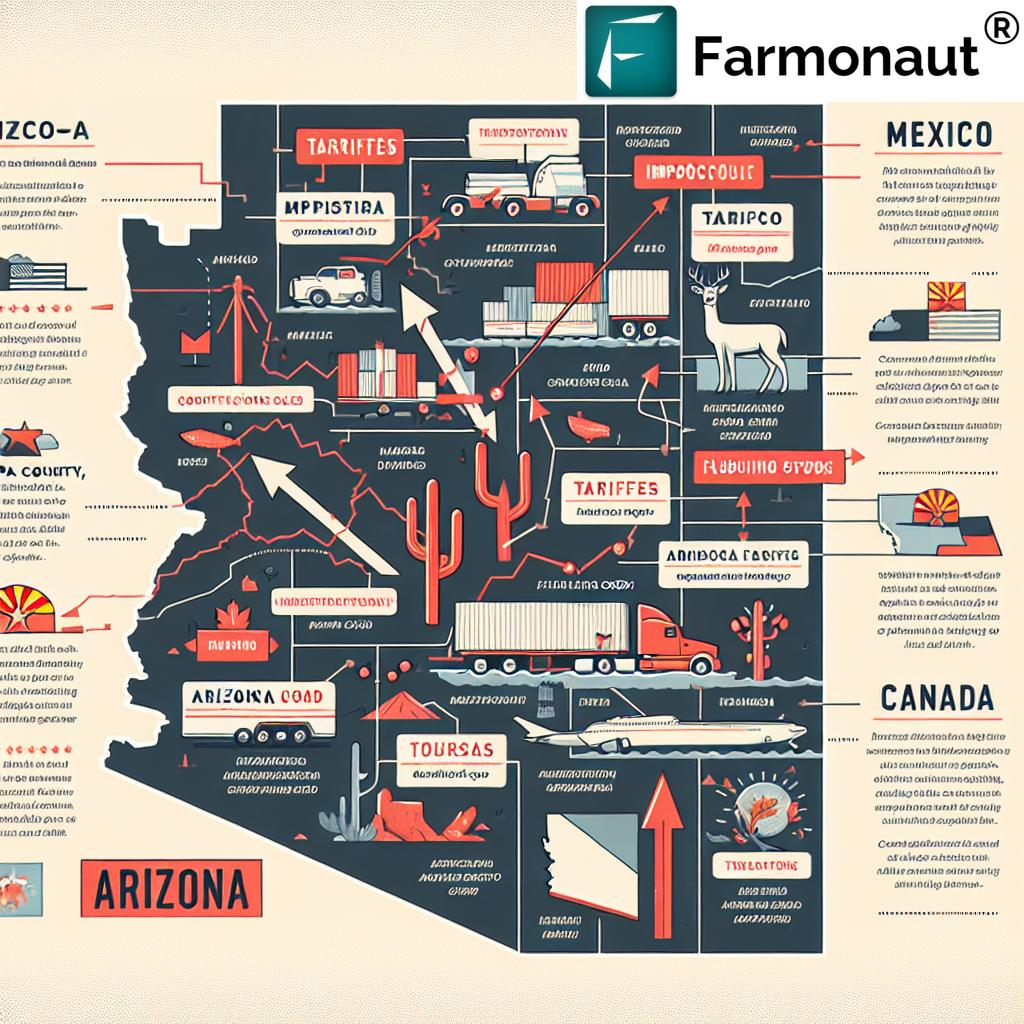

Arizona’s Economic Crossroads: How Tariffs Could Reshape Trade, Tourism, and Consumer Costs

“Proposed tariffs could cost U.S. households an average of $1,200 annually, impacting Arizona’s consumer spending and economy.”

In the heart of the American Southwest, Arizona finds itself at a critical economic juncture. As we delve into the potential impacts of proposed tariffs on imports from Mexico and Canada, we uncover a complex web of consequences that could reshape the state’s economic landscape. From the bustling produce markets of Nogales to the towering cranes of Maricopa County’s construction sites, the ripple effects of these trade policies threaten to touch every corner of Arizona’s diverse economy.

In this comprehensive analysis, we’ll explore how these tariffs could significantly alter trade dynamics, consumer prices, and tourism revenue in the Grand Canyon State. We’ll examine the potential consequences for Arizona’s key industries, including agriculture, construction, and tourism, while also considering the broader implications for household budgets and local government finances.

