

- Strategic Vision: Ability to navigate market challenges and opportunities

- Customer-Centric Focus: Alignment with mutual values and member priorities

By bringing in leadership with a strong background in these areas, mutual providers are better positioned to innovate and adapt to changing market conditions while staying true to their core principles of member value and financial resilience.

Comparing Mutual and Traditional Financial Service Providers

To better understand the unique value proposition of mutual organizations in the financial services sector, let’s examine the key differences between mutual and traditional providers:

| Aspect | Mutual Providers | Traditional Providers |

|---|---|---|

| Ownership Structure | Member-owned | Shareholder-owned |

| Primary Focus | Member benefits and long-term value | Profit maximization for shareholders |

| Profit Distribution | Reinvested or returned to members | Dividends to shareholders |

| Decision Making | Often involves member input | Board and executive-driven |

| Long-term Strategy | Focus on sustainable growth and member value | Balance between growth and shareholder returns |

This comparison highlights the fundamental differences in approach between mutual and traditional providers, underscoring the potential advantages of the mutual model in delivering long-term value to customers.

Innovations in Mutual Investment and Pension Services

As mutual investment providers continue to evolve, we’re seeing a range of innovative services designed to enhance member value and financial resilience. Some key areas of innovation include:

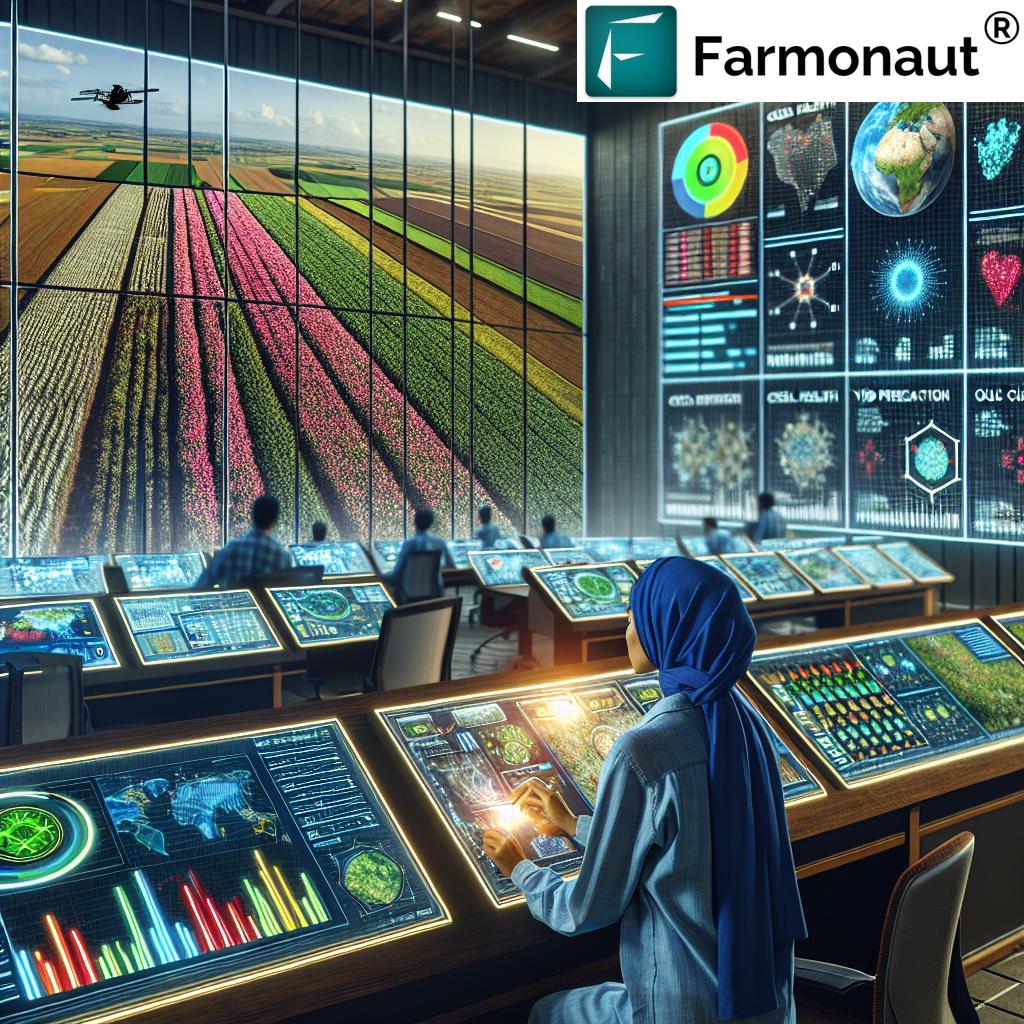

- Personalized Financial Planning: Leveraging AI and big data to offer tailored advice

- Sustainable Investment Options: Meeting growing demand for ethical and environmentally responsible investments

- Digital Platforms: Improving accessibility and user experience for members

- Flexible Pension Products: Adapting to changing work patterns and retirement expectations

These innovations demonstrate how mutual providers are adapting to meet the changing needs of their members while staying true to their core principles of mutuality and long-term value creation.

The Role of Regulation in Shaping Mutual Providers

Regulation plays a crucial role in the financial services sector, and mutual providers are no exception. The regulatory landscape has a significant impact on how these organizations operate and deliver value to their members. Key aspects include:

- Prudential Regulation: Ensuring financial stability and risk management

- Conduct Regulation: Protecting consumer interests and promoting fair practices

- Governance Requirements: Ensuring robust decision-making processes and accountability

- Reporting and Transparency: Providing clear information to members and regulators

The appointment of leadership with strong regulatory experience is particularly valuable in navigating this complex landscape while maintaining a focus on member benefits.

Building Financial Resilience Through Mutuality

