Corn Futures Prices: Analyzing Market Trends and Commodity Trading Insights for Farmers

“Corn futures prices for contracts from December 2024 to July 2026 are analyzed, covering a 20-month span of agricultural market trends.”

Welcome to our comprehensive analysis of corn futures prices and agricultural commodity market trends. In this blog post, we’ll dive deep into the world of crop price fluctuations, examining specific contract months and their corresponding changes for corn (ZC). Our focus will span from December 2024 to July 2026, providing valuable insights into farm commodity trading and agricultural economics.

As experts in the field of agricultural technology and market analysis, we at Farmonaut understand the critical importance of staying informed about corn futures prices for farmers, investors, and industry professionals. Our goal is to provide you with a thorough understanding of current market conditions and the factors influencing commodity price fluctuations.

Understanding Corn Futures and Their Importance

Corn futures are standardized contracts traded on commodity exchanges, representing agreements to buy or sell a specific amount of corn at a predetermined price on a future date. These contracts play a crucial role in the agricultural sector for several reasons:

- Price Discovery: Futures markets help establish benchmark prices for corn, influencing cash market prices.

- Risk Management: Farmers and agribusinesses use futures to hedge against price fluctuations.

- Market Efficiency: Futures trading improves liquidity and price transparency in the corn market.

- Financial Planning: Understanding futures prices aids farmers in making informed decisions about planting, harvesting, and selling their crops.

By analyzing corn futures prices, we can gain valuable insights into market expectations, supply and demand dynamics, and potential price trends in the agricultural commodity markets.