The Tariff Landscape: Understanding the Basics

Before we dive into the specifics of Arizona’s situation, let’s clarify what these proposed tariffs entail:

- A 25% tariff on nearly all imports from Mexico and Canada

- A 10% tariff on Canadian oil, gas, and electricity

- Potential retaliatory tariffs from both Mexico and Canada

These measures, if implemented, would directly affect Arizona’s top trading partners. In 2023, Arizona exported $8 billion worth of goods to Mexico alone, highlighting the state’s deep economic ties to its southern neighbor.

The Produce Predicament: Impacts on Arizona’s Agriculture

Arizona’s agricultural sector, particularly its produce industry, stands to be one of the most significantly affected areas. Let’s break down the potential consequences:

Rising Costs for Fresh Fruits and Vegetables

According to the USDA, imports account for 60% of the U.S. fresh fruit supply and 38% of fresh vegetables. Mexico is a crucial supplier, providing over half of the imported fruit and 69% of imported vegetables. Nogales, Arizona, serves as a major entry point for this produce, handling about 6.8 billion pounds worth $3.9 billion annually.

The implementation of tariffs would likely lead to:

- Higher prices for consumers on items like tomatoes, watermelons, cucumbers, and squash

- Potential disruptions in the supply chain for fresh produce

- Increased costs for local businesses dependent on the produce import industry

Allison Moore, executive vice president of the Fresh Produce Association of the Americas, warns that absorbing these added costs will be impossible for many in the industry, necessitating price increases for consumers.

Potential Bright Spots in Agriculture

Interestingly, not all agricultural products may see price increases. Daniel Scheitrum, assistant professor at California Polytechnic State University, suggests that prices for tree nuts and corn-based products could potentially decrease. This is because these are products that Mexico imports, and reduced demand from Mexico could lead to lower prices in Arizona.

However, it’s crucial to note that these potential decreases would likely be outweighed by the overall inflationary effect of the tariffs on other goods.

Building Uncertainty: Tariffs and the Construction Industry

Arizona’s construction sector, which has been booming in recent years, could face significant challenges from the proposed tariffs. In 2023, Maricopa County alone saw the completion of 35,269 new homes, the highest number in a decade. Of these, 13,561 were apartment units, marking a record high since at least 2000.

Steel Tariffs and Building Costs

The construction industry relies heavily on imported materials, particularly steel. While steel prices have dropped significantly since their peak during the global supply chain crisis of 2021, the introduction of tariffs could reverse this trend. Key considerations include:

- Potential increases in the cost of steel and other construction materials

- Uncertainty around how much of the tariff costs will be absorbed by producers versus passed on to builders and ultimately, home buyers

- Possible delays in construction projects as companies reassess costs and timelines

Josh Tracy, senior vice president of real estate development at Ryan Companies, a major developer in Arizona, expresses uncertainty about the full impact of these tariffs. He notes that while steel producers may absorb some of the costs initially, the long-term effects on construction and real estate markets remain unclear.

Labor Market Concerns

Adding to the construction industry’s challenges is the potential for labor shortages. Jonas Gamso, associate professor at ASU’s Thunderbird School of Global Management, points out that stricter immigration policies could compound the issue, leading to a shortage of workers in the construction sector. This combination of factors – rising material costs and potential labor shortages – could significantly impact Arizona’s robust housing market, potentially pricing out more potential homebuyers.

Tourism Troubles: Tariffs’ Impact on Arizona’s Visitor Economy

“Arizona’s produce industry, construction costs, and tourism revenue face significant challenges from potential tariffs on Mexican and Canadian imports.”

Tourism is a crucial component of Arizona’s economy, generating $2.6 billion in state and local tax revenue in 2023. The potential impact of tariffs on this sector could be substantial and multifaceted.

Declining International Visitors

Arizona’s tourism industry relies heavily on international visitors, particularly from Mexico and Canada. Consider these facts:

- Approximately 3.3 million visitors to Arizona (1 in 10) came from Mexico in 2023

- Canada accounts for more than 20 million annual visits to the U.S., many of whom visit Arizona

The implementation of tariffs could lead to:

- Reduced tourist numbers from Mexico due to economic pressures and potential resentment over trade policies

- Fewer Canadian visitors, as exemplified by Prime Minister Justin Trudeau’s call for Canadians to vacation at home rather than in the U.S.

- A significant drop in tourism revenue, affecting local businesses and government budgets

Ripple Effects on Local Economies

The potential decline in tourism could have far-reaching consequences for Arizona’s local economies, particularly in areas heavily dependent on visitor spending. Sarah Benatar, Coconino County treasurer, emphasizes the uncertainty and potential chaos these tariffs could cause, especially as officials plan for other seasonal challenges like flood and fire season.

