Mastering Oat Crop Insurance: Essential USDA Risk Management Strategies for Oklahoma City Farmers

“The USDA’s Risk Management Agency offers over 10 different crop insurance policies for oat producers.”

Welcome to our comprehensive guide on mastering oat crop insurance and essential USDA risk management strategies for Oklahoma City farmers. In today’s volatile agricultural market, understanding and implementing effective risk management techniques is crucial for the success and sustainability of your farming operations. As we delve into the intricacies of crop insurance for oats and explore the various federal crop insurance policies available, we aim to equip you with the knowledge and tools necessary to protect your farm revenue and mitigate potential risks.

The Importance of Crop Insurance in Agriculture

In the ever-changing landscape of agriculture, crop insurance plays a pivotal role in safeguarding farmers against unforeseen circumstances. For oat producers in Oklahoma City and beyond, having a robust insurance policy is not just a safety net; it’s a critical component of a successful farming strategy. Let’s explore why crop insurance is essential for modern agriculture:

- Financial Stability: Crop insurance provides a safety net that helps maintain financial stability in the face of crop losses due to natural disasters, pests, or market fluctuations.

- Risk Mitigation: By transferring some of the risk to insurance providers, farmers can focus on what they do best – producing high-quality crops.

- Access to Credit: Many lenders require crop insurance as a prerequisite for agricultural loans, making it easier for farmers to secure necessary financing.

- Peace of Mind: Knowing that your investment is protected allows for better decision-making and reduces stress during uncertain times.

As we navigate through the complexities of USDA risk management programs, it’s crucial to understand that crop insurance is not a one-size-fits-all solution. Each farm has unique needs, and the right insurance policy can make all the difference in ensuring long-term success.

Understanding USDA’s Risk Management Agency Policies

The United States Department of Agriculture’s Risk Management Agency (RMA) is at the forefront of providing comprehensive crop insurance options for farmers across the nation. For oat producers in Oklahoma City, understanding these policies is crucial for effective risk management. Let’s break down some of the key federal crop insurance policies and coverage options available:

- Yield Protection (YP): This policy protects against production losses due to natural causes such as drought, excessive moisture, hail, and disease.

- Revenue Protection (RP): RP policies provide coverage against both yield losses and revenue declines caused by changes in the harvest price.

- Revenue Protection with Harvest Price Exclusion (RP-HPE): Similar to RP, but the harvest price is not used to determine the revenue guarantee.

- Area Risk Protection Insurance (ARPI): This policy uses county-level data to determine losses, providing coverage based on the overall county yield or revenue.

Each of these policies has its own set of benefits and considerations. As Oklahoma City farmers, it’s essential to evaluate which option aligns best with your specific oat production goals and risk tolerance.

Commodity Exchange Price Provisions for Oats

One of the most critical aspects of crop insurance for oats is understanding the Commodity Exchange Price Provisions (CEPP). These provisions play a significant role in determining insurance guarantees and indemnities for revenue-based crop insurance products. For oat producers, the CEPP helps establish:

- Projected prices for insurance purposes

- Harvest prices used in revenue calculations

- Price discovery periods

By staying informed about CEPP updates and understanding how they affect your insurance coverage, you can make more informed decisions about your risk management strategy.

Whole-Farm Revenue Protection: A Comprehensive Approach

For diversified farms that grow oats alongside other crops, the Whole-Farm Revenue Protection (WFRP) program offers a unique and comprehensive insurance option. This program is designed to protect your farm’s revenue across all commodities on your farm under one insurance policy. Here are some key benefits of WFRP:

- Coverage for up to $8.5 million in insured revenue

- Protection against low revenues due to unavoidable natural causes

- Flexibility to insure a variety of farm products

- Potential premium discounts for farm diversification

WFRP can be an excellent option for Oklahoma City farmers looking to protect their entire operation, including oat production, under a single policy.

Margin Protection for Farmers: Safeguarding Profitability

In addition to traditional crop insurance policies, the USDA offers Margin Protection (MP) for some crops, including oats. This innovative program provides coverage against an unexpected decrease in operating margin. Here’s what you need to know about MP:

- Protects against declines in county-level crop margins

- Can be purchased as a standalone policy or in conjunction with other coverage

- Offers protection based on expected revenue and input costs

- Helps manage the risk of rising production costs

For Oklahoma City oat producers, MP can be a valuable tool in ensuring that your operation remains profitable even in challenging economic conditions.