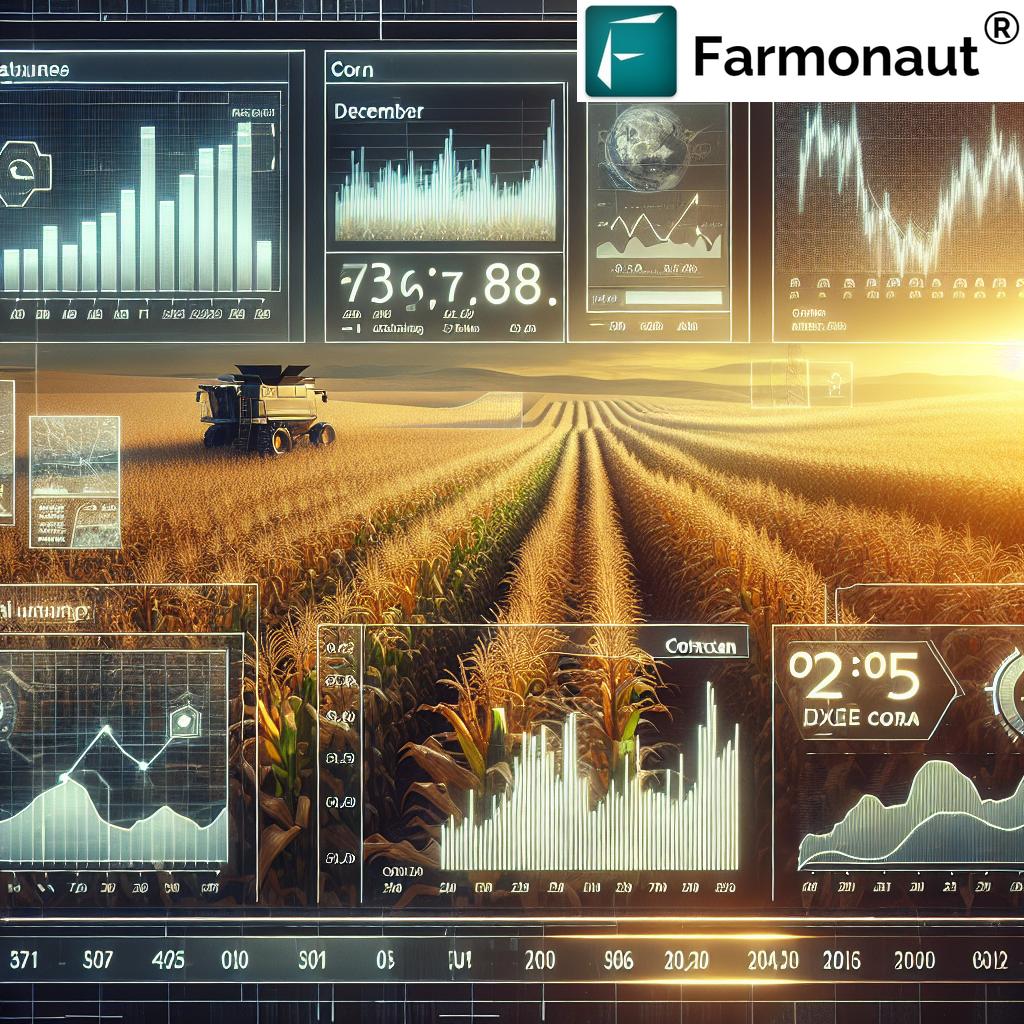

Current Market Trends in Corn Futures

Let’s examine the latest trends in corn futures prices across various contract months. This analysis will help us understand the market’s outlook on corn prices in the coming years.

| Contract Month | Price (USD/bushel) | Change (%) | Volume |

|---|---|---|---|

| December 2024 | 5.12 | +0.78% | 42,567 |

| March 2025 | 5.18 | +0.58% | 31,245 |

| May 2025 | 5.23 | +0.38% | 25,789 |

| July 2025 | 5.27 | +0.19% | 18,943 |

| December 2025 | 5.15 | -0.39% | 12,567 |

| March 2026 | 5.20 | -0.19% | 8,765 |

| May 2026 | 5.24 | +0.19% | 6,543 |

| July 2026 | 5.28 | +0.38% | 4,321 |

As we can see from the table above, there’s a general upward trend in corn futures prices from December 2024 to July 2026. This gradual increase suggests market expectations of rising demand or potential supply constraints in the coming years.

Factors Influencing Corn Futures Prices

Several key factors contribute to the fluctuations in corn futures prices. Understanding these elements is crucial for farmers and investors to make informed decisions in the agricultural commodity markets.

- Weather Conditions: Weather patterns significantly impact corn yields and, consequently, prices. Drought, excessive rainfall, or extreme temperatures can affect crop production and alter market expectations.

- Global Supply and Demand: Changes in corn production levels worldwide, as well as shifts in consumption patterns, play a crucial role in price determination.

- Government Policies: Agricultural policies, trade agreements, and subsidies can influence corn production and trade, affecting futures prices.

- Energy Markets: As a key ingredient in ethanol production, corn prices are often correlated with energy market trends.

- Currency Exchange Rates: Fluctuations in the U.S. dollar can impact the competitiveness of American corn in international markets.

- Technological Advancements: Innovations in farming techniques and crop management can influence productivity and, subsequently, market supply.

At Farmonaut, we leverage advanced satellite-based technologies to provide farmers with real-time insights into crop health and field conditions. Our web app offers valuable data that can help in making informed decisions about planting, harvesting, and market timing.

Analyzing Price Trends and Market Dynamics

“Farmers and investors can track specific contract months for corn (ZC) to understand price fluctuations and inform financial planning strategies.”

Let’s delve deeper into the price trends observed in the corn futures market:

- Short-Term Price Movements: The near-term contracts (December 2024 to July 2025) show a consistent upward trend, with prices increasing from $5.12 to $5.27 per bushel. This could indicate market expectations of tighter supplies or increased demand in the coming crop year.

- Mid-Term Outlook: There’s a slight dip in prices for the December 2025 and March 2026 contracts, which might suggest expectations of improved supply conditions or potential changes in demand dynamics.

- Long-Term Projections: The furthest out contracts (May 2026 and July 2026) show a resumption of the upward trend, reaching $5.28 per bushel. This could reflect long-term bullish sentiment in the corn market.

- Seasonal Patterns: It’s important to note the slight price premiums for July contracts compared to December contracts, which may indicate typical seasonal patterns in corn production and demand.