The tourism industry in Arizona supports 187,000 jobs, according to the Arizona Office of Tourism. A significant downturn in this sector could lead to job losses and reduced economic activity across the state.

Consumer Costs: From Groceries to Gasoline

The impact of tariffs on consumer goods extends far beyond the produce aisle. Let’s examine how various sectors of consumer spending could be affected:

Beverage Industry

Arizona consumers might see price increases in imported beers and liquors. For instance, Modelo, which became the best-selling beer in the United States in 2023, could become more expensive. Ben Hancock, national account manager for Constellation Brands (which sells Modelo, Corona, and Pacifico in the U.S.), indicates that while the company is taking measures to stave off price hikes, long-term cost increases may be inevitable if tariffs are implemented.

Gasoline and Energy Costs

While Arizona gets most of its petroleum products from California and Texas, the interconnected nature of energy markets means that tariffs on Canadian crude oil could eventually lead to price increases at the pump. Tom Pyle, president of the American Energy Alliance, warns that while the immediate impact might be limited, long-term effects could include:

- Gradual increases in gasoline prices

- Higher energy costs for factories and employers across various sectors

- Potential ripple effects on transportation and logistics costs

Economic Ripple Effects: Beyond Direct Imports

The impacts of these tariffs extend far beyond the immediate price increases on imported goods. Let’s explore some of the broader economic consequences Arizona might face:

Export Challenges

While much of the focus is on imports, Arizona’s export industries could also face significant challenges. The state’s top exports to Mexico include:

- Copper

- Electronics

- Aircraft

- Engines and parts

Retaliatory tariffs from Mexico and Canada could lead to reduced demand for these products, potentially impacting jobs and revenue in these sectors.

Supply Chain Disruptions

Many Arizona businesses rely on complex supply chains that involve components or materials from Mexico and Canada. Tariffs could disrupt these supply chains, leading to:

- Increased costs for manufacturers

- Potential production delays

- The need for businesses to seek alternative suppliers, possibly at higher costs

Investment Uncertainty

The uncertainty created by potential tariffs could have a chilling effect on business investment in Arizona. Companies may hesitate to expand operations or make significant capital investments until the trade situation stabilizes.

Local Government Budgets: The Hidden Victims

One often overlooked aspect of the tariff impact is its effect on local government budgets. Arizona’s state and local governments rely heavily on revenue generated from tourism and economic activity. The potential consequences include:

- Reduced tax revenue from tourism-related activities

- Potential budget shortfalls for essential services

- Challenges in planning for infrastructure projects and public services

Dave Young, Colorado state treasurer, emphasizes that these are not just abstract economic concepts but real impacts on people’s lives. The potential for reduced revenue could force cuts in essential services across Arizona’s communities.

The Role of Technology in Mitigating Economic Challenges

While the potential impacts of tariffs present significant challenges, technology could play a crucial role in helping Arizona’s businesses adapt and thrive. Here’s where innovative solutions like those offered by Farmonaut come into play:

Precision Agriculture for Efficiency

In the face of potential price increases for agricultural inputs, precision farming techniques become even more critical. Farmonaut’s satellite-based crop health monitoring system can help Arizona farmers:

- Optimize resource usage, reducing waste and costs

- Make data-driven decisions about irrigation and fertilizer application

- Improve crop yields to offset potential revenue losses from tariffs

Learn more about Farmonaut’s precision agriculture solutions:

Supply Chain Transparency

For businesses grappling with supply chain disruptions, Farmonaut’s blockchain-based traceability solutions could provide valuable insights. This technology can help:

- Increase transparency in supply chains

- Identify potential bottlenecks or risks

- Build consumer trust through verifiable product journeys

Data-Driven Decision Making

In an uncertain economic environment, access to real-time data becomes crucial. Farmonaut’s AI-driven advisory system, Jeevn AI, can provide valuable insights for agricultural businesses, helping them navigate changing market conditions.