Navigating Actuarial Information and Compliance Standards

Understanding actuarial information and compliance standards is crucial for making informed decisions about your crop insurance coverage. The RMA provides extensive actuarial information that includes:

- County crop programs and prices

- Dates for planting and coverage periods

- Special provisions and statements

- Coverage levels and premium rates

Compliance with USDA standards is equally important. Farmers must adhere to conservation compliance requirements and accurately report acreage and production to maintain eligibility for federal crop insurance programs.

“Oklahoma City farmers can access support from one of 13 USDA regional offices across the United States.”

Essential Reporting Tools for Agricultural Risk Mitigation

Effective risk management relies heavily on accurate and timely reporting. The USDA provides several tools to help farmers manage their reporting obligations:

- Acreage Reporting: Accurately reporting your planted acreage is crucial for maintaining insurance coverage.

- Production Reporting: Keeping detailed records of your oat production helps establish your Actual Production History (APH).

- Notice of Loss: Promptly reporting crop damage or loss is essential for claim processing.

Utilizing these reporting tools effectively can streamline your insurance processes and ensure you’re fully protected.

Prevented Planting Provisions: Protecting Your Investment

Prevented planting coverage is a crucial component of many crop insurance policies, including those for oats. This provision provides protection when you’re unable to plant your intended crop due to an insured cause of loss. Key points to remember about prevented planting include:

- Coverage is based on a percentage of your production guarantee

- Strict reporting deadlines must be met to qualify

- Options may be available for planting a cover crop or a different crop

Understanding prevented planting provisions can help Oklahoma City farmers make informed decisions when faced with challenging planting conditions.

Hurricane Preparedness and Crop Insurance

While Oklahoma City may not be directly in the path of hurricanes, the indirect effects of these storms can still impact oat production. Understanding how your crop insurance policy addresses hurricane-related losses is important:

- Review your policy for specific hurricane-related coverage

- Be prepared to document any storm-related damage

- Understand the claims process for weather-related losses

Being prepared for extreme weather events is an essential part of comprehensive risk management for any farmer.

Regional Office Support for Oklahoma City Farmers

The USDA’s regional offices play a crucial role in supporting farmers with their crop insurance needs. For Oklahoma City oat producers, the nearest regional office is an invaluable resource. These offices provide:

- Personalized assistance with policy selection

- Guidance on reporting requirements

- Information on local crop programs and provisions

- Support for beginning farmers and ranchers

Don’t hesitate to reach out to your regional office for support in navigating the complexities of crop insurance.

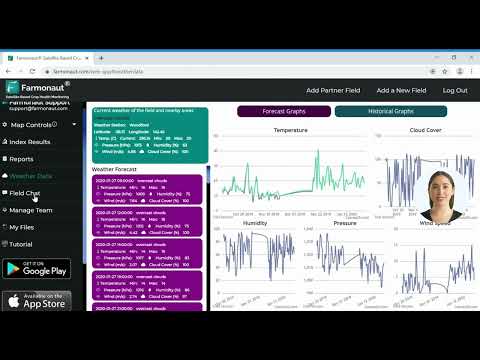

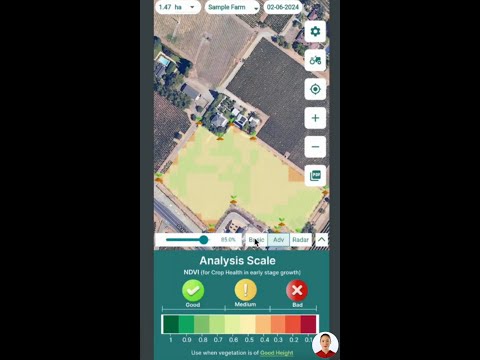

Leveraging Technology in Farm Risk Management

In today’s digital age, technology plays a crucial role in effective farm risk management. Farmers can leverage various tools and platforms to enhance their risk mitigation strategies:

- Satellite-based crop monitoring: Services like Farmonaut provide real-time insights into crop health and growth patterns.