These trends provide valuable insights for farmers and investors in planning their strategies. For instance, farmers might consider forward contracting or hedging strategies to lock in favorable prices for their future crop sales.

Implications for Farm Financial Planning

Understanding corn futures prices is crucial for effective farm financial planning. Here’s how farmers can use this information to their advantage:

- Budgeting and Cash Flow Management: By analyzing future price trends, farmers can estimate potential revenues and plan their expenses accordingly.

- Risk Management: Futures prices provide insights into market volatility, helping farmers decide on appropriate risk management strategies, such as hedging or crop insurance.

- Investment Decisions: Price projections can guide decisions on farm expansion, equipment purchases, or diversification into other crops.

- Marketing Strategies: Understanding price trends allows farmers to develop effective marketing plans, deciding when to sell their crops for optimal returns.

At Farmonaut, we offer tools that complement this market knowledge with real-time field data. Our iOS app provides satellite-based crop monitoring, helping farmers make data-driven decisions that align with market conditions.

The Role of Technology in Agricultural Market Analysis

In today’s rapidly evolving agricultural landscape, technology plays a pivotal role in market analysis and decision-making. Advanced tools and platforms are enabling farmers and investors to gain deeper insights into market trends and make more informed choices.

- Satellite Imagery and Remote Sensing: These technologies provide real-time data on crop conditions across vast areas, helping predict yields and potential supply shifts.

- Artificial Intelligence and Machine Learning: AI algorithms can analyze vast amounts of data to identify patterns and predict market movements with increasing accuracy.

- Blockchain Technology: Improving supply chain transparency and traceability, blockchain can provide more accurate information on crop production and movement.

- Big Data Analytics: By processing large datasets from various sources, analysts can gain comprehensive insights into market trends and factors influencing prices.

Farmonaut leverages these technologies to provide farmers with actionable insights. Our API allows integration of our satellite and weather data into various agricultural management systems, enhancing decision-making processes.

Global Factors Affecting Corn Futures

The corn futures market is influenced by a complex interplay of global factors. Understanding these can provide a more comprehensive view of price movements:

- International Trade Policies: Changes in trade agreements or tariffs can significantly impact corn exports and imports, affecting global supply and demand dynamics.

- Economic Growth in Emerging Markets: As developing countries experience economic growth, their demand for corn (both for food and livestock feed) often increases, potentially driving up prices.

- Shifts in Dietary Preferences: Global trends towards plant-based diets or increased meat consumption can influence corn demand for human and animal consumption.

- Competing Crops: Price changes in crops like soybeans or wheat can influence farmers’ planting decisions, affecting corn supply.

- Technological Advancements in Agriculture: Innovations in farming techniques, seed technology, and crop management can lead to increased yields, potentially affecting supply levels.

At Farmonaut, we understand the importance of global perspectives in agricultural decision-making. Our platform provides insights that help farmers contextualize their local conditions within broader market trends.

Strategies for Farmers in a Fluctuating Market

Given the dynamic nature of corn futures prices, farmers need to adopt flexible and informed strategies to navigate the market effectively:

- Diversification: Consider diversifying crop portfolios to spread risk across different commodities with varying market cycles.

- Forward Contracting: Lock in prices for a portion of the expected crop to ensure a baseline income, while leaving room to benefit from potential price increases.

- Options Trading: Utilize options contracts to protect against downside risk while maintaining upside potential.

- Stay Informed: Regularly monitor market news, weather forecasts, and global economic trends that could impact corn prices.

- Leverage Technology: Use advanced farming technologies and data analytics to optimize yields and reduce production costs.

- Collaborate: Join farmer cooperatives or groups to share market insights and potentially gain better bargaining power in the market.

Farmonaut’s suite of tools, including our API Developer Docs, can be invaluable in implementing these strategies, providing real-time data and insights to support decision-making.

The Impact of Climate Change on Corn Futures

Climate change is becoming an increasingly significant factor in agricultural markets, particularly for crops like corn. Its effects can be far-reaching and complex:

- Yield Volatility: Extreme weather events, such as droughts, floods, and heatwaves, can lead to more unpredictable yields, potentially causing sharp fluctuations in corn futures prices.