Explore Farmonaut’s API for custom agricultural data solutions: Farmonaut API

Economic Impact of Tariffs on Arizona’s Key Sectors

| Sector | Estimated Annual Impact | Primary Affected Areas | Potential Consequences |

|---|---|---|---|

| Agriculture | $500 million – $1 billion | Produce imports, Nogales area | Higher consumer prices, reduced import volume, job losses in distribution |

| Tourism | $1 – $2 billion | Grand Canyon, Sedona, Phoenix | Fewer international visitors, reduced local tax revenue, job losses in hospitality |

| Construction | $300 – $600 million | Maricopa County, Phoenix metro area | Increased building costs, slower growth in housing market, potential job losses |

| Consumer Goods | $800 million – $1.5 billion | Statewide retail sector | Higher prices on imported goods, reduced consumer spending power |

| Energy | $200 – $400 million | Statewide gasoline and electricity markets | Gradual increase in fuel and energy costs, impact on transportation and industry |

Strategies for Businesses and Consumers

As Arizona faces these potential economic challenges, businesses and consumers can take proactive steps to mitigate the impacts:

For Businesses:

- Diversify supply chains to reduce reliance on single sources

- Invest in technology to improve efficiency and reduce costs

- Explore new markets to offset potential losses in existing ones

- Collaborate with local partners to strengthen regional economic resilience

For Consumers:

- Budget for potential price increases on imported goods

- Consider locally-produced alternatives where possible

- Stay informed about economic changes and adjust spending habits accordingly

- Support local businesses to help maintain community economic health

The Road Ahead: Navigating Arizona’s Economic Future

As Arizona stands at this economic crossroads, the path forward remains uncertain. The potential implementation of tariffs on imports from Mexico and Canada could reshape the state’s economic landscape in profound ways. From the produce markets of Nogales to the tourism hotspots of Sedona and the Grand Canyon, from the construction sites of Maricopa County to the gas pumps across the state, the impacts could be far-reaching and complex.

However, Arizona’s economy has shown resilience in the face of challenges before. The state’s diverse economic base, innovative spirit, and strategic location position it to adapt to these potential changes. By leveraging technology, fostering local partnerships, and staying agile in the face of change, Arizona’s businesses and communities can work to mitigate the impacts of these potential tariffs and find new opportunities for growth and prosperity.

As we move forward, it will be crucial for policymakers, business leaders, and citizens to stay informed, engage in constructive dialogue, and work collaboratively to navigate these economic challenges. The decisions made in the coming months could shape Arizona’s economic future for years to come, making it more important than ever for all stakeholders to be actively involved in charting the state’s course through these uncertain waters.

FAQ Section

Q: How might the proposed tariffs affect the average Arizona household?

A: Based on estimates from the Peterson Institute for International Economics, the average U.S. household could face additional costs of about $1,200 per year due to these tariffs. For Arizona families, this could mean higher prices on a wide range of goods, from fresh produce to gasoline and imported consumer products.

Q: Will all prices go up immediately if tariffs are implemented?

A: Not necessarily. While some price increases might be immediate, others could be gradual. Some businesses may absorb part of the cost initially, but long-term, most economists expect these costs to be passed on to consumers.

Q: How might Arizona’s tourism industry be affected?

A: Arizona’s tourism industry could face challenges from reduced international visitors, particularly from Mexico and Canada. This could lead to decreased revenue for hotels, restaurants, and attractions, potentially resulting in job losses and reduced tax revenue for local governments.

Q: Are there any potential positive outcomes from these tariffs for Arizona?

A: While the overall impact is expected to be challenging, some sectors might see benefits. For example, if the tariffs lead to increased domestic production of certain goods, it could create new job opportunities. However, most economists predict that the negative impacts would outweigh any potential benefits.

Q: How can Arizona businesses prepare for these potential changes?

A: Businesses can prepare by diversifying their supply chains, investing in efficiency-improving technologies, exploring new markets, and staying informed about policy changes. Collaborating with local partners and industry associations can also help in developing strategies to navigate these challenges.

As we conclude this comprehensive analysis of Arizona’s economic crossroads, it’s clear that the potential implementation of tariffs on imports from Mexico and Canada could have far-reaching consequences for the state’s economy. From the produce industry to tourism, from construction to consumer goods, the impacts could touch every aspect of Arizona’s economic life.

While challenges lie ahead, Arizona’s resilience and adaptability offer hope for navigating these uncertain waters. By staying informed, leveraging innovative technologies, and working collaboratively, Arizona’s businesses and communities can work to mitigate the impacts of these potential tariffs and find new paths to economic prosperity.

As we move forward, it will be crucial for all stakeholders – from policymakers to business leaders to individual citizens – to engage in constructive dialogue and work together to shape Arizona’s economic future. The decisions made in the coming months could have long-lasting effects on the state’s economy, making it more important than ever for Arizonans to be actively involved in charting the course ahead.

In these challenging times, staying informed and adaptable will be key. We encourage our readers to continue following this developing situation and to consider how these potential changes might affect their businesses, communities, and personal finances. Together, we can work towards building a resilient and prosperous future for Arizona, regardless of the economic challenges that lie ahead.