One of the key strengths of mutual investment providers is their focus on building long-term financial resilience for their members. This approach is particularly relevant in today’s uncertain economic climate. Strategies for enhancing financial resilience include:

- Diversified Investment Portfolios: Spreading risk across various asset classes

- Education and Guidance: Empowering members to make informed financial decisions

- Stress Testing: Regularly assessing the organization’s ability to withstand economic shocks

- Long-Term Planning: Focusing on sustainable growth rather than short-term gains

By prioritizing financial resilience, mutual providers help ensure that their members are better prepared to face future economic challenges.

The Future of Mutuality in UK Financial Services

As we look to the future, the role of mutuality in UK financial services appears set to grow. The combination of customer-centric values, innovative services, and a focus on long-term value creation positions mutual providers well to meet the evolving needs of consumers. Key trends to watch include:

- Increased Digitalization: Enhancing member experiences through technology

- Focus on ESG: Integrating environmental, social, and governance factors into investment strategies

- Collaborative Ecosystems: Partnering with fintech firms to offer innovative services

- Member Engagement: Finding new ways to involve members in decision-making processes

These trends suggest a bright future for mutual investment providers and their members, as they continue to adapt and innovate in a rapidly changing financial landscape.

Challenges and Opportunities for Mutual Providers

While the mutual model offers many advantages, it also faces challenges in today’s competitive financial services market. Some key challenges and opportunities include:

- Competition from Traditional Providers: Differentiating services in a crowded market

- Regulatory Compliance: Navigating complex and evolving regulatory requirements

- Technological Adaptation: Investing in digital transformation to meet member expectations

- Demographic Shifts: Adapting to changing customer needs across different age groups

Addressing these challenges while capitalizing on the unique strengths of the mutual model will be crucial for long-term success.

The Impact of Mutuality on Customer Satisfaction

One of the most significant benefits of the mutual model is its positive impact on customer satisfaction. By aligning organizational goals with member interests, mutual providers often achieve higher levels of customer satisfaction compared to traditional financial institutions. Factors contributing to this include:

- Trust: Members feel confident that their interests are prioritized

- Transparency: Clear communication about decision-making and financial performance

- Personalized Service: Tailored solutions that meet individual member needs

- Long-Term Relationships: Focus on building lasting connections with members

These elements combine to create a strong foundation of trust and loyalty between mutual providers and their members.