- Weather forecasting apps: Advanced weather prediction tools can help in making timely decisions about planting and harvesting.

- Farm management software: These platforms can assist in record-keeping, which is crucial for accurate reporting and claims processing.

- API integration: For tech-savvy farmers, integrating crop data through APIs can streamline operations. Explore Farmonaut’s API

By embracing these technological advancements, Oklahoma City farmers can enhance their risk management strategies and make more informed decisions about their oat crops.

Policy Updates and Deadlines: Staying Informed

Keeping up with policy updates and important deadlines is crucial for maintaining effective crop insurance coverage. Here are some key points to remember:

- Sales closing dates for oat crop insurance policies

- Acreage reporting deadlines

- Production reporting timelines

- Policy change notification periods

Staying informed about these dates and any policy changes ensures that your coverage remains current and comprehensive.

Innovative Risk Management Techniques for Oat Producers

In addition to traditional insurance policies, Oklahoma City farmers can explore innovative risk management techniques to protect their oat crops:

- Crop diversification: Planting a variety of crops can help spread risk.

- Conservation practices: Implementing soil health and water management strategies can improve crop resilience.

- Forward contracting: Locking in prices for a portion of your crop can provide price stability.

- Precision agriculture: Using data-driven farming techniques can optimize yields and reduce input costs.

Combining these techniques with robust crop insurance coverage can create a comprehensive risk management strategy for your farm.

Oat Crop Insurance Comparison Matrix

| Insurance Program | Coverage Type | Risk Factors Covered | Estimated Premium Range | Max Coverage % | Key Eligibility Requirements | Application Deadline |

|---|---|---|---|---|---|---|

| Yield Protection | Yield | Natural disasters, pests | $10-$30 per acre | 85% | Insurable oat acreage | March 15 |

| Revenue Protection | Revenue | Yield loss, price decline | $15-$40 per acre | 85% | Insurable oat acreage | March 15 |

| Whole-Farm Revenue Protection | Revenue | Farm-wide revenue loss | Varies by operation | 85% | Diverse crop/livestock mix | March 15 |

| Margin Protection | Operating margin | Unexpected margin decrease | $5-$20 per acre | 95% | County availability | September 30 |

Mobile Solutions for On-the-Go Farm Management

In today’s fast-paced farming environment, having access to critical information on the go is essential. Mobile applications can provide instant access to crop data, weather information, and insurance details. Consider exploring these options:

These mobile solutions can help you stay connected to your farm’s data and make timely decisions, even when you’re away from your desk.

Conclusion: Empowering Oklahoma City Oat Farmers

As we’ve explored throughout this comprehensive guide, mastering oat crop insurance and implementing effective USDA risk management strategies is crucial for the success of Oklahoma City farmers. By understanding the various federal crop insurance policies, leveraging technology, and staying informed about policy updates, you can create a robust risk management plan that protects your farm’s financial stability.

Remember, the key to successful risk management lies in a combination of knowledge, preparation, and the right tools. Whether you’re exploring crop insurance options, implementing innovative farming techniques, or utilizing advanced technology like Farmonaut’s satellite-based monitoring, each step you take contributes to the resilience and sustainability of your oat farming operation.

We encourage you to take advantage of the resources available through the USDA’s regional offices, explore the various insurance options outlined in this guide, and consider how technology can enhance your risk management strategies. By doing so, you’ll be well-equipped to navigate the challenges of modern agriculture and ensure the long-term success of your farm.

FAQ Section

- Q: What is the most common type of crop insurance for oat farmers in Oklahoma City?

A: Revenue Protection (RP) is often the most popular choice as it protects against both yield losses and price declines. - Q: How often should I review my crop insurance policy?

A: It’s recommended to review your policy annually, especially before the sales closing date, to ensure it still meets your needs. - Q: Can I insure my oats if I’m a beginning farmer?

A: Yes, the USDA offers special provisions for beginning farmers, including premium discounts and other benefits. - Q: What should I do if I experience crop damage?

A: Contact your insurance agent immediately and file a Notice of Loss within 72 hours of discovering the damage. - Q: How can technology like satellite monitoring help with my crop insurance?

A: Satellite monitoring can provide accurate data on crop health and yields, which can be valuable for reporting and claims processes.