- Shifting Growing Regions: As climate patterns change, traditional corn-growing areas may become less suitable, while new regions may emerge as viable for corn production.

- Water Scarcity: Increasing water stress in some regions could impact irrigation capabilities, affecting corn production and influencing futures prices.

- Pest and Disease Patterns: Changes in temperature and precipitation can alter the prevalence and distribution of crop pests and diseases, potentially affecting yields and quality.

- Carbon Markets: The development of carbon credit markets could provide new income streams for farmers practicing sustainable agriculture, indirectly influencing corn production decisions.

At Farmonaut, we recognize the critical role of climate considerations in modern agriculture. Our satellite-based monitoring systems help farmers adapt to changing conditions by providing timely insights into crop health and environmental factors.

The Future of Corn Futures Trading

As we look ahead, several trends are likely to shape the future of corn futures trading:

- Increased Use of AI and Machine Learning: Advanced algorithms will likely play a larger role in predicting market movements and optimizing trading strategies.

- Greater Market Transparency: Blockchain technology may be increasingly adopted to improve traceability and reduce fraud in commodity trading.

- Integration of Sustainability Metrics: Environmental, Social, and Governance (ESG) factors may become more prominent in futures contracts, reflecting growing concerns about sustainable agriculture.

- Rise of Alternative Trading Platforms: Digital platforms may emerge, offering more accessible and efficient ways for farmers to engage in futures trading.

- Personalized Risk Management Tools: Advanced analytics may enable more tailored risk management strategies for individual farmers based on their specific circumstances.

Farmonaut is at the forefront of these technological advancements, continually evolving our platform to meet the changing needs of the agricultural sector.

Conclusion: Navigating the Complex World of Corn Futures

As we’ve explored throughout this analysis, corn futures prices are influenced by a complex interplay of factors ranging from weather conditions and global supply-demand dynamics to technological advancements and climate change. For farmers, investors, and industry professionals, staying informed about these trends is crucial for making sound decisions in an ever-changing market landscape.

The future of corn futures trading is likely to be characterized by increased technological integration, greater market transparency, and a growing emphasis on sustainability. As these trends unfold, tools and platforms that provide real-time, data-driven insights will become increasingly valuable.

At Farmonaut, we’re committed to empowering farmers and agricultural professionals with the information and tools they need to thrive in this dynamic environment. Our satellite-based crop monitoring, AI-driven insights, and comprehensive data analytics are designed to support informed decision-making and sustainable farming practices.

As we move forward, the ability to adapt to changing market conditions, leverage technological advancements, and make data-driven decisions will be key to success in the agricultural sector. By staying informed, embracing innovation, and utilizing advanced tools like those offered by Farmonaut, farmers and investors can navigate the complexities of corn futures markets with greater confidence and precision.

FAQ Section

Q: What are corn futures?

A: Corn futures are standardized contracts traded on commodity exchanges, representing agreements to buy or sell a specific amount of corn at a predetermined price on a future date.

Q: How do corn futures prices affect farmers?

A: Corn futures prices impact farmers’ financial planning, risk management strategies, and decision-making processes for planting, harvesting, and selling their crops.

Q: What factors influence corn futures prices?

A: Key factors include weather conditions, global supply and demand, government policies, energy markets, currency exchange rates, and technological advancements in agriculture.

Q: How can farmers use corn futures prices in their planning?

A: Farmers can use futures prices for budgeting, cash flow management, risk management, investment decisions, and developing marketing strategies.

Q: What role does technology play in analyzing corn futures markets?

A: Technology, including satellite imagery, AI, blockchain, and big data analytics, provides valuable insights into market trends, crop conditions, and supply-demand dynamics.

Q: How might climate change impact corn futures markets?

A: Climate change can affect corn futures through increased yield volatility, shifting growing regions, water scarcity issues, and changes in pest and disease patterns.

Q: What strategies can farmers use to navigate fluctuating corn futures markets?

A: Strategies include diversification, forward contracting, options trading, staying informed about market trends, leveraging technology, and collaborating with other farmers.