Case Study: The Impact of Leadership Change on a Major UK Mutual

To illustrate the significance of recent leadership changes, let’s examine the case of a major UK mutual investment provider. With the appointment of a new chair bringing extensive experience in insurance, pensions, and regulatory affairs, the organization is poised for transformative growth. Key impacts include:

- Strategic Realignment: Focusing on core mutual values and member benefits

- Enhanced Risk Management: Leveraging regulatory expertise to navigate market challenges

- Innovation Drive: Encouraging the development of new products and services

- Strengthened Governance: Implementing best practices in corporate governance

This case demonstrates how strategic leadership changes can reinvigorate mutual providers and drive innovation in the sector.

The Role of Technology in Enhancing Mutual Services

Technology plays a crucial role in enabling mutual investment providers to deliver enhanced services to their members. Key technological advancements include:

- AI-Driven Advice: Providing personalized investment recommendations

- Blockchain for Transparency: Enhancing security and traceability of transactions

- Mobile Apps: Offering convenient access to account information and services

- Data Analytics: Improving risk assessment and product development

By leveraging these technologies, mutual providers can offer more efficient, personalized, and secure services to their members.

Educating Members: A Key Priority for Mutual Providers

One of the core principles of mutuality is empowering members to make informed financial decisions. As such, mutual investment providers place a strong emphasis on financial education. This includes:

- Workshops and Seminars: Offering in-person and online educational events

- Informative Content: Providing clear, jargon-free explanations of financial concepts

- Interactive Tools: Developing calculators and simulators to help members plan their finances

- Personalized Guidance: Offering one-on-one sessions with financial advisors

By prioritizing member education, mutual providers not only enhance financial literacy but also strengthen their relationships with members.

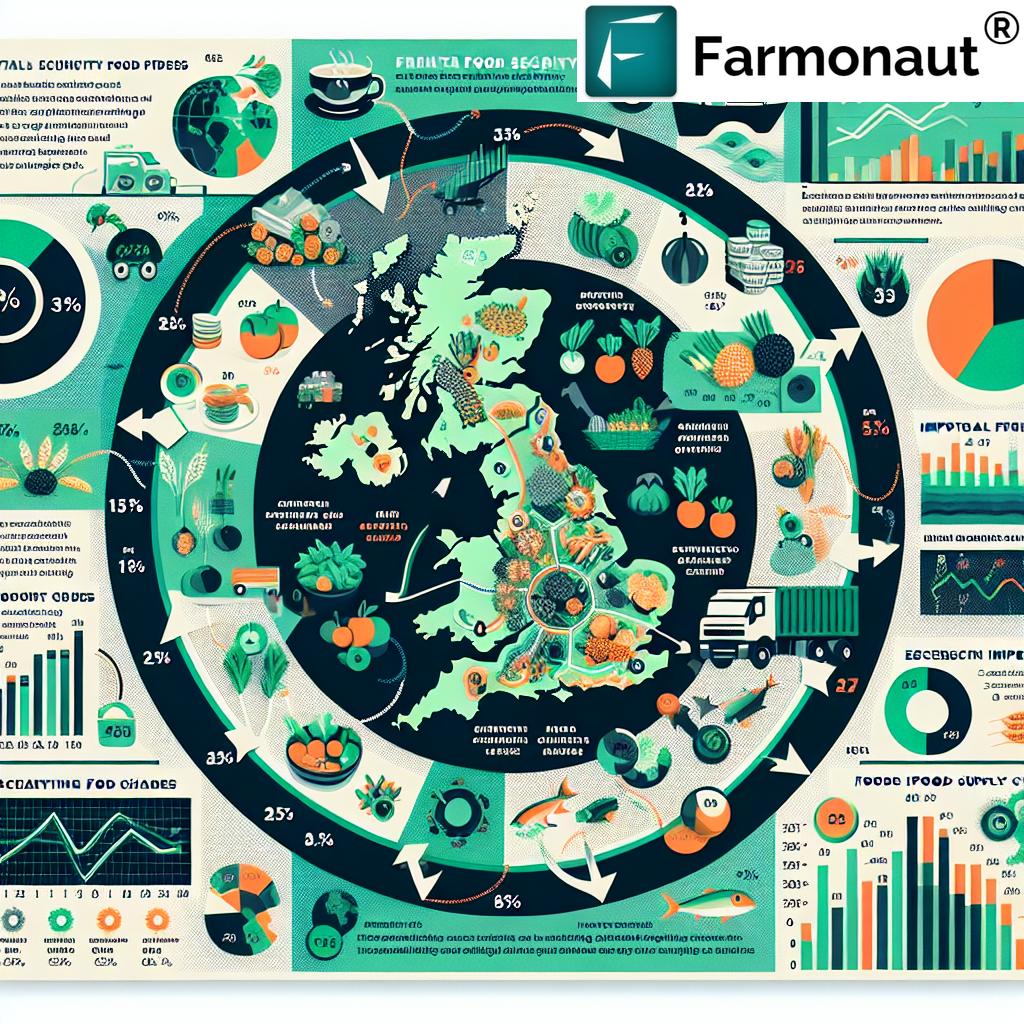

The Global Context: Mutuality in International Markets

While our focus has been on the UK, it’s worth considering the role of mutuality in global financial markets. Different countries have varying approaches to mutual financial services, influenced by local regulations, cultural factors, and economic conditions. Some interesting global trends include:

- Growth of Mutual Banks in Europe: Expanding services beyond traditional banking

- Microfinance Cooperatives in Developing Countries: Providing financial access to underserved communities

- Mutual Insurance Companies in North America: Competing effectively with traditional insurers

- Digital Mutual Platforms in Asia: Leveraging technology to reach new members

These global perspectives offer valuable insights for UK mutual providers, potentially inspiring new approaches and innovations.

Conclusion: The Bright Future of Mutuality in UK Financial Services

As we’ve explored throughout this article, mutuality continues to be a powerful force in driving customer value in UK investment and pensions. The recent leadership changes in major mutual providers signal a renewed commitment to this model, bringing fresh expertise and vision to the sector. By focusing on long-term value, financial resilience, and member benefits, mutual investment providers are well-positioned to meet the evolving needs of UK consumers.

The combination of customer-centric values, innovative services, and a focus on education and transparency creates a strong foundation for future growth. As the financial services landscape continues to evolve, mutual providers have the flexibility and commitment to adapt, ensuring they remain at the forefront of delivering value to their members.

In an era where trust in financial institutions is more important than ever, the mutual model offers a compelling alternative to traditional shareholder-owned companies. By aligning organizational goals with member interests, mutual providers create a virtuous cycle of value creation that benefits both individual members and the broader economy.

As we look to the future, it’s clear that mutuality will play an increasingly important role in shaping the UK’s financial services sector. Through continued innovation, strong leadership, and an unwavering commitment to member value, mutual investment providers are set to revolutionize the industry, driving positive change and enhancing financial resilience for millions of members across the country.

FAQs

- What is a mutual investment provider?

A mutual investment provider is a financial organization owned by its members rather than external shareholders. It focuses on delivering value to its members rather than maximizing profits for external investors. - How does mutuality benefit customers in financial services?

Mutuality benefits customers by aligning the organization’s interests with those of its members. This often results in better service, more favorable terms, and a focus on long-term value rather than short-term profits. - What impact does leadership have on mutual investment providers?

Strong leadership in mutual providers can drive innovation, enhance regulatory compliance, and ensure a continued focus on member benefits. Recent appointments bringing expertise in insurance, pensions, and regulation are expected to strengthen these organizations. - How are mutual providers adapting to technological changes?

Mutual providers are leveraging technologies like AI, blockchain, and mobile apps to enhance their services, improve efficiency, and provide more personalized experiences for their members. - What challenges do mutual providers face in the current market?

Key challenges include competition from traditional providers, regulatory compliance, technological adaptation, and meeting the evolving needs of different demographic groups.